Australien¶

Wichtig

Odoo ist derzeit dabei, die Anforderungen von STP Phase 2 und SuperStream zu erfüllen. Sobald Unternehmen Odoo als Komplettplattform für die Lohnbuchhaltung nutzen können, wird eine entsprechende Ankündigung erfolgen.

Mitarbeiter einrichten¶

Mitatbeitereinstellungen¶

Erstellen Sie einen Mitarbeiter, indem Sie zu gehen. Gehen Sie zum Reiter Einstellungen und konfigurieren Sie den Abschnitt Australische Personalabrechnung, indem Sie beispielsweise überprüfen, ob sie Nichtansässige sind, ob sie vom Steuerfreibetrag profitieren, ihren TFN-Status, Mitarbeitertyp usw.

Private Mitarbeiterinformation¶

Außerdem sind einige persönliche Mitarbeiterdaten für die Einhaltung der Personalabrechnung mit Single Touch Payroll und für die Bearbeitung von Rentenzahlungen erforderlich. Öffnen Sie den Reiter Private Informationen des Mitarbeiters und füllen Sie die folgenden Felder aus:

Private Adresse

Private E-Mail

Privattelefon

Geburtstag

Bemerkung

Odoo wird Sie daran erinnern, die erforderlichen Daten in verschiedenen Phasen des Prozesses zu vervollständigen.

Rentenkonten und -fonds¶

Sie können die Angaben zur Altersvorsorge neuer Mitarbeiter im Reiter Pensionskonten des Mitarbeiters hinzufügen. Klicken Sie auf Zeile hinzufügen und stellen Sie sicher, dass Sie das Datum Mitglied seit, die Mitgliedsnummer und die Pensionskasse angeben.

Tipp

Verwenden Sie das Feld Anteil, wenn die Beiträge eines Mitarbeiters an mehrere Kassen gleichzeitig gesendet werden sollen.

Um eine neue Pensionskasse zu erstellen, geben Sie den Namen ein und klicken Sie auf Erstellen und bearbeiten …. Füllen Sie Folgendes aus:

Adresse

ABN

Typ (APRA / SMSF)

eindeutige Kennung (USI für APRA, ESA für SMSF)

(nur für SMFS) Bankkonto

Tipp

Verwalten Sie alle Pensionskonten und -kassen, indem Sie zu oder gehen.

Wichtig

Odoo arbeitet derzeit daran, SuperStream-konform zu werden.

Verträge¶

Nachdem Sie den Mitarbeiter erstellt haben, erstellen Sie ihren Arbeitsvertrag, indem Sie auf die intelligente Schaltfläche Verträge klicken oder indem Sie auf gehen.

Bemerkung

Pro Mitarbeiter kann nur ein Vertrag gleichzeitig aktiv sein, aber einem Mitarbeiter können während seines Arbeitsverhältnisses aufeinanderfolgende Verträge zugewiesen werden.

Erstellung eines Arbeitsvertrags: empfohlene Schritte¶

1. Grundlegende Vertragsinformationen¶

Wählen Sie das Startdatum des Vertrags und Arbeitsplan (festgelegt oder flexibel für Gelegenheitsarbeiter).

Behalten Sie die Art der Gehaltsstruktur auf Australische Mitarbeiter eingestellt. Diese Struktur deckt alle Steuerpläne der ATO ab.

(bei Verwendung der Anwesenheits- oder Planungsapp) Wählen Sie die Quelle des Arbeitseintrags aus, um festzulegen, wie Arbeitsstunden und -tage auf der Gehaltsabrechnung des Mitarbeiters ausgewiesen werden.

Arbeitsplan: Arbeitseinträge werden automatisch auf der Grundlage des Arbeitszeitplans des Mitarbeiters erstellt, beginnend mit dem Startdatum des Vertrags.

Example

Ein Mitarbeiter arbeitet 38 Stunden pro Woche, sein Vertrag beginnt am 01.01., das heutige Datum ist der 16.01. und der Benutzer erstellt eine Gehaltsabrechnung vom 14.01. bis zum 20.01. Die Arbeitsstunden auf der Gehaltsabrechnung werden automatisch mit 38 Stunden berechnet (5 * 7,36 Stunden), wenn kein unbezahlter Urlaub genommen wird.

Anwesenheiten: Der Standardarbeitsplan wird ignoriert, und Arbeitseinträge werden nur nach der An-/Abmeldung in der Anwesenheitsapp erstellt. Beachten Sie, dass Anwesenheiten importiert werden können.

Planung: Der Standardarbeitsplan wird ignoriert, und Arbeitseinträge werden nur aus Planungsschichten in der Planungsapp generiert.

