智利¶

其他資料

模組¶

安裝 下列模組,以使用智利本地化的所有功能。

名稱 |

技術名稱 |

說明 |

|---|---|---|

智利 - 會計 |

|

根據 :abbr:`SII(智利國家稅務局)`法規和指導方針,增加了公司在智利運營所需的最基本會計功能。 |

智利 - 會計報告 |

|

加入 Propuesta F29 及 Balance Tributario (8 columnas) 報告。 |

智利 - 電子發票 |

|

包括根據 SII(智利國家稅務局) 法規在線生成和接收電子發票的所有技術和功能要求。 |

智利 - 電子收據 |

|

包括根據 SII(智利國家稅務局) 法規,以數碼方式生成和接收電子發票的所有技術和功能要求。 |

智利商品電子出口 |

|

包括根據 SII(智利國家稅務局) 和海關條例生成出口貨物電子發票的技術和功能要求。 |

智利 - 電子發票交貨指南 |

|

包括所有技術和功能要求,以便根據 SII(智利國家稅務局) 法規通過網絡服務生成交貨指南。 |

備註

Odoo 會根據創建數據庫時選擇的國家/地區,自動為公司安裝相應的軟件包。

智利 - 電子發票交貨指南 模組需要依賴 庫存 應用程式。

重要

公司必須已完成 SII Sistema de Facturación de Mercado 認證程序,才可使用所有功能。

公司資訊¶

前往 ,並確保以下公司資料最新且填寫正確:

公司名稱

地址:

街道

城市

州/省

郵遞區號

國家/地區

稅務識別碼:輸入所選 納稅人類型 的識別號碼。

活動名稱:最多選擇四個活動代碼。

公司活動描述:輸入公司活動的簡短描述。

會計設定¶

之後,前往 並依照指示進行設定:

財政資訊¶

配置以下 納稅人資訊:

納稅人類型:選擇適用的納稅人類型:

受增值稅影響(第一類):針對向客戶收取稅款的發票

付款票據發出者(第二類):適用於發出付款票據(Boleta)的供應商

最終消費者:只發出收據

外國人

SII 辦事處:選擇你公司的 SII 區域辦事處

電子發票數據¶

選擇你的 SII 網上服務 環境:

SII-Test:用於測試數據庫,使用從 SII(智利國家稅務局)`獲取的測試 :abbr:`CAF(發票授權代碼)。在這種模式下,可以測試直接連接流,文件被發送到 SII(智利國家稅務局) 。

SII - 正式運行數據庫:用於正式運行數據庫。

SII - 演示模式:文件在演示模式下自動創建和接受,但 不會 發送到 SII (智利國家稅務局)。因此,在此模式下不會出現拒絕錯誤或 接受並有異議 。每個內部驗證都可以在演示模式下進行測試。請避免在正式運行數據庫中選擇此選項。

然後,輸入 法律電子發票數據:

SII 決議編號

SII 決議日期

DTE 收取電郵伺服器¶

DTE 的 電郵郵箱電子發票 功能,可以定義為接收客戶的索款及接受的電子郵件。如果您想使用 電郵郵箱電子發票 作為 DTE 傳入電郵伺服器,需要在 啟用此選項。

重要

为了接收您的 SII 文件,有必要设置您自己的电子邮件服务器。有关如何设置的更多信息,请参阅本文档: 通过电子邮件在 Odoo 中交流 。

首先單擊 配置 DTE 接收電子郵件,然後單擊 新增 以加入伺服器,並填寫以下欄位:

名稱:為伺服器命名。

伺服器類型:選擇使用的伺服器類型。

IMAP 伺服器

POP 伺服器

本機伺服器:使用本機腳本來取得電子郵件並建立新記錄。該腳本可以在選取此選項的 :guilabel:`配置 部分中找到。

Gmail OAuth 驗證:需要在一般設定中配置您的 Gmail API 憑證。可以在 登入資訊 部分找到配置的直接連結。

DTE 伺服器:啟用此選項。選中此選項後,該電子郵件帳戶將用於接收供應商的電子發票,以及來自 SII(智利國家稅務局) 的有關電子發票的通信。在這種情況下,該電子郵件應與 SII(智利國家稅務局) 網站上,內部進口服務部分內聲明的兩個電子郵件一致: ACTUALIZACION DE DATOS DEL CONTRIBUYENTE 、 Mail Contacto SII 以及 Mail Contacto Empresas 。

