报销¶

Odoo Expenses streamlines the management of expenses. After an employee submits their expenses in Odoo, the expenses are reviewed by management and accounting teams. Once approved, payments can then be processed and disbursed back to the employee for reimbursement(s).

Set expense types¶

The first step to track expenses is to configure the different expense types for the company (managed as products in Odoo). Each “product” can be as specific or generalized as needed. Go to to view the current expensable products in a default kanban view.

To create a new expense product, click Create. A product form will appear. Only two fields are required, the Product Name and the Unit of Measure. Enter the Product Name in the field, and select the Unit of Measure from the drop-down menu (most products will be set to Units).

小技巧

The Sales app is where specification on the units of measure are created and edited (e.g.

units, miles, nights, etc.). Go to and

ensure Units of Measure is checked off in the Product Catalog section. Click on the

Units of Measure internal link to view, create, and edit the units of measure. Refer

to this document to

learn more about units of measure and how to configure them.

The Cost field on the product form is populated with a value of 0.00 by default. When

a specific expense should always be reimbursed for a particular price, enter that amount in the

Cost field. Otherwise, leave the Cost set to 0.00, and employees will

report the actual cost when submitting an expense report.

Example

Here are some examples for when to set a specific Cost on a product vs. leaving the

Cost at 0.00:

Meals: Set the Cost to

0.00. When an employee logs an expense for a meal, they enter the actual amount of the bill and will be reimbursed for that amount. An expense for a meal costing $95.23 would equal a reimbursement for $95.23.Mileage: Set the Cost to

0.30. When an employee logs an expense for “mileage”, they enter the number of miles driven, and are reimbursed 0.30 per mile they entered. An expense for 100 miles would equal a reimbursement for $30.00.Monthly Parking: Set the Cost to

75.00. When an employee logs an expense for “monthly parking”, the reimbursement would be for $75.00.Expenses: Set the Cost to

0.00. When an employee logs an expense that is not a meal, mileage, or monthly parking, they use the generic Expenses product. An expense for a laptop costing $350.00 would be logged as an Expenses product, and the reimbursement would be for $350.00.

Select an Expense Account if using the Odoo Accounting app. It is recommended to check with the accounting department to determine the correct account to reference in this field as it will affect reports.

Set a tax on each product in the Vendor Taxes and Customer Taxes fields if applicable. It is considered good practice to use a tax that is configured with Tax Included in Price. Taxes will be automatically configured if this is set.

Record expenses¶

Manually create a new expense¶

To record a new expense, begin in the main app dashboard, which presents the default My Expenses to Report view. This view can also be accessed from .

First, click Create, and then fill out the various fields on the form.

Description: Enter a short description for the expense in the Description field. This should be short and informative, such as

lunch with clientorhotel for conference.Product: Select the product from the drop-down menu that most closely corresponds to the expense. For example, an airplane ticket would be appropriate for an expense Product named Air Travel.

Unit Price: Enter the total amount paid for the expense in one of two ways:

If the expense is for one single item/expense, enter the cost in the Unit Price field, and leave the Quantity

1.00.If the expense is for multiples of the same item/expense, enter the price per unit in the Unit Price field, and enter the quantity of units in the Quantity field.

Example

In the case of a hotel stay, for example, the Unit Price would be set as the cost per night, and set the Quantity to the number of nights stayed.

Taxes: If taxes were paid on the expense, select the tax percentage using the drop-down menu. Tax options are pre-configured based on the localization setting selected when the database was created. Adding any new taxes should only be done when necessary.

注解

When a tax is selected, the Total value will update in real time to show the added taxes.

Paid By: Click the radio button to indicate who paid for the expense and should be reimbursed. If the employee paid for the expense (and should be reimbursed) select Employee (to reimburse). If the company paid directly instead (e.g. if the company credit card was used to pay for the expense) select Company.

Expense Date: Using the calendar module, enter the date the expense was incurred. Use the < (left) and > (right) arrows to navigate to the correct month, then click on the specific day to enter the selection.

Bill Reference: If there is any reference text that should be included for the expense, enter it in this field.

