智利¶

网络研讨会¶

您可以在下面找到带有本地化的一般说明以及如何配置它的视频。

“智利本地化视频网络研讨会:<https://youtu.be/BHnByZiyYcM>简介和演示”_。

“交付指南视频网络研讨会<https://youtu.be/X7i4PftnEdU>”_。

介绍¶

The Chilean localization has been improved and extended in Odoo v13. In this version, the next modules are available:

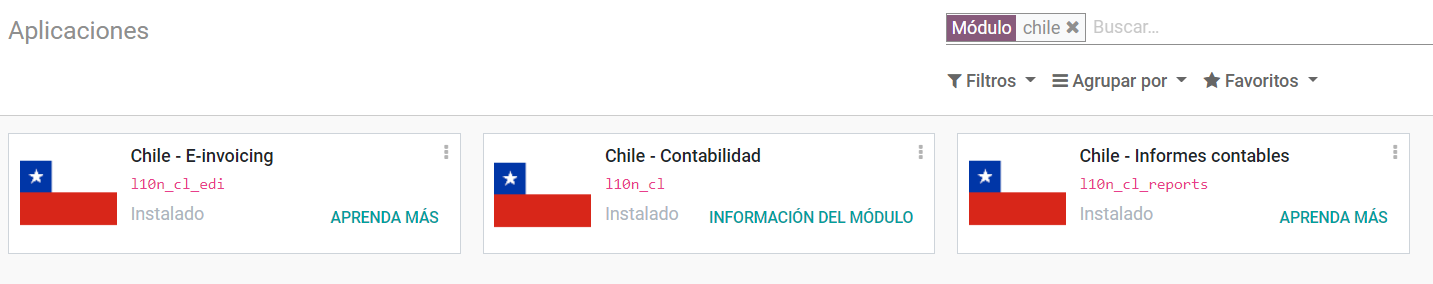

l10n_cl: Adds accounting features for the Chilean localization, which represent the minimal configuration required for a company to operate in Chile and under the SII (Servicio de Impuestos Internos) regulations and guidelines.

l10n_cl_edi: Includes all technical and functional requirements to generate and receive Electronic Invoice via web service, based on the SII regulations.

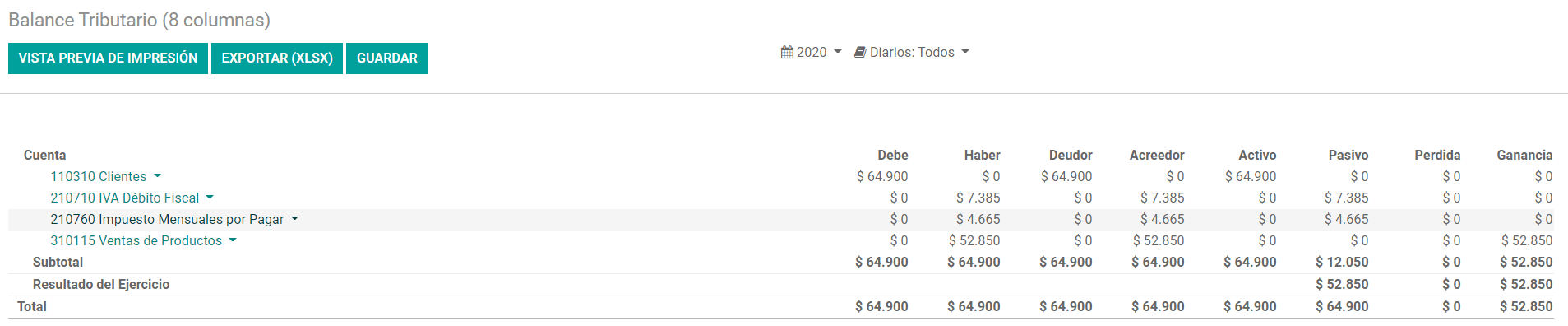

l10n_cl_reports: Adds the reports Propuesta F29 y Balance Tributario (8 columnas).

基础配置¶

Install the Chilean localization modules¶

For this, go to Apps and search for Chile. Then click Install in the module Chile E-invoicing. This module has a dependency with Chile - Accounting. In case this last one is not installed, Odoo installs it automatically with E-invoicing.