在 伺服器及登入 分頁中(針對 IMAP 和 POP 伺服器):

伺服器名稱:輸入伺服器的主機名稱或 IP 位址。

連接埠:輸入伺服器連接埠。

SSL/TLS:如果使用 SSL/TLS 協定為連線進行加密,請啟用此選項。

使用者名稱:輸入伺服器的登入使用者名稱。

密碼:輸入伺服器登入密碼。

小訣竅

在上線之前,建議存檔或刪除收件匣中不需要在 Odoo 處理的所有供應商賬單相關電子郵件。

證書¶

生成電子發票簽名需要 .pfx 格式的數碼證書。如要添加,請點擊 簽名證書 部分下的 配置簽名證書。然後,點擊 新增 配置證書:

證書密鑰:點擊 上傳文件 並選擇

.pfx文件。證書密碼:輸入文件的密碼。

主題序列號:根據證書格式,該欄位可能不會自動填充。在這種情況下,請輸入證書的法定代表 RUT。

證書所有者:如果需要限制特定用戶使用證書,請選擇一個。若要與所有計費用戶共享證書,請將該欄位留空。

警告

If the Certificate Owner field is set to a specific user, and there are no certificates shared with users, then the automatic sending of electronic documents and receipt acknowledgments is disabled.

多種貨幣¶

官方貨幣匯率由 智利的 mindicador.cl 提供。請在 ,設置匯率自動更新的 時間間隔,或選擇其他 服務。

合作夥伴資訊¶

要發送 SII(智利國家稅務局) 電子發票,也需要配置合作夥伴聯絡人。要執行此操作,請開啟 應用程式,並在新的或現有的聯絡人表單中,填寫以下欄位。

名稱

電郵

識別號碼

納稅人類型

活動描述

在 電子發票 分頁中:

DTE 電子郵件:為合作夥伴輸入發件人的電子郵件地址。

送貨指南價格:選擇送貨指南顯示的價格(如有)。

備註

DTE 電子郵件 是用於發送電子文件的電子郵件,必須在將成為電子文件一部分的聯絡人中設置。

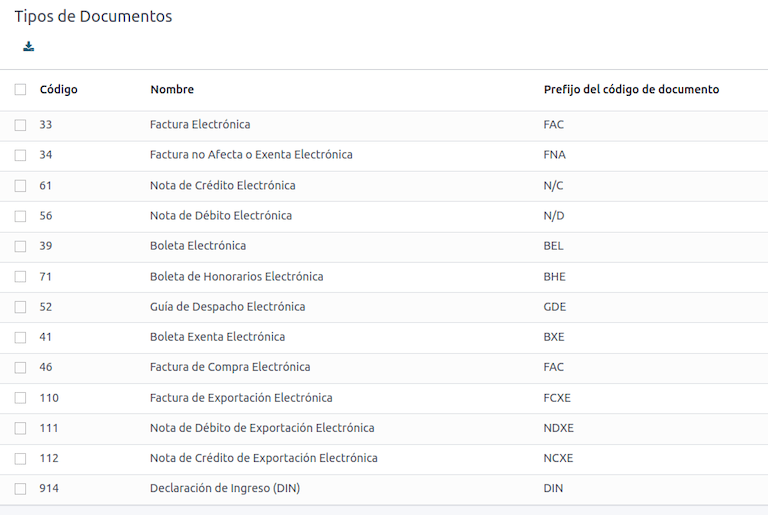

文件類型¶

會計文件按 SII(智利國家稅務局) 定義的文件類型分類。

文件類型在安裝本地化模組後會自動建立,亦可在 進行管理。

備註

有幾種文件類型預設為停用,但可以切換 生效 選項去啟用。

在發票上使用¶

每筆交易的文件類型由以下因素決定:

與發票相關的日記賬,確定該日記賬是否使用單據。

根據發出者及收件者的類型(如買方或賣方的財政制度)而套用的條件。

日記賬¶

Odoo 銷售日記賬 通常代表一個業務單位或地點。

Example

Ventas Santiago.