Wichtig

Zeiterfassungen haben keinen Einfluss auf die Arbeitseinträge in Odoo. Wenn Sie Ihre Zeiterfassungen in Odoo importieren müssen, importieren Sie sie stattdessen über: :

2. Reiter „Gehaltsinformationen“¶

Lohntyp: Wählen Sie für Vollzeit- und Teilzeitbeschäftigte die Lohnart Fester Lohn und Stundenlohn für Gelegenheitsarbeiter aus. Letzteres ermöglicht es Ihnen, einen Prozentsatz für Aufschlag für Gelegenheitsarbeiter hinzuzufügen.

Bemerkung

Für Stundenarbeiter sollte das Feld Stundenlohn Aufschläge für Gelegenheitsarbeiter ausschließen.

Bezahlung planen: In Australien werden nur die folgenden Häufigkeiten akzeptiert: Täglich, Wöchentlich, Zweiwöchentlich (oder vierzehntägig), Monatlich und Vierteljährlich.

Lohn (/Zeitraum): Weisen Sie dem Vertrag einen Lohn zu, der sich nach der Häufigkeit seiner Bezahlung richtet. Auf den Gehaltsabrechnungen werden die entsprechenden Jahres- und Stundensätze automatisch errechnet.

3. Reiter „Australien“¶

Allgemein

Fügen Sie einen Regulären Zahltag hinzu, falls zutreffend.

Aktivieren Sie Bericht in BAS - W3, wenn Sie PAYG-Einbehaltungsbeträge im BAS-Abschnitt W3 hinzufügen, anstatt W2 (Weitere Informationen finden Sie auf der Webseite der ATO zu PAYG-Einbehalt.

Urlaubsaufschlag / Spende am Arbeitsplatz

Legen Sie fest, ob Ihre Mitarbeiter Für Urlaubsaufschlag berechtigt sind.

Legen Sie den Betrag der Arbeitsspende des Mitarbeiters im Umtausch gegen Abzüge fest.

Legen Sie den Betrag der Gehaltsverzicht für Spenden am Arbeitsplatz fest (z. B. Erhalt eines Vorteils statt Abzugs).

Beitrag zur Altersversicherung

Add the Extra Negotiated Super % on top of the super guarantee.

Add the Extra Compulsory Super % as per industrial agreements or awards obligations.

Salary sacrifice

Salary Sacrifice Superannuation allows employees to sacrifice part of their salary in favor of reportable employer superannuation contributions (RESC).

Salary Sacrifice Other Benefits allows them to sacrifice part of their salary towards some other form of benefit (refer to the ATO’s web page on Salary sacrificing for employees for more information).

Bemerkung

As of Odoo 18, salary sacrificing for other benefits currently does not impact fringe benefits tax (FBT) reporting.

4. Gehaltsabtretungen/-zulagen¶

If the employee is to receive additional recurring payments every pay run, whether indefinitely or for a set number of periods, click the Salary Attachments smart button on the contract. Choose a Type and a Description.

Bemerkung

Around 32 recurring salary attachment types exist for Australia. These are mostly related to allowances and child support. Contact us for more information as to whether allowances from your industry can be covered.

5. Vertrag ausführen¶

Sobald alle Informationen vollständig sind, ändern Sie die Vertragsphase von Neu zu Laufend.

Gehaltszahlungen vorbereiten¶

Regulär¶

Pay runs are created by going to . After clicking New, enter a Batch Name, select a Period, and click Generate Payslips.

Employees on a pay run can be filtered down by Department and Job Position. There is no limit to the amount of payslips that can be created in one batch. After clicking Generate, one payslip is created per employee in the Waiting stage, in which they can be reviewed and amended before validation.

In der Ansicht des Formulars der Gehaltsabrechnung gibt es zwei Arten von Eingaben:

Worked days are computed based on the work entry source set on the employee’s contract. Work entries can be configured according to different types: attendance, overtime, Saturday rate, Sunday rate, public holiday rate, etc.

Other inputs are individual payments or amounts of different types (allowances, lump sums, deductions, termination payments, leaves, etc.) that have little to do with the hours worked during the current pay period. The previously configured salary attachments are simply recurring other inputs attached to a contract.

Under the Salary Computation tab, Odoo automatically computes payslip rules based on employees, contracts, worked hours, other input types, and salary attachments.

The salary structure Australian Employee has 35 payslip rules that automatically compute and dynamically display according to the payslip inputs.

Example

Die folgenden Regeln gelten für diesen Zahlungszeitraum im obigen Beispiel:

Basic Salary: pre-sacrifice gross salary

Ordinary Time Earnings: amount to which the super guarantee percentage needs to be applied

Salary Sacrifice Total: includes the $150 sacrificed to superannuation

Taxable Allowance Payments: includes the $10 allowance (cents per KM in this case)

Taxable Salary: gross salary amount minus non-taxable amounts

Salary Withholding and Total Withholding: amounts to be withheld from the taxable salary

Net Salary: the employee’s net wage

Concessional Super Contribution: in this scenario, the amount sacrificed to superannuation, payable to the employee’s super fund in addition to the super guarantee

Super Guarantee: as of 01 July 2024, it is computed as 11.5% of the ordinary time earnings amount

Bemerkung

As of Odoo 18, the most recent tax schedule rates (2024-2025) have been updated for all salary rules and computations.

