Deferred expenses¶

Deferred expenses and prepayments (also known as prepaid expenses) are both costs that have already occurred for products or services yet to be received.

Such costs are assets for the company that pays them since it already paid for products and services but has either not yet received them or not yet used them. The company cannot report them on the current profit and loss statement, or income statement, since the payments will be effectively expensed in the future.

These future expenses must be deferred on the company's balance sheet until the moment in time they can be recognized, at once or over a defined period, on the profit and loss statement.

For example, let's say we pay $1200 at once for one year of insurance. We already pay the cost now but haven't used the service yet. Therefore, we post this new expense in a prepayment account and decide to recognize it on a monthly basis. Each month, for the next 12 months, $100 will be recognized as an expense.

Odoo Accounting handles deferred expenses by spreading them across multiple entries that are posted periodically.

Catatan

Server memeriksa sekali sehari bila entri harus direkam. Lalu mungkin membutuhkan waktu sampai 24 jam sebelum Anda melihat perubahan dari Draft menjadi Direkam.

Konfigurasi¶

Pastikan pengaturan default secara tepat dikonfigurasi untuk bisnis Anda. Untuk melakukan ini, pergi ke . Opsi-opsi berikut tersedia:

- Jurnal

Entri-entri didefer direkam di jurnal ini.

- Akun Pengeluaran yang Didefer

Pengeluaran didefer pada akun Aset Lancar sampai mereka direkam.

- Akun Pendapatan yang Didefer

Pendapatan yang didefer pada akun Kewajiban Lancar sampai mereka direkam.

- Buat Entri-Entri

By default, Odoo automatically generates the deferral entries when you post a vendor bill. However, you can also choose to generate them manually by selecting the Manually & Grouped option instead.

- Perhitungan Jumlah

Suppose a bill of $1200 must be deferred over 12 months.

The Months option accounts for $100 each month prorated to the number of days in that month (e.g., $50 for the first month if the Start Date is set to the 15th of the month).

The Full Months option considers each month started to be full (e.g., $100 for the first month even if the Start Date is set to the 15th of the month); this means that with the Full Months option, a full $100 is recognized in the first partial month, eliminating the need for a 13th month to recognize any remainder as would be the case when using the Months option.

The Days option accounts for different amounts depending on the number of days in each month (e.g., ~$102 for January and ~$92 for February).

Buat entri yang didefer pada validasi¶

Tip

Make sure the Start Date and End Date fields are visible in the Invoice Lines tab. In most cases, the Start Date should be in the same month as the Bill Date. Deferred expense entries are posted from the bill date and are displayed in the report accordingly.

For each line of the bill that should be deferred, specify the start and end dates of the deferral period.

If the Generate Entries field is set to On invoice/bill validation, Odoo automatically generates the deferral entries when the bill is validated. Click on the Deferred Entries smart button to see them.

One entry, dated on the same day as the bill's accounting date, moves the bill amounts from the expense account to the deferred account. The other entries are deferral entries which will, month after month, move the bill amounts from the deferred account to the expense account to recognize the expense.

Example

You can defer a January bill of $1200 over 12 months by specifying a start date of 01/01/2023 and an end date of 12/31/2023. At the end of August, $800 is recognized as an expense, whereas $400 remains on the deferred account.

Laporan¶

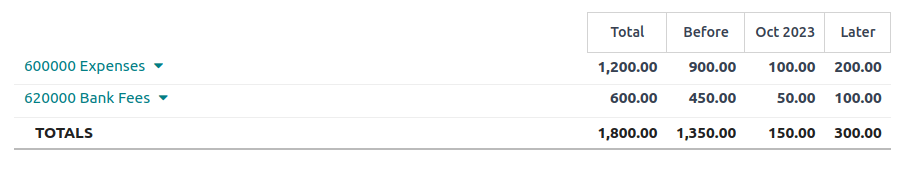

The deferred expense report computes an overview of the necessary deferral entries for each account. To access it, go to .

Untuk melihat item jurnal setiap akun, klik pada nama akun dan lalu pada Item-Item Jurnal.

Catatan

Only bills whose accounting date is before the end of the period of the report are taken into account.

Buat secara manual entri-entri yang didefer yang dikelompokkan¶

Bila Anda memiliki banyak pendapatan yang didefer dan ingin mengurangi jumlah entri-entri jurnal yang dibuat, Anda dapat membuat entri yang didefer secara manual. Untuk melakukan ini, tetapkan field Buat Entri di Pengaturan sebagai Secara Manual & Kelompok. Odoo lalu mengagregatkan jumlah yang didefer di satu entri.

At the end of each month, go to the Deferred Expenses report and click the Generate Entries button. This generates two deferral entries:

One dated at the end of the month which aggregates, for each account, all the deferred amounts of that month. This means that at the end of that period, a part of the deferred expense is recognized.

Pemutarbalikkan entri yang dibuat, dengan tanggal hari berikutnya (contoh, hari pertama bulan depan) untuk membatalkan entri sebelumnya.

Example

There are two bills:

Bill A: $1200 to be deferred from 01/01/2023 to 12/31/2023

Bill B: $600 to be deferred from 01/01/2023 to 12/31/2023

- Di bulan Januari

Di akhir bulan Januari, setelah mengeklik tombol Buat Entri, terdapat entri-entri berikut:

Entri 1 dengan tanggal 31 Januari:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both bills)

Line 2: Expense account 100 + 50 = 150 (recognizing 1/12 of bill A and bill B)

Baris 3: Akun yang didefer 1800 - 150 = 1650 (jumlah yang didefer nanti)

Entri 2 dengan tanggal 1 Febuari, pemutarbalikkan entri sebelumnya:

Baris 1: Akun pengeluaran 1800

Baris 2: Akun yang didefer -150

Baris 3: Akun pengeluaran -1650

- Di bulan Febuari

Di akhir bulan Febuari, setelah mengeklik tombol Buat Entri, terdapat entri-entri berikut:

Entri 1 dengan tanggal 28 Febuari:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both bills)

Line 2: Expense account 200 + 100 = 300 (recognizing 2/12 of bill A and bill B)

Baris 3: Akun yang didefer 1800 - 300 = 1500 (jumlah yang didefer nanti)

Entri 2 dengan tanggal 1 Maret, pemutarbalikkan entri sebelumnya.

- Dari Maret sampai Oktober

Perhitungan yang sama dilakukan untuk setiap bulan sampai Oktober.

- Di bulan November

Di akhir bulan November, setelah mengeklik tombol Buat Entri, terdapat entri-entri berikut:

Entri 1 dengan tanggal 30 November:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both bills)

Line 2: Expense account 1100 + 550 = 1650 (recognizing 11/12 of bill A and bill B)

Baris 3: Akun yang didefer 1800 - 1650 = 150 (jumlah yang didefer nanti)

Entri 2 dengan tanggal 1 Desember, pemutarbalikkan entri sebelumnya.

- Di bulan Desember

There is no need to generate entries in December. Indeed, if we do the computation for December, we will have an amount of 0 to be deferred.

- Secara total

Bila kita mengagregatkan semuanya, kita akan memiliki:

bill A and bill B

dua entri (satu untuk yang didefer dan satu untuk pemutarbalikkan) untuk setiap bulan dari Januari sampai November

Therefore, at the end of December, bills A and B are fully recognized as expense only once in spite of all the created entries thanks to the reversal mechanism.