注解

When you install a database from scratch selecting Chile as country, Odoo will automatically install the base module: Chile - Accounting.

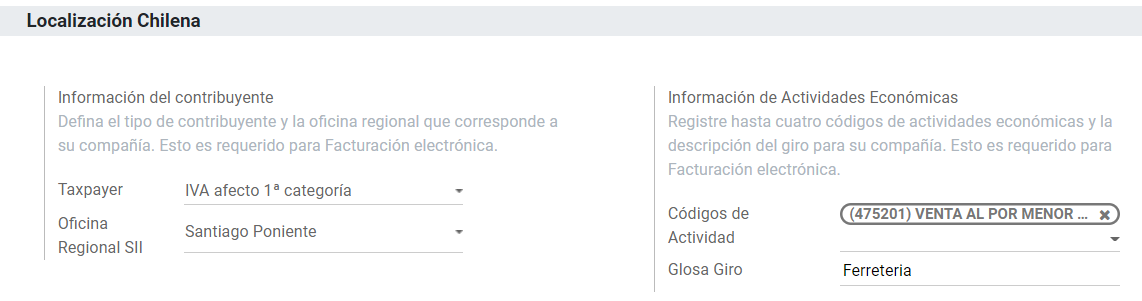

公司设置¶

Once the modules are installed, the first step is to set up your company data. Additional to the basic information, you need to add all the data and elements required for Electronic Invoice, the easiest way to configure it is in .

重要

以下所有配置和功能仅在Odoo中可用,如果您的公司已经通过了SII - Sistema de Facturación de Mercado中的“认证流程<https://www.sii.cl/factura_electronica/ factura_mercado/proceso_certificacion.htm>”_,此认证使您能够从ERP生成电子发票并将其自动发送到SII。如果您的公司尚未通过此认证,请确保您将其传达给您的客户经理,因为为了完成此认证,Odoo之外需要特殊流程。

税科目调整¶

Fill in the fiscal information for your company according to the SII register, follow the instructions on each section.

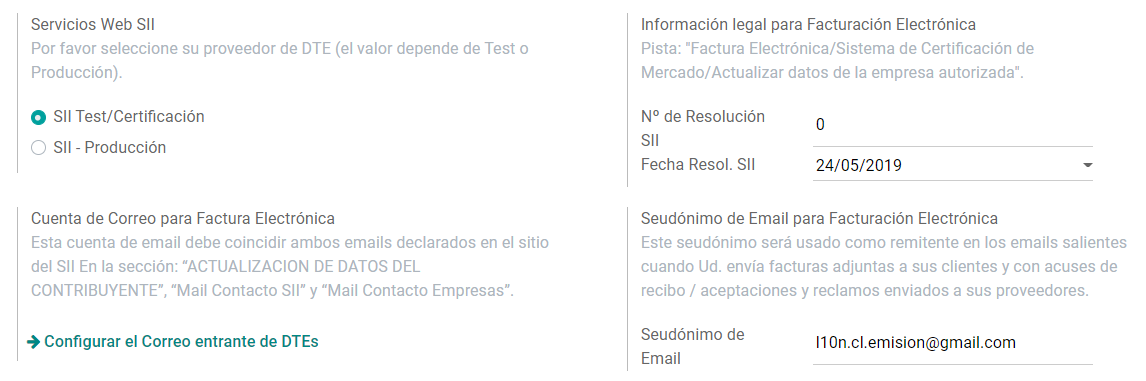

Electronic Invoice Data¶

This is part of the main information required to generate electronic Invoice, select your environment and the legal information, as well as the email address to receive invoices from your vendors and the alias you use to send invoices to your customers.

