Columbia¶

Odoo’s Colombian localization package provides accounting, fiscal and legal features in Colombia such as chart of accounts, taxes and electronic invoicing.

In addition, we have a series of videos covering how to start from scratch, configuration, main workflows, and specific use cases.

Vedeți și

Configurare¶

Module instalate¶

Install the following modules to get all the features of the Colombian localization:

Nume |

Nume tehnic |

Descriere |

|---|---|---|

Colombia - Accounting |

|

Default fiscal localization package. This module adds the base accounting features for the Colombian localization: chart of accounts, taxes, withholdings, identification document type. |

Colombian - Accounting Reports |

|

Includes accounting reports for sending certifications to suppliers for withholdings applied. |

Electronic invoicing for Colombia with Carvajal |

|

This module includes the features that are required for the integration with Carvajal and generates the electronic invoices and support document related to the vendor bills based on DIAN regulations. |

Colombian - Point of Sale |

|

Includes Point of Sale Receipt for Colombian Localization. |

Notă

When a database is created from scratch selecting Colombia as the country, Odoo automatically installs the base modules Colombia - Accounting and Colombia - Accounting Reports.

Configurarea companiei¶

To configure your company information, go to the app and search for your company. Alternatively, activate developer mode and navigate to . Then, edit the contact form to configure the following information:

Company Name.

Address: Including City, Department and Zip Code.

Tax ID: When it is a

NIT, it must have the verification digit at the end of the ID followed by a hyphen (-).

Next, configure the Fiscal Information in the Sales & Purchase tab:

Obligaciones y Responsabilidades: Select the fiscal responsibility for the company (O-13 Gran Contribuyente, O-15 Autorretenedor, O-23 Agente de retención IVA, O-47 Regimen de tributación simple, R-99-PN No Aplica).

Gran Contribuyente: If the company is Gran Contribuyente this option should be selected.

Fiscal Regimen: Select the Tribute Name for the company (IVA, INC, IVA e INC, No Aplica)

Commercial Name: If the company uses a specific commercial name, and it needs to be displayed in the invoice.

Carjaval credentials configuration¶

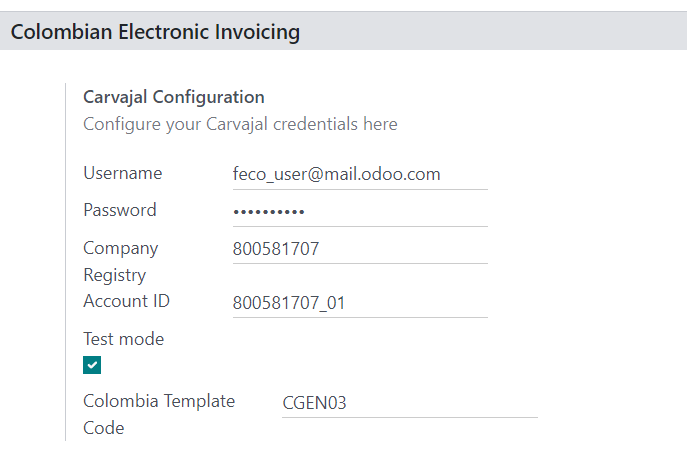

Once the modules installed, the user credentials must be configured in order to connect with Carvajal Web Service. Navigate to and scroll to the Colombian Electronic Invoicing section. Then, fill in the required configuration information provided by Carvajal:

Username and Password: Correspond to the username and password provided by Carvajal to the company.

Company Registry: Company’s NIT number without the verification code.

Account ID: Company ID followed by

_01.Colombia Template Code: Select one of the two available templates (CGEN03 or CGNE04) to be used in the PDF format of the electronic invoice.

Notă

Check the Test mode checkbox to connect with the Carvajal testing environment. Once Odoo and Carvajal are fully configured and ready for production, uncheck the Test mode checkbox to use the production database.

Important

Test mode must be used only on replicated databases, not the production environment.

Report data configuration¶

Report data can be defined for the fiscal section and bank information of the PDF as part of the configurable information sent in the XML.

Navigate to and scroll to the Colombian Electronic Invoicing section.