Ventas Valparaiso.

對於零售商店,為每個 POS 銷售點各自設立一個日記賬,是很常見的。

Example

收銀機 1。

收銀機 2。

採購 交易可使用一個日記賬進行管理,但有時公司會使用多個日記賬,以處理一些與供應商賬單無關的會計交易。這種配置可以通過以下模式輕鬆設置。

Example

向政府繳交稅款。

向員工付款。

建立銷售日記賬¶

要建立銷售日記賬,請前往 。然後,單擊 新增 按鈕,填寫以下所需資料:

類型:從下拉式選單中,選擇 銷售 作為客戶發票日記賬。

銷售點類型:如果銷售日記賬用於電子文件,必須選擇 線上 選項。否則,如果日記賬用於舊系統匯入的發票,或使用 SII 門戶網站的 Facturación MiPyme ,則可使用 手動 選項。

使用文件:如果日記賬將使用文件類型,請選取此欄位。此欄位僅適用於可與智利可用的不同單據類型組合相關的採購和銷售日記賬。預設情況下,建立的所有銷售日記賬都將使用憑證。

之後,在 日記賬記項 分頁中,在 會計資訊 部分定義 預設收入賬戶 及 專用貸記單序列。借記單的其中一個 使用例子 也需要配置這些欄位。

CAF¶

A folio authorization code (CAF) is required for each document type that will be issued electronically. The CAF is a file the SII provides to the issuer with the folios/sequences authorized for the electronic invoice documents.

Your company can request multiple folios and obtain several CAFs linked to different folio ranges. These CAFs are shared within all journals, so you only need one active CAF per document type, and it will be applied to all journals.

Please refer to the SII documentation to check the details on how to acquire the CAF files.

重要

The CAFs required by the SII are different from production to test (certification mode). Make sure you have the correct CAF set depending on your environment.

Upload CAF files¶

Once the CAF files have been acquired from the SII portal, they need to be uploaded in the database by navigating to . Then, click the New begin the configuration. On the CAF form, upload your CAF file by clicking the Upload your file button and then click Save.

Once uploaded, the status changes to In Use. At this moment, when a transaction is used for this document type, the invoice number takes the first folio in the sequence.

重要

The document types have to be active before uploading the CAF files. In case some folios have been used in the previous system, the next valid folio has to be set when the first transaction is created.

賬目總表¶

The chart of accounts is installed by default as part of the data set included in the localization module. The accounts are mapped automatically in:

稅項

Default Account Payable

預設應收賬戶

轉賬賬戶

轉換率

其他資料

稅項¶

As part of the localization module, taxes are created automatically with their related financial account and configuration. These taxes can be managed from .

Chile has several tax types, the most common ones are:

VAT: the regular VAT can have several rates.

ILA: the tax for alcoholic drinks.

其他資料

使用及測試¶

電子發票工作流程¶

在智利本地化中,電子發票工作流程包括開立客戶發票及收取供應商賬單。下圖說明相關資訊是如何向稅務機關(SII)、客戶和供應商分享的。

Customer invoice emission¶

After the partners and journals are created and configured, the invoices are created in the standard way. For Chile, one of the differences is the document type that is automatically selected based on the taxpayer. The document type can be changed manually if needed on the invoice by navigating to .

重要

Documents type 33 electronic invoice must have at least one item with tax, otherwise the SII rejects the document validation.