Out-of-cycle¶

In Australia, payslips created without a batch are considered to be out-of-cycle runs. Create them by going to . The same payslip rules apply, but the way these payslips are submitted to the ATO in the frame of Single Touch Payroll (STP) is slightly different.

Wichtig

As of Odoo 18, adding an out-of-cycle payslip to an existing batch is not recommended.

Finalise pay runs¶

Validate payslips¶

Once all payslip data is deemed correct, click Create Draft Entry on the payslip batch. This can also be done payslip by payslip for control reasons.

This has several impacts:

Marking the batch and its payslips as Done.

Creating a draft accounting entry per payslip or one entry for the whole batch, depending on your payroll settings. At this stage, accountants can post entries to affect the balance sheet, P&L report, and BAS report.

Preparing the STP submission (or payroll data to be filed to the ATO as part of STP compliance). This needs to be performed by the STP Responsible user, defined under .

Preparing super contribution lines as part of SuperStream compliance. This needs to be done by the HR Super Send user selected under .

Submit payroll data to the ATO¶

Wichtig

Odoo is currently in the process of becoming compliant with STP Phase 2, and this step described above does not submit data yet to the ATO.

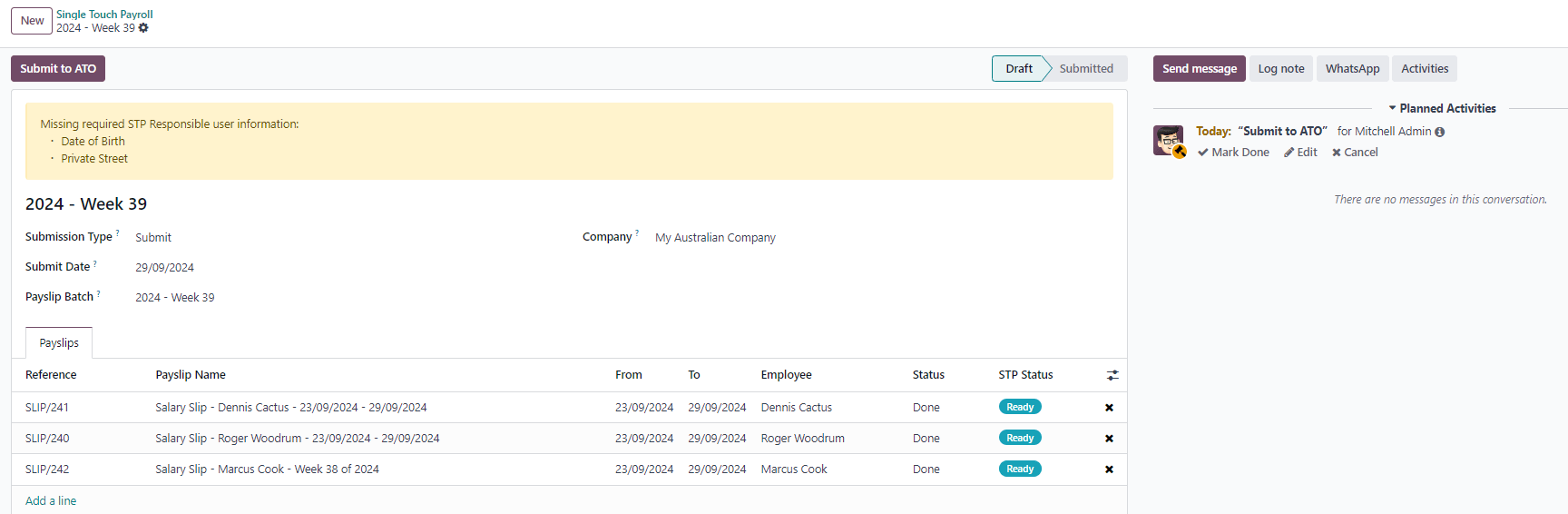

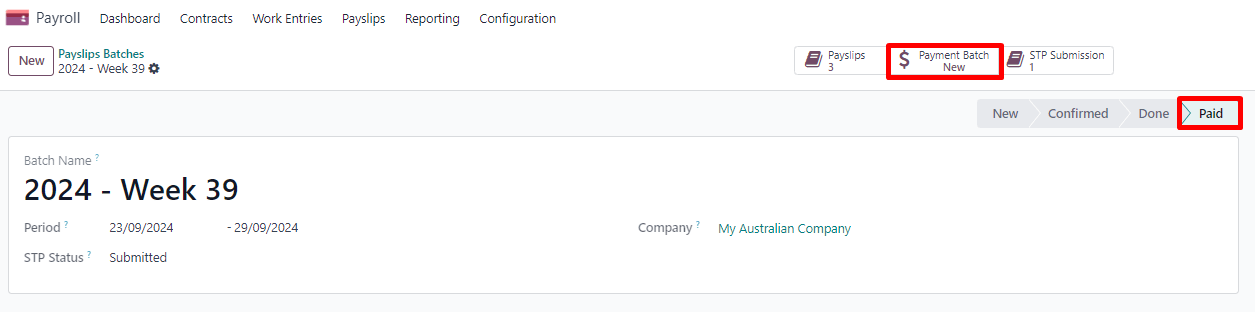