Master data configuration¶

Partener¶

Identification information¶

Document types defined by the DIAN are available on the partner form as part of the Colombian localization. Colombian partners must have their Identification Number (VAT) and Document Type set.

Sfat

When the Document Type is NIT, the Identification Number needs to be

configured in Odoo, including the verification digit; Odoo splits this number when the data to

is sent to the third party.

Fiscal information¶

The partner’s responsibility codes (section 53 in the RUT document) are included as part of the electronic invoicing module, as it is required by the DIAN.

The required fields can be found under :

Obligaciones y Responsabilidades: Select the fiscal responsibility for the company (O-13 Gran Contribuyente, O-15 Autorretenedor, O-23 Agente de retención IVA, O-47 Regimen de tributación simple, R-99-PN No Aplica).

Gran Contribuyente: If the company is Gran Contribuyente this option should be selected.

Fiscal Regimen: Select the Tribute Name for the company (IVA, INC, IVA e INC, No Aplica)

Commercial Name: If the company uses a specific commercial name, and it needs to be displayed in the invoice.

Produse¶

In addition to adding general information (in the General Information tab) on the product form, either the UNSPSC Category, Barcode, or Internal Reference field must also be configured.

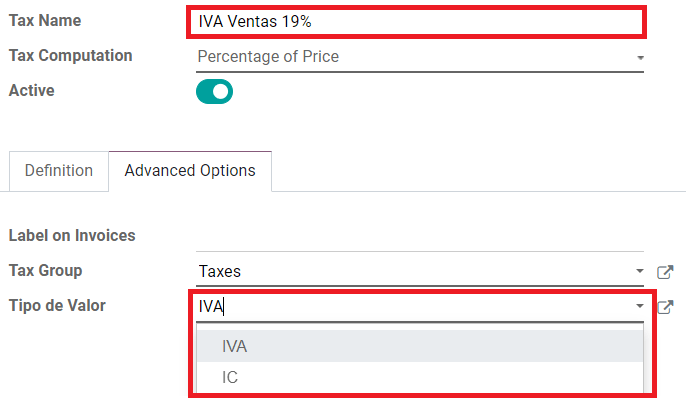

Taxe¶

If sales transactions include products with taxes, the Value Type field in the Advanced Options tab needs to be configured per tax. To do so, go to , and select the related tax.

Retention tax types (ICA, IVA, Fuente) are also included. This configuration is used to display taxes in the invoice PDF correctly.

Sales journals¶

Once the DIAN has assigned the official sequence and prefix for the electronic invoice resolution, the sales journals related to the invoice documents must be updated in Odoo. To do so, navigate to .

Configure the following data in the Advanced Settings tab:

Electronic invoicing: Enable UBL 2.1 (Colombia).

Invoicing Resolution: Resolution number issued by DIAN to the company.

Resolution Date: Initial effective date of the resolution.

Resolution end date: End date of the resolution’s validity.

Range of Numbering (minimum): First authorized invoice number.

Range of Numbering (maximum): Last authorized invoice number.

Notă

The sequence and resolution of the journal must match the one configured in Carvajal and the DIAN.

Invoice sequence¶

The invoice sequence and prefix must be correctly configured when the first document is created.

Notă

Odoo automatically assigns a prefix and sequence to the following documents.

Purchase journals¶

Once the DIAN has assigned the official sequence and prefix for the support document related to vendor bills, the purchase journals related to their supporting documents need to be updated in Odoo. The process is similar to the configuration of the sales journals.

Plan de conturi¶

The chart of accounts is installed by default as part of the localization module, the accounts are mapped automatically in taxes, default account payable, and default account receivable. The chart of accounts for Colombia is based on the PUC (Plan Unico de Cuentas).

Main workflows¶

Electronic invoices¶

Creare factura¶

Notă

The functional workflow taking place before an invoice validation does not alter the main changes introduced with the electronic invoice.

Electronic invoices are generated and sent to both the DIAN and customer through Carvajal’s web service integration. These documents can be created from your sales order or manually. Go to and configure:

Customer: Customer’s information.

