Argentinië¶

Webinars¶

Below you can find videos with a general description of the localization, and how to configure it.

Introductie¶

The Argentinean localization has been improved and extended in Odoo v13, in this version the next modules are available:

l10n_ar: This module add accounting features for the Argentinian localization, which represent the minimal configuration needed for a company to operate in Argentina and under the AFIP (Administración Federal de Ingresos Públicos) regulations and guidelines.

l10n_ar_reports: Add VAT Book report which is a legal requirement in Argentine and that holds the VAT detail info of sales or purchases recorded on the journal entries. This module includes as well the VAT summary report that is used to analyze the invoice

l10n_ar_edi: This module includes all technical and functional requirements to generate Electronic Invoice via web service, based on the AFIP regulations.

Configuratie¶

Install the Argentinean localization modules¶

For this, go to Apps and search for Argentina. Then click Install for the first two modules.

Configure your company¶

Once that the modules are installed, the first step is to set up your company data. Additional to the basic information, a key field to fill in the AFIP Responsibility Type, that represent the fiscal obligation and structure of the company:

Rekeningschema¶

In Accounting settings there are three available packages of Chart of accounts, which are related to the AFIP responsibility type of the Company, considering that if the base companies don’t require as many accounts as the companies that gave more complex fiscal requirements:

Monotributista (149 accounts).

IVA Exempto (159 accounts).

Responsables Inscriptos (166 Accounts).

Configure Master data¶

Electronic Invoice Credentials¶

Omgeving¶

The AFIP infrastructure is replicated in two separate environments, Testing and Production.

Testing is provided so that the Companies can test their developments until they are ready to move into the Production environment. As these two environments are completely isolated from each other, the digital certificates of one instance are not valid in the other one.

Go to to select the environment:

AFIP Certificates¶

The electronic invoice and other afip services work with WebServices (WS) provided by the AFIP.

In order to enable communication with the AFIP, the first step is to request a Digital Certificate if you don’t have one already.

Generate certificate Sign Request (Odoo). When this option is selected a file with extension

.csr(certificate signing request) is generated to be used the AFIP portal to request the certificate.

Generate Certificate (AFIP). Access the AFIP portal and follow the instructions described in the next document in order to get a certificate. Get AFIP Certificate.

Upload Certificate and Private Key (Odoo). Once the certificate has been generated, it needs to be uploaded in Odoo, using the pencil next in the field “Certificado” and selecting the corresponding file.

Tip

In case you need to configure the Homologation Certificate, please refer to the AFIP official documentation: Homologation Certificate.

Relatie¶

Identification Type and VAT¶

As part of the Argentinean localization, the document types defined by the AFIP are now available on the Partner form, this information is essential for most transactions. There are six identification types available by default:

Notitie

The complete list of Identification types defined by the AFIP is included in Odoo but only the common ones are active.

AFIP Responsibility Type¶

In Argentina the document type associated with customers and vendors transactions is defined based on the AFIP Responsibility type, this field should be defined in the partner form:

BTW¶

As part of the localization module, the taxes are created automatically with their related financial account and configuration.

Taxes Types¶

Argentina has several tax types, the most common ones are:

VAT. Is the regular VAT and it can have several percentages.

Perception. Advance payment of a tax that is applied on Invoices.

Retention. Advance payment of a tax that is applied on payments

Otros.

Special Taxes¶

Some argentine taxes are not commonly used for all companies, these type of taxes are included as inactive by default, it’s important that before creating a new tax you confirm if they are not already included in the Inactive taxes:

Document Types¶

In some Latin America countries, including Argentina, some accounting transactions like invoices and vendor bills are classified by document types defined by the government fiscal authorities (In Argentina case: AFIP).

The document type is an essential information that needs to be displayed in the printed reports and that needs to be easily identified, within the set of invoices as well of account moves.

Each document type can have a unique sequence per journal where it is assigned. As part of the localization, the Document Type include the country on which the document is applicable and the data is created automatically when the localization module is installed.

The information required for the document types is included by default so the user doesn’t need to fill anything on this view:

Notitie

There are several document types that are inactive by default but can be activated if needed.

