库存计价配置¶

All of a company’s stock on-hand contributes to the valuation of its inventory. That value should be reflected in the company’s accounting records to accurately show the value of the company and all of its assets.

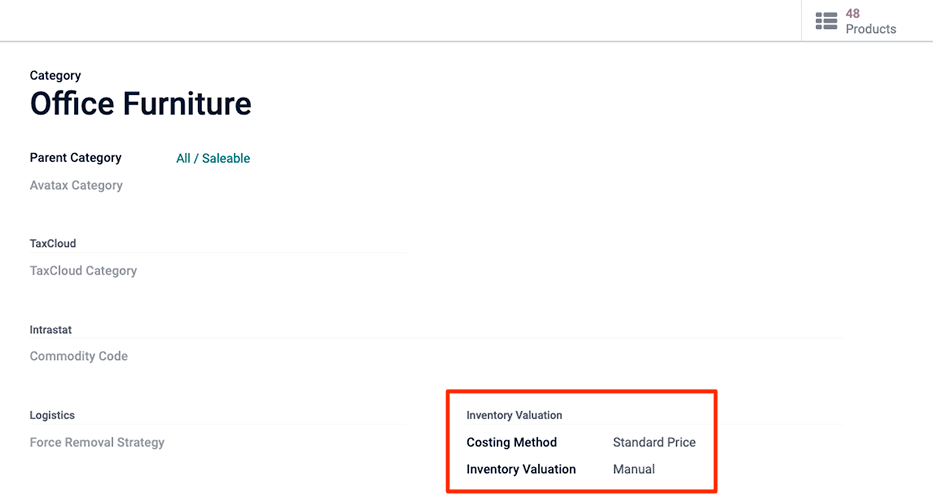

默认情况下,Odoo 使用定期库存估价(也称为手动库存估价)。这种方法意味着会计团队会根据公司的实际库存,记录日记账分录,仓库员工也会花时间清点库存。在 Odoo 中,这种方法反映在每个产品类别中,其中 成本计算方法 字段将默认设置为`标准价格`,而 库存估值 字段将设置为`手动`。

另外,自动存货估价是一种综合估价方法,每当公司存货在不同地点之间发生存货移动时,就会创建日记账分录,从而实时更新存货价值。

注解

鉴于日记账分录配置涉及额外步骤,建议专业会计师采用自动存货估价方法。即使在初始设置之后,也需要定期检查该方法,以确保准确性,并根据企业需求和优先事项不断进行调整。

会计类型¶

Accounting entries will depend on the accounting mode: Continental or Anglo-Saxon.

小技巧

激活 开发者模式 并导航至 以验证会计模式。

In Anglo-Saxon accounting, the costs of goods sold (COGS) are reported when products are sold or delivered. This means that the cost of a good is only recorded as an expense when a customer is invoiced for a product. Interim Stock Accounts are used for the input and output accounts, and are both Asset Accounts in the balance sheet.

In Continental accounting, the cost of a good is reported as soon as a product is received into stock. Additionally, a single Expense account is used for both input and output accounts in the balance sheet.

Costing methods¶

Below are the three costing methods that can be used in Odoo for inventory valuation.

标准价格:是 Odoo 的默认成本计算方法。产品成本在产品表单中手动定义,并使用该成本计算估值。即使采购订单上的采购价格不同,估价仍将使用产品表单上定义的成本。

平均成本法(AVCO):根据产品的平均成本除以手头可用存货总数来计算产品估值。采用这种成本计算方法,存货估值是*动态*的,会根据产品的购买价格不断调整。

先进先出(FIFO):实时追踪进货和出货成本,并使用产品的实际价格来改变估价。最旧的进货价被用作下一个售出产品的成本,直到该产品整批售出。当下一个库存批次进入队列时,根据该特定批次的估值使用更新的产品成本。这种方法可以说是最准确的库存估值方法,不过,它对输入数据和人为误差非常敏感。

警告

Changing the costing method greatly impacts inventory valuation. It’s highly recommended to consult an accountant first before making any adjustments here.

Configure automated inventory valuation in Odoo¶

Make changes to inventory valuation options by navigating to , and choose the category/categories where the automated valuation method should apply.

注解

It is possible to use different valuation settings for different product categories.

Under the Inventory Valuation heading are two labels: Costing Method and Inventory Valuation. Pick the desired Costing Method using the drop-down menu (e.g. Standard, Average Cost (AVCO), or First In First Out (FIFO)) and switch the Inventory Valuation to Automated.

注解

When choosing Average Cost (AVCO) as the Costing Method, changing the numerical value in the Cost field for products in the respective product category creates a new record in the Inventory Valuation report to adjust the value of the product. The Cost amount will then automatically update based on the average purchase price both of inventory on hand and the costs accumulated from validated purchase orders.

When the Costing Method is changed, products already in stock that were using the Standard costing method do not change value; rather, the existing units keep their value, and any product moves from then on affect the average cost, and the cost of the product will change. If the value in the Cost field on a product form is changed manually, Odoo will generate a corresponding record in the Inventory Valuation report.

On the same screen, the Account Stock Properties fields will appear, as they are now required fields given the change to automated inventory valuation. These accounts are defined as follows:

Stock Valuation Account: when automated inventory valuation is enabled on a product, this account will hold the current value of the products.

Stock Input Account: counterpart journal items for all incoming stock moves will be posted in this account, unless there is a specific valuation account set on the source location. This is the default value for all products in a given category, and can also be set directly on each product.

Stock Output Account: counterpart journal items for all outgoing stock moves will be posted in this account, unless there is a specific valuation account set on the destination location. This is the default value for all products in a given category, and can also be set directly on each product.

Access reporting data generated by inventory valuation¶

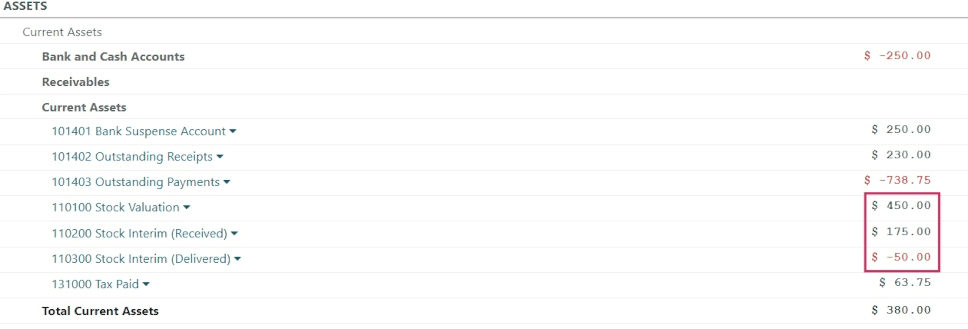

To start, go to . At the top of the dashboard, change the As of field value to Today, and adjust the filtering Options to Unfold All in order to see all of the latest data displayed, all at once.

Under the parent Current Assets line item, look for the nested Stock Valuation Account line item, where the total valuation of all of the inventory on hand is displayed.

Access more specific information with the Stock Valuation Account drop-down menu, by selecting either the General Ledger to see an itemized view of all of the journal entries, or by selecting Journal Items to review all of the individualized journal entries that were submitted to the account. As well, annotations to the Balance Sheet can be added by choosing Annotate, filling in the text box, and clicking Save.