Down payments¶

首付款是买方在签订销售合同时支付的部分款项。这意味着双方(卖方和买方)完全承诺履行合同。

With a down payment, the buyer pays a portion of the total amount owed while agreeing to pay the remaining amount at a later date. In turn, the seller provides goods or services to the buyer after accepting the down payment, trusting that the remaining amount will be paid later on.

创建发票¶

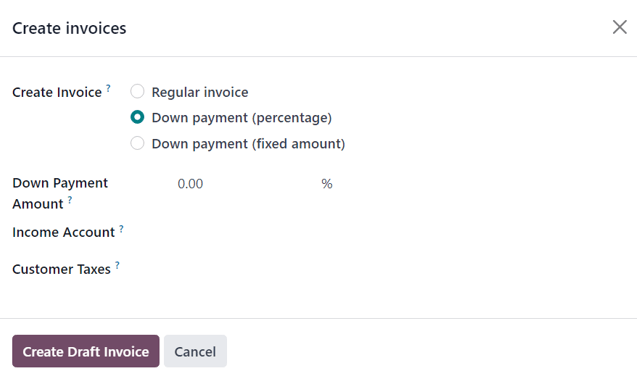

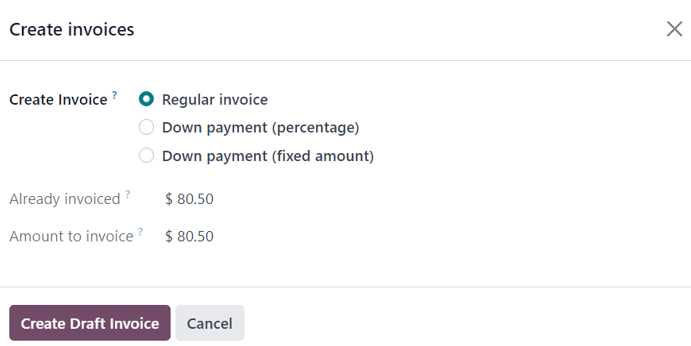

When a sales order is confirmed, the option to create an invoice becomes available, via the Create Invoice button, located in the upper-left corner of the sales order form. When clicked, a Create invoices pop-up appears.

注解

Invoices are automatically created as drafts, so they can be reviewed before validation.

On the Create invoices pop-up, there are 3 options to choose from in the Create Invoice field:

Regular invoice

Down payment (percentage)

Down payment (fixed amount)

注解

If Regular Invoice is selected, the other fields disappear, as they only pertain to down payment configurations.

Initial down payment request¶

On the Create invoices pop-up form, the down payment options are:

Down payment (percentage)

Down payment (fixed amount)

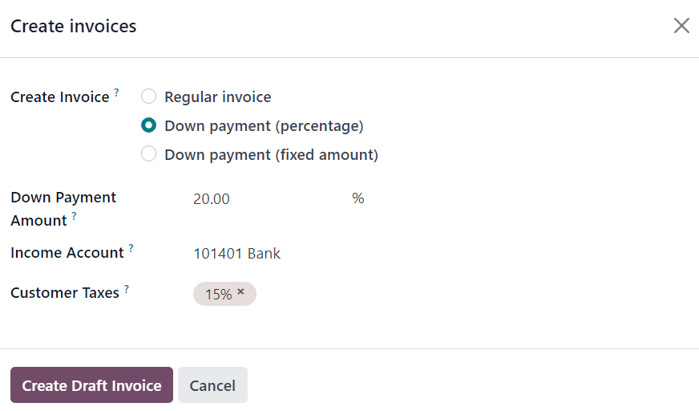

Once the desired down payment option is selected in the Create Invoice field on the pop-up form, designate the desired amount, either as a percentage or a fixed amount, in the Down Payment Amount field.

Then, select the appropriate income account for the invoice in the Income Account field. Next, select a tax amount, if necessary, in the Customer Taxes drop-down field.

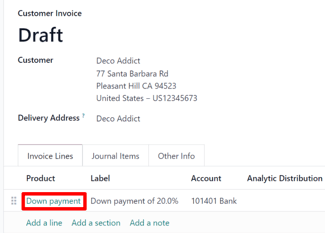

Once all fields are filled in with the desired information, click the Create Draft Invoice button. Upon clicking this button, Odoo reveals the Customer Invoice Draft.

