EU intra-community distance selling¶

Distance sales within the European Union include cross-border sales of goods and services to a private consumer (B2C) in another EU Member State when the seller doesn’t meet face-to-face with the customer. Organizations must ensure that the VAT on distance sales is paid to the Member State in which the goods or services are delivered.

Note

This remains true even if your organization is located outside of the European Union.

While this regulation mainly applies to eCommerce sales to private EU consumers, it is also valid for mail order sales and telesales.

The Union One-Stop Shop (OSS) is an online portal where businesses can register for the OSS and declare their intra-community distance sales. Each EU member state integrates an online OSS portal.

The EU intra-community Distance Selling feature helps your organization comply with this regulation by creating and configuring new fiscal positions and taxes based on your company’s country.

Configuration¶

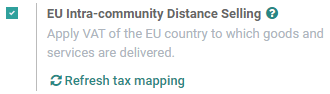

Go to , then enable EU intra-community Distance Selling (or EU Digital Goods VAT if you created your database before July 1, 2021), and Save.

Important

Please upgrade the module l10n_eu_service if you already installed it

before July 1, 2021, or if you activated the feature EU Digital Goods VAT in the

Accounting settings. Then, make sure to refresh the tax mapping.

Positions fiscales et taxes¶

Une fois activée, la fonctionnalité crée automatiquement toutes les taxes et positions fiscales nécessaires pour chaque État membre de l’UE, en fonction du pays de votre entreprise.

Nous vous recommandons vivement de vérifier que la cartographie proposée est adaptée aux produits et services que vous vendez avant de l’utiliser.

Actualiser la cartographie des taxes¶

Chaque fois que vous ajoutez ou modifiez des taxes, vous pouvez mettre à jour automatiquement vos positions fiscales.

To do so, go to and click on the Refresh tax mapping button.

Voir aussi