Automatic inventory valuation¶

All of a company’s stock on-hand contributes to the valuation of its inventory. That value should be reflected in the company’s accounting records to accurately show the value of the company and all of its assets.

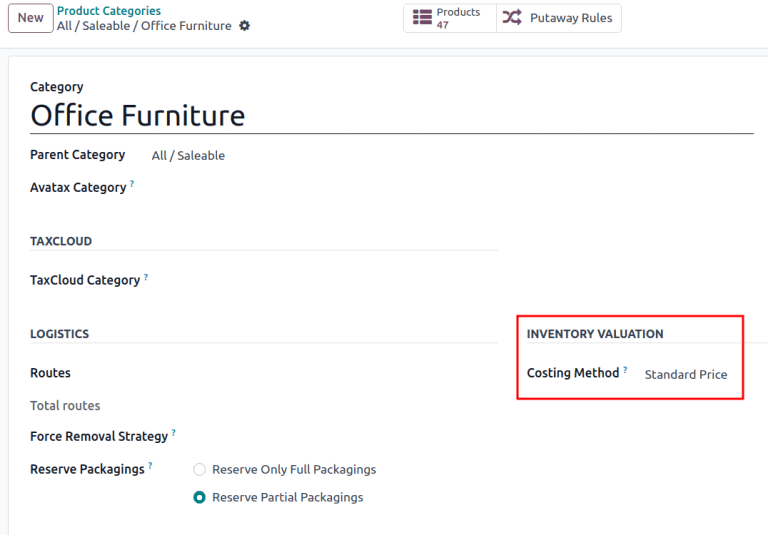

By default, Odoo uses a periodic inventory valuation (also known as manual inventory valuation). This method implies that the accounting team manually posts journal entries, based on the physical inventory of the company, and warehouse employees take the time to count the stock. In Odoo, each product category reflects this, with the Costing Method set to Standard Price, and the Inventory Valuation (not visible by default) set to Manual.

Alternatively, perpetual (automatic) inventory valuation creates real-time journal entries in the Accounting app whenever stock enters or leaves the company’s warehouse.

This document is focused on the proper setup of automatic inventory valuation, which is an integrated valuation method that ensures journal entries in the Accounting app match stock valuation updates in the Inventory app. For an introduction of inventory valuation in Odoo, refer to the Using inventory valuation documentation.

Warning

Switching from manual to automatic inventory valuation may cause discrepancies between stock valuation and accounting journals.

One successful strategy for switching to automated valuation:

Clear existing stock (possibly with an inventory adjustment)

Change the inventory valuation method to Automatic

Return the existing stock, with the original monetary value (using an inventory adjustment)

Once the existing stock is recovered, the Odoo Accounting app automatically generates the journal entries to corresponding stock valuation records.

Configuration¶

To properly set up automatic inventory valuation, follow these steps in Odoo:

Accounting setup¶

To use automatic inventory valuation, install the Accounting app. Next, go to , and in the Stock Valuation section, tick the Automatic Accounting checkbox. Then, click Save.

Note

Enabling Automatic Accounting shows the previously invisible Inventory Valuation field on a product category.

Refer to the Expense and Stock input/output sections of documentation for details on configuring the accounting journals shown.

Product category setup¶

After enabling inventory valuation, the next step is to set the product category to use automatic inventory valuation.

Go to , and select the desired product category. In the Inventory Valuation section, set the Inventory Valuation field to Automated. Repeat this step for every product category intending to use automatic inventory valuation.

Note

After enabling automatic accounting, each new stock move layer (SVL), that is created during inventory valuation updates, generates a journal entry.

Costing method¶

After enabling inventory valuation, the costing method for calculating and recording inventory costs is defined on the product category in Odoo.

Go to and select the desired product category. In the Inventory Valuation section, select the appropriate Costing Method:

Standard Price: the default costing method in Odoo. The cost of the product is manually defined on the product form, and this cost is used to compute the valuation. Even if the purchase price on a purchase order differs, the valuation will still use the cost defined on the product form.