Brieven¶

For Argentina, the document types include a letter that helps that indicates the transaction/operation, example:

When an invoice is related to a B2B transaction, a document type “A” must be used.

When an invoice is related to a B2C transaction, a document type “B” must be used.

When an invoice is related to exportation transaction, a document type “E” must be used.

The documents included in the localization have the proper letter associated, the user doesn’t need to configure anything additional.

Use on Invoices¶

The document type on each transaction will be determined by:

The Journal related to the Invoice, identifying if the journal use documents.

Condition applied based on the type of Issues and Receiver (ex. Type of fiscal regimen of the buyer and type of fiscal regimen of the vendor)

Dagboeken¶

In the Argentinean localization the Journal can have a different approach depending on its usage and internal type, to configure you journals go to :

For Sales and Purchase Journals it’s possible to enable the option Use Documents, this indicates the Journal enables a list of document types that can be related to the Invoices and vendor Bills, for more detail of the invoices, please refer to the section 2.3 Document Types.

If the Sales/Purchase journal are used without the option Use Documents it because they won’t be used to generate fiscal invoices, but mostly for account moves related to internal control process.

AFIP Information (also known as AFIP Point of Sale)¶

AFIP POS System: This field is only visible for the Sales journals and defined the type of AFIP POS that will be used to manage the transactions for which the journal is created. The AFIP POS defines as well:

The sequences of document types related to the Web service.

The structure and data of the electronic invoice file.

Web Services¶

wsfev1: Electronic Invoice.This is the most common service, is used to generated invoices for document types A, B, C, M with no detail per item.wsbfev1: Electronic Fiscal Bond.For those who invoice capital goods and wish to access the benefit of the Electronic Tax Bonds granted by the Ministry of Economy. For more detail you can refer to the next link: Fiscal Bond.wsfexv1: Electronic Exportation Invoice.Used to generate invoices for international customers and transactions that involve exportation process, the document type related is type “E”.

AFIP POS Number: This is the number configured in the AFIP to identify the operations related to this AFIP POS.

AFIP POS Address: This field is related to commercial address registered for the POS, which is usually the same address than the Company. For example: has multiple stores (fiscal locations) then AFIP will require that you have one AFIP POS per location: this location will be printed in the invoice report.

Unified Book: When AFIP POS System is Preimpresa the document types (applicable to the journal) with the same letter will share the same sequence. For example:

Invoice: FA-A 0001-00000002.

Credit Note: NC-A 0001-00000003.

Debit Note: ND-A 0001-00000004.

Reeksen¶

In case that you want to synchronize the next number in the sequence in Odoo based on the next number in the AFIP POS, the next button that is visible under developer mode can be used:

Notitie

When creating the Purchase journals, it’s possible to define if they can be related to document types or not. In case that the option to use documents is selected, there is no need to manually associate the document type sequences as the document number is provided by the vendor.

Usage and testing¶

Factuur¶

After the partners and journals are created and configured, when the invoices are created the will have the next behaviour:

Document type assignation¶

Once the partner is selected the document type will filled automatically, based on the AFIP document type:

Invoice for a customer IVA Responsable Inscripto, prefix A.

Invoice for an end customer, prefix B.

Exportation Invoice, prefix E.

As it is shown in the invoices, all of them use the same journal but the prefix and sequence is given by the document type.

The most common document type will be defined automatically for the different combinations of AFIP responsibility type but it can be updated manually by the user.

Electronic Invoice elements¶

When using electronic invoice, if all the information is correct the Invoice is posted in the standard way, in case that something needs to be addressed (check the section common errors for more detail), an error message is raised indicating the issue/proposed solution and the invoice remains in draft until the related data is corrected.

Once the invoice is posted, the information related to the AFIP validation and status is displayed in the AFIP Tab, including:

AFIP Autorisation: CAE number.

Expiration date: Deadline to deliver the invoice to the customers. Normally 10 days after the CAE is generated.

Result:

Aceptado en AFIP.

Aceptado con Observaciones.

Invoice Taxes¶

Based on the AFIP Responsibility type, the VAT tax can have a different behavior on the pdf report:

A. Tax excluded: In this case the taxed amount needs to be clearly identified in the report. This condition applies when the customer has the following AFIP Responsibility type:

Responsable Inscripto.

