意大利¶

配置¶

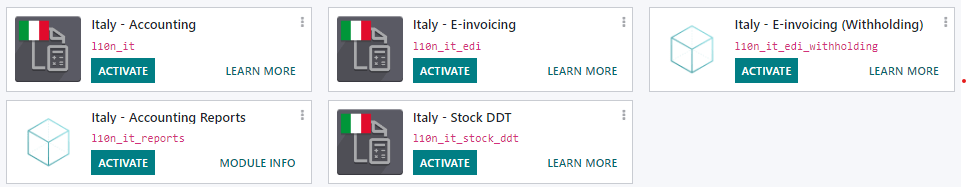

Install the following modules to get all the features of the Italian localization:

名稱 |

技術名稱 |

說明 |

|---|---|---|

意大利 - 會計 |

|

預設 財務本地化套裝 |

義大利 - 電子發票 |

|

e-invoice implementation |

義大利 - 電子發票 |

|

e-invoice withholding |

意大利 - 會計報表 |

|

特定国家/地区报告 |

Italy - Stock DDT |

|

Transport documents - Documento di Trasporto (DDT) |

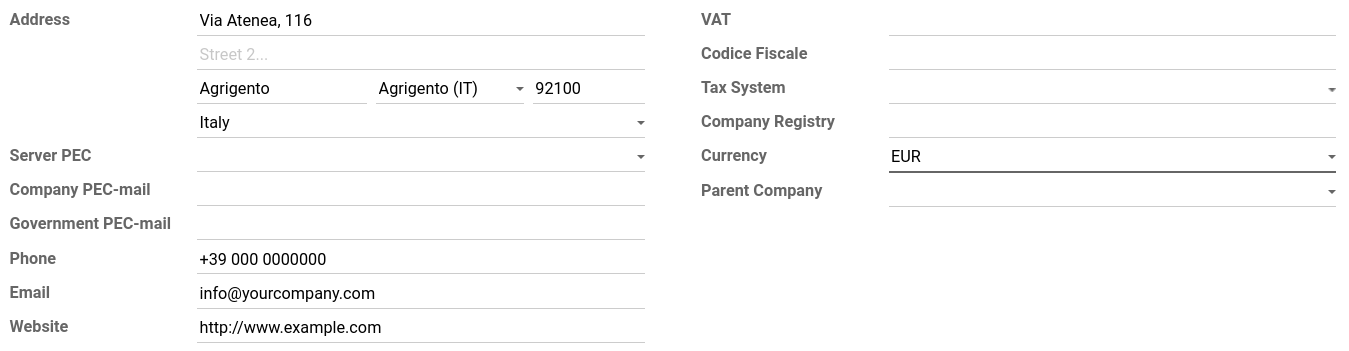

公司資訊¶

配置公司信息可确保您的会计数据库设置正确。要添加信息,请进入 ,在 公司`部分,点击 :guilabel:`更新信息。在此处填写字段:

地址:公司地址;

增值税:公司增值税;

Codice Fiscale: the fiscal code of the company;

Tax System: the tax system under which the company falls;

电子发票¶

The SdI is the electronic invoicing system used in Italy. It enables to send and receive electronic invoices to and from customers. The documents must be in XML format and formally validated by the system before being delivered.

To be able to receive invoices and notifications, the SdI service must be notified that the user’s files are to be sent to Odoo and processed on their behalf. To so, you must set up Odoo’s Codice Destinatario on the Agenzia Delle Entrate portal.

Go to https://ivaservizi.agenziaentrate.gov.it/portale/ and authenticate;

Go to section ;

Set the user as Legal Party for the VAT number you wish to configure the electronic address;

In , insert Odoo’s Codice Destinatario

K95IV18, and confirm.