Average Cost (AVCO): calculates the valuation of a product based on the average cost of that product, divided by the total number of available stock on-hand. With this costing method, inventory valuation is dynamic, and constantly adjusts based on the purchase price of products.

Note

When choosing Average Cost (AVCO) as the Costing Method, changing the numerical value in the Cost field for products in the respective product category creates a new record in the Inventory Valuation report to adjust the value of the product. The Cost amount will then automatically update based on the average purchase price both of inventory on hand and the costs accumulated from validated purchase orders.

First In First Out (FIFO): tracks the costs of incoming and outgoing items in real-time and uses the real price of the products to change the valuation. The oldest purchase price is used as the cost for the next good sold until an entire lot of that product is sold. When the next inventory lot moves up in the queue, an updated product cost is used based on the valuation of that specific lot. This method is arguably the most accurate inventory valuation method for a variety of reasons, however, it is highly sensitive to input data and human error.

Warning

Changing the costing method greatly impacts inventory valuation. It is highly recommended to consult an accountant first before making any adjustments here.

See also

When the Costing Method is changed, products already in stock that were using the Standard costing method do not change value; rather, the existing units keep their value, and any product moves from then on affect the average cost, and the cost of the product will change. If the value in the Cost field on a product form is changed manually, Odoo generates a corresponding record in the Inventory Valuation report.

Note

It is possible to use different valuation settings for different product categories.

Types of accounting¶

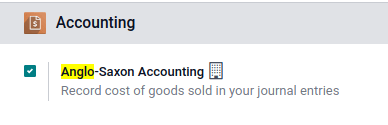

With automated inventory valuation set up, the generated journal entries depend on the chosen accounting mode: Continental or Anglo-Saxon.

Tip

Verify the accounting mode by activating the Developer mode (debug mode), and navigating to .

Then, in the Search… bar, look for Anglo-Saxon Accounting, to see if the feature

is enabled. If it is not enabled, Continental accounting mode is in use.

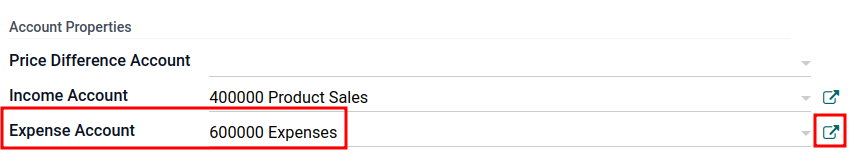

In Anglo-Saxon accounting, the costs of goods sold (COGS) are reported when products are sold or delivered. This means the cost of a good is only recorded as an expense when a customer is invoiced for a product.

So, for manual valuation method, set the Expense Account to Stock Valuation for the current asset type; for automatic valuation method, set the Expense Account to an Expenses or a Cost of Revenue type (e.g. Cost of Production, Cost of Goods Sold, etc.).

In Continental accounting, the cost of a good is reported as soon as a product is received into stock. Because of this, the Expense Account can be set to either Expenses or a Cost of Revenue type, however, it is more commonly set to an Expenses account.

Refer to the Expense and Stock input/output sections for details on configuring each account type.

Expense account¶

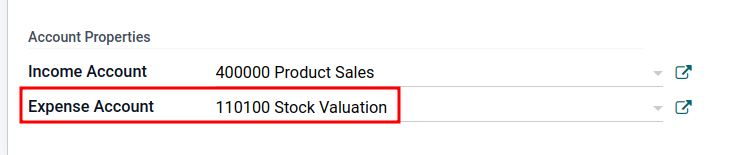

To configure the expense account, which is used in both manual and automatic inventory valuation, go to the Account Properties section of the intended product category (). Then, choose an existing account from the Expense Account drop-down menu.

To ensure the chosen account is the correct Type, click the (right arrow) icon to the right of the account. Then, set the account type based on the information below.

In Anglo-Saxon accounting for automated inventory valuation, set the Expense

Account to the Expenses account. Then, click the (right arrow) icon to the right of

the account.

In the pop-up window, choose Expenses or Cost of Revenue from the Type drop-down menu.

To configure the Expense Account, choose Stock Valuation from the field’s drop-down menu. Verify the account’s type by clicking the (right arrow) icon, and then ensure the Type is Current Assets.

