澳大利亚¶

重要

Odoo 目前正在逐步实现与 STP 第二阶段及 SuperStream 的合规兼容。一旦企业可将 Odoo 作为一站式薪资平台使用,我们将立即发布公告。

员工设置¶

员工设置¶

通过 创建员工档案。进入 设置 选项卡,配置 澳大利亚薪资 部分,例如勾选是否为 非税务居民、是否享受 免税额度,以及填写 税号状态、员工类型 等信息。

员工隐私信息¶

为满足 STP 薪资合规要求并处理养老金支付,还需录入员工个人信息。打开员工的 个人信息 选项卡,填写以下字段:

居住地址

个人邮箱

私人电话

出生日期

注解

Odoo 将在流程各阶段提醒您完善必填数据。

养老金账户与基金¶

您可以在员工的 养老金账户 选项卡下添加新员工的养老金详细信息。点击 添加一行,确保包含 成员起始日期、成员编号 和 养老基金。

小技巧

如需将员工缴款分配至多个基金,请使用 分配比例 字段。

新建 养老基金 时,输入名称并点击 创建并编辑…,需填写以下信息:

地址

ABN

:guilabel:`类型`(APRA / SMSF)

唯一标识符(APRA 为 USI,SMSF 为 ESA)。

(仅适用于 SMFS):guilabel:

银行账户

小技巧

通过 或 管理所有养老金账户和基金。

重要

Odoo 目前正在与 SuperStream 兼容。

合同¶

创建员工后,点击 合同 智能按钮,或进入 ,创建员工的劳动合同。

注解

每位员工每次只能签订一份有效合同。不过,员工在工作期间可以连续签订合同。

签订劳动合同:建议步骤¶

1. 基本合同信息¶

选择 合同开始日期 和 工作时间表 (固定排班或为临时工选择弹性制)。

保持 薪资结构类型 设置为 澳大利亚员工。该结构涵盖澳大利亚税务局(ATO)的所有税收方案。

(若使用考勤或排期应用)选择 工时来源 以定义员工工资单上的工时计算方式。

工作时间表:系统将根据员工的工作时间表,从合同开始日期自动生成工时记录。

Example

示例:某员工每周工作 38 小时,合同起始日为 1 月 1 日,当前日期为 1 月 16 日,用户生成 1 月 14 日至 20 日的薪资周期。若未申请无薪假,工资单上的工时将自动计算为 38 小时(5 天 × 7.6 小时/天)。

考勤:忽略工作时间表,仅在考勤应用打卡后生成工时记录(注:考勤数据可导入)。

排期:忽略工作时间表,根据排期应用的排班,生成工时记录。

重要

工时单不影响 Odoo 中的工时记录。如需导入工时单,请通过 导入。

2. 薪资信息选项卡¶

工资类型:全职和兼职员工选择 固定工资,为临时工选择 时薪。后者允许您添加 临时工补贴 率。

注解

时薪员工的 时薪 字段应不含临时工补贴。

发薪频率:澳大利亚仅支持以下周期:日结、周结、双周结、月结、季结。

薪资 /周期:根据发薪频率设置合同薪资。系统将自动计算工资单中的年薪和时薪。

3. 澳大利亚选项卡¶

通用

如适用,请添加 常规发薪日。

若选择将 PAYG 预扣税金额填入 BAS 表格的 W3 栏而非 W2 栏,请启用 :guilabel:`在 BAS-W3 栏报告`(详情参阅 ATO 关于 PAYG 预扣税的网页 <https://www.ato.gov.au/businesses-and-organisations/preparing-lodging-and-paying/business-activity-statements-bas/in-detail/instructions/payg-withholding-how-to-complete-your-activity-statement-labels#W3Otheramountswithheldexcludinganyamount>_)。