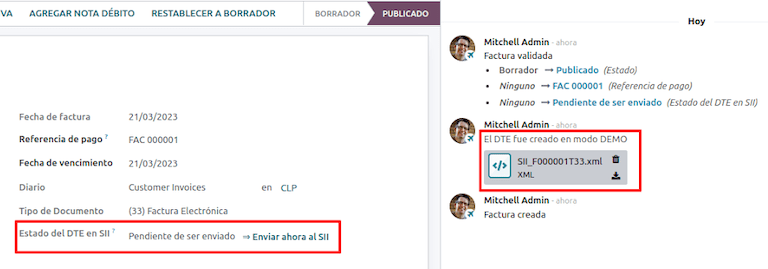

Validation and DTE status¶

Once all invoice information is filled, either manually or automatically when generated from a sales order, validate the invoice. After the invoice is posted:

The DTE file is created automatically and recorded in the chatter.

The DTE SII status is set as Pending to be sent.

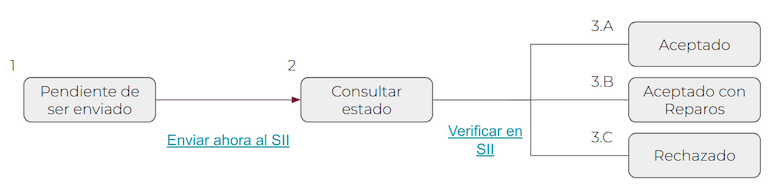

DTE 狀態是由 Odoo 透過每天晚上運行的預定操作進行自動更新。若需要立即取得稅務機關(SII)的回應,你也可以按照 DTE 狀態工作流程,手動執行:

The first step is to send the DTE to the SII. This can be sent manually by clicking the Enviar Ahora button. This generates a SII Tack number for the invoice, which is used to check the details sent by the SII via email. Then, the DTE status is updated to Ask for Status.

Once the SII response is received, Odoo updates the DTE status. To do it manually, click on the button Verify on SII. The result can either be Accepted, Accepted With Objection or Rejected.

重要

There are intermediate statuses in the SII before acceptance or rejection. It’s recommended to NOT continuously click Verify in SII for smooth processing.

The final response from the SII can take on one of these values:

Accepted: indicates the invoice information is correct, our document is now fiscally valid and it’s automatically sent to the customer.

Accepted with objections: indicates the invoice information is correct, but a minor issue was identified, nevertheless the document is now fiscally valid and it’s automatically sent to the customer.

Rejected: indicates the invoice information is incorrect and must be corrected. Details are sent to emails you registered in the SII. If it is properly configured in Odoo, the details are also retrieved in the chatter once the email server is processed.

If the invoice is rejected please follow these steps:

Change the document to Draft.

Make the required corrections based on the message received from the SII in the chatter.

Post the invoice again.

Crossed references¶

When the invoice is created, as a result of another fiscal document, the information related to the originator document must be registered in the Cross-Reference tab. This tab is commonly used for credit or debit notes, however, in some cases it can be used for customer invoices, as well. In the case of the credit and debit notes, they are set automatically by Odoo.

發票 PDF 報告¶

Once the invoice is accepted and validated by the SII and the PDF is printed, it includes the fiscal elements that indicate that the document is fiscally valid.

重要

If you are hosted in Odoo SH or On-Premise, you should manually install the pdf417gen library. Use the following command to install it: pip install pdf417gen.

Commercial validation¶

Once the invoice has been sent to the customer:

DTE Partner Status changes to Sent.

The customer must send a reception confirmation email.

Subsequently, if commercial terms and invoice data are correct, an acceptance confirmation is sent; otherwise, a claim is sent.

The field DTE Acceptance Status is updated automatically.

Processed for claimed invoices¶

Once the invoice has been accepted by the SII, it can not be cancelled in Odoo. In case you get a claim for your customer, the correct way to proceed is with a credit note to either cancel the invoice or correct it. Please refer to the 貸記單 section for more details.