As per ATO requirements, STP submission for a pay run needs to be done on or before the payday. For this reason, submit your STP data to the ATO first before proceeding with payment. To do so, click Submit to ATO on the payslip batch.

On the STP record for this pay run, a few useful information is displayed:

a warning message if important information is missing,

an automatically generated activity for the STP responsible user, and

eine Zusammenfassung der Gehaltsabrechnungen, die in diesem Zahlungsstapel enthalten sind, prüfbar aus dieser Ansicht.

Once the STP record is ready to go, click Submit to ATO, then read and accept the related terms and conditions.

Mitarbeiter bezahlen¶

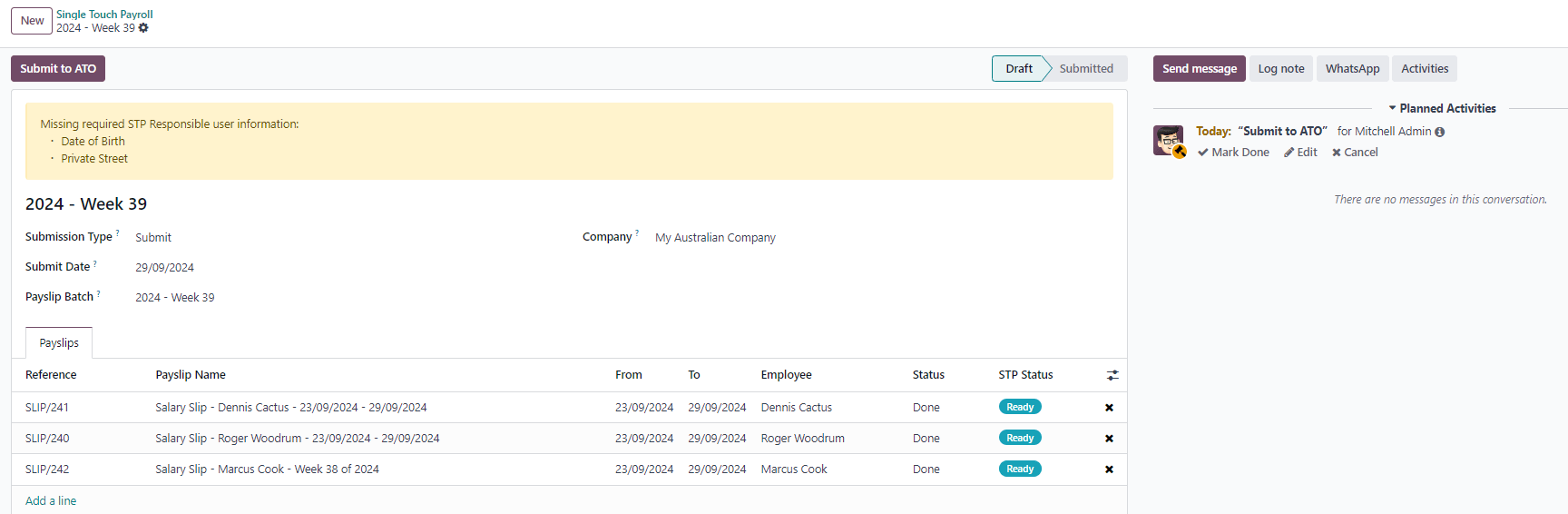

Once the ATO submission is complete, you can proceed to pay your employees. To facilitate the payment matching process, remember to post the payslip-related journal entries prior to validating a payment.

Although you may decide to pay your employees individually, we recommend creating a batch payment from your payslip batch. To do so, click Pay on the payslip batch, and select ABA Credit Transfer as the Payment Method.

Dies hat zwei Auswirkungen:

Marking the batch and its payslips as Paid.

Creating a Payment Batch linked to the payslip batch.

When receiving the bank statement in Odoo, you can now match the statement line with the batch payment in one click. The payment is not reconciled against the payslip batch, and all individual payslips.

Auswirkungen auf die Buchhaltung¶

Depending on the employee and contract configuration, the journal entry linked to a payslip will be more or less exhaustive.