B. Tax amount included: This means that the taxed amount is included as part of the product price, subtotal and totals. This condition applies when the customer has the following AFIP Responsibility types:

IVA Sujeto Exento.

Consumidor Final.

Responsable Monotributo.

IVA liberado.

Special Use Cases¶

Invoices for Services¶

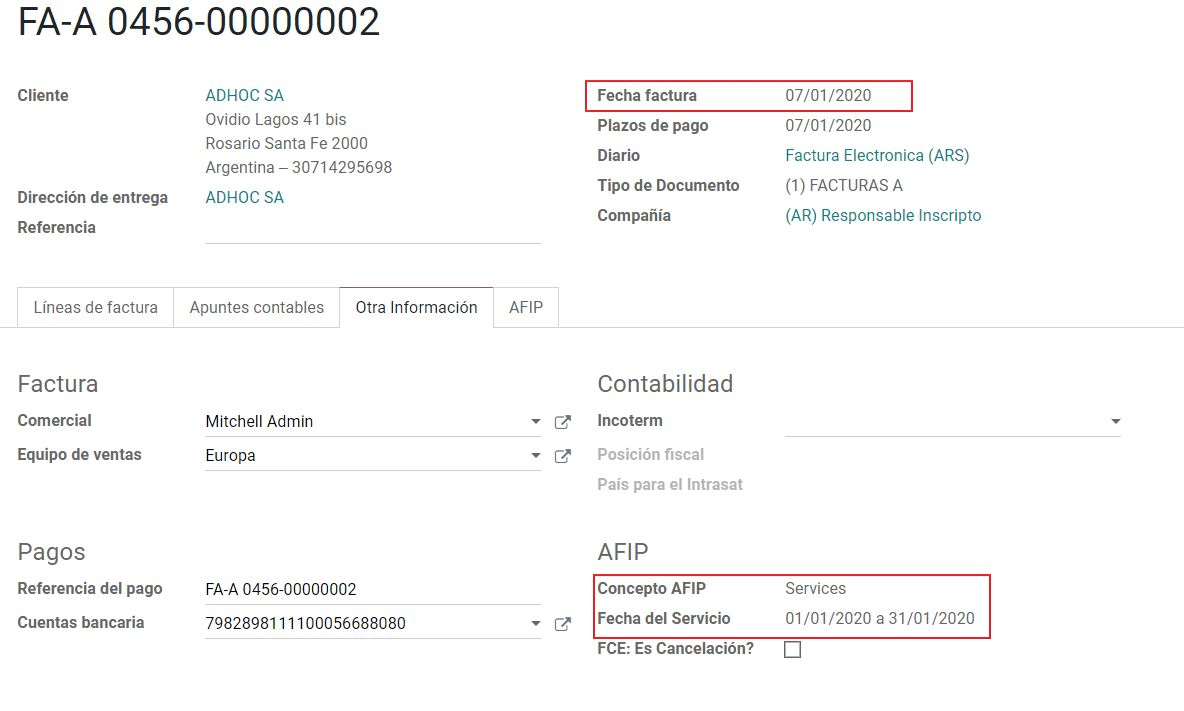

For electronic invoices that include Services, the AFIP requires to report the service starting and ending date, this information can be filled in the tab “Other Info”:

If the dates are not selected manually before the invoice is validated, the values will be filled automatically considering the beginning and day of the invoice month:

Exportation Invoices¶

The invoices related to Exportation transactions required a Journal that used the AFIP POS System “Expo Voucher - Web Service” so the proper document type be associated:

When the customer selected in the Invoice has set the AFIP responsibility type as “Cliente / Proveedor del Exterior” or “IVA Liberado – Ley Nº 19.640”, Odoo automatically assigned:

Journal related to the exportation Web Service.

Exportation document type .

Fiscal position: Compras/Ventas al exterior.

Concepto AFIP: Products / Definitive export of goods.

Exempt Taxes.

Notitie

The Exportation Documents required the Incoterm in :

Fiscal Bond¶

The Electronic Fiscal bond is used for those who invoice capital goods and wish to access the benefit of the Electronic Tax Bonds granted by the Ministry of Economy.

For these transactions it’s important to have into consideration the next requirements:

Currency (according to parameter table) and invoice quotation.