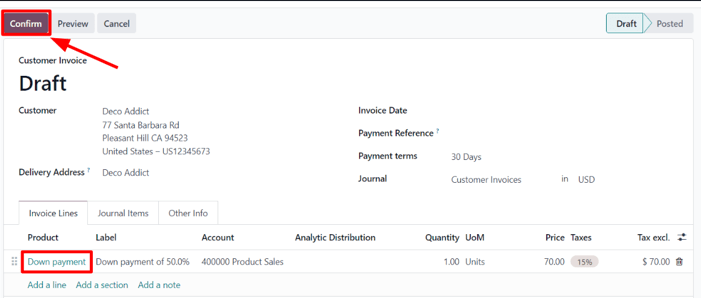

In the Invoice Lines tab of the Customer Invoice Draft, the down payment that was just configured in the Create invoices pop-up form appears as a Product.

注解

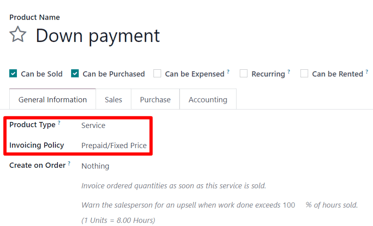

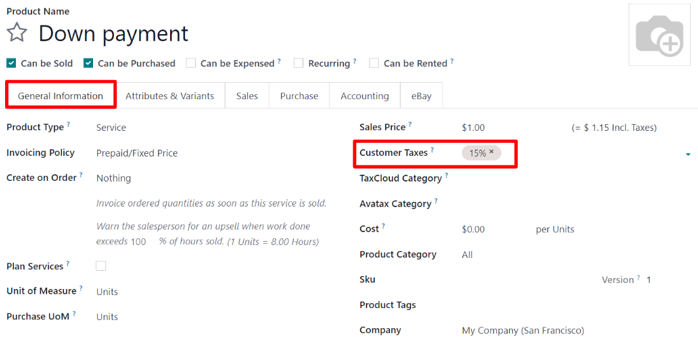

When the Down payment product in the Invoice Lines tab is clicked, Odoo reveals the product form for the down payment.

By default, the Product Type of down payment products generated for invoices are set as Service, with the Invoicing Policy set to Prepaid/Fixed Price.

This product can be edited/modified at any time.

警告

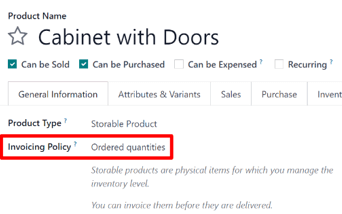

If Based on Delivered Quantity (Manual) is chosen as the Invoicing Policy, an invoice will not be able to be created.

