巴西¶

介绍¶

With the Brazilian localization you can automatically compute sales taxes for goods using AvaTax (Avalara) through API calls, also configure taxes for services.

For the goods tax computation part, you need to configure the contacts, company, products, and create an account in Avatax from the Odoo general settings.

对于服务税,您可以直接从 Odoo 创建和配置,而无需使用 AvaTax 进行计算。

本地化功能还包括税收和可根据需要修改的会计科目表模板。

配置¶

模块安装¶

安装 以下模块,以获得巴西本地化的所有功能:

名称 |

技术名称 |

说明 |

|---|---|---|

巴西 - 会计 |

|

Default fiscal localization package - adds accounting characteristics for the Brazilian localization, which represent the minimum configuration required for a company to operate in Brazil. The module’s installation automatically loads: the chart of accounts, taxes, and required fields to properly configure the contact. |

巴西 - 会计报告 |

|

Adds a simple tax report that helps check the tax amount per tax group in a given period of time. Also adds the P&L and BS adapted for the Brazilian market. |

Avatax 巴西 |

|

Add Brazilian tax calculation via Avatax and all necessary fields needed to configure Odoo in order to properly use Avatax and send the needed fiscal information to retrieve the correct taxes. |

Avatax for SOs in Brazil |

|

Same as the |

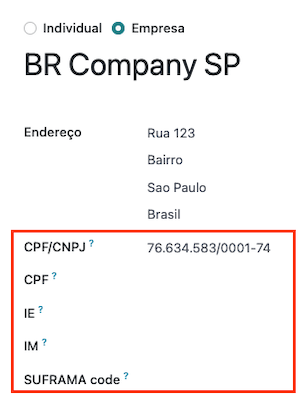

Configure your company¶

要配置公司信息,请访问 应用程序并搜索公司名称。

选择页面顶部的 公司 选项。然后,配置以下字段:

名称

Address (add City, State, Zip Code, Country)

Tax ID (CNPJ)

IE (State Registration)

IM (Municipal Registration)

SUFRAMA code (Superintendence of the Manaus Free Trade Zone - add if applicable)

电话

电子邮件

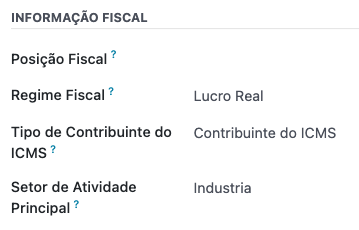

配置 销售及采购 选项卡中的 财务信息:

为 Avatax Brazil 添加 财政状况。

Tax Regime (Federal Tax Regime)

ICMS Taxpayer Type (indicates ICMS regime, Exempt status, or Non-Taxpayer.)

主要活动部门

Finally, upload a company logo and save the contact.

注解

如果是简化制度,则需要在 下配置 ICMS 税率。

配置 AvaTax 整合¶

Avalara AvaTax is a tax calculation provider that can be integrated in Odoo to automatically compute taxes by taking into account the company, contact (customer), product, and transaction information to retrieve the correct tax to be used.

Odoo is a certified partner of Avalara Brazil, which means that Avalara experts reviewed workflows covered within the scope of the integration.

Using this integration requires In-App-Purchases (IAPs) to compute taxes. Every time you compute taxes, an API call is made, using credits from your IAP credits balance.

凭证配置¶

To activate AvaTax in Odoo, you need to create an account. To do so, go to , and, in the AvaTax Brazil section, add the email address you want to use to log in to the AvaTax portal, and click on Create account. This email is used as the administrator email address in AvaTax.

从 Odoo 创建账户后,您需要进入 Avalara 门户设置密码:

Access the Avalara portal

Click on Meu primeiro acesso

Add the email address you used in Odoo to create the Avalara/Avatax account, and then click Solicitar Senha

您将收到一封电子邮件,其中包含一个令牌和一个创建密码的链接。点击该链接并复制粘贴令牌,即可分配您所需的密码。

警告

If you intend first to try the integration on a testing or sandbox database, using an alternate email address is recommended, as you won’t be able to re-use the same email address on your production database.

小技巧

You can start using AvaTax in Odoo without creating a password and accessing the Avalara Portal; for Odoo, the only requirement to start using the Avalara Tax Computation Engine is to create an account from the settings page.