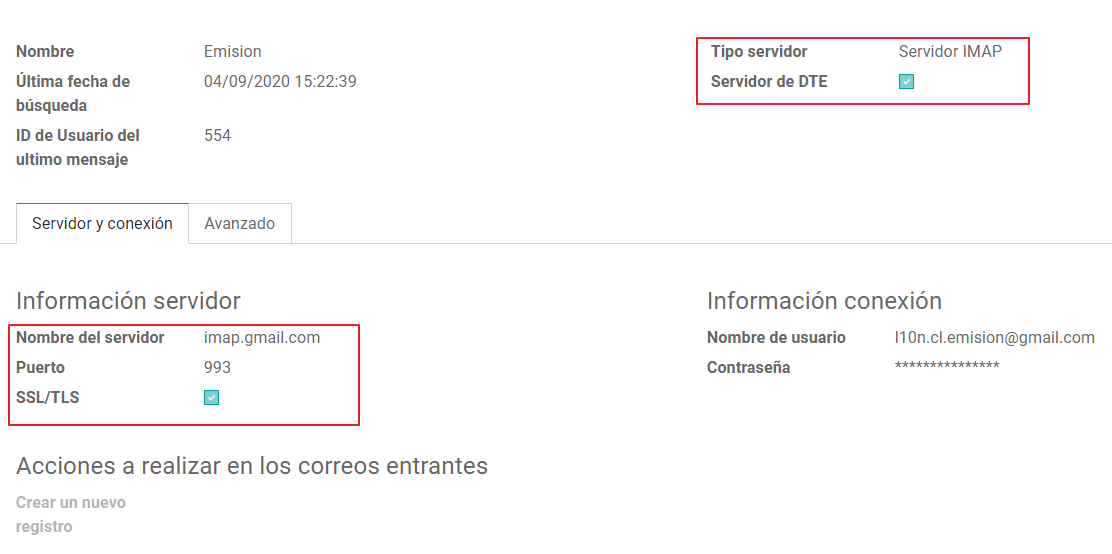

Configure DTE Incoming email server¶

In order to receive you the claim and acceptance emails from your customers, it is crucial to define the DTE incoming email server, considering this configuration:

小技巧

For your Go-live make sure you archive/remove from your inbox all the emails related to vendor bills that are not required to be processed in Odoo.