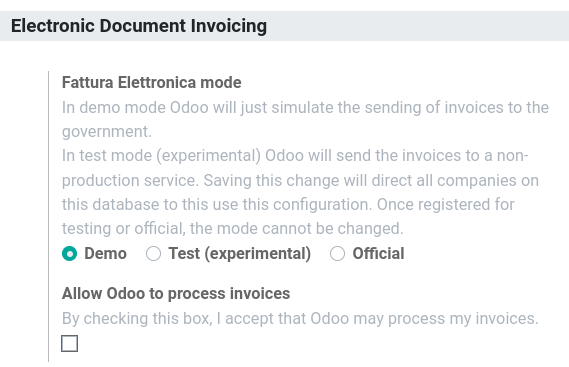

Electronic Data Interchange (EDI)¶

Odoo uses the FatturaPA EDI format for the Italian localization and is enabled on the default journals when installed. When the file processing authorization has been set, all invoices and bills are automatically sent.

備註

You can enable electronic invoicing for other sales and purchase journals than the default ones.

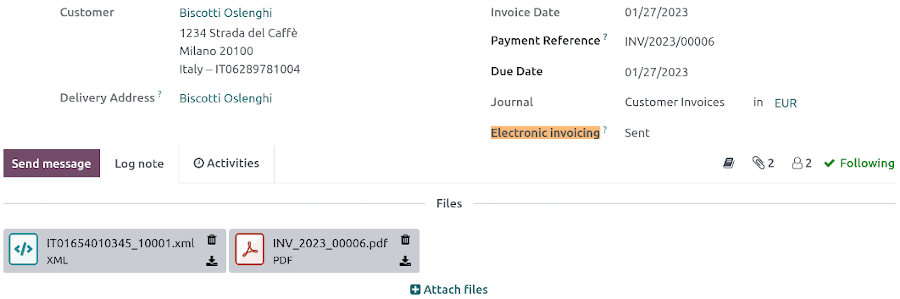

You can check the current status of an invoice by the Electronic invoicing field. The XML file can be found in the chatter of the invoice.

也參考

税项配置¶

许多电子发票功能都是使用 Odoo 的税务系统实现的。因此,正确配置税金对于正确生成发票和处理其他账单用例非常重要。例如,需要对**反向收费**类型的税进行特定配置。在**反向收取**税的情况下,卖方不会向客户收取增值税,而是由客户自己向政府支付增值税。主要有**两种**类型:

External reverse charge¶

發票¶

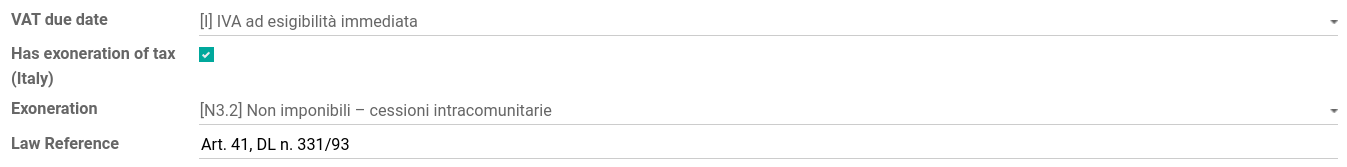

要开具出口发票,请确保发票行全部使用为**反向收费**配置的税种。意大利语**本地化包含欧盟出口反向征税的**示例,可作为参考(0% EU,发票标签 00eu),可在:menuselection:会计--> 配置--> 税务`下找到。出口免征增值税,因此**反收费**税需要勾选 :guilabel:`免税(意大利)`选项,并填写 :guilabel:`免税`种类和 :guilabel:`法律参考。

備註

If you need to use a different kind of Exoneration, click within the tax menu to create a copy of an existing similar tax. Then, select another Exoneration, and Save. Repeat this process as many times as you need different kind of Exoneration taxes.

小訣竅

Rename your taxes in the Name field according to their Exoneration to differentiate them easily.

