哥伦比亚¶

Odoo 的哥伦比亚本地化软件包为哥伦比亚的数据库提供会计、财务和法律功能,如会计科目表、税务和电子发票。

此外,还提供了一系列相关视频。这些视频涵盖了如何从零开始、如何设置配置、如何完成常见的工作流程,并深入介绍了一些特定使用案例。

配置¶

模块安装¶

安装 下列模块,以获得哥伦比亚本地化的所有功能:

名称 |

技术名称 |

说明 |

|---|---|---|

哥伦比亚 - 会计 |

|

默认 财务本地化套装。该模块为哥伦比亚本地化添加了基本会计功能:会计科目表、税金、预扣款和身份证明文件类型。 |

哥伦比亚 - 会计报告 |

|

包括向供应商发送预扣款证明的会计报告。 |

哥伦比亚电子发票 - 使用 Carvajal |

|

该模块包括与 Carvajal 整合所需的功能,可根据 DIAN 规定生成电子发票和与供应商账单相关的支持文件。 |

哥伦比亚 - 销售点 |

|

包括哥伦比亚本地化的销售点收据。 |

注解

当公司的 财政本地化 选择 哥伦比亚 时,Odoo 会自动安装某些模块。

公司配置¶

要配置公司信息,请访问 应用程序并搜索您的公司。

或者,激活 开发者模式 并导航至 。然后,编辑联系表单并配置以下信息:

公司名称。

地址:包括 城市、部门 和 邮政编码。

识别号码:选择 识别类型`(`NIT、

Cédula de Ciudadanía、Registro Civil`等)。当 :guilabel:`识别类型为NIT时,识别号码 必须 在 ID 末尾有*验证码*,以连字号(-)为前缀。

接下来,在 销售与采购 选项卡中配置 财政信息:

Obligaciones y Responsabilidades:选择公司的财务责任(`O-13`Gran Contribuyente、`O-15`Autorretenedor、`O-23`Agente de retención IVA、`O-47`Regimen de tributación simple、`R-99-PN`No Aplica)。

Gran Contribuyente:如果公司是 Gran Contribuyente,则应选择此选项。

财务制度:选择适用于公司的征税项目名称(

IVA、INC、IVA e INC或No Aplica)商业名称:如果公司使用特定的商业名称,并且需要在发票中显示。

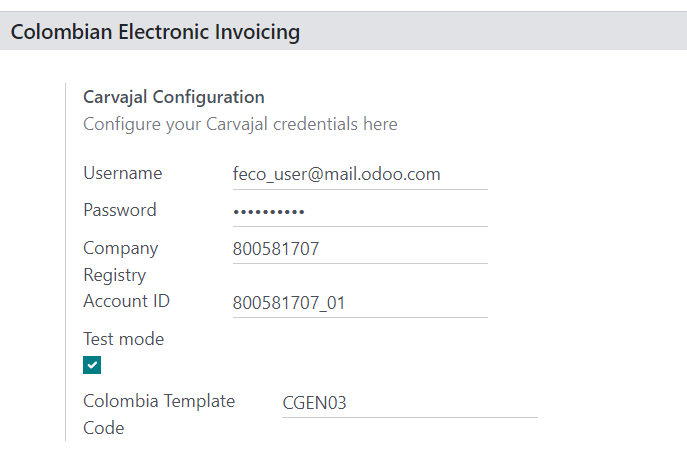

Carjaval 证书配置¶

安装模块后,**必须**配置用户凭据,以便与 Carvajal Web 服务连接。要执行此操作,请导航至 并滚动至 哥伦比亚电子发票 部分。然后,填写 Carvajal 提供的所需配置信息:

用户名 和 密码:公司的用户名和密码(由 Carvajal 提供)。

公司注册号:公司的 NIT 编号,*不包括*验证码。

账户 ID:公司的 NIT 编号,后跟

_01。哥伦比亚模板代码:从两个可用模板(

CGEN03或CGNE04)中选择一个,用于 PDF 格式的电子发票。

启用 测试模式 复选框,以连接 Carvajal 测试环境。

一旦 Odoo 和 Carvajal 完全配置好并准备投入生产,请停用 测试模式 复选框以使用生产数据库。

报告数据配置¶

作为 XML 中发送的可配置信息的一部分,可为 PDF 的财务部分和银行信息定义报告数据。

导航至 ,并滚动至 哥伦比亚电子发票 部分,以找到 报告配置 字段。在此可配置每种报告类型的标题信息。

Gran Contribuyente

Tipo de Régimen

Retenedores de IVA

Autorretenedores

Resolución Aplicable

Actividad Económica

银行信息

主数据配置¶

业务伙伴¶

合作伙伴联系人可在*联系人*应用程序中创建。要执行此操作,请导航至 并点击 创建 按钮。

然后,为联系人命名,并使用单选按钮选择联系人类型,即 个人 或 公司。

填写完整的 地址,包括 城市、州`和 :guilabel:`ZIP 代码。然后,填写身份和财务信息。

身份信息¶

作为哥伦比亚本地化的一部分,DIAN 定义的识别类型可在合作伙伴表单中找到。哥伦比亚合作伙伴**必须**设置其 识别号码`(VAT) 和 :guilabel:`文件类型。

小技巧

当 文件类型 为`NIT`时,需要在 Odoo 中配置 识别码,包括 ID 末尾的*验证码,前缀为连字符 (-)*。

Fiscal information¶

合作伙伴的责任代码(:abbr:`RUT [Registro único tributario]`文件)中的第 53 节)是电子发票模块的一部分,这是 DIAN 的要求。

必填字段可在 下找到:

Obligaciones y Responsabilidades:选择公司的财务责任(`O-13`Gran Contribuyente、`O-15`Autorretenedor、`O-23`Agente de retención IVA、`O-47`Regimen de tributación simple,或`R-99-PN`No Aplica)。

Gran Contribuyente:如果公司是 Gran Contribuyente,则应选择此选项。

财务制度:选择适用于公司的征税项目名称(

IVA、INC、IVA e INC或No Aplica)商业名称:如果公司使用特定的商业名称,并且需要在发票中显示。

产品¶

要管理产品,请导航至 ,然后单击产品。

在产品表单中添加一般信息时,需要配置 UNSPSC 类别`(:guilabel:`会计`选项卡)或 :guilabel: 内部参考`(:guilabel:`一般信息`选项卡)字段。配置完成后,请务必 :guilabel:`保存`产品。

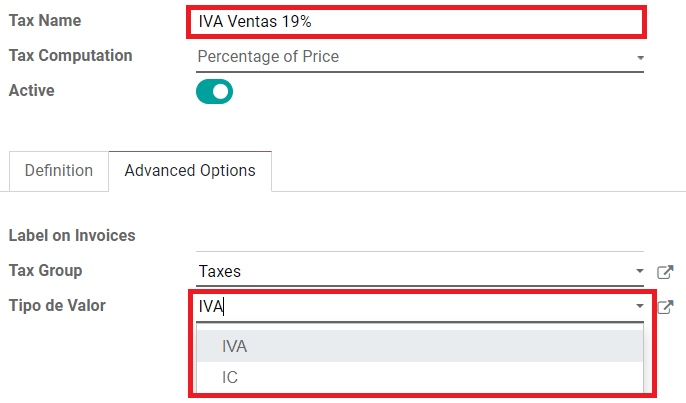

税¶

要创建或修改税种,请转到 并选择相关税项。

如果销售交易包括含税产品,则需要按税种配置 高级选项 选项卡中的 价值类型 字段。保留税类型(ICA、IVA、Fuente)也包括在内。该配置用于在 PDF 格式的发票中正确显示税款。

销售日记账¶

一旦 DIAN 为电子发票决议指定了正式序列和前缀,**必须**在 Odoo 中更新与发票文件相关的销售日记账。要执行此操作,请导航至:menuselection:会计 --> 配置 --> 日记账,然后选择一个现有的销售日记账,或使用:guilabel:`创建`按钮创建一个新的销售日记账。