例如:要求支付 50%的首付款¶

注解

以下示例涉及产品(带门橱柜)的 50%首付款,订购数量`为:guilabel:`发票政策。

首先,导航至 ,然后在报价单中添加 客户 。

然后,点击 订单行 选项卡中的 添加产品 并选择 带门橱柜 产品。

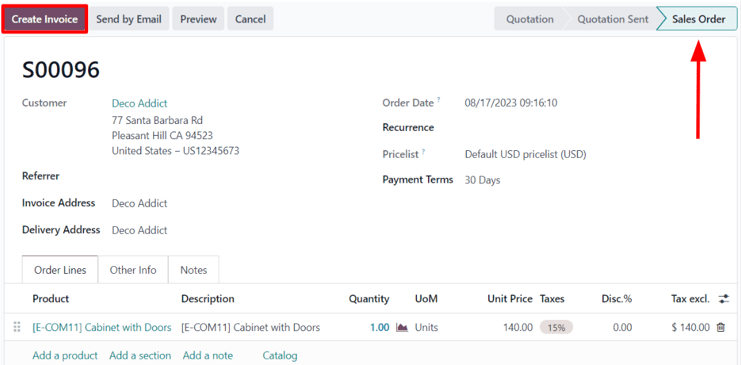

订单确认后(通过 确认 按钮),报价单将变为销售订单。此时,请点击 创建发票,创建并查看发票。

然后,在弹出的 创建发票 窗口中,选择 首付款(百分比),并在 首付金额 字段中输入`50`。

注解

:guilabel:`收入账户`和 :guilabel:`客户税金`字段**不是**必填字段,如果已在之前的首付款请求中预先配置,则**不会**出现。

有关更多信息,请查看 首期付款的客户税金修改 和 首期付款的收入账户修改 文档。

最后,单击:guilabel:创建发票草稿,创建并查看发票草稿。

点击 创建发票草稿 将显示发票草稿,其中包括作为 发票行 选项卡中的 产品 的首付款。

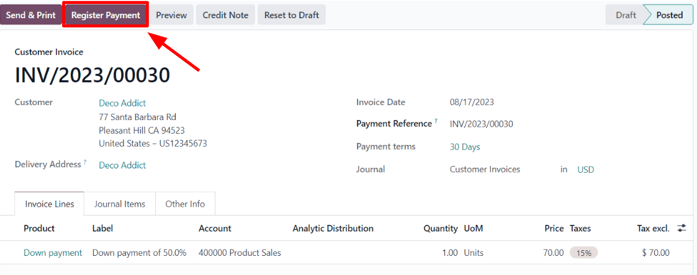

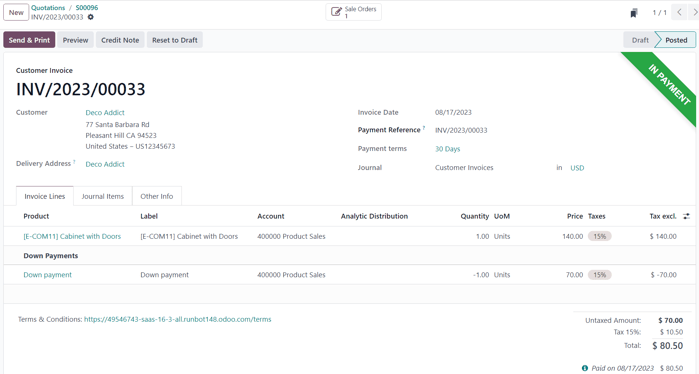

点击 确认 即可确认和张贴发票。确认发票后,状态将从 草稿 变为 已发布。页面顶部还会显示一系列新按钮。

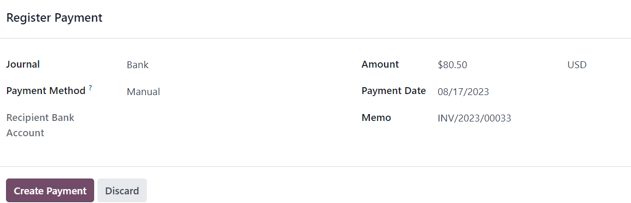

在这些按钮中,点击 注册付款 即可注册付款。

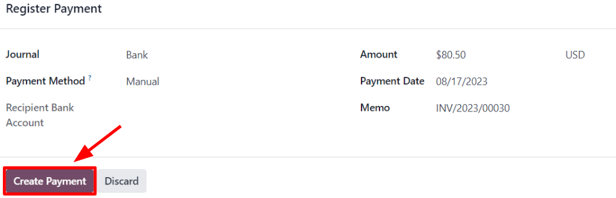

这样做会弹出一个 注册付款 表格,该表格会自动填充必要的信息。确认所提供的信息是否正确,并进行必要的调整。准备就绪后,点击 创建付款 按钮。

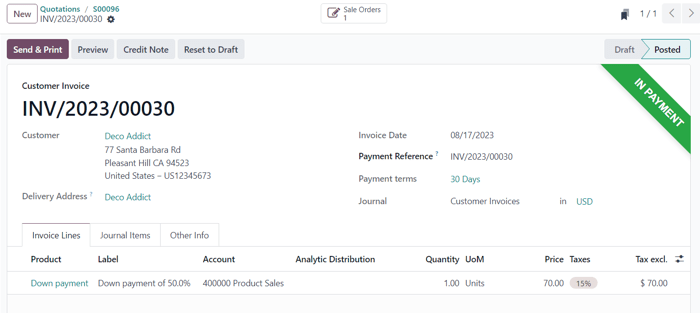

点击 创建付款 后,Odoo 会显示客户发票,现在右上角有一个绿色的 付款中 横幅。

现在,当客户要支付订单剩余金额时,必须再创建一张发票。为此,请通过面包屑链接返回销售订单

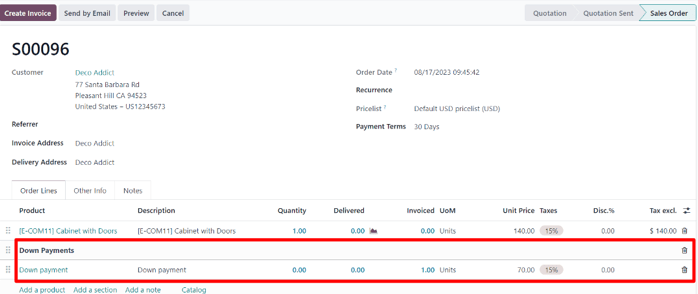

回到销售订单,在 订单行 选项卡中出现了一个新的 首付款 部分,以及刚刚开具发票并入账的首付款。

然后,点击 创建发票 按钮。

在弹出的 创建发票 窗口中,有两个新字段:已开发票 和 发票金额。

如果剩余金额已准备好支付,请选择 普通发票 选项。Odoo 将根据 发票金额 字段中显示的完成总付款所需的确切金额创建发票。

准备就绪后,点击 创建发票草稿。

这样做会显示另一个 客户发票草稿 页面,在 发票行 选项卡中列出该特定销售订单的*所有*发票。每个发票行项目显示与每张发票相关的所有必要信息。

要完成流程,请点击:guilabel:确认,发票状态将从 草稿`变为 :guilabel:`已发布。然后,点击 登记付款。