On your invoice, select the corresponding tax you need in the Taxes field. You can find the following additional info by opening the XML file of the issued invoice:

SdI address (Codice Destinatario): must be filled for both EU or non-EU;

Country Id: must contain the country of the foreign seller in the two-letter ISO (Alpha-2) code (ex.,

ITfor 『Italy』);CAP: must be filled with

00000;Partita Iva (VAT number): must contain the VAT number for EU businesses and

OO99999999999(double 『O』 letter, not 『zero』) for non-EU businesses. In case of private customers without VAT number, use0000000;Fiscal Code: for foreign entities without an actual Codice Fiscale, any recognizable identifier is valid.

備註

Odoo does not support sending user-modified XML files.

For invoices, multiple configurations are technically identified by a Tipo Documento code:

TD02- Down payments;TDO7- Simplified invoice;TD08- Simplified credit note;TD09- Simplified debit note;TD24- 递延发票。

首付款。

Down payment invoices are imported/exported with a different Tipo Documento code

TDO2than regular invoices. Upon import of the invoice, it creates a regular vendor bill.Odoo exports moves as

TD02if the following conditions are met:

Is an invoice;

All invoice lines are related to sales order lines that have the flag

is_downpaymentset asTrue.

Simplified invoices, and credit/debit notes.

Simplified invoices and credit notes can be used to certify domestic transactions under 400 EUR (VAT included). Its status is the same as a regular invoice, but with fewer information requirements.

For a simplified invoice to be established, it must include:

Customer Invoice reference: unique numbering sequence with no gaps;

Invoice Date: issue date of the invoice;

Company Info: the seller’s full credentials (VAT/TIN number, name, full address) under ;

VAT: the buyer’s VAT/TIN number (on their profile card);

Total: the total amount (VAT included) of the invoice.

In the EDI, Odoo exports invoices as simplified if:

It is a domestic transaction (i.e., the partner is from Italy);

The buyer’s data is insufficient for a regular invoice;

The required fields for a regular invoice (address, ZIP code, city, country) are provided;

The total amount VAT included is less than 400 EUR.

備註

The 400 EUR threshold was defined in the decree of the 10th of May 2019 in the Gazzetta Ufficiale. We advise you to check the current official value.

递延发票。

**递延发票**是在销售货物或提供服务**之后**开具的发票。**递延发票**最迟必须在单据所涉交货后的下一个月**15 天**内开具。

它通常是一张**汇总发票**,包含当月进行的多次货物或服务销售清单。企业可将销售额**归类为**一张发票,一般在**月底**开具,以便会计核算。对于有经常性客户的**批发商**而言,默认情况下使用延期发票。

如果货物由**承运人**运输,则每次交货都有相关的**运输文件(DDT)**或**运输单据**。延期发票**必须**注明所有**DDT**详细信息,以便更好地追踪。

備註

E-invoicing of deferred invoices requires the l10n_it_stock_ddt

module. In this case, a dedicated Tipo Documento TD24

is used in the e-invoice.

Odoo exports moves as TD24 if the following conditions are met:

Is an invoice;

Is associated to deliveries whose DDTs have a different date than the issuance date of the invoice.

供應商賬單¶

从欧盟国家购买商品或服务(或从非欧盟国家购买服务)的意大利公司必须将收到的账单中包含的信息发送给 Agenzia delle Entrate。这样您就可以在账单上填写税务相关信息并发送。卖方必须设置为 Cedente/Prestatore,买方必须设置为 Cessionario/Committente。在供应商账单的 XML 文件中,供应商的证书显示为 Cedente/Prestatore,贵公司的证书显示为 Cessionario/Committente。

備註

自开票发票或增值税发票整合必须被开具并发送给税务机构。

在供应商账单中输入税金时,可以选择**反向收费**税金。在意大利财务状况下,这些税项会自动激活。通过 ,10% 和 22% `商品`和:guilabel:`服务`税收范围被激活,并预先配置了正确的税收网格。这些都是自动设置,以确保正确显示会计分录记账和税务报告。

For vendor bills, three types of configurations are technically identified by a code called Tipo Documento:

TD17- Buying services from EU and non-EU countries;TD18- Buying goods from EU;TD19- Buying goods from a foreign vendor, but the goods are already in Italy in a VAT deposit.