Example

For instance, here is the journal entry generated by the employee Marcus Cook configured above.

Once posted, predefined accounts will impact the company’s balance sheet (PAYGW, wages, and superannuation liabilities) and profit & loss report (wages and superannuation expenses). In addition, the employee’s gross wage and PAYG withholding will update the BAS report for the relevant period (see Tax Grid: W1 and W2). Accounts can be adjusted to the company’s chart of accounts.

Other payroll flows¶

Paying super contributions¶

Wichtig

Odoo has a partnership with a clearing house to process both superannuation payments and data to the right funds in one click, via direct debit. Odoo is currently in the process of becoming compliant with SuperStream, and an announcement will be made as soon as superannuation contributions can be processed via Odoo’s payroll solution.

Once a quarter (or more frequently, in preparation for Payday Super), you have to process superannuation payments to your employees‘ super funds. To do so, go to .

When ready to pay, add the Bank Journal that will be used to pay the super from, then click Lock to prevent the contributions from subsequent payslips from being added to that file. Instead, a new Super file will be created.

Once the payment has been processed, it can be traced back to the Super file and matched with a bank statement.

Terminating employees¶

Employees can be terminated by going to .

The following fields must be completed:

Contract End Date: once the termination is validated, this date will be added to the contract automatically, and mark the contract as Expired when the date has been reached.

Cessation Type Code: a mandatory field for the ATO’s STP reporting.

Termination Type: the type of redundancy (genuine or non-genuine) affects the computation of unused annual and long service leave withholding.

The balance of unused annual leaves and long service leaves is displayed for reference.

Confirming the termination creates an out-of-cycle payslip with the tag final pay. It computes the worked days until the contract end date, in addition to the employee’s unused annual and long service leave entitlements.

Odoo automatically computes unused leave entitlements based on the employee’s current hourly rate leave loading (for annual leaves only), and the remaining leave balance. However, these amounts can be manually edited in the Other Inputs table if necessary.

Employment Termination Payments (ETP) can also be added to the Other Inputs table. Odoo has a comprehensive list of excluded and non-excluded ETPs for companies to select from.

Bemerkung

Withholding for unused leaves and ETPs is computed according to the ATO’s Schedule 7 and Schedule 11 and updated as of 01 July 2024.

Tipp

Once an employee has been terminated and the last detailed of their employment resolved, you can archive the employee by clicking the (Actions) icon, then Archive on the employee’s form view.

Switching from another STP software to Odoo¶

When switching from another STP-enabled software to Odoo, you might need to maintain the continuity in the YTD values of your employees. Odoo allows importing employees‘ YTD values by going to and clicking Import YTD Balances.

For the ATO to recognize the employee records of your previous software and keep a continuity in Odoo, you must enter the:

Previous BMS ID (one per database)

Previous Payroll ID (one per employee)

Ask your previous software provider if you cannot find its BMS ID or your employees‘ payroll IDs.

This will give you the opportunity to add your employees‘ YTD opening balances in the current fiscal year. The ATO reports on a lot of different types of YTD. These are represented by the 13 following Salary Rules in Odoo.

Example

Let us say that the employee Marcus Cook has been transitioned from another STP-enabled software on September 1. Marcus has received two monthly payslips in his previous software (for July and August). Here are the YTD balances Marcus’s company needs to transfer to Odoo:

YTD category |

YTD balance to transfer |

|---|---|

Gross (normal attendance) |

$13,045.45 |

Gross (overtime) |

1.000 € |

Paid leave |

$954.55 |

Laundry allowance |

200 $ |

Total withholding |

2956 € |

Super Guarantee |

$1,610 |

If some YTD balances need to be reported with more granularity to the ATO, you can use the salary rule’s inputs.

Example

For instance, the Basic Salary rule can contain six inputs, and three are necessary in our example: regular gross amounts, overtime, and paid leaves. These are all reported differently in terms of YTD amounts.

The finalized YTD opening balances for Marcus Cook look like the following.

As a result, YTD computations on payslips are based on the employee’s opening balances instead of starting from zero.

STP finalisation¶

Wichtig

Odoo is currently in the process of becoming compliant with STP Phase 2, and the finalisation flows described below do not yet submit data to the ATO.

EOFY finalisation¶

Employers reporting through STP must make a finalization declaration by 14 July each year. To do so, go to .

Both active and terminated employees to finalise are displayed.

From the finalisation form view, you can proceed with a final audit of all employees‘ payslips during the relevant financial year. Once ready, click Submit to ATO. When you have made the finalisation declaration, employees will see the status of their payment information change to Tax ready on their online income statement after the end of the financial year.

Individual finalisation¶

Odoo also allows you to finalise employees individually during the year. This can be useful when:

one-off payments are made after a first finalisation; and

finalisation after termination of employment during the year.

