Cash reconciliation¶

By default in Odoo, payments registered in the cash journal are automatically reconciled with an outstanding account and their related invoices or bills marked as In Payment until they are reconciled with a bank statement. It is possible to bypass the In Payment status for cash transactions, therefore removing the need to reconcile with a bank statement.

Cash logs¶

At the start of each day, create a cash log. To do so, go to your Accounting Dashboard and click New Transaction in the Cash journal.

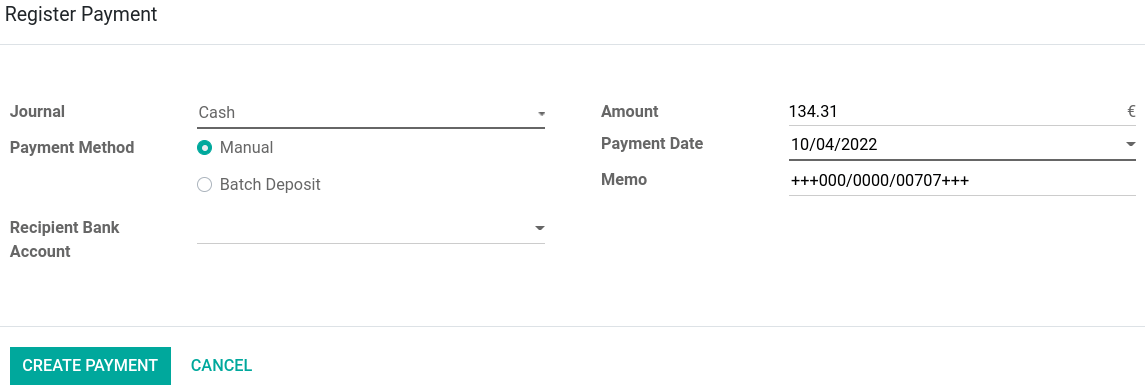

Enter the Starting Balance of your cash float and save, but do not post the entry yet. Create your invoice by going to and confirm it. Click Register Payment and select the cash Journal. Repeat the process for each invoice.

Go back to your Accounting Dashboard, and click again on New transactions. Click on the Add a line button in the Transactions tab, and enter the total of cash earned during the day. Add a label name according to your needs. Input the amount displayed under Computed Balance in the Ending Balance field, and make sure it matches your end cash float.

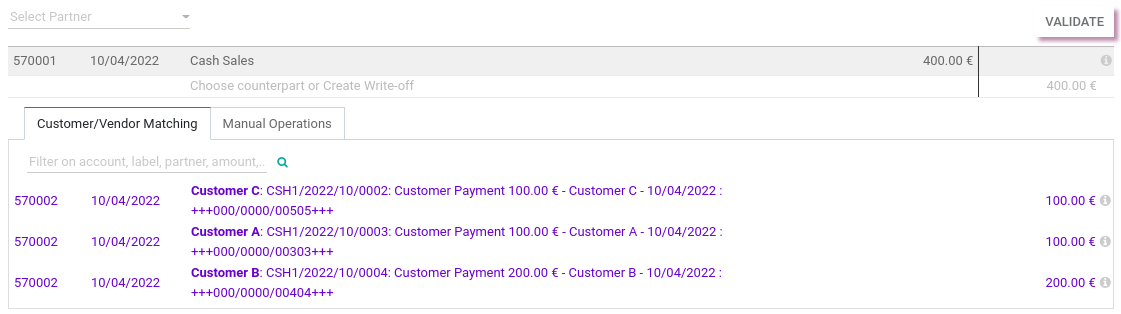

Once certain the computed balance is correct, click Save, Post, and then Reconcile. This will take you to the bank reconciliation page.

Cash payments reconciliation¶

On the bank reconciliation page, search through the list for the cash log transaction you created earlier. To be able to match all cash payments, make sure no partner is selected in the Select Partner field. If a partner is selected, click in the field and delete the partner. Then, pair (or match) each cash payment with your cash log by clicking on the payment in the Customer/Vendor Matching, and validate.

Notă

If your ending cash balance is over or under the computed balance, add another Transaction line corresponding to the over or under amount in order to match it later during reconciliation.

Cash reconciliation bypass¶

Important

Bypassing the cash journal is recommended only for organizations that do not need a cash report or do not wish to reconcile cash.

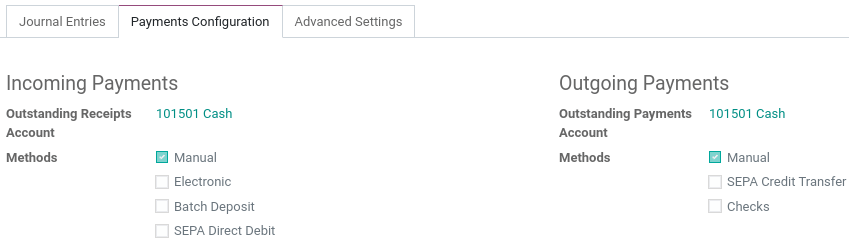

To bypass the In Payment status, go to and select the Cash journal. Click on the Payments

Configuration tab and set a Cash account in both the Outstanding Receipts Account and

Outstanding Payments Account fields, then save. Payments registered in the cash

journal now bypass the In Payment status.

Sfat

In case you use cash to pay expenses, advance employees, are required to keep records of cash flows, or use anything resembling a cash box, you can benefit from creating a second cash journal that does use the outstanding accounts. This way, you can both generate and reconcile bank statements when closing your POS session or your books at the end of the day.