假期津贴/职场捐赠

设置员工是否 符合假期津贴资格。

设定 职场捐赠员工 金额(用于抵扣税款)。

设定 薪资置换职场捐赠 金额(例如以福利替代抵扣)。

养老金缴款

在*养老金保证*基础上添加 额外协商养老金%。

根据行业协议或裁决义务添加 额外强制养老金 %。

薪资置换

养老金薪资置换 允许员工用部分薪资置换为可申报雇主养老金缴款(RESC)。

其他福利薪资置换 允许员工用部分薪资置换其他形式福利(详情参阅 ATO 员工薪资置换网页 <https://www.ato.gov.au/individuals-and-families/jobs-and-employment-types/working-as-an-employee/salary-sacrificing-for-employees>_)。

注解

截至 Odoo 18 版本,其他福利薪资置换暂不影响附加福利税(FBT)申报。

4. 薪资附件¶

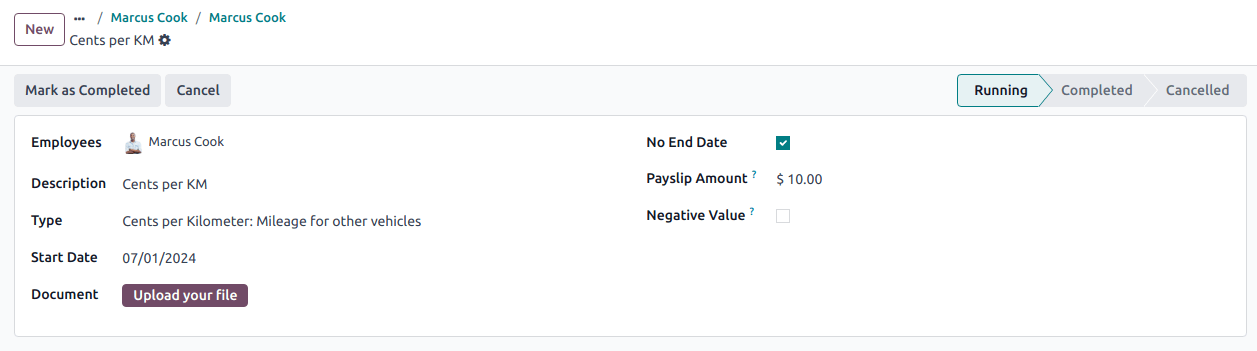

如需为员工设置每期薪资的循环附加款项(永久性或定期),点击合同上的 :icon:fa-book 薪资附件智能按钮,选择 类型 和 说明。

注解

澳大利亚约有 32 种循环薪资附件类型,主要涉及津贴和子女抚养费。联系我们 <https://www.odoo.com/help>_了解是否支持您行业的特定津贴。

5. 启用合同¶

完成所有信息后,将合同状态从 新建 改为 有效。

准备薪资周期¶

常规¶

通过 创建薪资周期。点击 新建 后,输入 批次名称,选择 周期,再点击 生成工资单。

可通过 部门 和 职位 筛选纳入薪资周期的员工。单个批次可创建的工资单数量无限制。点击 生成`后,系统会为每位员工生成状态为 :guilabel:`待处理 的工资单,供审核修改后确认。

在工资单表单视图中,包含两类输入项:

工作日数 根据 员工合同设置的工时来源 计算。可 按不同类型配置工时记录:考勤、加班、周六费率、周日费率、公共假日费率等。

其他输入项 是与当前周期工作时长无关的独立款项,包括 多种类型 即关联至合同的循环其他输入项。

在 薪资计算 选项卡下,Odoo 根据员工信息、合同、工时、其他输入类型及薪资附件自动计算工资单规则。

澳大利亚员工 薪资结构包含 35 条工资单规则,系统会根据输入项动态计算并显示结果。

Example

以上示例中适用于该薪资周期的计算规则如下:

基本薪资:薪资置换前的总薪资

常规工时收入:需应用养老金保证比例的计算基数

薪资置换总额:包含置换至养老金的 $150

应税津贴支付:包含 $10 津贴(本例为每公里补贴)

