现金折扣及减税¶

Cash discounts are reductions in the amount a customer must pay for goods or services offered as an incentive for paying their invoice promptly. These discounts are typically a percentage of the total invoice amount and are applied if the customer pays within a specified time. Cash discounts can help the company maintain a steady cash flow.

Example

您在 1 月 1 日开出一张 100 欧元的发票。应在 30 天内完成全额支付,如果客户在 7 天内付款,您还会提供 2% 的折扣。

客户可在 1 月 8 日前支付 98 欧元。此后,必须在 1 月 31 日前支付 100 欧元。

根据国家或地区的不同,还可以使用 减税优惠。

配置¶

To grant cash discounts to customers, you must first set up the type of tax reduction, verify the gain and loss accounts, and configure new payment terms.

减税¶

Depending on the country or region, the base amount used to compute the tax can vary, which can lead to a tax reduction.

To configure how the tax reduction is applied, go to , and in the Taxes section, in the Cash Discount Tax Reduction feature, select one of the three following options:

- 始终(根据发票)

税额总是减少。无论客户是否享受折扣,计算税款的基数都是折扣后的金额。

- 关于提前付款

只有客户提前付款,税款才会减少。用于计算税额的基数与销售额相同:如果客户从减税中受益,则税额减少。这意味着,根据客户的不同,发票开具后的税额也会不同。

- 从不

税额不会减少。无论客户是否享受折扣,用于计算税款的基数都是全额。

Example

您在 1 月 1 日开出一张 100 欧元的发票(不含税),税率为 21%。全款应在 30 天内支付,如果客户在 7 天内付款,您还会提供 2% 的折扣。

到期日期 |

应付款总额 |

计算 |

|---|---|---|

1 月 8 日 |

€118.58 |

(€98 + (21% of €98)) |

1 月 31 日 |

€120.58 |

(€100 + (21% of €98)) |

到期日期 |

应付款总额 |

计算 |

|---|---|---|

1 月 8 日 |

€118.58 |

(€98 + (21% of €98)) |

1 月 31 日 |

€121.00 |

(€100 + (21% of €100)) |

到期日期 |

应付款总额 |

计算 |

|---|---|---|

1 月 8 日 |

€119.00 |

(€98 + (21% of €100)) |

1 月 31 日 |

€121.00 |

(€100 + (21% of €100)) |

现金折扣损益账户¶

通过现金折扣,您所获得的金额取决于客户是否从现金折扣中受益。这不可避免地会导致盈亏,这些盈亏会记录在默认账户上。

To modify these accounts, go to , and in the Default Accounts section, select the accounts you want to use for the Cash Discount Gain account and Cash Discount Loss account.

付款条件¶

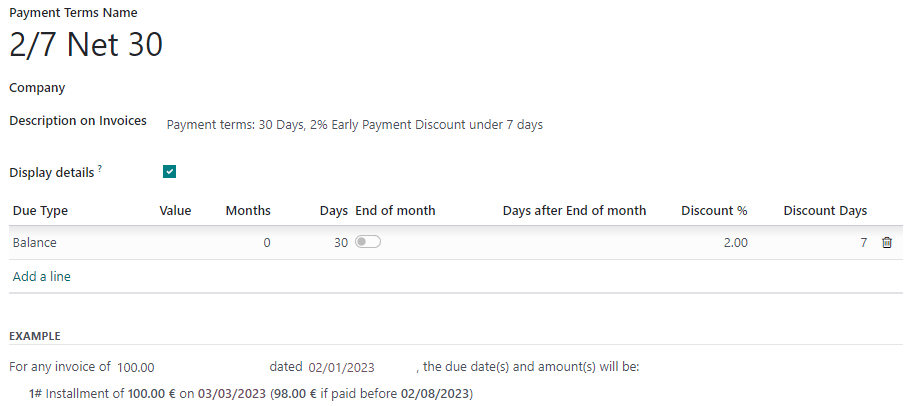

Cash discounts are defined on payment terms. Configure them to your liking by going to , and make sure to fill out the fields Discount % and Discount Days.

为客户发票申请现金折扣¶

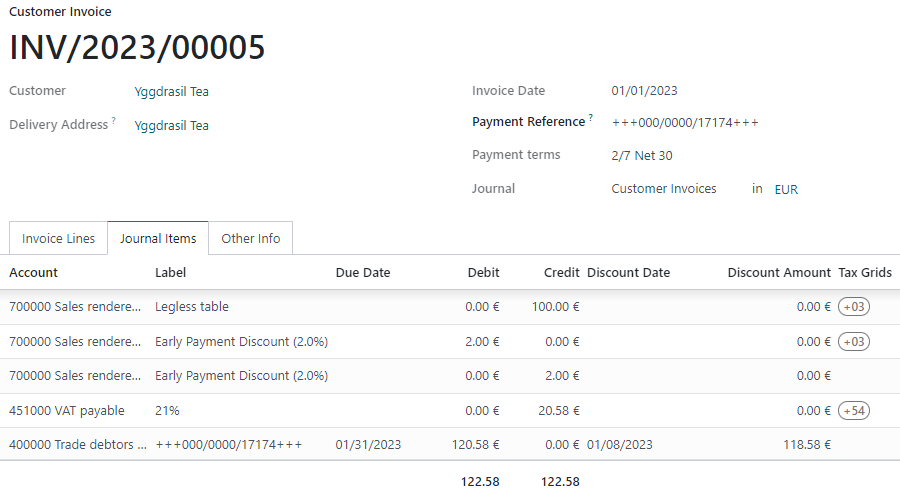

Apply a cash discount to a customer invoice by selecting the payment terms you created. Odoo automatically computes the correct amounts, tax amounts, due dates, and accounting records.

在 日记账项目 标签下,点击“切换”按钮并添加 折扣日期 和 折扣金额 列,即可显示折扣详情。

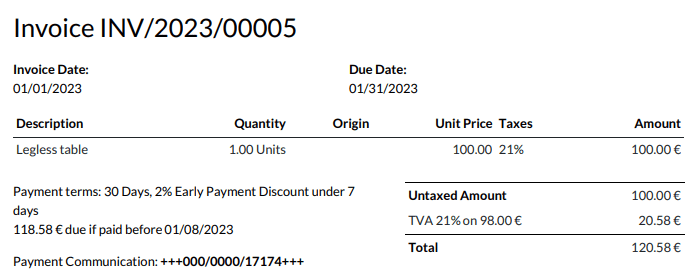

The discount amount and due date are also displayed on the generated invoice sent to the customer.

付款对账¶

When you record a payment or reconcile your bank statements, Odoo takes the customer payment’s date into account to define if they can benefit from the cash discount or not.

注解

If your customer pays the discount amount after the discount date, you can always decide whether to mark the invoice as fully paid with a write-off or as partially paid.

参见