常見錯誤¶

There are multiple reasons behind a rejection from the SII, but these are some of the common errors you might have and how to solve them:

- Error:

RECHAZO- DTE Sin Comuna OrigenHint: make sure the company address is properly filled including the state and city. - Error:

en Monto - IVA debe declararseHint: the invoice lines should include one VAT tax, make sure you add one on each invoice line. - Error:

Rut No Autorizado a FirmarHint: the RUT entered is not allowed to invoice electronically, make sure the company RUT is correct and is valid in the SII to invoice electronically. - Error:

Fecha/Número Resolucion Invalido RECHAZO- CAF Vencido : (Firma_DTE[AAAA-MM-DD] - CAF[AAAA-MM-DD]) > 6 mesesHint: try to add a new CAF related to this document as the one you’re using is expired. - Error:

Element '{http://www.sii.cl/SiiDte%7DRutReceptor': This element is not expected. Expected is ( {http://www.sii.cl/SiiDte%7DRutEnvia ).Hint: Make sure the field Document Type and VAT are set in the customer and in the main company. - Error:

Usuario sin permiso de envio.Hint: this error indicates that most likely, your company has not passed the Certification process in the SII - Sistema de Facturación de Mercado. If this is the case, please contact your Account Manager or Customer Support as this certification is not part of the Odoo services, but we can give you some alternatives. If you already passed the certification process, this error appears when a user different from the owner of the certificate is trying to send DTE files to the SII. - Error:

CARATULAHint: there are just five reasons why this error could show up and all of them are related to the Caratula section of the XML:The company’s RUT number is incorrect or missing.

The certificate owner RUT number is incorrect or missing.

The SII’s RUT number (this should be correct by default) is incorrect or missing.

The resolution date is incorrect or missing.

The resolution number is incorrect or missing.

貸記單¶

When a cancellation or correction is needed over a validated invoice, a credit note must be generated. It is important to consider that a CAF file is required for the credit note, which is identified as Document Type 61 in the SII. Please refer to the CAF section for more information on the process to load the CAF on each document type.

使用例子¶

Cancel referenced document¶

In case you need to cancel or invalidate an invoice, navigate to and select the desired invoice. Then, use the button Add Credit Note and select Full Refund, in this case the SII reference code is automatically set to Anula Documento de referencia.

Correct referenced document¶

If a correction in the invoice information is required, for example the street name on the original invoice is wrong, then use the button Add Credit Note, select Partial Refund and select the option Only Text Correction. In this case the SII Reference Code field is automatically set to Corrects Referenced Document Text.

Odoo creates a credit note with the corrected text in an invoice and Price 0.00.

重要

Make sure to define the Default Credit Account in the sales journal specifically for this use case.

Corrects referenced document amount¶

When a correction on the amounts is required, use the button Add Credit note and select Partial Refund. In this case the SII Reference Code is automatically set to Corrige el monto del Documento de Referencia.

借記單¶

In Chilean localization, debit notes, in addition to credit notes, can be created using the Add Debit Note button, with two main use cases.

使用例子¶

Add debt on invoices¶

The primary use case for debit notes is to increase the value of an existing invoice. To do so, select option 3. Corrige el monto del Documento de Referencia for the Reference Code SII field.

In this case Odoo automatically includes the Source Invoice in the Cross Reference tab.

小訣竅

You can only add debit notes to an invoice already accepted by the SII.

Cancel credit notes¶

In Chile, debits notes are used to cancel a valid credit note. To do this, click the Add Debit Note button and select the 1: Anula Documentos de referencia option for the Reference Code SII field.

供應商賬單¶

作為智利本地化的一部分,您可以配置您的收件電郵伺服器,以符合您在 SII 中註冊的伺服器,以便:

Automatically receive the vendor bills DTE and create the vendor bill based on this information.

Automatically send the reception acknowledgement to your vendor.

Accept or claim the document and send this status to your vendor.

Reception¶

As soon as the vendor email with the attached DTE is received:

The vendor bill maps all the information included in the XML.

An email is sent to the vendor with the reception acknowledgement.

The DTE Status is set as Acuse de Recibido Enviado.

Acceptation¶

If all the commercial information is correct on your vendor bill, then you can accept the document using the Aceptar Documento button. Once this is done, the DTE Acceptation Status changes to Accepted and an email of acceptance is sent to the vendor.

領取¶

In case there is a commercial issue or the information is not correct on your vendor bill, you can claim the document before validating it, using the Claim button. Once this is done, the DTE Acceptation Status changes to Claim and a rejection email is sent to the vendor.