应税薪资:总薪资减去免税部分

薪资预扣税 与 总预扣金额:从应税薪资中代扣的税款

净薪资:员工实得工资

优惠养老金缴款:本例中指置换至养老金的金额,需与养老金保证金额一并支付至员工养老基金

养老金保证:自 2024 年 7 月 1 日起,按常规工时收入的 11.5% 计算

注解

截至Odoo 18版本,所有薪资规则和计算均已更新至最新税率表(2024-2025年度)。

特殊周期¶

在澳大利亚,未通过批次创建的工资单视为特殊周期薪资。可通过 创建。虽然适用相同计算规则,但其通过STP(一键式薪酬系统)系统向澳大利亚税务局(ATO)提交的方式略有不同。

重要

截至 Odoo 18 版本,**不建议**将特殊周期工资单添加至现有批次。

完成薪资周期¶

验证工资单¶

确认所有工资单数据无误后,在工资单批次页面点击 创建草稿分录。出于管控需要,也可逐张工资单进行操作。

该操作将产生以下影响:

将批次及其包含的工资单标记为 已完成 状态。

根据薪资设置生成单张工资单分录或整批合并分录(会计人员可过账该分录以更新资产负债表、损益表及 BAS 报表)

准备 STP 申报(即向澳大利亚税务局 ATO 提交的薪资合规数据)。该操作需由 中指定的 STP 申报负责人 执行。

准备 SuperStream 合规要求的养老金缴款数据。该操作需由 中指定的 养老金发放负责人 完成。

向 ATO 提交薪资数据¶

重要

Odoo 目前正在逐步实现与 STP 第二阶段的合规兼容,上述操作步骤暂未实际向澳大利亚税务局(ATO)提交数据。

根据 ATO 要求,薪资周期的 STP 申报需在发薪日或之前完成。因此,请先点击工资单批次上的 提交至 ATO按 钮完成数据申报,再进行实际付款操作。

在该薪资周期的 STP 记录中,系统将显示以下实用信息:

当重要信息缺失时显示警告提示,

an automatically generated activity for the STP responsible user, and

a summary of payslips contained in this pay run, auditable from this view.

Once the STP record is ready to go, click Submit to ATO, then read and accept the related terms and conditions.

向员工支付薪酬¶

Once the ATO submission is complete, you can proceed to pay your employees. To facilitate the payment matching process, remember to post the payslip-related journal entries prior to validating a payment.

Although you may decide to pay your employees individually, we recommend creating a batch payment from your payslip batch. To do so, click Pay on the payslip batch, and select ABA Credit Transfer as the Payment Method.

This has two impacts:

Marking the batch and its payslips as Paid.

Creating a Payment Batch linked to the payslip batch.

When receiving the bank statement in Odoo, you can now match the statement line with the batch payment in one click. The payment is not reconciled against the payslip batch, and all individual payslips.

Impact on accounting¶

Depending on the employee and contract configuration, the journal entry linked to a payslip will be more or less exhaustive.

Example

For instance, here is the journal entry generated by the employee Marcus Cook configured above.

Once posted, predefined accounts will impact the company’s balance sheet (PAYGW, wages, and superannuation liabilities) and profit & loss report (wages and superannuation expenses). In addition, the employee’s gross wage and PAYG withholding will update the BAS report for the relevant period (see Tax Grid: W1 and W2). Accounts can be adjusted to the company’s chart of accounts.

