印度¶

安装¶

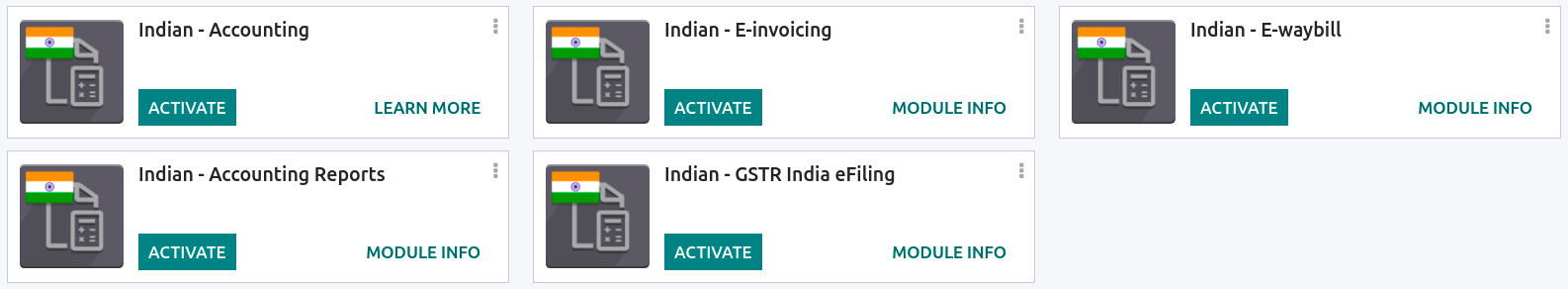

:ref:`安装<general/install>`以下模块,以获得印度本地化的所有功能:

名称 |

技术名称 |

描述 |

|---|---|---|

印度—会议 |

|

默认:ref: |

印度电子发票 |

|

|

印度电子运单 |

|

|

印度电子运单库存 |

|

|

印度 - GSTR India 电子文件 |

|

|

印度 - 会计报告 |

|

电子发票系统¶

Odoo 符合**印度商品和服务税(GST)电子发票系统**的要求。

设置¶

NIC 电子发票注册¶

您必须先在 NIC(国家信息中心) 电子发票门户注册,以获取 API 凭证。这些凭证用于 配置您的 Odoo 会计应用。

登录 NIC 电子发票门户,点击 登录 并输入您的 用户名 和 密码;

注解

如果您已在 NIC 门户注册,可直接使用相同的登录凭证。

在仪表板中,进入 ;

随后,您将在注册的手机号上收到一条 OTP(一次性密码) ` 验证码。输入该验证码并点击 :guilabel:`验证 OTP;

选择 通过 GSP 作为 API 接口方式,设置 :guilabel:`Tera Software Limited 为 GSP 提供商,并填写 API 的 用户名 和 密码。完成后,点击 提交。

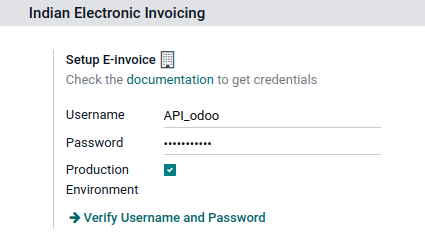

Odoo 中的配置¶

要在 Odoo 中启用电子发票服务,请访问 ,并输入之前为 API 设置的 用户名 和 密码 。

日记账¶

要自动向 NIC 电子发票门户网站发送电子发票,您必须首先配置您的 销售 日记账,方法是进入 ,打开您的 销售 日志,在 高级设置 选项卡的 电子数据交换 下,启用 电子发票(IN) 并保存。

工作流¶

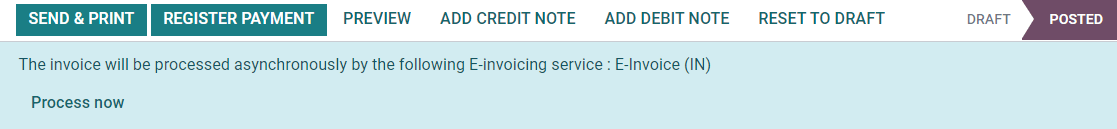

Invoice validation¶

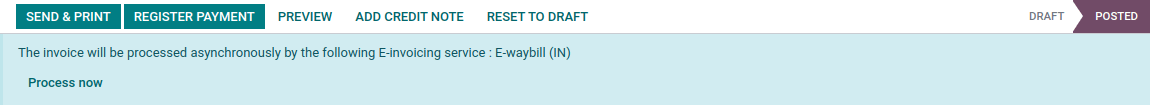

发票一经验证,顶部就会显示一条确认信息。一段时间后,Odoo 会自动将已验证发票的 JSON 签名文件上传到 NIC 电子发票门户网站。如果您想立即处理发票,请点击 立即处理。