Buying services from EU and non-EU countries:

The foreign seller invoices a service with a VAT-excluded price, as it is not taxable in Italy. The VAT is paid by the buyer in Italy;

Within EU: the buyer integrates the invoice received with the VAT information due in Italy (i.e., vendor bill tax integration);

Non-EU: the buyer sends themselves an invoice (i.e., self-billing).

Odoo exports a transaction as

TD17if the following conditions are met:

Is a vendor bill;

At least one tax on the invoice lines targets the tax grids VJ;

All invoice lines either have Services as products, or a tax with the Services as tax scope.

Buying goods from EU:

Invoices issued within the EU follow a standard format, therefore only an integration of the existing invoice is required.

Odoo exports a transaction as TD18 if the following conditions are met:

Is a vendor bill;

At least one tax on the invoice lines targets the tax grids VJ;

All invoice lines either have Consumable as products, or a tax with the Goods as tax scope.

Buying goods from a foreign vendor, but the goods are already in Italy in a VAT deposit:

From EU: the buyer integrates the invoice received with the VAT information due in Italy (i.e., vendor bill tax integration);

Non-EU: the buyer sends an invoice to themselves (i.e., self-billing).

Odoo exports a move as a TD19 if the following conditions are met:

Is a vendor bill;

At least one tax on the invoice lines targets the tax grid VJ3;

所有发票行要么有 消耗品 产品,要么有以 商品 作为征税范围的税项。

警告

Odoo不提供 「Conservazione Sostitutiva <https://www.agid.gov.it/index.php/it/piattaforme/conservazione>`_要求。其他供应商和 Agenzia delle Entrate 可免费提供经认证的存储空间,以满足所要求的条件。

Internal reverse charge¶

警告

Odoo currently does not support domestic internal reverse charge processes.

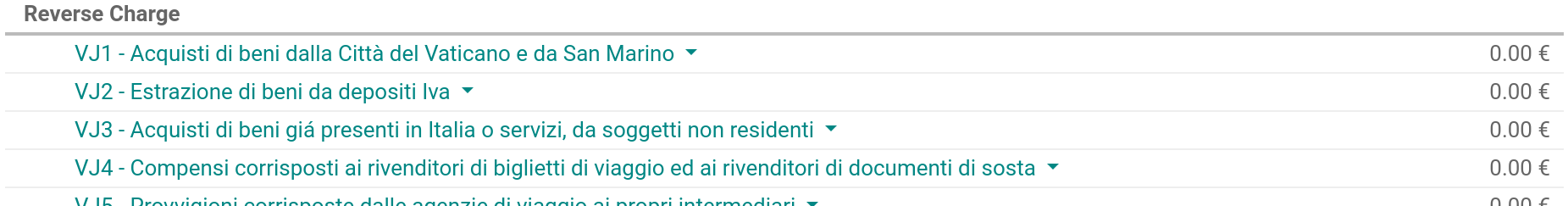

『Reverse Charge』 tax grids¶

意大利语本地化有一个专门的**税务网格**部分,用于**反向收费**税。这些税收网格可通过 VJ 标签识别,并可在 。

聖馬力諾¶

發票¶

圣马力诺和意大利签订了电子发票业务特别协议。因此,**发票**遵循常规**反向收费**规则。Odoo 不强制执行其他要求,但**国家/地区**要求用户:

Select a tax with the option Has exoneration of tax (Italy) ticked, and the Exoneration set to

N3.3;Use the generic SdI Codice Destinatario

2R4GTO8. The invoice is then routed by a dedicated office in San Marino to the correct business.