其他工资流¶

缴纳养老金¶

重要

Odoo与一家清算所建立了合作关系,通过直接借记的方式,一键处理养老金支付和正确基金的数据。Odoo 目前正在与SuperStream 进行兼容,一旦可以通过 Odoo 薪资解决方案处理养老金缴款,将立即发布公告。

每季度一次(或更频繁,为 Payday Super <https://www.ato.gov.au/about-ato/new-legislation/in-detail/superannuation/payday-superannuation>`_做准备),您必须处理向员工的超级基金支付的超级年金。要执行此操作,请访问 :menuselection:`薪酬管理 --> 报告 --> 养老金。

准备付款时,添加将用于支付养老金的 银行日记账,然后点击 锁定 以防止后续工资单的供款被添加到该文件中。相反,将创建一个新的养老金文件。

一旦付款处理完成,可以追溯到养老金文件并与银行对账单匹配。

终止雇员¶

进入 。

必须填写以下字段:

合同结束日期:一旦终止得到验证,该日期将自动添加到合同中,并在达到日期时将合同标记为 已到期。

停止类型代码:澳大利亚税务局 STP 报告的必填字段。

终止类型:裁员类型(真实或非真实)会影响未使用的年假和长期服务假预扣税的计算。

未使用的年假和长期服务假余额会显示供参考。

确认终止会创建一个带有 最终付款 标签的非周期性工资单。它计算直到合同结束日期的工作天数,以及雇员未使用的年假和长期服务假权益。

Odoo自动根据雇员当前的小时工资率、休假补贴(仅适用于年假)和剩余休假余额计算未使用的休假权益。但是,如有必要,这些金额可以在 :guilabel:`其他输入`表格中手动编辑。