To proceed with an individual finalisation, go to , leave the EOFY Declaration checkbox unticked, and manually add employees to be finalised.

Even if you finalise an employee record partway through the financial year, the ATO will not pre-fill the information into the employee’s tax return until after the end of the financial year.

Anpassungen¶

Wichtig

Odoo is currently in the process of becoming compliant with STP Phase 2, and the adjustment flows described below do not yet submit data to the ATO.

Amend finalisation¶

If you need to amend YTD amounts for an employee after a finalisation declaration was made, it is still possible to remove the finalisation indicator for that employee. To do so, go to , select the employee, and leave the Finalisation checkbox unticked.

When ready, click Submit to ATO to file the finalisation update to the ATO.

Once the correct YTD details are ready for that employee after amendment, finalise that employee again.

Bemerkung

The ATO expects employers to correct errors within 14 days of detection or, if your pay cycle is longer than 14 days (e.g., monthly), by the date you would be due to lodge the next regular pay event. Finalisation amendments can be done through STP up to five years after the end of the financial year.

Finalising and amending finalisation for a single employee can also be useful when rehiring an employee within the same financial year.

Full file replacements¶

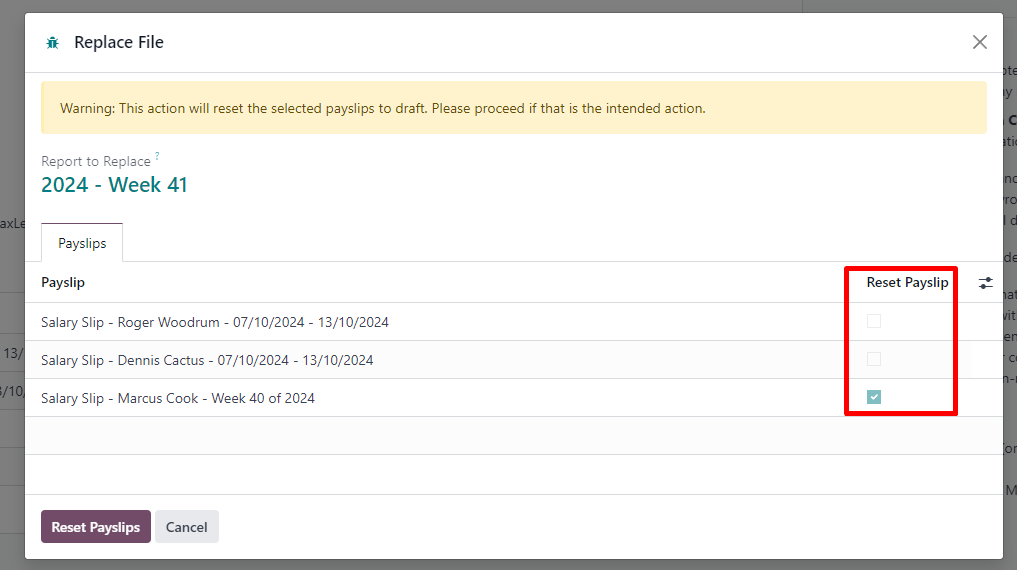

An employer can make full file replacements of pay runs to replace the last lodgement sent to the ATO if it turns out to contain significantly inaccurate data.

To do so, open the last STP submission and click Replace File. Then, select which payslips need to be reset by ticking the Reset Payslip checkbox.

Resetting payslips does not create new payslips or a new pay run, but instead:

The payslips batch is reset from Paid or Done to Confirmed.

The status of the reset payslips revert back to Draft.

The correct payslips remain paid and matched against the original payment.

A new STP submission is created to replace the former one. For traceability purposes, the former STP submission is not deleted but marked as replaced.

First, correct the reset payslips and create their draft entry. Once done, the Submit to ATO reappears on the payslip batch to process the full file replacement.

When ready, submit the pay run to the ATO once again. Please note that full file replacements are only meant as a last resort to amend a substantial amount of erroneous data. When possible, the ATO recommends correcting an incorrect payslips by submitting a correction as part of the next pay run or via update event.

Moreover, it is not possible to submit a second full file replacement of the same submission, and a full file replacement can only be done once every 24 hours.

Zero out YTD values¶

In case of a mid-year change of several key identifiers, YTD values need to be zeroed out, and then re-posted with the updated key identifier.

For the following company identifiers, all employees need to be zeroed out:

ABN

Branch Code

BMS ID

For the following employee identifiers, only individual employees can be zeroed out:

TFN

Payroll ID

Before updating any key identifiers, create a new STP submission by going to and:

Change the Submission Type to Update.

Tick the Zero Out YTD checkbox.

Click Add a line to specify which employees.

Click Submit to ATO.

Once that is done, modify the key identifier(s) to amend.