注解

您可以在沟通栏附件中找到经 JSON 签名的文件。

您可以在发票的 EDI 文件 选项卡或 电子发票 字段下检查文档的 :abbr:`EDI(电子数据交换)`状态。

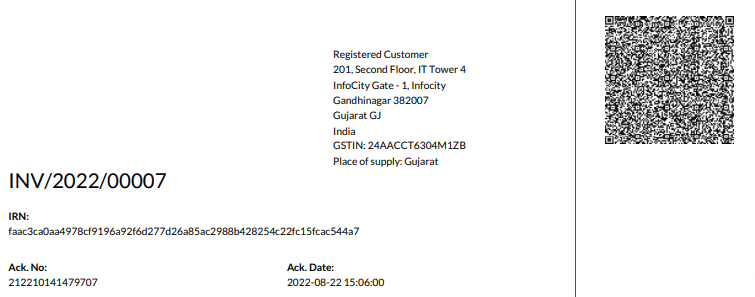

开票报告PDF¶

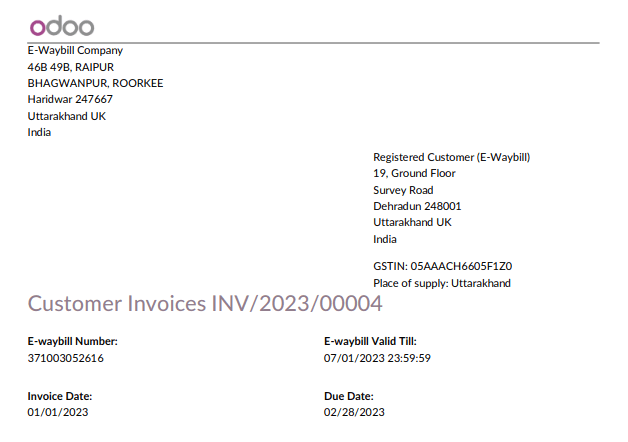

发票一经验证和提交,即可打印发票 PDF 报告。报告包括 IRN(发票参考号)、:guilabel:`Ack. No`(确认编号)、:guilabel:`Ack.Date`(确认日期)和二维码。这些证明发票是有效的财务文件。

取消电子发票¶

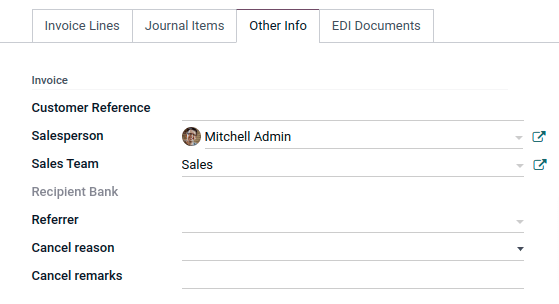

如果您想取消电子发票,请转到发票的 其他信息 选项卡,填写 取消原因 和 取消备注 字段。然后,点击 请求 EDI 取消。电子发票开具`字段的状态将变为 :guilabel:`取消。

注解

如果要在处理发票前取消作废,请点击 取消 EDI 作废。

一旦您请求取消电子发票,Odoo 将自动向 NIC 电子发票门户网站提交 JSON 签名文件。如果您想立即处理发票,可点击 立即处理。

GST 电子发票验证¶

提交电子发票后,您可以从 GST 电子发票系统网站上验证发票是否已签署。

从附件中下载 JSON 文件。它可以在相关发票的沟通栏中找到;

打开`NIC 电子发票门户网站 <https://einvoice1.gst.gov.in/>`_,进入 ;

选择 JSON 文件并提交;

如果文件已签署,则会显示一条确认信息。

电子货运单¶

设置¶

Odoo 符合**印度商品和服务税(GST)电子运单系统**的要求。

API registration on NIC E-Way bill¶

You must register on the NIC E-Way bill portal to create your API credentials. You need these credentials to configure your Odoo Accounting app.