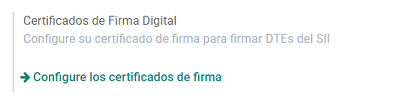

证书¶

为了生成电子发票签名,需要扩展名为``pfx`` 的数字证书,跳转至该部分,并加载文件和密码。

证书可与多个用户共享。要这种情况下,将用户栏留空,以便所有计费用户共享证书。要限制特定用户使用证书,在证书中规定用户即可。

注解

在某些情况下,根据证书格式,可能不会自动加载“主题序列号”栏。在这种情况下,您可以使用证书法定代表人RUT手动编辑此栏。

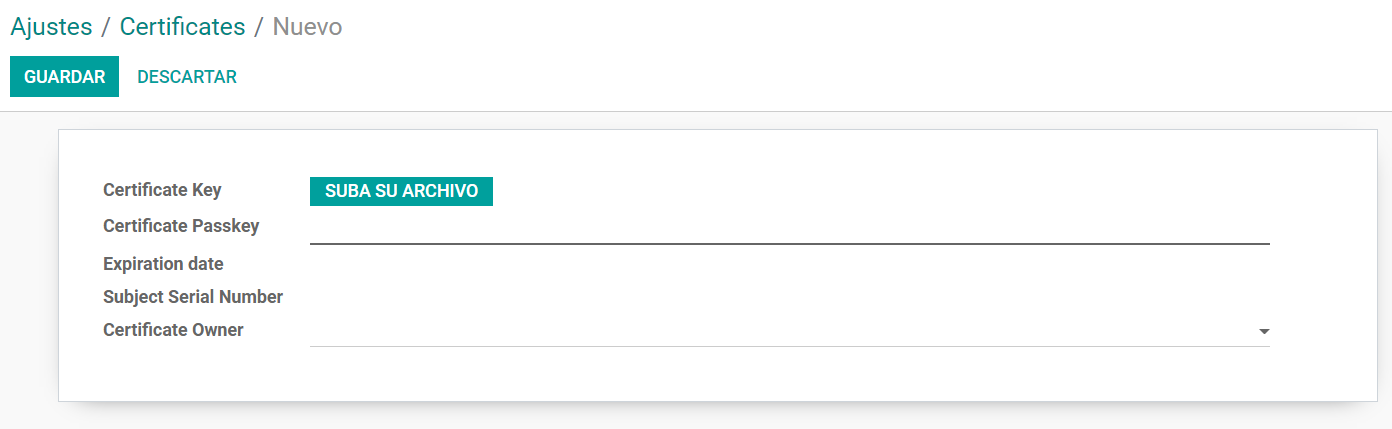

财务报告¶

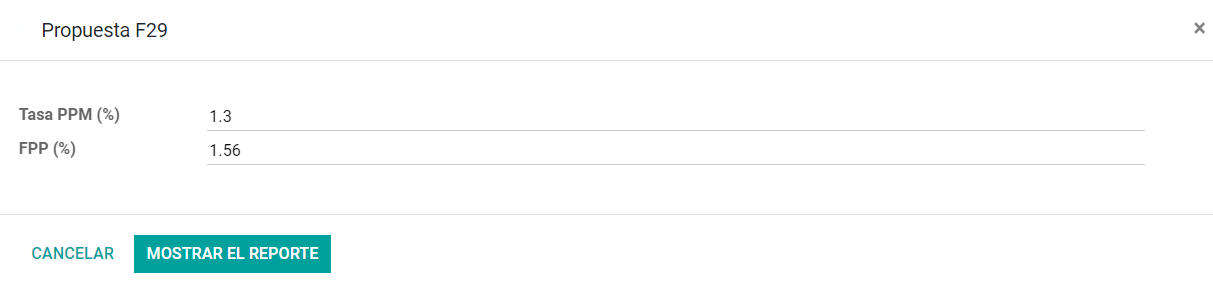

The report Propuesta F29 requires two values that need to be defined as part of the company configuration:

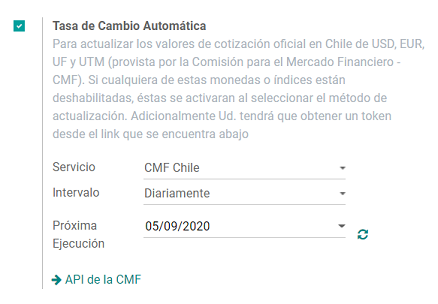

多币种¶

智利的官方货币汇率由智利服务“mindicador.cl <https://mindicador.cl>”_提供。您可以在货币汇率配置中找到此服务,并且可以为汇率更新设置预定义的间隔。

科目表¶

The chart of accounts is installed by default as part of the set of data included in the localization module. The accounts are mapped automatically in:

Taxes.

Default Account Payable.

Default Account Receivable.

Transfer Accounts.

Conversion Rate.

主数据¶

业务伙伴¶

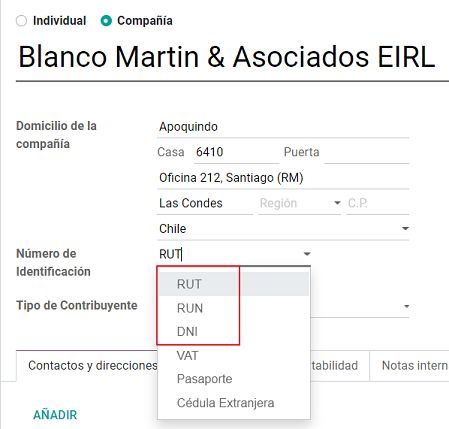

Identification Type and VAT¶

As part of the Chilean localization, the identification types defined by the SII are now available on the Partner form. This information is essential for most transactions.

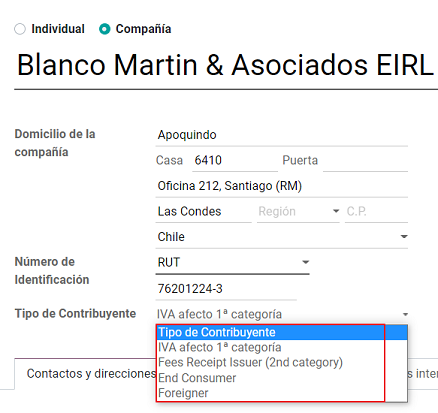

TaxpayerType¶

In Chile, the document type associated with customers and vendors transactions is defined based on the Taxpayer Type. This field should be defined in the partner form, when creating a customer is important you make sure this value is set:

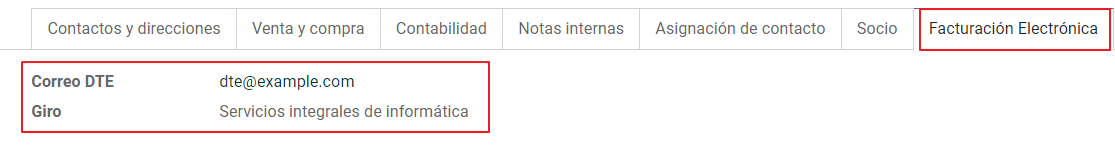

Electronic Invoice Data¶

As part of the information that is sent in the electronic Invoice, you need to define the email that is going to appear as the sender of the electronic invoice to your customer, and the Industry description.

