Manage cash basis taxes¶

The cash basis taxes are due when the payment has been done and not at the validation of the invoice (as it is the case with standard taxes). Reporting your income and expenses to the administration based on the cash basis method is legal in some countries and under some conditions.

Example : You sell a product in the 1st quarter of your fiscal year and receive the payment the 2nd quarter of your fiscal year. Based on the cash basis method, the tax you have to pay to the administration is due for the 2nd quarter.

How to configure cash basis taxes ?¶

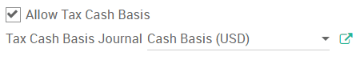

You first have to activate the setting in . You will be asked to define the Tax Cash Basis Journal.

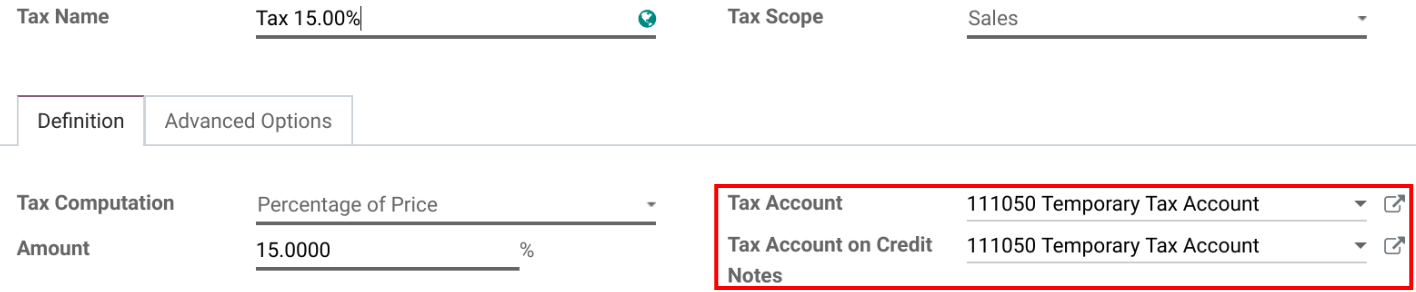

Once this is done, you can configure your taxes in . At first set the proper transitional accounts to post taxes until you register the payment.

In the Advanced Options tab you will turn Tax Due to Based on Payment. You will then have to define the Tax Received account in which to post the tax amount when the payment is received and the Base Tax Received Account to post the base tax amount for an accurate tax report.

What is the impact of cash basis taxes in my accounting ?¶

Prenons un exemple. Vous réalisez une vente de 100 $ avec une taxe de 15 % sur la base de trésorerie. Lorsque vous validez la facture client, l’écriture suivante est créée dans votre comptabilité :

Journal de facturation des clients |

|

|---|---|

Débit |

Crédit |

Créances 115 $ |

|

Compte fiscal temporaire 15 $ |

|

Compte de revenus 100 € |

Vous recevez le paiement quelques jours après :

Journal de banque |

|

|---|---|

Débit |

Crédit |

Banque 115 $ |

|

Créances 115 $ |

When you reconcile the invoice and the payment, this entry is generated:

Journal basé sur la comptabilité de trésorerie |

|

|---|---|

Débit |

Crédit |

Compte fiscal temporaire 15 $ |

|

Tax Received Account $15 |

|

Compte de revenus 100 € |

|

Compte de revenus 100 € |

|

Astuce

The last two journal items are neutral but they are needed to insure correct tax reports in Odoo with accurate base tax amounts. We advise to use a default revenue account. The balance of this account will then always be at zero.