If you claim a vendor bill, the status changes from Draft to Cancel automatically. Considering this as best practice, all the claimed documents should be canceled as they won’t be valid for your accounting records.

Electronic purchase invoice¶

The electronic purchase invoice is a feature included in the l10n_cl_edi module.

完成 電子發票 的所有配置後(例如, 上載有效的公司證書、設定主數據等),電子採購發票便需要有自己的 CAF。有關如何取得電子採購發票 CAF 的詳細資料,請參閱 CAF 使用說明。

Electronic purchase invoices are useful when vendors are not obligated to expedite an electronic vendor bill for your purchase. Still, your obligations require a document to be sent to the SII as proof of purchase.

配置¶

To generate an electronic purchase invoice from a vendor bill, the bill must be created in a purchase journal with the Use Documents feature enabled. It is possible to modify an existing purchase journal or create a new one in the following process.

To modify the existing purchase journal, or create a new purchase journal, navigate to . Then, click the New button, and fill in the following required information:

Type: select Purchase from the drop-down menu for vendor bill journals.

Use Documents: check this field so the journal can generate electronic documents (in this case the electronic purchase invoice).

Generate an electronic purchase invoice¶

To generate this type of document, it is necessary to create a vendor bill in Odoo. To do so, navigate to , and click the New button.

When all of the electronic purchase invoice information is filled, select the option (46) Electronic Purchase Invoice in the Document Type field:

After the vendor bill is posted:

The DTE file (Electronic Tax Document) is automatically created and added to the chatter.

The DTE SII Status is set as Pending to be sent.

Odoo automatically updates the DTE Status every night using a scheduled action. To get a response from the SII immediately, click the Send now to SII button.

Delivery guide¶

To install the Delivery Guide module, go to and search for Chile

(l10n_cl). Then click Install on the module Chile - E-Invoicing Delivery

Guide.

備註

Chile - E-Invoicing Delivery Guide has a dependency with Chile - Facturación Electrónica. Odoo will install the dependency automatically when the Delivery Guide module is installed.

The Delivery Guide module includes the ability to send the DTE to SII and the stamp in PDF reports for deliveries.

完成 電子發票 的所有配置後(例如, 上載有效的公司證書、設定主數據等),送貨指示便需要有自己的 CAF。有關如何取得電子送貨指示 CAF 的詳細資料,請參閱 CAF 使用說明。

Verify the following important information in the Price for the Delivery Guide configuration:

From Sales Order: delivery guide takes the product price from the sales order and shows it on the document.

From Product Template: Odoo takes the price configured in the product template and shows it on the document.

No show price: no price is shown in the delivery guide.

Electronic delivery guides are used to move stock from one place to another and they can represent sales, sampling, consignment, internal transfers, and basically any product move.

Delivery guide from a sales process¶

警告

A delivery guide should not be longer than one page or contain more than 60 product lines.

When a sales order is created and confirmed, a delivery order is generated. After validating the delivery order, the option to create a delivery guide is activated.

警告

When clicking on Create Delivery Guide for the first time, a warning message pops up, stating the following:

No se encontró una secuencia para la guía de despacho. Por favor, establezca el primer número

dentro del campo número para la guía de despacho

This warning message means the user needs to indicate the next sequence number Odoo has to take to generate the delivery guide (e.g. next available CAF number), and only happens the first time a delivery guide is created in Odoo. After the first document has been correctly generated, Odoo takes the next available number in the CAF file to generate the following delivery guide.

After the delivery guide is created:

The DTE file (Electronic Tax Document) is automatically created and added to the chatter.

The DTE SII Status is set as Pending to be sent.

The DTE Status is automatically updated by Odoo with a scheduled action that runs every night. To get a response from the SII immediately, press the Send now to SII button.

Once the delivery guide is sent, it may then be printed by clicking on the Print Delivery Guide button.

Delivery guide will have fiscal elements that indicate that the document is fiscally valid when printed (if hosted in Odoo SH or on On-premise remember to manually add the pdf417gen library mentioned in the Invoice PDF report section).