Log in to the NIC E-Way bill portal by clicking Login and entering your Username and Password;

From your dashboard, go to ;

Click Send OTP. Once you have received the code on your registered mobile number, enter it and click Verify OTP;

Check if Tera Software Limited is already on the registered GSP/ERP list. If so, use the username and password used to log in to the NIC portal. Otherwise, follow the next steps;

Select Add/New, select Tera Software Limited as your GSP Name, create a Username and a Password for your API, and click Add.

Odoo 中的配置¶

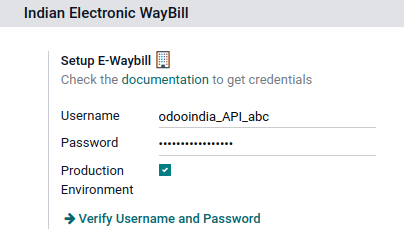

要设置电子运单服务,请访问 ,然后输入您的 用户名 和 密码 。

工作流¶

发送电子运单¶

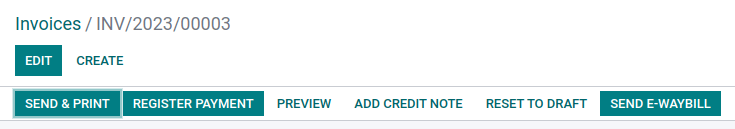

要发送电子账单,请确认客户发票/供应商账单,然后点击 发送电子账单。

Invoice validation¶

通过 发送电子账单 发送发票/账单后,会显示一条确认信息。

注解

您可以在沟通栏附件中找到经 JSON 签名的文件。

一段时间后,Odoo 会自动将 JSON 签名文件上传到政府门户网站。如果您想立即处理发票/账单,请点击 立即处理。

开票报告PDF¶

提交电子运单后,您可以打印发票 PDF 报告。该报告包括**电子运单编号**和**电子运单有效日期**。

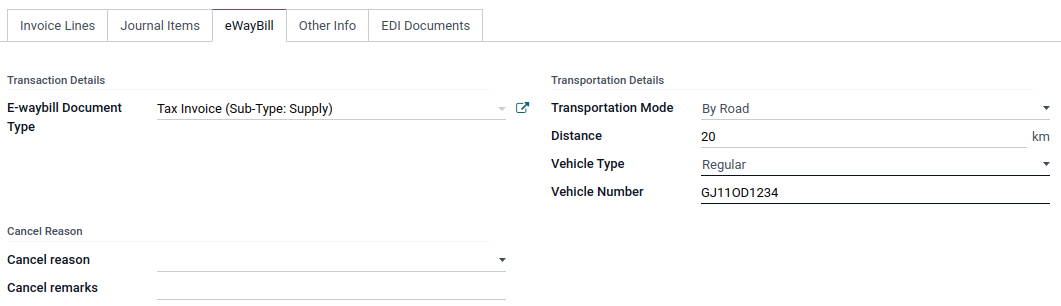

取消电子运单¶

如果您想取消电子汇票,请进入相关发票/账单的 电子运单 选项卡,填写 取消理由 和 取消备注 字段。然后,点击 请求 EDI 取消。

重要

这样做会同时取消 电子发票。

注解

如果要在处理发票之前取消取消,请点击 取消 EDI 取消。

一旦您请求取消电子支付账单,Odoo 将自动向政府门户网站提交 JSON 签名文件。如果您想立即处理发票,可点击 立即处理。

根据收据和送货单创建电子运单¶

要从库存应用程序中的 收据和交货 创建电子运单,请按以下步骤操作:

进入 或 ,选择一个现有的送货单/收据或创建一个新的送货单/收据。

点击 创建电子运单/Challan.