帳單¶

当收到来自圣马力诺的**纸质账单**时,任何意大利公司**必须**向**Agenzia delle Entrate**提交该发票,在电子发票的 Tipo Documento 字段中注明特殊值`TD28`。

Odoo exports a move as TD28 if the following conditions are met:

Is a vendor bill;

At least one tax on the invoice lines targets the tax grids VJ;

合作伙伴的**国家**为**圣马力诺**。

Pubblica amministrazione (B2G)¶

警告

Odoo 不会直接向政府发送发票,因为发票需要签名。如果我们看到codice destinatario是6位数字,那么它不会自动发送到 PA,但您可以下载 XML,用外部程序签署,然后通过门户网站发送。

Digital qualified signature¶

对于向**Pubblica Amministrazione (B2G)**发送的发票和账单,通过 :abbr:`SdI (Sistema di Interscambio) `发送的所有文件都需要**数字合格签名**。**XML**文件必须使用以下证书之一进行认证:

一张**智能卡**;

USB 令牌;

硬件安全模块(HSM)。

CIG, CUP, DatiOrdineAcquisto¶

为确保有效追踪公共行政部门的付款,向公共行政部门开具的电子发票必须包含以下内容:

The CIG, except in cases of exclusion from traceability obligations provided by law n. 136 of August 13, 2010;

The CUP, in case of invoices related to public works.

如果**XML**文件需要,**Agenzia Delle Entrate**只能在**XML**文件包含::CIG (Codice Identificativo Gara)`和::`CUP (Codice Unico di Progetto)`的情况下进行电子发票付款。对于每张电子发票,***有必要***标明 "CUU (Codice Univoco Ufficio)",它代表唯一的识别码,使:abbr:`SdI (Sistema di Interscambio) 能够正确地将电子发票传送给收件处。

備註

必须在**2.1.2** (DatiOrdineAcquisto), 2.1.3 (Dati Contratto), 2.1.4 (DatiConvenzione), 2.1.5 (Date Ricezione) 或**2.1.6** (Dati Fatture Collegate)信息块中包含:[guilabel:`Codice Unico di Progetto]和:[guilabel:`CIG (Codice Identificativo Gara)]。这些信息块与电子发票**XML**文件中名为:guilabel:`CodiceCUP`和:guilabel:`CodiceCIG`的元素相对应,其表格可在政府网站<http://www.fatturapa.gov.it/>`_上找到。

The CUU must be included in the electronic invoice corresponding to the element 1.1.4 (CodiceDestinario).

Ri.Ba. (Ricevuta Bancaria)¶

Ri.Ba. is a payment method widely used in Italy where vendors request payments through their bank, which forwards the request to the customer’s own bank and takes responsibility for the collection. This enables payment automation and reduces risks for the vendor.

The vendor generally uploads a fixed-format text file with the list of payments to the bank’s web portal.

備註

Ri.Ba. are exclusively for domestic payments in Italy. For recurring international payments, please use SEPA Direct Debt (SDD)

配置¶

Check that the

l10n_it_ribamodule is installed.Go to and select the company that will use Ri.Ba.

Fill out the required SIA Code.

備註

SIA 代码 用于识别意大利银行网络内的企业,并通过特定的支付方式接收资金。它由一个字母和四位数字组成(如 T1234),通常可在银行门户网站上找到或通过联系银行获得。

确保公司的银行账户拥有意大利 IBAN 号码。

也參考

如何配置 银行账户

Accept Ri.Ba. for your invoices¶

Payments of type Ri.Ba. can be registered from the Invoices ().

重要

Make sure that your invoice involves a Partner that has a bank account with an Italian IBAN.

Then, all Payments must be grouped in a Batch Payment.

Once you press the Validate button for the Batch Payment, the Ri.Ba. file is generated and attached to the Batch Payment, so you can download it and upload it through your bank’s web portal.