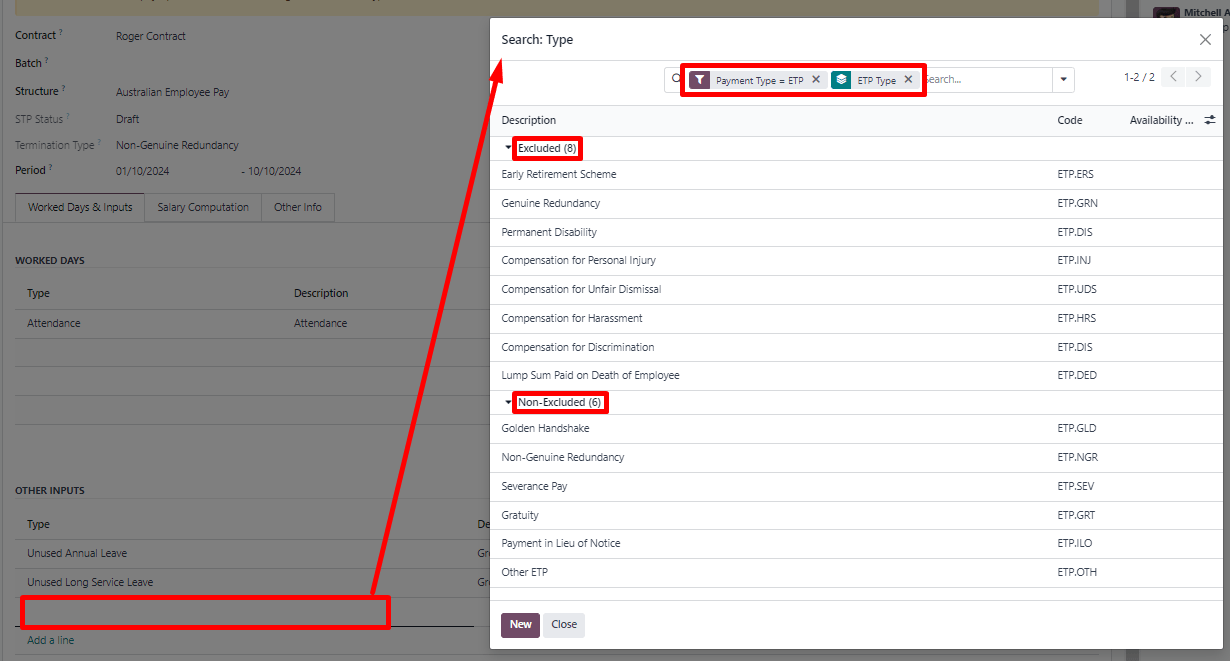

就业终止付款(ETP)也可以添加到 其他输入 表格中。Odoo有一份全面的排除和非排除ETP列表供公司选择。

小技巧

一旦雇员被终止且其就业的最后细节已解决,您可以通过点击 (操作) 图标,然后点击雇员表单视图上的 存档 来存档该雇员。

从其他 STP 软件切换到 Odoo¶

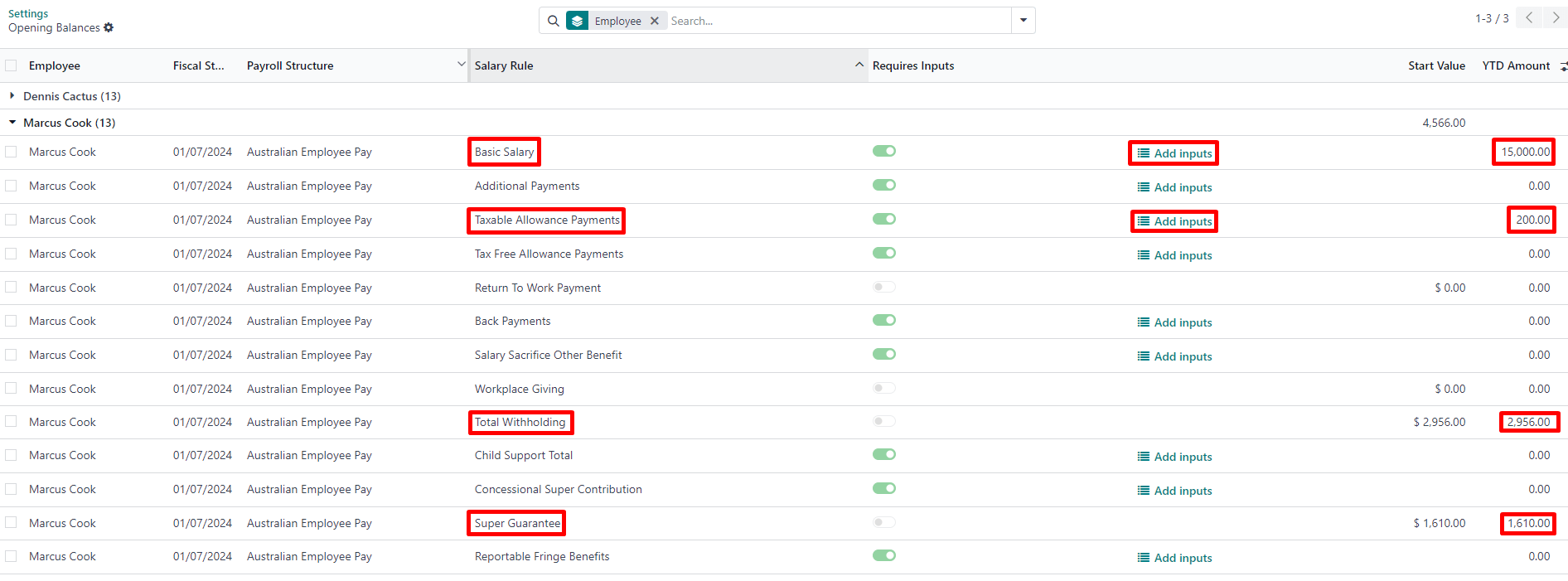

当从其他启用STP的软件切换到 Odoo 时,您可能需要维持雇员年初至今(YTD)值的连续性。Odoo 允许通过进入 并点击 导入 YTD 余额 来导入雇员的YTD值。

为了让澳大利亚税务局识别您之前软件的雇员记录并在 Odoo 中保持连续性,您必须输入:

