退税(增值税申报)¶

注册了增值税(VAT)号码的公司必须根据其营业额和注册规定,每月或每季度提交一份**税务申报表**。税务申报表(或 VAT 申报表)向税务机关提供了有关公司可纳税交易的信息。**销项税**是企业销售货物和服务的税额,而**进项税**是购买货物或服务时添加到价格上的税额。基于这些数值,公司可以计算出需要缴纳或退还的税款金额。

備註

有关增值税及其机制的更多信息,请参阅欧盟委员会的网页:`“什么是增值税?”<https://ec.europa.eu/taxation_customs/business/vat/what-is-vat_en>`_。

先決條件¶

報稅周期¶

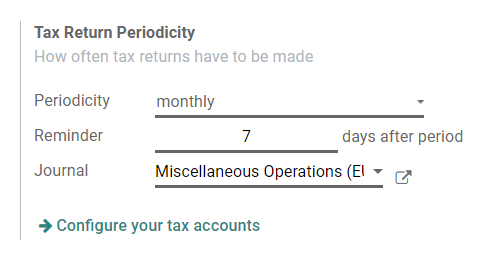

配置**报税周期**可让 Odoo 正确计算您的报税表,并向您发送提醒,使您不会错过报税截止日期。

要执行此操作,请转至 。在 退税周期 下,可以设置:

定义:在此定义是按月还是按季提交报税表;

提醒:定义 Odoo 提醒您提交报税表的时间;

日记账:选择用于记录税务申报表的日记账。

備註

这通常在 应用程序的初始设置 中配置。

稅務列表¶

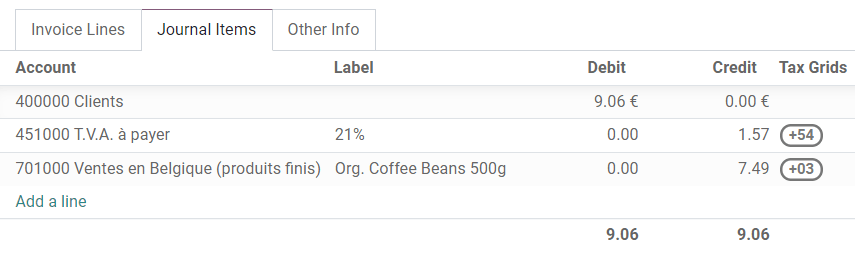

Odoo 根据配置在税项上的 税务网格 设置生成税务报告。因此,确保所有记录的交易使用正确的税项至关重要。打开任何发票和账单的 日记账项目 选项卡,即可查看 税务网格 设置。