在销售日记账表单中,输入 日记账名称、类型,并在 日记账条目 选项卡中设置唯一的 简码。然后,在 高级设置 选项卡中配置以下数据:

电子发票: 启用 UBL 2.1 (哥伦比亚)。

发票决议:DIAN 向公司发出的决议编号。

决议日期:决议的初始生效日期。

决议结束日期:决议有效期的结束日期。

编号范围(最小):第一个授权发票编号。

编号范围(最大值):最后授权的发票号码。

注解

日记账的顺序和决议 必须 与 Carvajal 和 DIAN 中配置的一致。

发票顺序¶

创建第一个文档时,必须正确配置发票顺序和前缀。

注解

Odoo 会自动为以下发票指定前缀和顺序。

采购日记账¶

一旦 DIAN 为与供应商账单相关的*支持文件*指定了正式序列和前缀,就需要在 Odoo 中更新与其支持文件相关的采购日记账。该过程与 销售日记账 的配置类似。

会计科目表¶

作为本地化模块的一部分,:doc:`会计科目表</applications/finance/accounting/get_started/chart_of_accounts>`是默认安装的,会计科目自动映射为税金、默认应付账款和默认应收账款。哥伦比亚的会计科目表基于 PUC(Plan Unico de Cuentas)。

主要工作流程¶

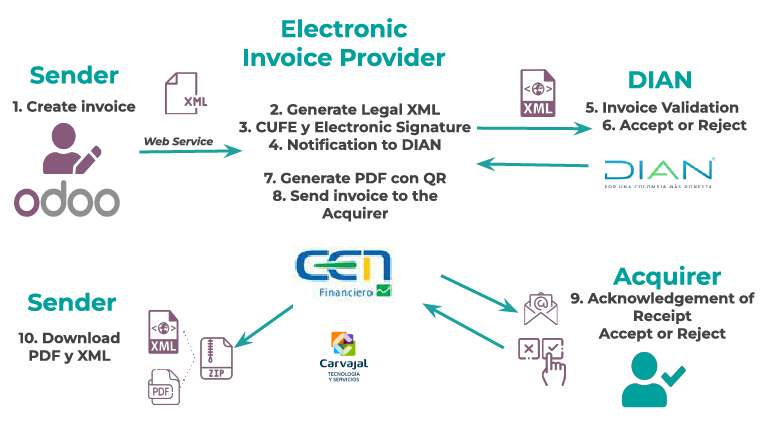

电子发票¶

以下是哥伦比亚本地化电子发票主要工作流程的细目:

发件人创建发票。

电子发票提供商生成法律 XML 文件。

电子发票提供商创建带有电子签名的 CUFE(发票电子代码)。

电子发票提供商向 DIAN 发送通知。

DIAN 验证发票。

DIAN 接受或拒绝发票。

电子发票提供商生成带有二维码的 PDF 发票。

电子发票提供商向收单机构发送发票。

收单方发送确认收据,并接受或拒绝发票。

发送方下载包含 PDF 和 XML 的

.zip文件。

开票创建¶

注解

发票验证前的功能工作流程**不会**改变电子发票带来的主要变化。

电子发票通过 Carvajal 的网络服务整合生成并发送给 DIAN 和客户。这些文件可以根据销售订单创建,也可以手动生成。要创建新发票,请进入 并选择 创建。在发票表格中配置以下字段:

客户:客户信息。

日记账:电子发票使用的日记账。

电子发票类型:选择文件类型。默认情况下,选择 Factura de Venta。

发票行:指定正确纳税的产品。

完成后,点击 确认。

Invoice validation¶

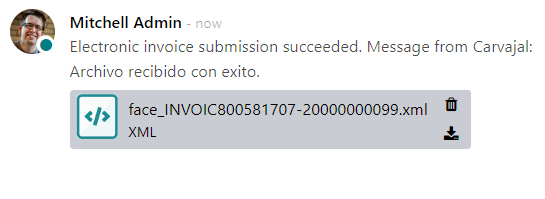

发票确认后,将创建一个 XML 文件并自动发送给 Carvajal。然后由电子发票服务 UBL 2.1(哥伦比亚)异步处理发票。该文件也会显示在聊天工具中。

电子发票名称`字段现在显示在 :guilabel:`EDI 文档`选项卡中,并带有 XML 文件名称。此外,:guilabel:`电子发票状态`字段显示的初始值为 :guilabel:`发送。要手动处理发票,请点击 立即处理 按钮。

Reception of legal XML and PDF¶

电子发票供应商(Carvajal)收到 XML 文件后,会对其结构和信息进行验证。

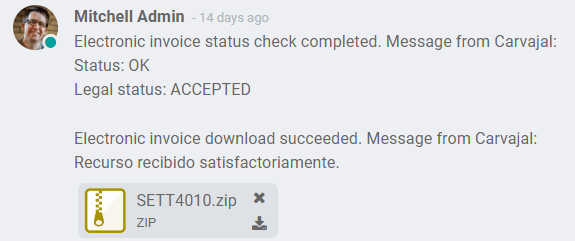

验证电子发票后,继续生成包含数字签名和唯一代码 (CUFE)的合法 XML,同时生成包含二维码和 CUFE 的 PDF 发票。如果一切正常,电子发票 字段值将变为 已发送。

下载包含法定电子发票(XML 格式)和发票(PDF 格式)的 :文件:.zip,并显示在发票沟通栏中:

电子发票状态更改为 已接受。

贷记单据¶

贷记单的流程与发票相同。要参照发票创建信用证,请转到 。在发票上点击 添加贷记单,然后填写以下信息:

贷记方式:选择贷记方式的类型。

部分退款: 部分退款时使用此选项。

全额退款:如果贷记票据为全额,请使用此选项。

全额退款和新发票草稿:如果贷记单已自动验证并与发票对账,则使用此选项。原始发票将作为新的草稿被复制。

原因:输入贷记的原因。

逆转日期:选择是否要为贷方票据设置一个特定日期,或者是日记账分录日期。

使用特定日记账:为贷记单选择日记账,如果想使用与原始发票相同的日记账,则将其留空。

退款日期:如果选择了特定日期,请选择退款日期。

审核完毕后,点击 逆转 按钮。

借记单¶

借记单的创建过程与贷记单类似。要参照发票创建借记单,请转到 。在发票上点击 添加借记单 按钮,然后输入以下信息:

原因:键入借记的原因。

借记日期:选择特定选项。

复制行:如果您需要用发票的相同行数登记借记票据,请选择此选项。

使用特定日记账:选择借记单的打印点,如果要使用与原始发票相同的日记账,则将其留空。

完成后,点击 创建借记单。

供应商账单支持文件¶

有了主数据、凭证和为供应商账单相关支持文档配置的采购日记账,您就可以开始使用*支持文档*了。

供应商账单的支持文件可通过采购订单或手动创建。进入 并填写以下数据:

供应商:输入供应商信息。

账单日期:选择账单日期。

日记账:选择与供应商账单相关的支持文件的日记账。

已开票行:指定正确纳税的产品。

审核完成后,点击 确认 按钮。确认后,将创建一个 XML 文件并自动发送给 Carvajal。

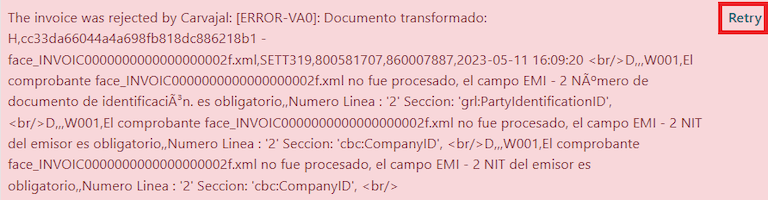

Common errors¶

在 XML 验证过程中,最常见的错误与缺少主数据(联系税号、地址、产品、税号)有关。在这种情况下,更新电子发票状态后的沟通栏中会显示错误信息。

更正主数据后,可使用 重试 按钮用新数据重新处理 XML 并发送更新版本。

财务报告¶

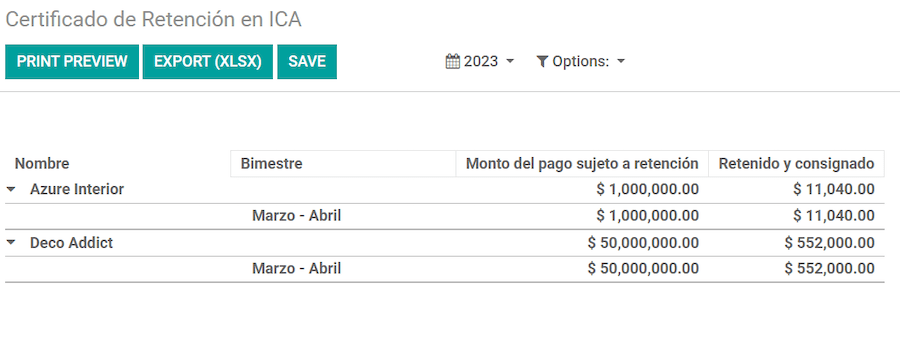

Certificado de Retención en ICA¶

该报告是向供应商提供的哥伦比亚工商业税(ICA)预扣证明。该报告可在 下找到。

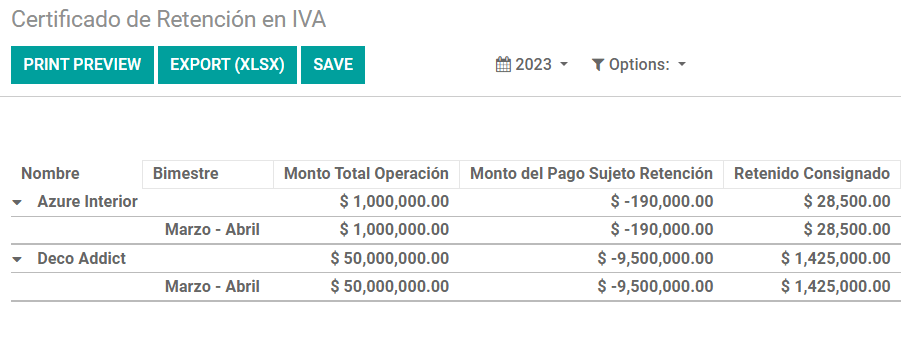

Certificado de Retención en IVA¶

该报告出具关于从供应商预扣增值税金额的证明。该报告可在 下找到。

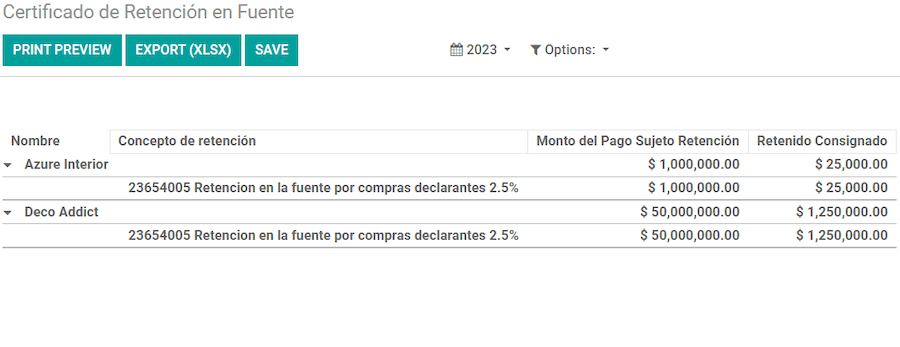

Certificado de Retención en la Fuente¶

该证书用于向合作伙伴发放预扣税款。该报告可在 下找到。