Account: Select the expense account that this expense should be logged on from the drop-down menu.

Employee: Using the drop-down menu, select the employee this expense is for.

Customer to Reinvoice: If the expense is something that should be paid for by a customer, select the customer that will be invoiced for this expense from the drop-down menu. For example, if a customer wishes to have an on-site meeting, and agrees to pay for the expenses associated with it (such as travel, hotel, meals, etc.), then all expenses tied to that meeting would indicate that customer as the Customer to Reinvoice.

Analytic Account: Select the account the expense should be written against from the drop-down menu.

Company: If multiple companies are set-up, select the company this expense should be filed for from the drop-down menu. If there is only one company, this field will be automatically populated.

Notes…: If any notes are needed in order to clarify the expense, enter them in the notes field.

Once all the fields have been filled out, click Save.

Attach a receipt¶

After the expense is saved, the next step is to attach a receipt. A new Attach Receipt button appears after the entry is saved, beneath the former Save button (which turns into an Edit button).

Click the new Attach Receipt button, and a file explorer appears. Navigate to the receipt to be attached, and click Open. A new Receipts smart button appears at the top, and the new receipt is recorded in the chatter. More than one receipt can be attached to an individual expense, as needed. The number of receipts attached to the expense will be noted on the smart button.

Automatically create new expenses from an email¶

Instead of individually creating each expense in the Expenses app, expenses can be automatically created by sending an email to an email alias.

To do so, first, an email alias needs to be configured. Go to . Ensure Incoming Emails is checked off.

注解

If the domain alias needs to be set up, Setup your domain alias will appear beneath the incoming emails check box instead of the email address field. Refer to this documentation for setup instructions and more information: 网站域名. Once the domain alias is configured, the email address field will be visible beneath the incoming emails section.

Next, enter the email address to be used in the email field, then click Save. Now that the email address has been entered, emails can be sent to that alias to create new expenses without having to be in the Odoo database.

To submit an expense via email, create a new email and enter the product’s internal reference code (if available) and the amount of the expense in the email subject. Next, attach the receipt to the email. Odoo creates the expense by taking the information in the email subject and combining it with the receipt.

To check an expense product’s internal reference, go to . If an internal reference is listed on the product, it is visible in this view as (Ref###).

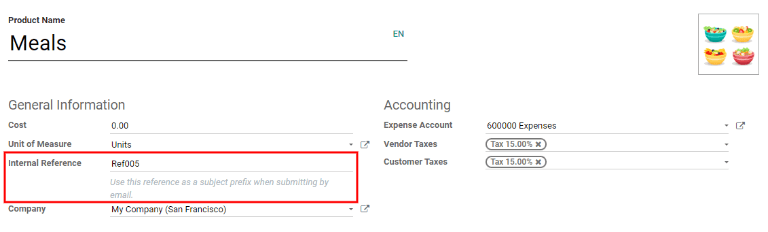

To add an internal reference on an expense product, click on the product, then click Edit. In edit mode, enter the Internal Reference in the field. Beneath the Internal Reference field, this sentence appears: Use this reference as a subject prefix when submitting by email..

注解

For security purposes, only authenticated employee emails are accepted by Odoo when creating an expense from an email. To confirm an authenticated employee email address, go to the employee card in the Employees app, and refer to the Work Email in the main field.

Example

If submitting an expense via email for a $25.00 meal during a work trip, the email subject would

be Ref005 Meal $25.00.

解释 :

The Internal Reference for the expense product

MealsisRef005The Cost for the expense is

$25.00

Create an expense report¶

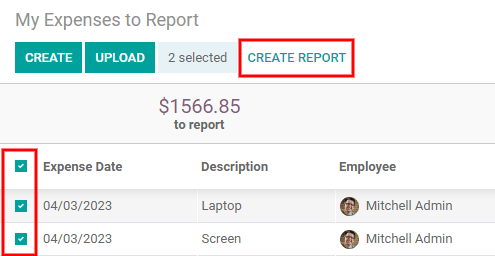

When expenses are ready to submit (such as at the end of a business trip, or once a month), an expense report needs to be created. Go to the main app dashboard, which displays a default My Expenses view, or go to .