如果您找不到其 BMS ID 或雇员的工资单 ID,请咨询您之前的软件提供商。

这将使您有机会在当前财政年度添加雇员的 YTD 期初余额。澳大利亚税务局报告许多不同类型的 YTD。这些在 Odoo 中由以下13个 薪资规则 表示。

Example

假设雇员 Marcus Cook 于9月1日从另一个启用 STP 的软件转移过来。Marcus 在之前的软件中收到了两个月度工资单(7月和8月)。以下是 Marcus 的公司需要转移到 Odoo 的 YTD 余额:

YTD 类别 |

需要转移的 YTD 余额 |

|---|---|

总收入(正常出勤) |

$13,045.45 |

总收入(加班) |

$1,000 |

带薪休假 |

$954.55 |

洗衣津贴 |

$200 |

预扣总额 |

$2,956 |

Super Guarantee |

$1,610 |

If some YTD balances need to be reported with more granularity to the ATO, you can use the salary rule’s inputs.

Example

For instance, the Basic Salary rule can contain six inputs, and three are necessary in our example: regular gross amounts, overtime, and paid leaves. These are all reported differently in terms of YTD amounts.

The finalized YTD opening balances for Marcus Cook look like the following.

As a result, YTD computations on payslips are based on the employee’s opening balances instead of starting from zero.

STP finalisation¶

重要

Odoo is currently in the process of becoming compliant with STP Phase 2, and the finalisation flows described below do not yet submit data to the ATO.

EOFY finalisation¶

Employers reporting through STP must make a finalization declaration by 14 July each year. To do so, go to .

Both active and terminated employees to finalise are displayed.

From the finalisation form view, you can proceed with a final audit of all employees’ payslips during the relevant financial year. Once ready, click Submit to ATO. When you have made the finalisation declaration, employees will see the status of their payment information change to Tax ready on their online income statement after the end of the financial year.

Individual finalisation¶

Odoo also allows you to finalise employees individually during the year. This can be useful when:

one-off payments are made after a first finalisation; and

finalisation after termination of employment during the year.

To proceed with an individual finalisation, go to , leave the EOFY Declaration checkbox unticked, and manually add employees to be finalised.

Even if you finalise an employee record partway through the financial year, the ATO will not pre-fill the information into the employee’s tax return until after the end of the financial year.

调整¶

重要

Odoo is currently in the process of becoming compliant with STP Phase 2, and the adjustment flows described below do not yet submit data to the ATO.

Amend finalisation¶

If you need to amend YTD amounts for an employee after a finalisation declaration was made, it is still possible to remove the finalisation indicator for that employee. To do so, go to , select the employee, and leave the Finalisation checkbox unticked.

When ready, click Submit to ATO to file the finalisation update to the ATO.

Once the correct YTD details are ready for that employee after amendment, finalise that employee again.

注解

The ATO expects employers to correct errors within 14 days of detection or, if your pay cycle is longer than 14 days (e.g., monthly), by the date you would be due to lodge the next regular pay event. Finalisation amendments can be done through STP up to five years after the end of the financial year.

Finalising and amending finalisation for a single employee can also be useful when rehiring an employee within the same financial year.

Full file replacements¶

An employer can make full file replacements of pay runs to replace the last lodgement sent to the ATO if it turns out to contain significantly inaccurate data.

To do so, open the last STP submission and click Replace File. Then, select which payslips need to be reset by ticking the Reset Payslip checkbox.

Resetting payslips does not create new payslips or a new pay run, but instead:

The payslips batch is reset from Paid or Done to Confirmed.

The status of the reset payslips revert back to Draft.

The correct payslips remain paid and matched against the original payment.

A new STP submission is created to replace the former one. For traceability purposes, the former STP submission is not deleted but marked as replaced.

First, correct the reset payslips and create their draft entry. Once done, the Submit to ATO reappears on the payslip batch to process the full file replacement.

When ready, submit the pay run to the ATO once again. Please note that full file replacements are only meant as a last resort to amend a substantial amount of erroneous data. When possible, the ATO recommends correcting an incorrect payslips by submitting a correction as part of the next pay run or via update event.

