欧盟境内远程销售¶

EU intra-community distance selling involves the cross-border trade of goods and services from vendors registered for VAT purposes to individuals (B2C) located in a European Union member state. The transaction is conducted remotely, typically through online platforms, mail orders, telephone, or other means of communication.

EU intra-community distance selling is subject to specific VAT rules and regulations. The vendor must charge VAT per the VAT rate applicable in the buyer’s country.

備註

This remains applicable even if the vendor is located outside of the European Union.

配置¶

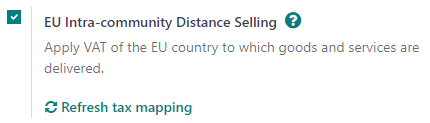

The EU Intra-community Distance Selling feature helps you comply with this regulation by creating and configuring new fiscal positions and taxes based on your company’s country. To enable it, go to , tick EU Intra-community Distance Selling, and Save.

小訣竅

Whenever you add or modify taxes, you can automatically update your fiscal positions. To do so, go to and click on the Refresh tax mapping.

備註

强烈建议您在使用前检查拟议映射是否适合您销售的产品或服务。

也參考

One-Stop Shop (OSS)¶

欧盟引入的:abbr:`一站式服务`系统简化了**跨境**货物和服务销售的增值税征收。它主要适用于企业对消费者**(B2C)**的情况。有了开放源码软件,企业可以在本国注册增值税,并使用单一的在线门户来处理在欧盟境内销售的增值税义务。有**两个主要计划**:用于跨境服务的**欧盟开放源码软件**计划和用于价值等于或低于 150 欧元的货物的**进口开放源码软件**计划。

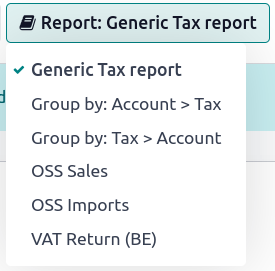

報表¶

要生成**OSS 销售**或**OSS 进口**报告并提交到 OSS 门户,请进入 ,点击 报告:通用税务报告,然后选择 OSS 销售`或:guilabel:`OSS 进口。选择后,点击左上角的 PDF、XLSX 或 XML。这将以所选格式生成当前打开的报告。生成后,登录联邦主管机构的平台,将其提交到 OSS 门户网站上。