First, each individual expense for the report must be selected by clicking the check box next to each entry, or quickly select all the expenses in the list by clicking the check box next to Expense Date.

Once the expenses have been selected, click the Create Report button. The new report appears with all the expenses listed, and the number of documents is visible in the Documents smart button.

It is recommended to add a short summary for each report to help keep expenses organized. Click the

Edit button, and the Expense Report Summary field appears. Enter a short

description for the expense report (such as Client Trip NYC, or Repairs for Company Car). Next,

select a Manager from the drop-down menu to assign a manager to review the report.

If some expenses are not on the report that should be, they can still be added. Click Add a line at the bottom of the Expense tab. Click the check box next to each expense to add, then click Select. The items now appear on the report that was just created.

注解

Add a line only appears when the document is in edit mode. It does not appear otherwise.

When all edits have been completed, click Save.

Submit an expense report¶

When an expense report is completed, the next step is to submit the report to a manager for approval. Reports must be individually submitted, and cannot be submitted in batches. Open the specific report from the list of expense reports (if the report is not already open). To view all expense reports, go to .

If the list is large, grouping the results by status may be helpful since only reports that are in a Draft mode need to be submitted, reports with an Approved or Submitted status do not.

注解

The status of each report is shown in the Status column on the far right. If the Status column is not visible, click the ⋮ (additional options) icon at the end of the row, and check the box next to Status.

Click on a report to open it, then click Submit To Manager. After submitting a report, the next step is to wait for the manager to approve it.

重要

The Approve expenses, Post expenses in accounting, and Reimburse employees sections are only for users with the necessary rights.

Approve expenses¶

In Odoo, not just anyone can approve expense reports— only users with the necessary rights (or permissions) can. This means that a user must have at least Team Approver rights for the Expenses app. Employees with the necessary rights can review expense reports, and approve or reject them, as well as provide feedback thanks to the integrated communication tool.

To see who has rights to approve, go to the main app and click on Manage Users.

注解

If the Settings app is not available, then certain rights are not set on the account. In the Access Rights tab of a user’s card in the app, the Administration section is set to one of three options:

None (blank): The user cannot access the Settings app at all.

Access Rights: The user can only view the User’s & Companies section of the Settings app.

Settings: The user has access to the entire Settings app with no restrictions.

Please refer to this document to learn more about managing users and their access rights.

Click on an individual to view their card, which displays the Access Rights tab in the default view. Scroll down to the Human Resources section. Under Expenses, there are four options:

None (blank): A blank field means the user has no rights to view or approve expense reports, and can only view their own.

Team Approver: The user can only view and approve expense reports for their own specific team.

All Approver: The user can view and approve any expense report.

Administrator: The user can view and approve any expense report as well as access the reporting and configuration menus in the Expenses app.

Users who are able to approve expense reports (typically managers) can easily view all expense reports to validate. Go to . This view lists all the expense reports that have been submitted but not approved, as noted by the Submitted tag in the status column.

Reports can be approved in two ways (individually or several at once) and refused only one way. To approve multiple expense reports at once, remain in the list view. First, select the reports to approve by clicking the check box next to each report, or click the box next to Employee to select all reports in the list. Next, click on the ⚙️ Action (gear) icon, then click Approve Report.

To approve an individual report, click on a report to go to a detailed view of that report. In this view, several options are presented: Approve, Refuse, or Reset to draft. Click Approve to approve the report.

If Refuse is clicked, a pop-up window appears. Enter a brief explanation for the refusal in the Reason to refuse Expense field, then click Refuse.

Team managers can easily view all the expense reports for their team members. While in the Reports to Approve view, click on Filters, then click My Team. This presents all the reports for the manager’s team.

注解

If more information is needed, such as a receipt is missing, communication is easy from the chatter. In an individual report, simply type in a message, tagging the proper person (if needed), and post it to the chatter by clicking Send. The message is posted in the chatter, and the person tagged will be notified via email of the message, as well as anyone following.

Post expenses in accounting¶

Once an expense report is approved, the next step is to post the report to the accounting journal. To view all expense reports to post, go to .