Moreover, it is not possible to submit a second full file replacement of the same submission, and a full file replacement can only be done once every 24 hours.

Zero out YTD values¶

In case of a mid-year change of several key identifiers, YTD values need to be zeroed out, and then re-posted with the updated key identifier.

For the following company identifiers, all employees need to be zeroed out:

ABN

Branch Code

BMS ID

For the following employee identifiers, only individual employees can be zeroed out:

TFN

Payroll ID

Before updating any key identifiers, create a new STP submission by going to and:

Change the Submission Type to Update.

Tick the Zero Out YTD checkbox.

Click Add a line to specify which employees.

Click Submit to ATO.

Once that is done, modify the key identifier(s) to amend.

最后,回到 页面,创建并提交新的 更新,这次不要勾选 归零 YTD 复选框。这将通知 ATO,以前记录的 YTD 余额将根据新的关键标识符进行调整。

工资单链接至其他应用程序¶

休假¶

休假应用程序 与 Odoo 中的薪酬管理应用程序原生整合。不同类型的休假将根据*工作条目*的概念填充工资单。

进入 ,为每种类型在 薪酬管理 部分配置以下两个字段:

工作条目类型:定义应在工资单的 工作天数 表中选择哪个工作条目。

未使用假期类型:在:guilabel:

年假、长期服务假 或:guilabel:事假之间进行选择。如果选择了 个人假期,则在离职时,该假期类型的剩余假期将不显示为应享权利。如果员工符合条件,年假 类型的未使用假期将包括休假津贴。

费用¶

报销应用程序 也与 Odoo 中的 薪酬管理 应用程序原生整合。首先,进入 并启用 在工资单中报销。

当您的工资单上的员工提交已获批准的费用需要报销时,您可以通过两种方式进行报销:

如果要在工资流水之外报销费用,请点击 发布日记账分录。必须手动付款。

如果费用将在下一次发薪时报销,请点击 在下一张工资单中报告。

在下一张工资单中添加费用后,您可以在 其他输入 表中找到它。该输入类型将作为净工资的附加项进行计算。

支付员工工资后,工资单上与员工报销相关的日记账项目会自动与支出的供应商账单相匹配。

高级配置¶

其他输入类型¶

您可以通过 访问其他输入类型。与澳大利亚有关的其他输入类型有 63 种。我们不建议将其他输入类型作为薪资解决方案的一部分,因为它们不能在 STP 框架内使用。您可以将它们存档或删除。

在每种输入类型中,以下字段都很重要:

付款类型 将输入类型分为六类:

津贴:除工资和薪金外,您支付给员工的另一笔款项。其中一些津贴是裁定待遇所规定的:洗衣费、交通费等。

重要

如果您计划使用不同预扣率的津贴(如 *每公里美分* 或 *差旅津贴*),请联系我们,以了解 Odoo 目前是否涵盖您的业务情况。

注解

截至 Odoo 18,一些津贴,如 洗衣:核准制服津贴 由另外两个输入进行管理:一个输入用于存入 ATO 限额内的已付金额,另一个输入用于存入超过 ATO 限额的金额。这是 Odoo 正确计算 PAYGW 所必需的。

有些企业可能需要根据员工情况将津贴报告从 OTE 转移到 薪水和工资。在这种情况下,您必须复制并重新配置现有的其他输入类型。例如, 与工作相关的非费用 津贴默认为 OTE。

扣除:工会费和子女抚养费扣款被视为扣款。

ETP:终止雇用付款。这些款项要么被视为除外款项,要么被视为非除外款项(见`ATO关于ETP组成部分税收的网页<https://www.ato.gov.au/individuals-and-families/jobs-and-employment-types/working-as-an-employee/leaving-your-job/employment-termination-payments-for-employees/how-etp-components-are-taxed>`_)。