Electronic receipt¶

To install the Electronic Receipt module, go to and search for

Chile (l10n_cl). Then click Install on the module Chile - Electronic

Receipt.

備註

Chile - Electronic Receipt has a dependency with Chile - Facturación Electrónica. Odoo will install the dependency automatically when the E-invoicing Delivery Guide module is installed.

完成 電子發票 的所有配置後(例如, 上載有效的公司證書、設定主數據等),電子收據便需要有自己的 CAF。有關如何取得電子收據 CAF 的詳細資料,請參閱 CAF 使用說明。

Electronic receipts are useful when clients do not need an electronic invoice. By default, there is

a partner in the database called Anonymous Final Consumer with a generic RUT 66666666-6 and taxpayer type of Final Consumer. This partner can be

used for electronic receipts or a new record may be created for the same purpose.

Although electronic receipts should be used for final consumers with a generic RUT, it can also be used for specific partners. After the partners and journals are created and configured, the electronic receipts are created in the standard way as electronic invoice, but the type of document (39) Electronic Receipt should be selected in the invoice form:

Validation and DTE status¶

When all of the electronic receipt information is filled, manually (or automatically) proceed to validate the receipt from the sales order. By default, Electronic Invoice is selected as the Document Type, however in order to validate the receipt correctly, make sure to edit the Document Type and change to Electronic Receipt.

After the receipt is posted:

The DTE file (Electronic Tax Document) is created automatically and added to the chatter.

The DTE SII Status is set as Pending to be sent.

The DTE Status is automatically updated by Odoo with a scheduled action that runs every day at night. To get a response from the SII immediately, press the Send now to SII button.

至於電子發票,請參閱 DTE 工作流程,因為電子發票的工作流程相同。

Electronic export of goods¶

To install the Electronic Exports of Goods module, go to and

search for Chile (l10n_cl). Then click Install on the module Electronic

Exports of Goods for Chile.

備註

Chile - Electronic Exports of Goods for Chile has a dependency with Chile - Facturación Electrónica.

完成 電子發票 的所有配置後(例如, 上載有效的公司證書、設定主數據等),電子貨物出口單便需要有自己的 CAF。有關如何取得電子收據 CAF 的詳細資料,請參閱 CAF 使用說明。

Electronic invoices for the export of goods are tax documents that are used not only for the SII but are also used with customs and contain the information required by it.

Contact configurations¶

Chilean customs¶

When creating an electronic exports of goods invoice, these new fields in the Other Info tab are required to comply with Chilean regulations.

PDF 報表¶

Once the invoice is accepted and validated by the SII and the PDF is printed, it includes the fiscal elements that indicate that the document is fiscally valid and a new section needed for customs.

电子商务电子发票¶

要安装 智利电子商务 模块,请访问 ,然后点击 启用 按钮。

此模組使功能和配置能夠:

从*电子商务* 应用程序生成电子文件

支持 电子商务 应用程序中的必填财务字段

有效地让最终客户决定为其购买生成的电子文档

为智利 电子发票 流程进行所有配置后,还需要进行以下配置才能整合电子商务流程。

要配置您的网站在销售过程中生成电子文档,请进入 并激活 自动发票 功能。激活此功能可在确认在线付款时自动生成电子文档。

由于需要确认在线付款,*自动发票*功能才能生成文件,因此必须为相关网站配置付款提供商。

備註

查看 網上付款 文档,了解 Odoo 支持哪些支付提供商,以及如何配置它们。

我们还建议您对产品进行配置,以便在确认在线付款后开具发票。要执行此操作,请进入 并选择所需产品的产品模板。然后,将 发票政策 设置为 订购数量。

开票流程¶

智利的客户可以在结账过程中多加一个步骤,选择是否需要**发票**或**小票**。

如果客户选择 电子发票 选项,则必须填写财务字段,包括 活动说明、识别码 和 DTE 电子邮件。

如果客户选择了 电子收据 选项,他们将被引导到下一步,并为*Consumidor Final Anónimo*联系人生成电子文档。

来自智利以外国家的客户将由 Odoo 自动生成电子收据。

備註

如果通过电子商务购买的商品需要出口,客户需要联系公司以生成电子出口发票(文件类型 110),可以通过*会计*应用程序完成。

销售点电子发票¶

要安装 智利销售点模块,请进入 Odoo 主仪表板上的 ,搜索模块的技术名称 l10n_cl_edi_pos,然后点击 启用 按钮。

此模組支援以下功能和配置:

从*销售点*应用程序生成电子文档

支持在*销售点*应用程序中创建的联系人所需的财务字段

有效地让最终客户决定为其采购生成的电子文档类型

在票据中打印二维码或 5 位数代码,以获取电子发票

要为联系人配置所需的财务信息,请查看 合作伙伴信息 <chile/partner-information>`部分,或直接修改联系人。导航至 :menuselection:`销售点 –> 会话 –> 客户 –> 详情,并编辑以下任一字段:

名稱

電郵

識別類型

納稅人類型

Type Giro

DTE 電郵

RUT

要配置产品,请导航至 并选择产品记录。在产品表单的 销售 选项卡中,必须将产品标记为 可用于 POS,这将使产品可在*销售点*应用程序中销售。

可选择在 :menuselection:`销售点 –> 配置 –> 设置 –> 账单和收据部分配置以下功能:

在票单上使用二维码:此功能可在用户收据上打印二维码,方便用户在购买后索取发票。

在票据上生成代码:此功能可以在收据上生成 5 位代码,允许用户通过客户门户申请发票

开票流程¶

以下部分介绍*销售点*应用程序的开票流程。

电子收据:匿名终端用户¶

以匿名用户身份购物,且不要求电子发票时,Odoo 会自动选择 :guilabel:`Consumidor Final Anónimo`作为订单联系人,并生成电子收据。

備註

如果客户因退货而要求开具贷记单据,则应使用 会计 应用程序开具贷记单据。详细说明请参阅 贷方票据和退款 文档。

电子收据:特定客户¶

当特定用户购物时不要求电子发票,Odoo 会自动选择订单的联系人作为 :guilabel:`Consumidor Final Anónimo』,并允许您选择或创建所需的客户联系人及其财务信息,以获取收据。

備註

如果客户因退货而要求出具贷项凭单,贷项凭单和退货流程可直接由 POS(销售点) 会话管理。

電子發票¶

当客户要求开具电子发票时,可以选择或创建包含其财务信息的所需联系人。付款时,选择 发票 选项即可生成文件。

備註

对于电子收据和发票,如果产品不受税收影响,Odoo 会检测到这一点,并为免税销售生成正确类型的文档。

退貨¶

对于电子收据(不为 *Consumidor Final Anónimo*生成)和电子发票,可以通过选择 退款 按钮,管理退回在 POS(销售点) 订单中售出的产品的流程。

可按订单状态或联系人搜索订单,并根据客户的原始订单选择退款。

当退货付款生效时,Odoo 会参照原始收据或发票生成必要的贷项凭单,部分或全部取消单据。

其他資料

財務報表¶

Balance tributario de 8 columnas¶

This report presents the accounts in detail (with their respective balances), classifying them according to their origin and determining the level of profit or loss that the business had within the evaluated period of time.

You can find this report in and selecting in the Report field the option Chilean Fiscal Balance (8 Columns) (CL).

Propuesta F29¶

The form F29 is a new system that the SII enabled to taxpayers, and that replaces the Purchase and Sales Books. This report is integrated by Purchase Register (CR) and the Sales Register (RV). Its purpose is to support the transactions related to VAT, improving its control and declaration.

重要

Odoo 中的 Propuesta F29 (CL) 报告涵盖了基本法律要求,是您最终纳税申报的第一份建议。

This record is supplied by the electronic tax documents (DTE’s) that have been received by the SII.

You can find this report in and selecting the Report option Propuesta F29 (CL).

It is possible to set the PPM and the Proportional Factor for the fiscal year from the .

Or manually in the reports by clicking on the ✏️ (pencil) icon.