Acquéreurs de paiement (Cartes de crédit, Paiement en ligne)¶

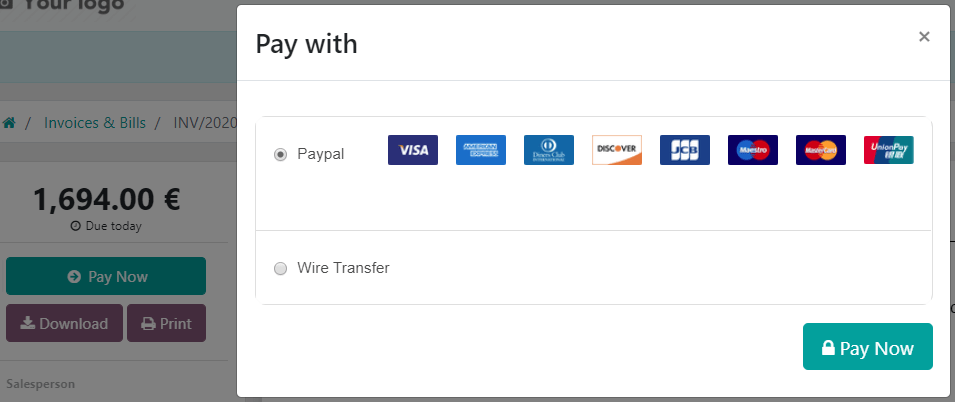

Odoo embeds several payment acquirers that allow your customers to pay on their Customer Portals or your eCommerce website. They can pay Sales Orders, invoices, or subscriptions with recurring payments with their favorite payment methods such as Credit Cards.

Offrir plusieurs méthodes de paiement augmente les chances d’être payé à temps, voire immédiatement, car vous facilitez le paiement de vos clients avec la méthode qu’ils préfèrent et en laquelle ils ont confiance.

Note

Les applications Odoo délèguent le traitement des informations sensibles à l’acquéreur de paiement certifié afin que vous n’ayez jamais à vous soucier de la conformité PCI.

This means that no sensitive information (such as credit card numbers or credentials) is stored on Odoo servers or Odoo databases hosted elsewhere. Instead, Odoo apps use a unique reference number to the data stored safely in the payment acquirers” systems.

Intermédiaires de paiement¶

D’un point de vue comptable, on peut distinguer deux types d’acquéreurs de paiement : les paiements qui vont directement sur le compte bancaire et suivent le flux de lettrage habituel, et les acquéreurs de paiement qui sont des services tiers et vous obligent à suivre un autre flux comptable.

Paiements bancaires¶

- Lorsqu’il est sélectionné, Odoo affiche vos informations de paiement avec une référence de paiement. Vous devez approuver le paiement manuellement une fois que vous l’avez reçu sur votre compte bancaire.

- Prélèvement SEPAVos clients peuvent signer en ligne un mandat de prélèvement SEPA et se faire débiter directement leur compte bancaire. Cliquez ici pour plus d’informations sur ce mode de paiement.

Fournisseurs de paiement en ligne¶

Redirection vers le site de l’intermédiaire |

Paiement d’Odoo |

Enregistrer les cartes |

Capturer le montant manuellement |

|

|---|---|---|---|---|

✔ |

||||

Alipay |

✔ |

|||

✔ |

✔ |

✔ |

✔ |

|

Buckaroo |

✔ |

|||

Ingenico |

✔ |

✔ |

✔ |

|

✔ |

||||

PayUMoney |

✔ |

|||

SIPS |

✔ |

|||

Stripe |

✔ |

✔ |

✔ |

Note

Some of these Online Payment Providers can also be added as Bank Accounts, but this is not the same process as adding them as Payment Acquirers. Payment Acquirers allow customers to pay online, and Bank Accounts are added and configured on your Accounting app to do a bank reconciliation, which is an accounting control process.

Configuration¶

Some of the features described in this section are available only with some Payment Acquirers. Refer to the table above for more details.