注解

创建电子运单:

配送单必须处于 已完成 状态(即已验证)。

收据必须处于 准备 或 :guilabel:已完成` 状态。

点击 生成电子运单 以验证电子运单并将其发送到 NIC 电子运单门户。

小技巧

若要将电子运单(E-Way Bill)作为货物交付的交运单使用,而无需提交至 NIC 电子运单门户,请点击 用作交运单。

如需打印电子运单或货运单,请点击 :icon:fa-cog :guilabel:(齿轮) 图标,并选择 :icon:fa-print :guilabel:电子运单/货运单。

印度 GST 申报¶

启用 API 访问权限¶

要在 Odoo 中进行 GST 申报,您必须先在 GST 门户上启用 API 访问权限。

请登录

GST 门户网站 <https://services.gst.gov.in/services/login>,输入您的 用户名 和 密码,然后进入**个人资料**菜单中的 我的资料;

选择 管理 API 访问权限,并点击 是 以启用 API 访问;

注解

建议将 有效期 设置为 30天,以避免频繁重新进行令牌认证;

这样做将启用 持续时间 下拉菜单。选择您偏好的 持续时间 并点击 确认。

Odoo 中的印度 GST 服务¶

在商品及服务税门户网站上启用 API 访问<india/gstr_api>`后,您就可以在 Odoo 中设置 :guilabel:`印度 GST 服务。

进入 并输入 GST 用户名。点击 发送 OTP,输入代码,最后点击 验证。

提交GST申报表¶

当 印度 GST 服务 配置完成后,您就可以提交消费税申报表了。进入 并创建一个新的 GST 申报期 (如果不存在)。在 Odoo 中,GST 申报分**三步**完成:

注解

报税周期 可以根据用户需要 配置 。

发送 GSTR-1¶

The user can also get details to be submitted in GSTR-1 in Spreadsheet view by clicking on Generate;

如果**GSTR-1**报告正确,则点击 推送至 GSTN,将其发送至**GST 门户**。GSTR-1`报告的状态将变为:guilabel:`发送;

几秒钟后,GSTR-1 报告的状态将变为 等待状态。这意味着 GSTR-1 报告已发送到 GST 门户 并正在 GST 门户 上验证;

Once more, after a few seconds, the status either changes to Sent or Error in Invoice. The status Error in Invoice indicates that some of the invoices are not correctly filled out to be validated by the GST portal;

If the state of the GSTR-1 is Sent, it means your GSTR-1 report is ready to be filed on the GST portal.

如果**GSTR-1**的状态为:guilabel:

发票出错,则可在:guilabel:日志备注`中检查发票是否出错。问题解决后,用户可点击 :guilabel:`推送到 GSTN再次在**GST 门户**上提交文件。

Click Mark as Filed after filing the GSTR-1 report on the GST portal. The status of the report changes to Filed in Odoo.

Receive GSTR-2B¶

Users can retrieve the GSTR-2B Report from the GST portal. This automatically reconciles the GSTR-2B report with your Odoo bills;

Click Fetch GSTR-2B Summary to retrieve the GSTR-2B summary. After a few seconds, the status of the report changes to Waiting for Reception. This means Odoo is trying to receive the GSTR-2B report from the GST portal;

Once more, after a few seconds, the status of the GSTR-2B changes to the Being Processed. It means Odoo is reconciling the GSTR-2B report with your Odoo bills;

Once it is done, the status of the GSTR-2B report changes to either Matched or Partially Matched;

If the status is Matched:

If the status is Partially Matched, you can make changes in bills by clicking View Reconciled Bills. Once it is done, click re-match.

GSTR-3 报告¶

GSTR-3 报告是**销售额**和**采购额**的月度汇总。该报表通过提取**GSTR-1**和**GSTR-2**中的信息自动生成。

用户可通过点击 GSTR-3 报告 将**GSTR-3**报告与**GST门户网站上提供的**GSTR-3**报告进行比较,以验证两者是否匹配;

Once the GSTR-3 report has been verified by the user and the tax amount on the GST portal has been paid. Once paid, the report can be closed by clicking Closing Entry;

In Closing Entry, add the tax amount paid on the GST portal using challan, and click POST to post the Closing Entry;

Once posted, the GSTR-3 report status changes to Filed.

税务报表¶

GSTR-1 report¶

The GSTR-1 report is divided into sections. It displays the Base amount, CGST, SGST, IGST, and CESS for each section.

GSTR-3 报告¶

The GSTR-3 report contains different sections:

Details of inward and outward supply subject to a reverse charge;

Eligible ITC;

Values of exempt, Nil-rated, and non-GST inward supply;

Details of inter-state supplies made to unregistered persons.