Philippines¶

Modules¶

Install the following modules to get all the features of the Philippines localization:

Name |

Technical name |

Description |

|---|---|---|

Philippines - Accounting |

|

This module includes the default fiscal localization package. |

Philippines - Accounting Reports |

|

This module includes the accounting reports for the Philippines. |

Philippines Checks Layout |

|

This module includes the features required to enable the PCHC check format. |

Note

In some cases, such as when upgrading to a version with additional modules, modules may not be installed automatically. Any missing modules can be manually installed.

Localization overview¶

The Philippine localization package ensures compliance with Philippine fiscal and accounting regulations. It includes tools for managing taxes, fiscal positions, reporting, and a predefined chart of accounts tailored to the Philippines’ standards.

The Philippine localization package provides the following key features to ensure compliance with local fiscal and accounting regulations:

Chart of accounts: a predefined structure tailored to Philippine accounting standards

Taxes: pre-configured tax rates, including standard VAT, zero-rated, and exempt options

Fiscal positions (tax and account mapping): automated tax adjustments based on customer or supplier registration status

Tax reporting: detailed overview of your net tax liability

Taxes¶

Installing the Philippines - Accounting (l10n_ph) and Philippines -

Accounting Reports (l10n_ph_reports) modules automatically creates default taxes for tax reports generation.

The following categories are linked to the relevant accounts:

Sales and Purchase VAT: 12%

Sales and Purchase VAT Zero-Rated: 0%

Sales and Purchase VAT Exempt: Exempt

Withholding Tax: Expanded Withholding Tax (EWHT), Final Withholding Tax (FWHT), and Withholding VAT (WVAT).

Tip

Default taxes are pre-configured and mapped to the relevant reports. To create a new tax, it is recommended to duplicate an existing one to preserve this configuration. To do so, select the tax, click Actions, and select Duplicate.

ATC codes¶

ATC codes are essential for generating BIR 2307, SAWT and QAP reports. These codes ensure compliance with regulatory requirements.

To configure a withholding tax, go to , select the tax, and fill in the Philippines ATC (Alphanumeric Tax Code) field under the Philippines tab.

Reports¶

2550Q¶

The BIR Form 2550Q summarizes sales, purchases, output VAT, input VAT, and the resulting VAT payable or refundable for the period.

To access it, navigate to , click Report, and select 2550Q (PH).

SAWT and QAP¶

To access these reports, navigate to , click Report, and select SAWT & QAP (PH).

Summary of Alphalist of Withholding Taxes (SAWT): Displays all customer invoices that have sales withholding taxes applied. This export is used as a supporting document for forms 1701Q, 1701, 1702Q, and 1702.

Quarterly Alphalist of Payees (QAP): Includes all vendor bills that have purchase withholding taxes applied. This export is used as a supporting document for forms 1601EQ and 1604E.

Note

The generated file is based on the specific period selected in the calendar report filter.

For example, while the 1601EQ is a quarterly report, .DAT files are submitted monthly.

Make sure to filter by Month and select the appropriate month before exporting.

Both SAWT and QAP reports can be exported in .DAT format, which is compatible with the BIR

Alpha module. To do so, follow these steps:

Make sure to filter by the appropriate month.

On the report page, click the (gear) icon and select Export SAWT & QAP.

In the DAT Export Options window, choose the relevant Attachment For (e.g., 1601EQ) and click Export.

SLSP¶

The SLSP (Summary lists of sales and purchases) is an electronic schedule required from VAT‑registered taxpayers listing sales and purchase transactions.

To access it, navigate to .

Summary List of Sales (SLS): Detailed sales per customer with amounts and output VAT.

Summary List of Purchases (SLP): Detailed purchases per supplier with amounts and input VAT.

Note

The Summary List of Purchases report excludes imports by default. To include import transactions, click Posted Entries and select Including Importations.

The generated file is based on the specific period selected in the calendar report filter. For example, while the 2550Q is a quarterly report,

.DATfiles are submitted monthly. Make sure to filter by Month and select the appropriate month before exporting.

SLS and SLP reports can be exported in .DAT format, which is compatible with the ReLiEf module. To do so, follow these steps:

Make sure to filter by the appropriate month.

On the report page, click the (gear) icon and select Export SLSP.

In the DAT Export Options window, click Export.

BIR 2307¶

The BIR 2307, or Certificate of Creditable Tax Withheld at Source, can be generated for vendor bills that include expanded withholding taxes.

To generate a BIR 2307 report:

Go to and select one or multiple vendor bills from the list view.

Click Actions, and select Download BIR 2307 XLS.

In the BIR 2307 Report window, review the selection and click Generate.

Note

The XLS file generates records only for bill lines with expanded withholding taxes applied.

Important

Odoo does not generate the BIR 2307 PDF report natively. The exported Form_2307.xls file must

be converted to BIR DAT or PDF format.

Company information¶

To use all the features of this fiscal localization, the following fields are required on the company record:

Name

Address, including the City, State, Zip Code, and Country.

In the Street field, enter the street name, number, and any additional address information.

In the Street 2 field, enter the barangay.

Tax ID: Taxpayer Identification Number (TIN) should follow the

NNN-NNN-NNN-NNNNNformatCompany Branch code uses the last 3 to 5 digits of the Tax ID, or defaults to

000if not provided.RDO: Revenue District Office code.

Phone

Email

Contacts¶

The Philippine localization utilizes specific fields on contact forms to generate BIR reports and files used for submission.

The Tax ID field is used to register the TIN for both companies and individuals. Filling in this field is recommended to ensure the accuracy of tax reports.

For individuals not associated with a company, use the following additional fields to identify them:

First Name

Middle Name

Last Name

Accounting¶

Payments by check¶

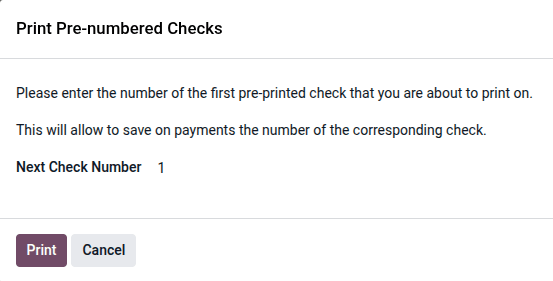

The Philippines check print layout adheres to the New Check Design Standards and Specifications (CICS OM No. 23-040).

To use check payments, activate the check payment option, then, in the Check Layout field, select Print Check - PH.

When paying a vendor bill by check, enter the check number manually during the printing process to match the physical check stock.

See also

Payment providers¶

Odoo supports two payment providers available for the Philippines: Xendit and AsiaPay.