预扣税¶

预扣税,也称为留存税,规定客户发票的付款人从付款中扣除税款并将其汇给政府。通常情况下,税款包含在计算支付总额的小计中,而预扣税则直接从付款中扣除。

配置¶

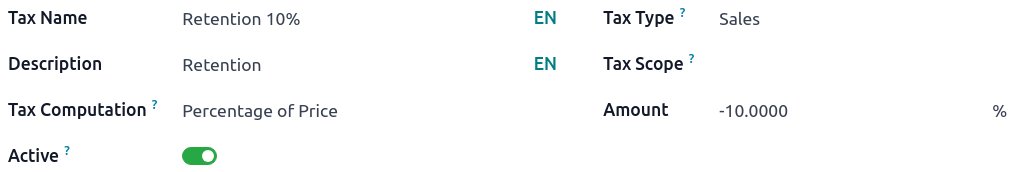

在 Odoo 中,预扣税是通过创建负税来定义的。要创建负税,请转到 并在 金额 字段中输入负数。

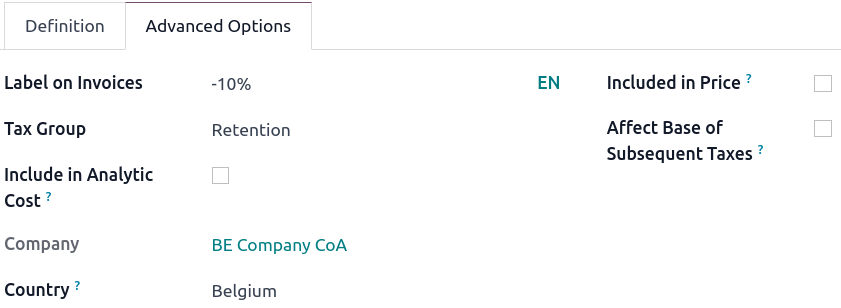

然后,转到 选项卡并创建一个保留 税组。

小技巧

If the retention is a percentage of a regular tax, create a Tax with a Tax Computation as a Group of Taxes. Then, set both the regular tax and the retention one in the Definition tab.

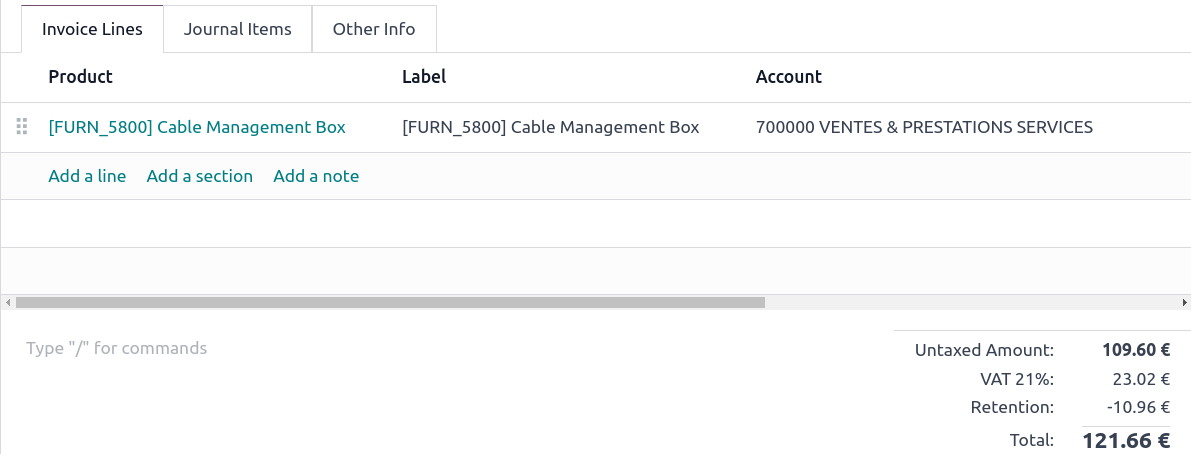

Retention taxes on invoices¶

Once the retention tax has been created, it can be used on customer forms, sales orders, and customer invoices. Several taxes can be applied on a single customer invoice line.

参见