Finally, go back to to create and submit a new Update, this time without ticking the Zero Out YTD checkbox. This will notify the ATO that the previously recorded YTD balances are to be adjusted to the new key identifiers.

Payroll links to other apps¶

Abwesenheiten¶

The Time Off app is natively integrated with the Payroll app in Odoo. Different types of leaves will populate payslips based on the concept of work entries.

Gehen Sie auf und konfigurieren Sie für jeden Typ die folgenden Felder im Abschnitt Personalabrechnung.

Work Entry Type: defines which work entry should be selected on the Worked Days table of the payslip.

Unused Leave Type: choose between Annual, Long Service, or Personal Leave. If Personal Leave is selected, the remaining leave balance for this time off type will not show up as an entitlement at the time of termination. Unused leaves of the type Annual will include leave loading if the employee is eligible for it.

Aufwände¶

The Expenses app is also natively integrated with the Payroll app in Odoo. First of all, go to and enable Reimburse in Payslip.

When an employee on your payroll submits an approved expense to be reimbursed, you can reimburse them using two ways:

If the expense is to be reimbursed outside of a pay run, click Post Journal Entries. The payment must be made manually.

If the expense is to be reimbursed as part of the next pay run, click Report in Next Payslip instead.

After an expense has been added to the next payslip, you can find it in the Other Inputs table. This input type is then computed as an addition to the net salary.

After paying the employee, the payslip’s journal item related to the employee’s reimbursement is automatically matched against the expense’s vendor bill.

Erweiterte Konfigurationen¶

Andere Eingabetypen¶

Sie können auf andere Eingabetypen zugreifen, indem Sie zu navigieren. Es gibt 63 weitere Eingabetypen für Australien. Wir empfehlen, die anderen nicht als Teil Ihrer Personalabrechnungslösung zu verwenden, da sie im Rahmen von STP nicht verwendet werden können. Sie können sie archivieren oder löschen.

On each input type, the following fields are important:

Payment Type classifies input types in six categories:

Allowance: a separate amount you pay to your employees in addition to salary and wages. Some of these allowances are mandated by modern awards: laundry, transport, etc.

Wichtig

Contact us if you plan to use allowances subject to varied rates of withholding (such as cents per KM or travel allowances) to see whether Odoo currently covers your business case.

Bemerkung

As of Odoo 18, some allowances such as Laundry: Allowance for approved uniforms are managed by two other inputs: one to lodge the amount paid up to the ATO limit, and the other one to lodge the amount exceeding the ATO limit. This is necessary for Odoo to compute PAYGW correctly.

Some businesses may require to shift the reporting of an allowance from OTE to Salary & Wages depending on the employee. In this case, you must duplicate and re-configure an existing other input type. For example, Work-Related Non-Expense allowance is OTE by default.

Deduction: union fees and child support deductions are considered deductions.

ETP: employment termination payments. These are either considered excluded or non-excluded (see ATO’s web page on ETP components taxation).

Leave: leave-related other inputs that are not pertaining to a single pay period (lump sum, cashing out leaves while in service, unused leaves, etc.).

Lump Sum: return to work and lump sum E (for back payments) fall under this category.

Other: other payments with their own specific logic.

PAYGW Treatment affects how Odoo withholds tax for this input type: Regular, No PAYG Withholding, and Excess Only (for allowances).

Superannuation Treatment: OTE, Salary & Wages, and Not Salary & Wages.

STP Code: only visible in developer mode, this field tells Odoo how to report the gross value of this payment to the ATO. We do not recommend changing the value of this field if it was already set by default.

Grouping other input types by Payment Type can help you understand the different scenarios in which these inputs can be used.

Arbeitseintragsarten¶

A work entry type is a type of attendance for employees (e.g., attendance, paid leave, overtime, etc.). A few work entry types are created by default in every Australian database.

Before using Odoo’s payroll solution for Australia, it is recommended you trim work entry types to keep the ones you need only by going to

For each type, make sure to configure the following fields for Australia:

Is OTE: determines whether time spent in this category can be considered ordinary time earnings, meaning that the superannuation guarantee rate will apply (e.g., regular attendance, paid leave, etc.).

Penalty Rate: used to determine the percentage of penalty that applies to time spent in this category. It is important that you configure the penalty rate that applies in your state or industry according to the type of work (e.g., Saturday rate, Sunday rate, overtime rate, etc.).

STP Code: only visible in developer mode, this field tells Odoo how to report the time spent in this category to the ATO. We do not recommend changing the value of this field if it was already set by default.

Current limitations¶

As of Odoo 18, we do not recommend companies to use the Payroll app for the following business flows:

Income stream types: Foreign Employment Income

Tax treatment category: actors & performers

Death benefits reporting

Reporting obligations for WPN (instead of ABN)

Allowances subject to a varied rate of withholding (such as cents per kilometer allowance and travel allowances)

Contact us if you would like to make sure whether Odoo fits your payroll requirements in Australia.