Journal: Journal used for electronic invoices.

Electronic Invoice Type: Select the type of document. By default, Factura de Venta is selected.

Invoice Lines: Specify the products with the correct taxes.

When done, click Confirm.

Validare factura¶

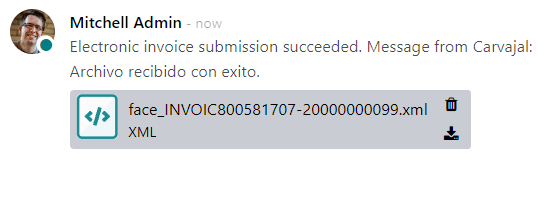

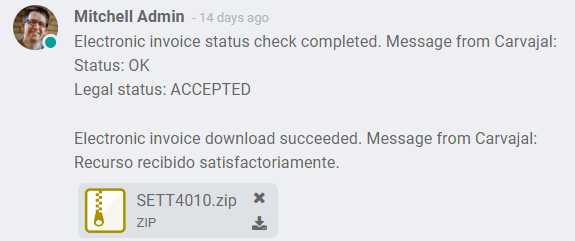

After the invoice confirmation, an XML file is created and sent automatically to Carvajal. The invoice is then processed asynchronously by the E-invoicing service UBL 2.1 (Colombia). The file is also displayed in the chatter.

The Electronic Invoice Name field is now displayed in the EDI Documents tab with the name of the XML file. Additionally, the Electronic Invoice Status field is displayed with the initial value In progress.

Recipisa legala XML si PDF¶

The electronic invoice vendor (Carvajal) receives the XML file and proceeds to validate its structure and information.

In the Action menu, select the Check Carvajal Status button. The Electronic Invoice Status field value changes to Validated if everything is correct. Then, proceed to generate a legal XML, which includes a digital signature and a unique code (CUFE), and a PDF invoice that includes a QR code, and the previously-generated CUFE code.

A ZIP containing the legal electronic invoice in XML format and the invoice in PDF format is downloaded and displayed in the invoice chatter:

The electronic invoice status changes to Accepted.

Credit notes¶

The process for credit notes is the same as for invoices. To create a credit note with reference to an invoice, go to . On the invoice, click Add Credit Note and complete the following information:

Credit Method: Select the type of credit method.

Partial Refund: Use this option when it is a partial amount.

Full Refund: Use this option if the credit note is for the full amount.

Full refund and new draft invoice: Use this option if the credit note is auto-validated and reconciled with the invoice. The original invoice is duplicated as a new draft.

Reason: Enter the reason for the credit note.

Reversal Date: Select if you want a specific date for the credit note or if it is the journal entry date.

Use Specific Journal: Select the journal for your credit note or leave it empty if you want to use the same journal as the original invoice.

Refund Date: If you chose a specific date, select the date for the refund.

Once reviewed, click the Reverse button.

Debit notes¶

The process for debit notes is similar to credit notes. To create a debit note with reference to an invoice, go to . On the invoice, click the Add Debit Note button and complete the following information:

Reason: Type the reason for the debit note.

Debit note date: Select the specific options.

Copy lines: Select this option if you need to register a debit note with the same lines of invoice.

Use Specific Journal: Select the printer point for your debit note, or leave it empty if you want to use the same journal as the original invoice.

When done, click Create Debit Note.

Support document for vendor bills¶

With master data, credentials, and the purchase journal configured for support documents related to vendor bills, you can start using support documents.

Support documents for vendor bills can be created from your purchase order or manually. Go to and fill in the following data:

Vendor: Enter the vendor’s information.

Bill Date: Select the date of the bill.

Journal: Select the journal for support documents related to the vendor bills.

Invoiced Lines: Specify the products with the correct taxes.

Once reviewed, click the Confirm button. Upon confirmation, an XML file is created and automatically sent to Carvajal.

