泰国¶

配置¶

安装 🇹🇭 泰国 本地化软件套装,以获得泰国本地化的所有功能:

名称 |

技术名称 |

说明 |

|---|---|---|

泰国 - 会计 |

|

默认:ref: |

泰国 - 会计报告 |

|

特定国家/地区的会计报告 |

会计科目表和税金¶

Odoo 针对泰国的财政本地化套餐包括以下税种:

VAT 7%

免增值税

预扣税

预扣收入税

税务报告¶

Odoo 允许用户生成 Excel 文件,以便向泰国**税务局**提交增值税。

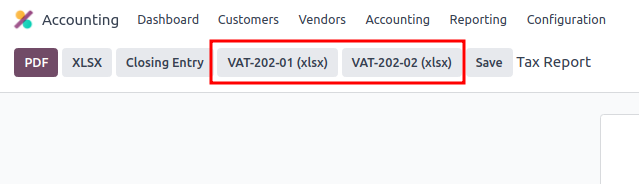

销售税和采购税报告¶

要生成销售税和采购税报告,请转至 。在税务报告中选择特定时间或时间范围,点击 VAT-202-01 (xlsx) 生成采购税报告,点击 VAT-202-02 (xlsx) 生成销售税报告。

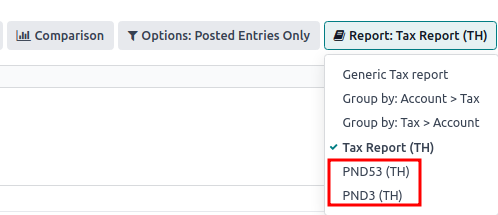

预扣 PND 税报告¶

PND 报告数据显示 PND53 (TH) 和 PND3 (TH) 税务报告下供应商账单中适用的 预扣代缴企业所得税申报表(国内) 的汇总金额。默认安装为泰语本地化。

注解

预扣代缴企业所得税申报表(国内)是指公司从 “个人(PND3)” 或 “公司(PND53)” 提供的服务(如租赁、雇用、运输、保险、管理费、咨询等)中预扣代缴税款时使用的税款。

PND 税收报告允许用户生成 CSV 文件,用于在 `RDprep for Thailand e-Filling Application <https://efiling.rd.go.th/rd-cms/>`_上上传账单。

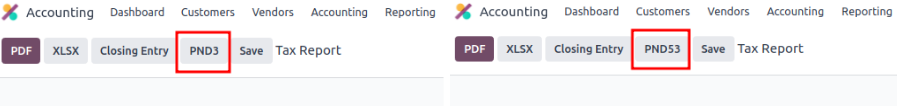

要生成 PND CSV 文件,请访问 ,在税务报告中选择特定时间或时间范围,然后点击 PND3 或 PND53。

这将生成 税务报告 PND3.csv 和 税务报告 PND53.csv 文件,列出所有供应商账单行和适用的预扣税款。

警告

Odoo 无法直接生成 PND 或 PDF 报告或 预扣税证明。生成的 Tax Report PND3.csv 和 Tax Report PND53.csv 文件必须导出到外部工具,以将其转换为**预扣税 PND** 报告或 PDF 文件。

税务发票¶

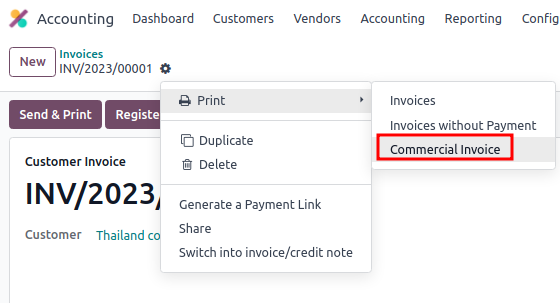

税务发票 PDF 报告可通过 Odoo 的**发票**模块生成。用户可选择打印普通发票和税务发票的 PDF 报告。要打印**税务发票**,用户可在 Odoo 中点击 打印发票。普通发票可通过点击:menuselection:`齿轮按钮(⚙️) –> 打印 –> 商业发票`打印为**商业发票**。

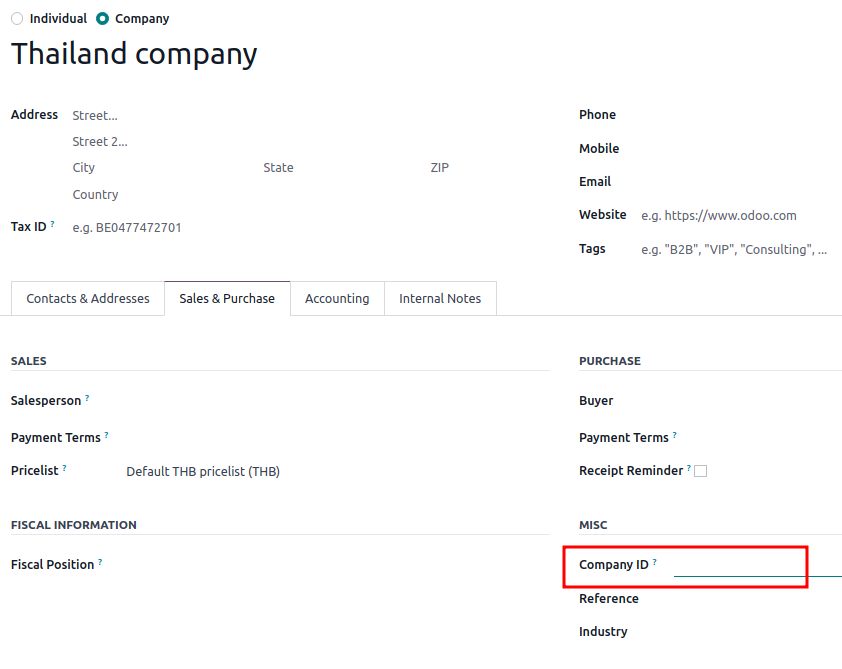

总部/分部编号设置¶

您可以在**联系人**应用程序中告知公司的**总部**和**分公司号码**。进入应用程序后,打开公司的**联系表**,在:guilabel:`销售和采购`选项卡下:

如果联系人被识别为分支机构,请在 公司 ID 字段中输入**分支编号**。

如果联系人是**总部**,则 公司 ID 字段为**空**。

小技巧

该信息用于**税务发票** PDF 报告和 PND **税务报告**导出。