Employment Hero integration¶

If your business is already up and running with Employment Hero, you can use the connector as an alternative payroll solution. The Employment Hero module synchronizes payslip accounting entries (e.g., expenses, social charges, liabilities, taxes) automatically from Employment Hero to Odoo. Payroll administration is still done in Employment Hero; Odoo only records the journal entries.

Konfiguration¶

Install the Employment Hero Payroll module (

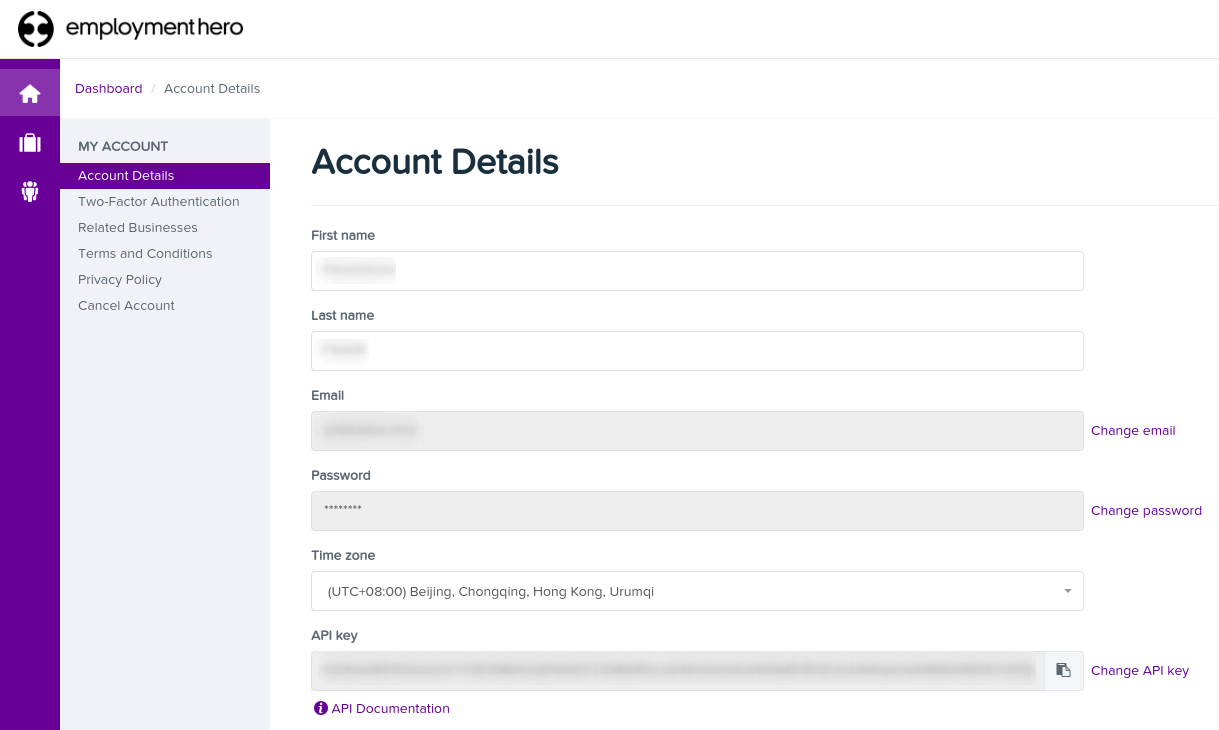

l10n_employment_hero).Configure the Employment Hero API by going to . More fields become visible after ticking the Enable Employment Hero Integration checkbox.

Find the API Key in the My Account section of the Employment Hero platform.

The Payroll URL is pre-filled with

https://keypay.yourpayroll.com.au.Warnung

Do not change the pre-filled Payroll URL.

Find the Business Id in the Employment Hero URL (e.g.,

189241).

Select any Odoo journal as the Payroll Journal to post the payslip entries.

Configure the tax by going to . Create the necessary taxes for the Employment Hero payslip entries. Fill in the tax code from Employment Hero in the field.

The API explained¶

Die API synchronisiert die Journaleinträge von Employment Hero mit Odoo und lässt sie im Entwurfsmodus. Die Referenz enthält die Eintragsnummer von Employment Hero in Klammern, damit der Benutzer denselben Datensatz in Employment Hero und Odoo leicht abrufen kann.

By default, the synchronization happens once per week. It is possible to fetch the records manually by going to and, in the Employment Hero, clicking Fetch Payruns Manually.

Employment Hero payslip entries also work based on double-entry bookkeeping. The accounts used by Employment Hero are defined in the Payroll settings section.

For the API to work, you must create the same accounts as the default accounts of your Employment Hero business (same name and same code) in Odoo. You also need to choose the correct account types in Odoo to generate accurate financial reports.