休假:与休假相关的其他输入,与单个发薪期无关(一次性支付、在职期间兑现假期、未使用的假期等)。

一次性支付:重返工作岗位和一次性支付 E(用于支付背债)属于这一类。

其他:其他支付方式,有自己的特定逻辑。

PAYGW 处理 影响 Odoo 如何预扣该输入类型的税款:常规、无现收现付预扣税 和 :guilabel:`仅超额`(用于津贴)。

养老金处理方式:普通时间收入、 薪资与工资、非薪资与工资。

STP代码:仅在 :ref:`开发者模式<developer-mode>`中可见,此字段告诉 Odoo 如何向澳大利亚税务局(ATO)报告此项支付的总价值。如果该字段已默认设置了值,我们不建议更改它。

通过 付款类型 对其他输入类型进行分组,可以帮助您了解这些输入的不同使用场景。

工作条目类型¶

*工作记录类型*是员工出勤的一种类型(例如,出勤、带薪休假、加班等)。在每个澳大利亚数据库中,默认创建了几种工作记录类型。

在使用 Odoo 的澳大利亚工资单解决方案之前,建议您通过前往 类型来精简工作记录类型,只保留您需要的类型。

对于每种类型,请确保为澳大利亚配置以下字段:

是否为OTE:确定在此类别中花费的时间是否可被视为普通时间收入,这意味着将适用养老金保证率(例如,常规出勤、带薪休假等)。

罚款率:用于确定适用于该类别时间的罚款百分比。重要的是,您应根据工作类型(如周六费率、周日费率、加班费率等)配置适用于您所在省/州或行业的罚款率。

STP 代码:仅在 开发者模式 中可见,此字段告诉 Odoo 如何向 ATO 报告在此类别中花费的时间。如果该字段已默认设置,我们不建议更改其值。

当前限制¶

从 Odoo 18 开始,我们不建议公司在以下业务流程中使用薪酬管理应用程序:

收入流类型:国外就业收入

税收待遇类别:演员和表演者

身故抚恤金报告

WPN 的报告义务(而不是 ABN)

预扣率不同的津贴(如*每公里美分*的津贴和*差旅津贴*)。

如果您想确定 Odoo 是否符合您在澳大利亚的薪资要求,请联系我们。

就业英雄整合¶

如果您的企业已经开始使用就业英雄,您可以使用该连接器作为替代薪资解决方案。就业英雄模块可将工资单会计分录(如支出、社会费用、负债、税金)从 就业英雄自动同步到 Odoo。薪酬管理仍在就业英雄中完成;Odoo 仅记录日记账分录。

配置¶

安装 就业英雄工资单模块 (

l10n_employment_hero)。通过 配置就业英雄 API。勾选 启用就业英雄整合 复选框后,将显示更多字段。

在就业英雄平台的 我的账户 部分找到 API 密钥。

工资单 URL 已预填为

https://keypay.yourpayroll.com.au。警告

不要更改预先填写的 工资单 URL。

在就业英雄URL中查找 企业 ID`(例如,`189241)。

选择任何 Odoo 日记账作为 薪酬管理日记账 来发布工资单条目。

进入 配置税金。为就业英雄工资单条目创建必要的税项。在 字段中填写匹配就业英雄税的税号。

应用程序接口解释¶

该应用程序接口将日记账条目从 Employment Hero 同步到 Odoo,并将其保留在草稿模式。参考资料包括括号中的 Employment Hero 工资单条目 ID,方便用户在 Employment Hero 和 Odoo 中检索相同的记录。

默认情况下,每周同步一次。您可以进入 ,在 Employment Hero 中点击 手动获取薪资运行,以获取记录。

Employment Hero 工资单分录也基于复式簿记。Employment Hero 使用的账户在薪酬管理设置部分进行了定义。

为使 API 正常工作,您必须在 Odoo 中创建与 Employment Hero 业务默认账户相同的账户(相同名称和相同代码)。您还需要在 Odoo 中选择正确的账户类型,以生成准确的财务报告。