Just like approvals, expense reports can be posted in two ways (individually or several at once). To post multiple expense reports at once, remain in the list view. First, select the reports to post by clicking the check box next to each report, or click the box next to Employee to select all reports in the list. Next, click on the ⚙️ Action (gear) icon, then click Post Entries.

To post an individual report, click on a report to go to the detailed view of that report. In this view, several options are presented: Post Journal Entries, Report In Next Payslip, or Refuse. Click Post Journal Entries to post the report.

If Refuse is clicked, a pop-up window appears. Enter a brief explanation for the refusal in the Reason to refuse Expense field, then click Refuse. Refused reports can be viewed by going to . This list shows all reports, including the refused ones.

注解

To post expense reports to an accounting journal, the user must have following access rights:

会计:会计或顾问

报销费用:经理

Reimburse employees¶

After an expense report is posted to an accounting journal, the next step is to reimburse the employee. To view all expense reports to pay, go to .

Just like approvals and posting, expense reports can be paid in two ways (individually or several at once). To pay multiple expense reports at once, remain in the list view. First, select the reports to pay by clicking the check box next to each report, or click the box next to Employee to select all reports in the list. Next, click on the ⚙️ Action (gear) icon, then click Register Payment.

To pay an individual report, click on a report to go to a detailed view of that report. Click Register Payment to pay the employee.

向客户重新开具费用开票¶

If expenses are tracked on customer projects, expenses can be automatically charged back to the customer. This is done by creating an expense report, then creating a sales order with the expensed items on it. Then, managers approve the expense report, and the accounting department posts the journal entries. Finally, the customer is invoiced.

设置¶

First, specify the invoicing policy for each expense product. Go to . Click on the expense product to edit, then click Edit. Under the Invoicing section, select the Invoicing Policy and Re-Invoicing Policy by clicking the radio button next to the desired selection.

Invoicing Policy:

Ordered quantities: Expense product will only invoice expenses based on the ordered quantity.

Delivered quantities: Expense product will only invoice expenses based on the delivered quantity.

Re-Invoicing Policy:

No: Expense product will not be re-invoiced.

At cost: Expense product will invoice expenses at their real cost.

At sales price: Expense product will invoice the price set on the sale order.

Create an expense¶

First, when creating a new expense, the correct information needs to be entered in order to re-invoice a customer. Select the Customer to Reinvoice from the drop-down menu. Next, select the Analytic Account the expense will be posted to.

Create a quote and sales order¶

In the app, create a quote for the customer being invoiced, listing the expense products. First, click Create to create a new quotation. Next, select the Customer being invoiced for the expenses from the drop-down menu.

In the Order Lines tab, click Add a product. In the Product field, select the first item being invoiced from the drop-down menu, or type in the product name. Then, update the Quantity, the Delivered quantity, and the Unit Price if needed. Repeat this for all products being invoiced. When all the products have been added to the quote, click Confirm and the quotation becomes a sales order.

Once the quote turns into a sales order, a Delivered column appears. The delivered

quantity must be updated for each item. Click on the 0.000 field for each product, and enter the

delivered quantity. When all delivered quantities have been entered, click Save.

Validate and post expenses¶

Only employees with permissions (typically managers or supervisors) can approve expenses. Before approving an expense report, ensure the Analytic Account is set on every expense line of a report. If an Analytic Account is missing, click Edit and select the correct account from the drop-down menu, then click Approve or Refuse.

The accounting department is typically responsible for posting journal entries. Once an expense report is approved, it can then be posted.

发票费用¶

Once the quote has turned into a sales order, and the expense report has been approved, it is time to invoice the customer. Go to to view the sales orders ready to be invoiced.

Next, find the sales order related to the expense report, click into it, and then click Create Invoice and a Create invoices pop-up window appears. Select if the invoice is a Regular invoice, Down payment (percentage), or Down payment (fixed amount) by clicking the radio button next to the selection. For either down payment options, enter the amount (fixed or percentage) in the Down Payment Amount field. Finally, click either create and view invoice or create invoice.