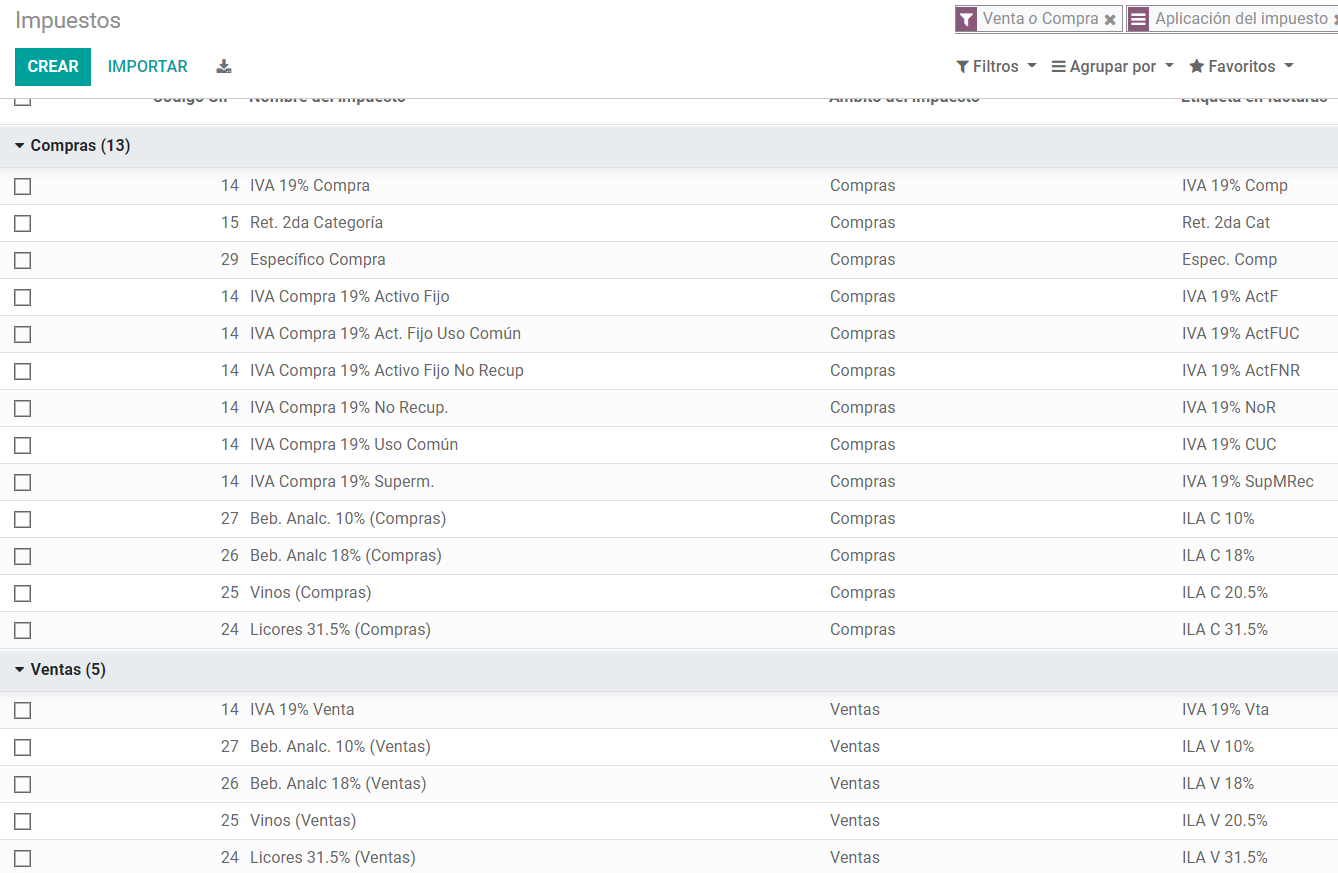

税金设置¶

As part of the localization module, the taxes are created automatically with their related financial account and configuration.