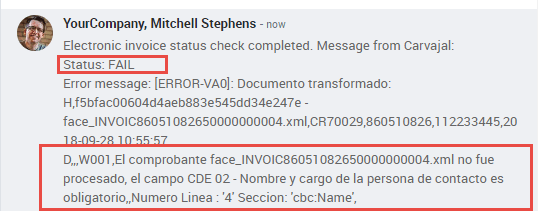

Erori comune¶

During the XML validation, the most common errors are related to missing master data (Contact Tax ID, Address, Products, Taxes). In such cases, error messages are shown in the chatter after updating the electronic invoice status.

After the master data has been corrected, you can reprocess the XML with the new data and send the updated version using the Action menu.

Financial reports¶

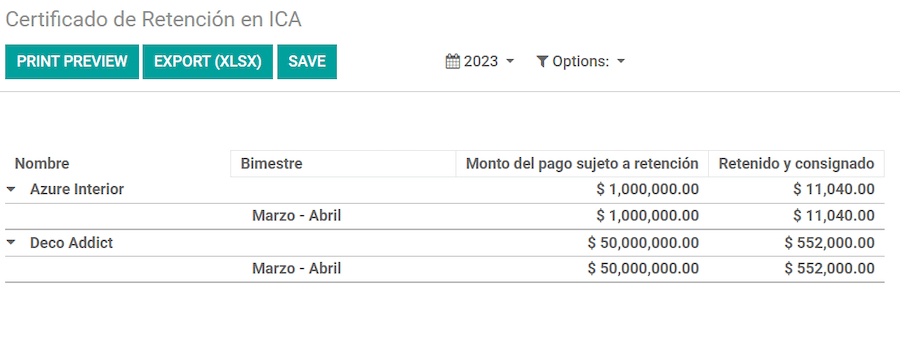

Certificado de Retención en ICA¶

This report is a certification to vendors for withholdings made for the Colombian Industry and Commerce (ICA) tax. The report can be found under .

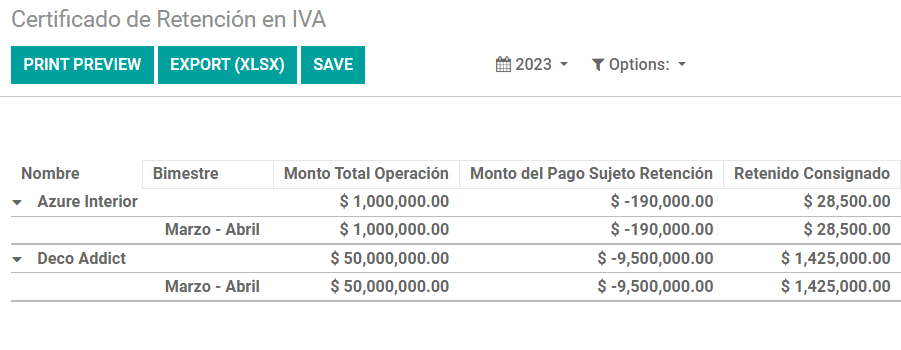

Certificado de Retención en IVA¶

This report issues a certificate on the amount withheld from vendors for VAT withholding. The report can be found under .

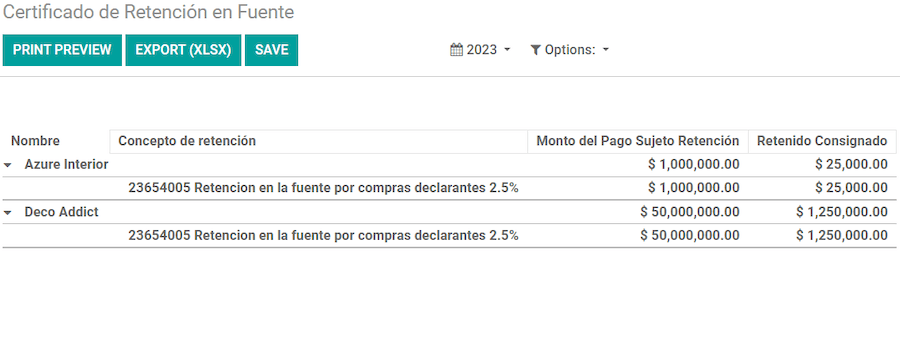

Certificado de Retención en la Fuente¶

This certificate is issued to partners for the withholding tax that they have made. The report can be found under .