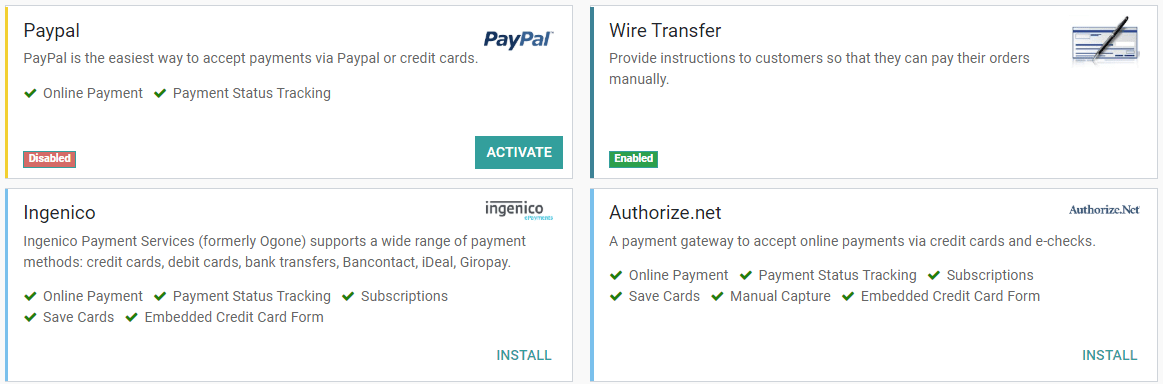

Add a new Payment Acquirer¶

To add a new Payment acquirer and make it available to your customers, go to , look for your payment acquirer, install the related module, and activate it. To do so, open the payment acquirer and change its state from Disabled to Enabled.

Avertissement

Nous vous recommandons d’utiliser le mode test sur une base de données dupliquée ou une base de données de test. Le mode test est destiné à être utilisé avec vos identifiants de test/sandbox, mais Odoo génère des bons de commande et des factures comme d’habitude. Il n’est pas toujours possible d’annuler une facture, et cela pourrait créer des problèmes de numérotation de vos factures si vous deviez tester vos acquéreurs de paiement sur votre base de données principale.

Onglet Identifiants¶

If not done yet, go to the Online Payment Provider’s website, create an account, and make sure to have the credentials required for third-party use. Odoo requires these credentials to communicate with the Payment Acquirer and get the confirmation of the payment authentication.

The form in this section is specific to the Payment Acquirer you are configuring. Please refer to the related documentation for more information.

Onglet Configuration¶

You can change the Payment Acquirer front-end appearance by modifying its name under the Displayed as field and which credit card icons to display under the Supported Payment Icons field.

Save and reuse Credit Cards¶

With the Save Cards feature, Odoo can store Payment Tokens in your database, which can be used for subsequent payments, without having to reenter the payment details. This is particularly useful for subscriptions” recurring payments.

Faire une réservation sur une carte¶

If the Capture Amount Manually field is enabled, the funds are reserved for a few days on the customer’s card, but not charged yet. You must then go to the related Sales Order and manually capture the funds before its automatic cancellation, or void the transaction to unlock the funds from the customer’s card.

Flux de règlement¶

Choose in the Payment Flow field if to redirect the user to the payment acquirer’s portal to authenticate the payment, or if to stay on the current page and authenticate the payment from Odoo.

Note

Some features are available only if you select Redirection to the acquirer website.

Avertissement

When configuring a payment acquirer with the payment flow Payment from Odoo, the payment acquirer is visible only to people who have an account and are logged in on the related database. To add a payment acquirer visible to everyone, the payment flow has to be set to Redirection to the acquirer website.

Pays¶

Restrict the use of the Payment Acquirer to a selection of countries. Leave this field blank to make the Payment Acquirer available to all countries.

Journal des paiements¶

The Payment Journal selected for your Payment Acquirer must be a Bank journal.

Important

In many cases, Odoo automatically creates a new Journal and a new Account when you activate a new Payment Acquirer. Both of them are preset to work out-of-the-box, but we strongly recommend you to make sure these fields are correctly set according to your accounting needs, and adapt them if necessary.

Messages tab¶

Modifiez ici les messages affichés par Odoo après la confirmation ou l’échec d’un paiement.

Perspective Comptable¶

Les paiements bancaires qui vont directement sur l’un de vos comptes bancaires suivent leurs flux de lettrage habituels. Toutefois, les paiements enregistrés auprès de fournisseurs de paiement en ligne vous obligent à réfléchir à la manière dont vous souhaitez enregistrer les écritures comptables de vos paiements. Nous vous recommandons de demander conseil à votre comptable.

Odoo default method is to record the payments on a Current Assets Account, on a dedicated Bank Journal, once the Payment Authentication is confirmed. At some point, you transfer the funds from the Payment Acquirer to your Bank Account.

Voici les conditions pour que cela fonctionne :

Journal de banque

The Journal’s type must be Bank Journal.

Select the right Default Debit Account and Default Credit Account.

- Under the Advanced Settings tab, make sure that Posting is set as Post At Payment Validation.This implies that the Journal Entry is recorded directly when your Odoo database receives the confirmation of the Payment Authentication from the Online Payment Provider.

Current Asset Account

The Account’s type is Current Assets

The Account must Allow Reconciliation

Note

In many cases, Odoo automatically creates a new Journal and a new Current Asset Account when you activate a new Payment Acquirer. You can modify them if necessary.