Taxes Types¶

Chile has several tax types, the most common ones are:

VAT. Is the regular VAT and it can have several rates.

ILA (Impuesto a la Ley de Alcholes). Taxes for alcoholic drinks. It has a different rate.

税科目调整¶

Based on the purchase transactions, the VAT can have different affections. This will be done in Odoo using the default purchase fiscal positions.

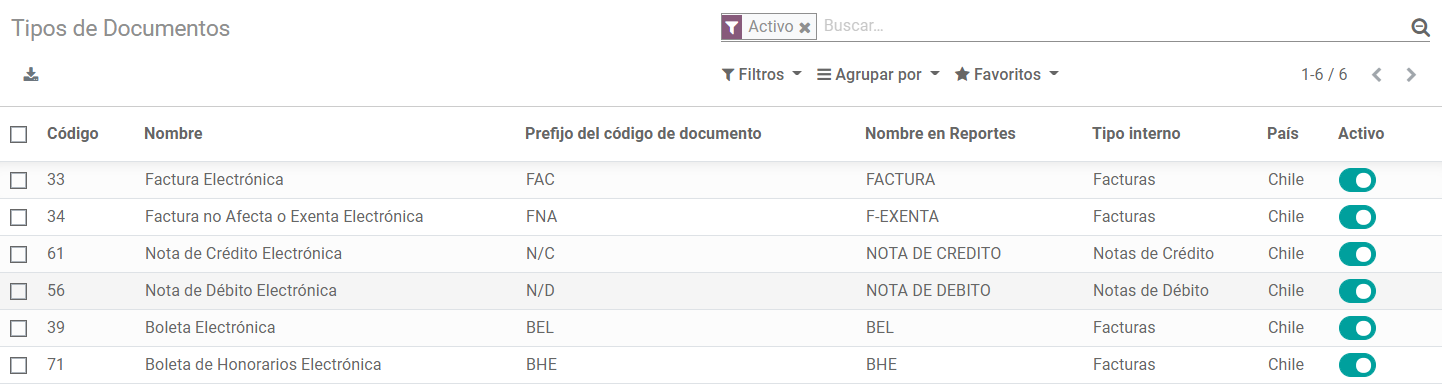

Document Types¶

In some Latin American countries, including Chile, some accounting transactions like invoices and vendor bills are classified by document types defined by the government fiscal authorities (In Chile case: SII).

The document type is essential information that needs to be displayed in the printed reports and that needs to be easily identified within the set of invoices as well of account moves.

每种文档类型可以具有公司的唯一序列。作为本地化的一部分,文档类型包括文档适用的国家,并且在安装本地化模块时自动创建数据。

The information required for the document types is included by default so the user doesn’t need to fill anything on this view:

注解

There are several document types that are inactive by default but can be activated if needed.

Use on Invoices¶

The document type on each transaction will be determined by:

The Journal related to the Invoice, identifying if the journal uses documents.

Condition applied based on the type of Issues and Receiver (ex. Type of fiscal regimen of the buyer and type of fiscal regimen of the vendor).

日记账¶

用途¶

销售¶

Sales Journals in Odoo usually represent a business unit or location, example:

Ventas Santiago.

Ventas Valparaiso.

For the retail stores is common to have one journal per POS:

Cashier 1.

Cashier 2.

采购¶

The transactions purchase can be managed with a single journal, but sometimes companies use more than one in order to handle some accounting transactions that are not related to vendor bills but can be easily registered using this model, for example:

Tax Payments to government.

Employees payments.