Taxes.

Zone.

Detail each item.

Code according to the Common Nomenclator of Mercosur (NCM).

Complete description.

Unit Net Price.

Quantity.

Unit of measurement.

Bonus.

VAT rate.

Electronic Credit Invoice MiPyme (FCE)¶

Invoices: There are several document types classified as Mipyme also known as Electronic Credit Invoice (FCE in spanish), which is used to impulse the SME, its purpose is to develop a mechanism that improves the financing conditions of these companies and allows them to increase their productivity, through the early collection of credits and receivables issued to their clients and / or vendors.

For these transactions it’s important to have into consideration the next requirements:

Specific document types (201, 202, 206, etc).

The emisor should be eligible by the AFIP to MiPyme transactions.

The amount should be bigger than 100,000 ARS.

A bank account type CBU must be related to the emisor, otherwise the invoice can’t be validated, having these errors messages for example:

Credit& Debit Notes: When creating a Credit/Debit note related to a FCE document, it is important take the next points into consideration:

Use the Credit and Debit Note buttons, so the correct reference of the originator document passed to the note.

The document letter should be the same than the originator document (either A or B).

The same currency as the source document must be used. When using a secondary currency there is an exchange difference if the currency rate is different between the emission day and the payment date, it’s possible to create a credit/debit note to decrease/increase the amount to pay in ARS.

In the workflow we can have two scenarios:

The FCE is rejected so the Credit Note should have the field “FCE, is Cancellation?” as True.

The Credit Note, is created with the negative amount to annulate the FCE document, in this case the field “FCE, is Cancellation?” must be empty (false).

Invoice printed report¶

The PDF report related to electronic invoices that have been validated by the AFIP includes a barcode at the bottom of the format which represent the CAE number, the Expiration Date is also displayed as it’s legal requirement:

Troubleshooting and Auditing¶

For auditing and troubleshooting purposes you can get the detailed information of an invoice number that has been previously sent to the AFIP,

You can also get the last number used in AFIP for a specific Document Type and POS Number as support for any possible issues on the sequence synchronization between Odoo and AFIP.

Leveranciersfacturen¶

Based on the purchase journal selected for the vendor bill, the document type is now a required field. This value is auto populated based on the AFIP Responsibility type of Issuer and Customer, but the value can be switched if necessary.

The document number needs to be registered manually and the format is validated automatically, in case that the format is invalid a user error will be displayed indicating the correct format that is expected.

The vendor bill number is structured in the same way that the invoices with the difference that the document sequence is input by the user: “Document Prefix - Letter - Document number”.

Validate Vendor Bill number in AFIP¶

As most companies have internal controls to verify that the vendor bill is related to an AFIP valid document, an automatic validation can be set in , considering the following levels:

Not available: The verification is not done (this is the default value).

Available: The verification is done, in case the number is not valid it only raises a warning but it allows you to post the vendor bill.

Required: The verification is done and it doesn’t allow the user to post the vendor bill if the document number is not valid.

How to use it in Odoo¶

This tool incorporates in the vendor bill a new “Verify on AFIP” button located next to the AFIP Authorization code.

In case it’s not a valid AFIP authorization the value “Rejected” will be displayed and the details of the validation will be added to the chatter.

Special Use cases¶

Untaxed Concepts¶

There are some transactions that include items that are not part of the VAT base amount, this is commonly used in fuel and gasoline invoices.

The vendor bill will be registered using 1 item for each product that is part of the VAT base amount and an additional item to register the amount of the Exempt concept:

Perception Taxes¶

The vendor bill will be registered using 1 item for each product that is part of the VAT base amount, the perception tax can be added in any of the product lines, as result we will have one tax group for the VAT and one for the perception, the perception default value is always 1.00.

You should use the pencil that is the next to the Perception amount to edit it and set the correct amount.

After this is done the invoice can be validated.

Rapportages¶

As part of the localization the next Financial reports were added:

VAT Reports¶

Libro de IVA Ventas¶

Libro de IVA Compras¶

Resumen de IVA¶

IIBB - Reports¶

IIBB - Ventas por Jurisdicción¶

IIBB - Compras por Jurisdicción¶