Fatturazione elettronica (EDI)¶

Per EDI, o scambio elettronico di dati, si intende lo scambio tra aziende di documenti commerciali, come ordini di acquisto e fatture, in un formato standard. L’invio di documenti secondo uno standard EDI garantisce che il sistema che riceve il messaggio possa interpretare correttamente le informazioni. Esistono diversi formati di file EDI, disponibili a seconda del Paese dell’azienda.

La funzione EDI consente di automatizzare l’amministrazione tra aziende e può essere richiesta anche da alcuni governi per il controllo fiscale o per facilitare l’amministrazione.

La fatturazione elettronica di documenti come fatture clienti, note di credito o fatture fornitori rappresenta uno dei campi di applicazione dell’EDI.

Odoo supports, among others, the following formats.

Nome formato |

Applicabilità |

|---|---|

Factur-X (PDF/A-3) |

For French and German companies |

Peppol BIS Billing 3.0 (UBL) |

For companies whose countries are part of the EAS list |

E-FFF |

For Belgian companies |

XRechnung (UBL) |

For German companies |

Fattura PA (IT) |

For Italian companies |

CFDI (4.0) |

For Mexican companies |

Peru UBL 2.1 |

For Peruvian companies |

SII IVA Llevanza de libros registro (ES) |

For Spanish companies |

UBL 2.1 (Columbia) |

For Colombian companies |

Egyptian Tax Authority |

For Egyptian companies |

E-Invoice (IN) |

For Indian companies |

NLCIUS (Netherlands) |

For Dutch companies |

EHF 3.0 |

For Norwegian companies |

SG BIS Billing 3.0 |

For Singaporean companies |

A-NZ BIS Billing 3.0 |

For Australian/New Zealand companies |

Vedi anche

Configurazione¶

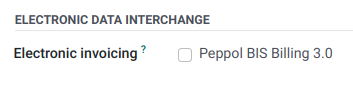

Go to and enable the formats you need for this journal.

Once an electronic invoicing format is enabled, XML documents are generated when clicking on Confirm in documents such as invoices, credit notes, etc. These documents are either visible in the attachment section, or embedded in the PDF.

Nota

For E-FFF, the xml file only appears after having generated the PDF (Print or Send & Print button), since the PDF needs to be embedded inside the xml.

Every PDF generated from Odoo contains a Factur-X XML file (for interoperability purpose). For German and French companies, the option Factur-X (PDF/A-3) in addition enables validation checks on the invoice and generates a PDF/A-3 compliant file, required by plaftorms like Chorus Pro.

The formats available depend on the country registered in your company’s General Information.

Odoo supports the Peppol BIS Billing 3.0 format that can be used via existing access points.