注解

You can transfer API credentials. Use this only when you have already created an account in another Odoo instance and wish to reuse it.

配置主数据¶

会计科目表¶

The chart of accounts is installed by default as part of the data set included in the localization module. The accounts are mapped automatically in their corresponding taxes, and the default account payable and account receivable fields.

注解

巴西账目总表是建基于 SPED 的账目总表,它提供了巴西市场所需的基础账户。

您可以根据公司需要添加或删除账户。

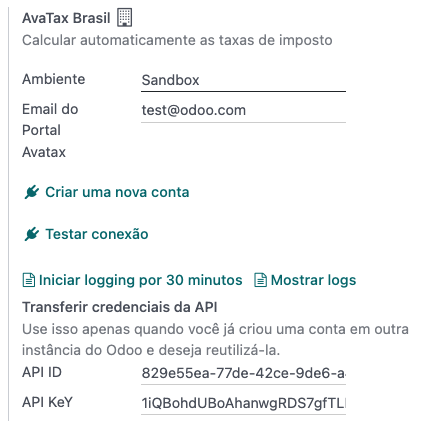

税¶

安装巴西本地化软件时会自动创建税项。Avalara 在计算销售订单或发票上的税额时,会使用已配置的税额。

可以编辑税项或添加更多税项。例如,用于服务的某些税项需要手动添加和配置,因为税项可能因提供服务的城市而异。

重要

AvaTax 不计算服务税。只计算货物税。

When configuring a tax used for a service that is included in the final price (when the tax is not added or subtracted on top of the product price), set the Tax Computation to Percentage of Price Tax Included, and, on the Advanced Options tab, check the Included in Price option.

For more information on configuring taxes to fit your needs better, please go to the taxes functional documentation.

产品¶

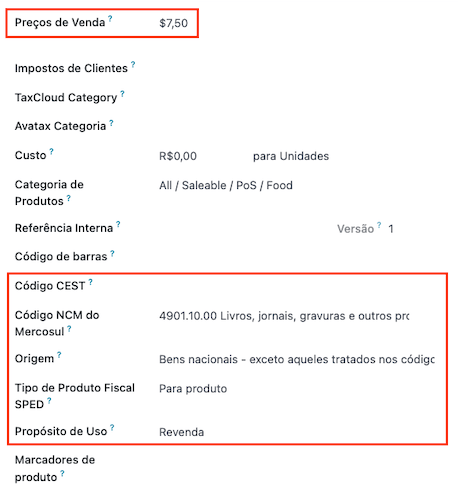

要在销售订单和发票上使用 AvaTax 整合,首先要在产品上指定以下信息:

CEST Code (Code for products subject to ICMS tax substitution)

Mercosul NCM Code (Mercosur Common Nomenclature Product Code)

Source of Origin (Indicates the origin of the product, which can be foreign or domestic, among other possible options depending on the specific use case)

SPED Fiscal Product Type (Fiscal product type according to SPED list table)

Purpose of Use (Specify the intended purpose of use for this product)

注解

Odoo automatically creates three products to be used for transportation costs associated with

sales. These are named Freight, Insurance, and Other Costs. They are already configured, if

more need to be created, duplicate and use the same configuration (configuration needed:

Product Type Service, Transportation Cost Type Insurance, Freight,

or Other Costs)

联系人¶

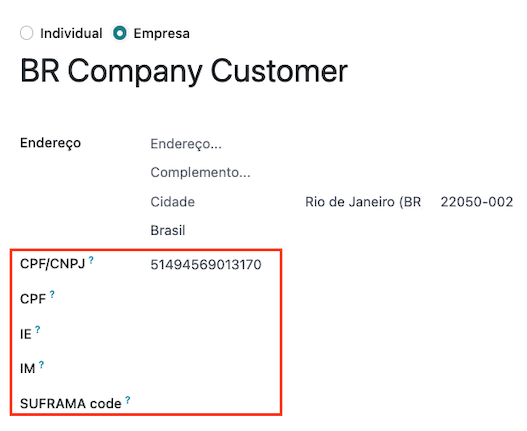

使用整合前,请在联系人上指定以下信息:

联系人的基本信息:

如果联系人有税号(CNPJ),请选择 公司 选项;如果联系人有 CPF,请选择 个人。

名称

Address: Zip Code is a required field to compute taxes properly.

