Indonesia¶

Modules¶

The following modules related to the Indonesian localization are available:

Name |

Technical name |

Description |

|---|---|---|

Indonesian - Accounting |

|

This module includes the default fiscal localization package. |

Indonesia E-faktur |

|

This module includes the features required to export invoices as e-Faktur. |

Indonesia E-faktur (Coretax) |

|

This module facilitates the generation of XML files for the Coretax system. |

Configuration¶

Company¶

Open the Settings app, go to the Companies section, and click Update Info. Ensure the NPWP field contains the Tax Identification Number, as an e-Faktur cannot be generated from an invoice otherwise.

Contacts¶

To configure a partner for e-Faktur, go to their contact form and fill in the following Indonesian-specific fields:

Is PKP: Check this box to allow e-Faktur generation for the partner.

NPWP: Enter the partner’s Tax Identification Number.

NIK: If the partner does not have an NPWP, enter the NIK in the Accounting tab under Indonesian taxes.

Products¶

To set a product’s E-Faktur product code, go to and access the desired product form. In the Indonesian Localization section, select a code in the E-Faktur Product code field. By default, the code is set to 000000 - Barang.

Note

E-Faktur product codes are pre-generated by Odoo and cannot be edited. Select a code from the available options.

E-Faktur UoM Code¶

Tip

Go to to make sure the Units of Measure option has been enabled.

To configure the E-Faktur UoM code, go to . Open a category and select the appropriate E-Faktur UoM Code from the options.

Accounting¶

E-invoicing¶

Generate an E-Faktur XML¶

An e-Faktur can be created for an invoice if the customer’s country is Indonesia and the Is PKP checkbox is enabled on their contact form.

To generate an e-Faktur XML:

Go to and create an invoice.

In the Other Info tab, under the Electronic Tax section, select a Kode Transaksi code.

Note

The Kode Transaksi codes are pre-generated by Odoo and cannot be edited.

After confirming the invoice, click the (Actions) icon and select Download e-faktur.

The downloaded XML file can then be uploaded to the Coretax system. After the file is generated, the e-Faktur Document (Coretax) field in the invoice’s Electronic Tax section is populated automatically.

Note

To create a batch XML file for several invoices, select them in the invoice list view and choose Download e-faktur from the Actions menu.

Important

The tax invoice number is generated by the Coretax system, not by Odoo.

Once an e-Faktur XML file has been downloaded, it cannot be changed. Any subsequent download will retrieve the original file.

QRIS QR code on invoices¶

QRIS is a digital payment system that allows customers to make payments by scanning the QR code from their preferred e-wallet.

Important

According to the QRIS API documentation, QRIS expires after 30 minutes. Due to this restriction, the QR code is not included in reports sent to customers and is only available on the customer portal.

Activate QR codes¶

Go to . Under the Customer Payments section, activate the QR Codes feature.

QRIS bank account configuration¶

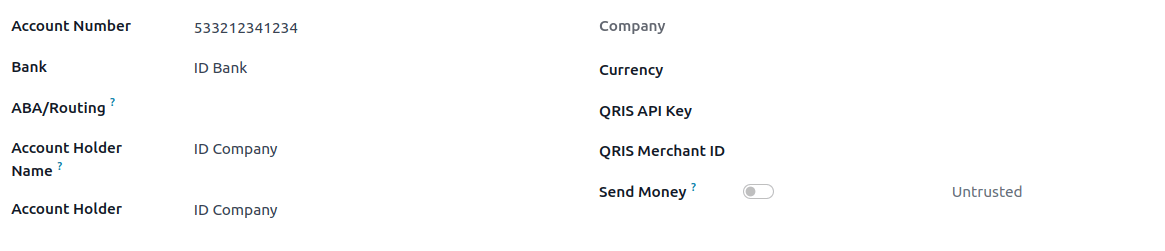

Go to and select the bank account for which you want to activate QRIS. Set the QRIS API Key and QRIS Merchant ID based on the information provided by QRIS.

Important

The account holder’s country must be set to Indonesia on its contact form.

See also

Bank journal configuration¶

Go to , open the bank journal, then fill out the Account Number and Bank under the Journal Entries tab.

Issue invoices with QRIS QR codes¶

When creating a new invoice, open the Other Info tab and set the Payment QR-code option to QRIS.

Ensure that the Recipient Bank is the one you configured, as Odoo uses this field to generate the QRIS QR code.