Set the Expense Account to the Expenses or Cost of Revenue account type.

Set the Expense Account to the Expenses or Cost of Revenue account type.

Stock input/output (automated only)¶

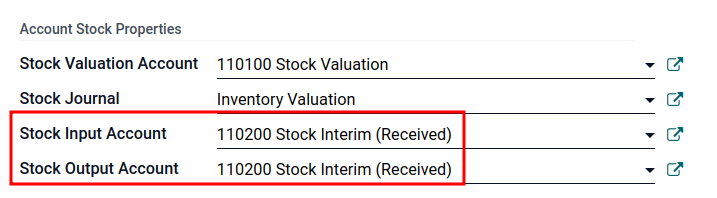

To configure the Stock Input Account and Stock Output Account, go to and select the desired product category.

In the Inventory Valuation field, select Automated. Doing so makes the Account Stock Properties section appear. These accounts are defined as follows:

Stock Valuation Account: when automated inventory valuation is enabled on a product, this account will hold the current value of the products.

Stock Journal: accounting journal where entries are automatically posted when a product’s inventory valuation changes.

Stock Input Account: counterpart journal items for all incoming stock moves will be posted in this account, unless there is a specific valuation account set on the source location. This is the default value for all products in a given category, and can also be set directly on each product.

Stock Output Account: counterpart journal items for all outgoing stock moves will be posted in this account, unless there is a specific valuation account set on the destination location. This is the default value for all products in a given category, and can also be set directly on each product.

In Anglo-Saxon accounting, the Stock Input Account and Stock Output Account are set to different Current Assets accounts. This way, delivering products and invoicing the customer balance the Stock Output account, while receiving products and billing vendors balance the Stock Input account.

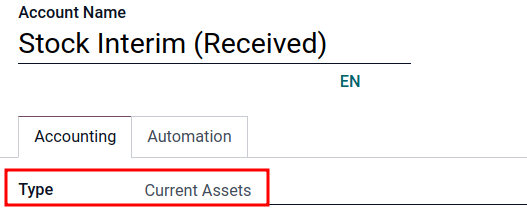

To modify the account type, go to the click the (right arrow) icon to the right of the stock input/output account. In the pop-up window, choose Current Assets from the Type drop-down menu.

The Stock Input account is set to Stock Interim (Received), a Current Asset account

type.¶

In Continental accounting, the Stock Input Account and Stock Output Account are set to the same Current Assets account. That way, one account can be balanced when items are bought and sold.

Example

The stock input and output accounts are both set to Stock Interim (Received), a

Current Assets account type. They can also be set to the Stock Interim

(Delivered), as long as the input and output accounts are assigned to the same

account.

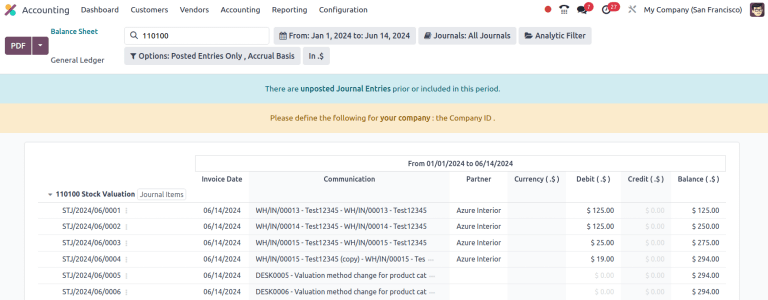

Inventory valuation reporting¶

To start, go to . Click the Current Assets line item to unfold the drop-down menu, and look for the nested Stock Valuation, Stock Interim (Received), and Stock Interim (Delivered) lines.

Tip

At the top of the dashboard, click the As of [date] button to display accounting records up to a specified date.

Access more specific information by clicking the (ellipsis) icon to the right of the desired journal. Select General Ledger to see a list of all of the journal entries, where each line item’s (ellipsis) icon can be clicked to reveal the View Journal Entry option to open the individualized journal entry.

Additionally, annotations to the Balance Sheet can be added by choosing Annotate, filling in the text box, and clicking Save.