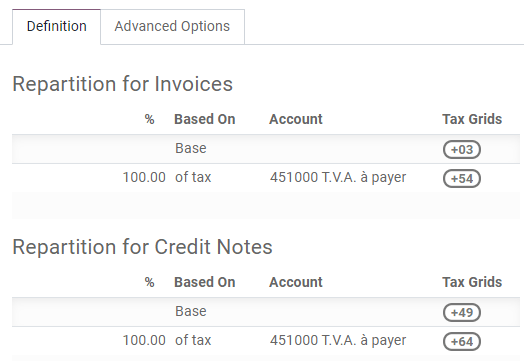

要配置您的税务网格,请转到 并打开您要修改的税收。在那里,您可以编辑税收设置,以及用于记录发票或贷项通知的税务网格。

備註

税务和报告通常已在 Odoo 中预先配置:根据您在创建数据库时选择的国家/地区,会安装一个 财务本地化套装。

关闭纳税期¶

稅收鎖定日期¶

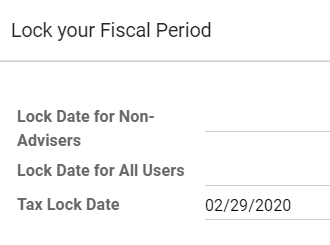

任何会计日期在 税收锁定日期 之前的新交易,其税值都将移至下一个未清税期。这对于确保在报告期关闭后无法对报告进行更改非常有用。

因此,我们建议您在处理 期终日记账 前锁定纳税日期。这样,其他用户就无法修改或添加对 期终日记账分录 有影响的交易,从而帮助您避免一些报税错误。

要查看当前的 税收锁定日期 或对其进行编辑,请进入 。

稅金報告¶

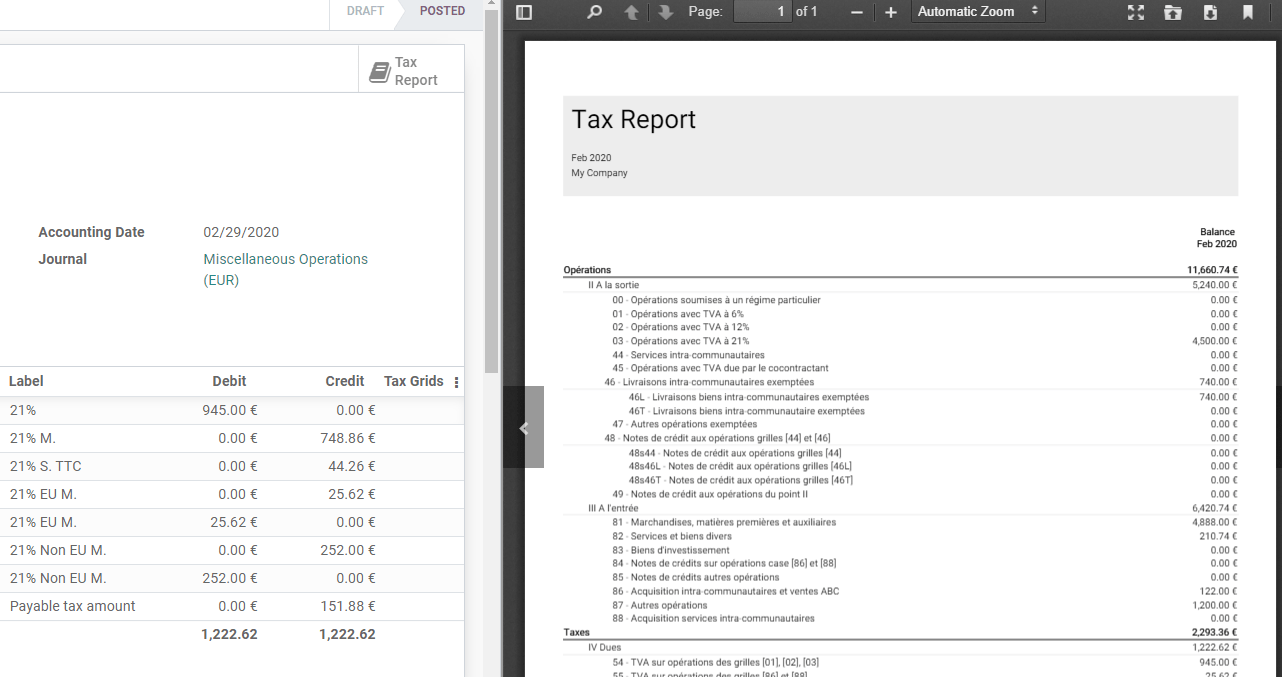

Once all the transactions involving taxes have been posted for the period you want to report, open the Tax Report by going to . Select the period you want to declare using the date filter to have an overview of the tax report. From the report, click PDF or XLSX to download the desired format of the tax report, or click Save to save the report to the Documents app. The report includes all the values to report to the tax authorities, along with the amount to be paid or refunded.

備註

如果您在点击:guilabel:`关闭日记账条目`之前忘记锁定纳税日期,Odoo 会自动将您的会计期间锁定在与您的条目会计日期相同的日期。此安全机制可以防止出现一些财务错误,但如上所述,建议您先手动锁定纳税日期.