注册付款 再次出现时,所有字段都会自动填充必要信息,包括订单的剩余付款金额。

确认信息后,点击 创建付款。这样就会显示最终的 客户发票 并在右上角显示绿色的 付款中 横幅。此外,两个首付款都会出现在 发票行 选项卡中。

至此,流程完成。

注解

使用 固定金额 首付款选项也可实现此流程。

重要

如果首付款与具有 交付数量 发票政策的产品一起使用,则在向客户开具发票时,首期付款将**无法**扣除。

这是因为,根据发票政策,产品必须在开具最终发票*之前*交付。

If nothing has been delivered, a Credit Note is created, which cancels the draft invoice that was created after the down payment.

To utilize the Credit Note option, the Inventory application must be installed, in order to confirm the delivery. Otherwise, the delivered quantity can be entered manually directly on the sales order.

Customer taxes modification on down payments¶

要调整首期付款所附的收入账户和客户税金,请导航至 产品 页面(),在搜索栏中搜索 首期付款 产品,然后选择该产品以显示产品详细页面。

On the Down Payment product page, in the General Information tab, the customer taxes can be modified in the Customer Taxes field.

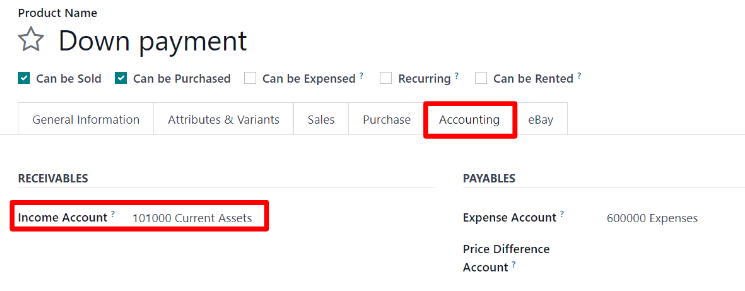

Income account modification on down payments¶

To change or adjust the income account attached to the Down Payment product page, the Accounting app must be installed.

With the Accounting app installed, the Accounting tab becomes available on the product page. That tab will not be accessible without the Accounting app installed.

In the Accounting tab, the income account can be changed in the Income Account field, located in the Receivables section.