Tax ID or CPF: Use CPF for individuals and Tax ID (CNPJ) for companies

IE: state tax identification number

IM: municipa tax identification number

SUFRAMA code: SUFRAMA registration number

电话

电子邮件

注解

在 CF、IE、IM`和 :guilabel:`SUFRAMA 代码 字段设置为`巴西`之前,这些字段将被隐藏。

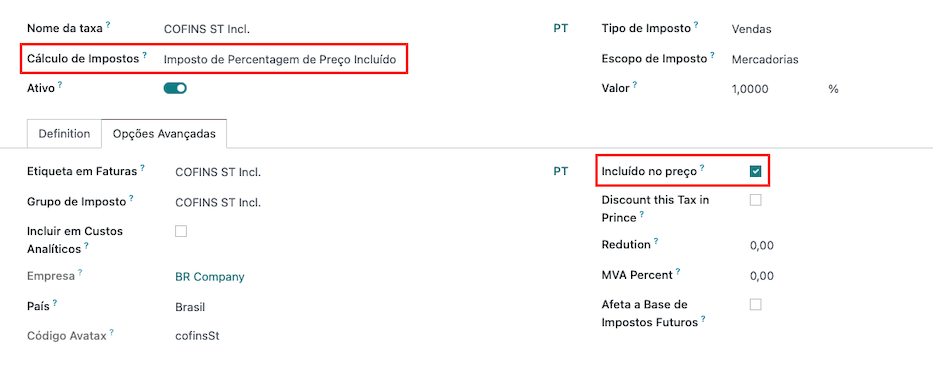

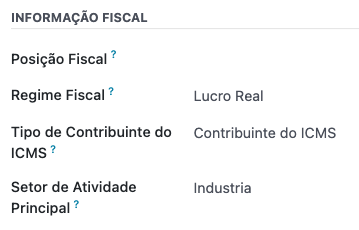

Fiscal information about the contact under the Sales & Purchase tab:

Fiscal Position: add the AvaTax fiscal position to automatically compute taxes on sale orders and invoices automatically.

税收制度:(联邦税制)

ICMS Taxpayer Type: taxpayer type determines if the contact is within the ICMS regime, if it is exempt, or if it is a non-taxpayer.

主要活动行业:联络人主要活动行业的清单

财政状况¶

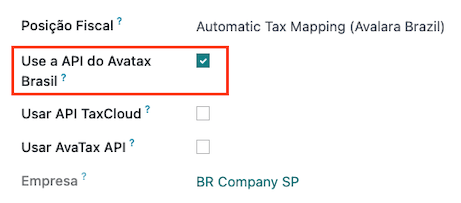

To compute taxes on sale orders and invoices, it is necessary to have a Fiscal Position with the Detect Automatically and the Use AvaTax API options enabled.

财政状况 可在联系人上配置,或在创建销售订单或发票时选择。

工作流¶

This section provides an overview of the actions that trigger API calls for tax computation.

警告

Please note that each API call incurs a cost. Be mindful of the actions that trigger these calls to manage costs effectively.

Tax calculations on quotation / sales orders¶

Trigger an API call to calculate taxes on a quotation or sales order automatically with AvaTax in any of the following ways:

- 报价确认

将报价单确认为销售订单。

- 手动触发

点击 使用 Avatax 计算税额。

- 预览

点击 预览 按钮。

- 通过电子邮件发送报价单/销售订单

通过电子邮件向客户发送报价单或销售订单。

- 在线报价

When a customer accesses the quotation online (via the portal view), the API call is triggered.

Mirto Bonan¶

Trigger an API call to calculate taxes on a customer invoice automatically with AvaTax any of the following ways:

- 手动触发

点击 使用 AvaTax 计算税款。

- 预览

点击 预览 按钮。

- 在线发票访问

When a customer accesses the invoice online (via the portal view), the API call is triggered.

注解

必须将 财政状况 设为`自动税收映射(Avalara Brazil)`,这些操作才能自动计算税款。