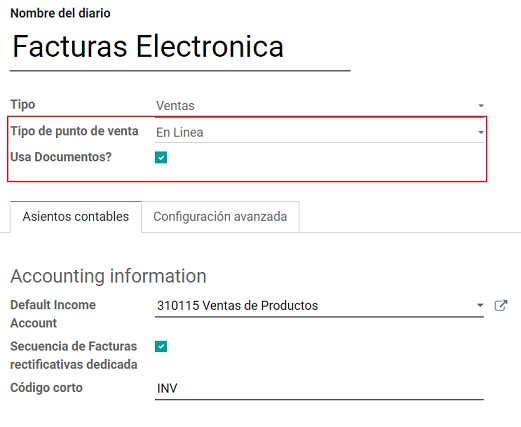

基础配置¶

When creating sales journals the next information must be filled in:

Point of sale type: If the Sales journal will be used for electronic documents, the option Online must be selected. Otherwise, if the journal is used for invoices imported from a previous system or if you are using the SII portal “Facturación MiPyme“ you can use the option Manual.

Use Documents: This field is used to define if the journal will use Document Types. It is only applicable to Purchase and Sales journals that can be related to the different sets of document types available in Chile. By default, all the sales journals created will use documents.

重要

对于智利本地化,定义默认的借方和贷方帐户非常重要,因为它们是其中一个借方票据用例所必需的。

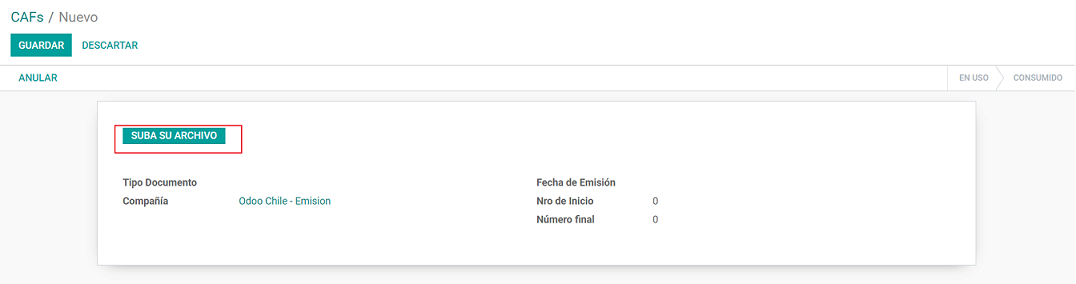

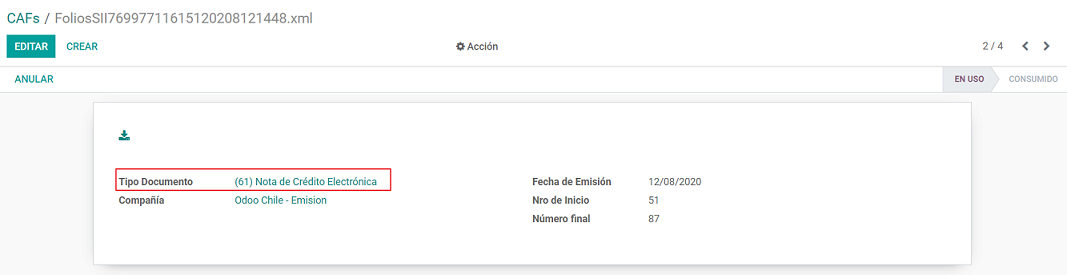

CAF¶

CAF(作品集授权码)是必需的,对于发给客户的每种单据类型,CAF是SII提供给Emisor的文件,其中包含电子发票单据授权的对开页/序列。

您的公司可以对作品集提出多个请求并获取多个 CAF,每个 CAF 都与不同范围的作品集相关联。CAF 在所有日志中共享,这意味着每个文档类型只需要一个活动 CAF,它将应用于所有日志。

请参见`SII文档<https://palena.sii.cl/dte/mn_timbraje.html>`_,检查如何获取CAF详细信息。

重要

SII 要求的 CAF 因生产与测试(认证模式)而异。请确保您具有正确的 CAF 集,具体取决于您的环境。

基础配置¶

获得CAF文件后,您需要将它们与Odoo中的文档类型相关联,以便添加CAF,只需按照以下步骤操作:

访问:菜单选择:“会计 –>设置 –> CAF`

Upload the file.

Save the CAF.

加载后,状态将更改为“使用中”。此时,当交易记录用于此单据类型时,发票编号将采用序列中的第一个作品集。

重要

如果您在以前的系统中使用了某些作品集,请确保在创建第一个事务时设置下一个有效的作品集。

Usage and Testing¶

Electronic Invoice Workflow¶

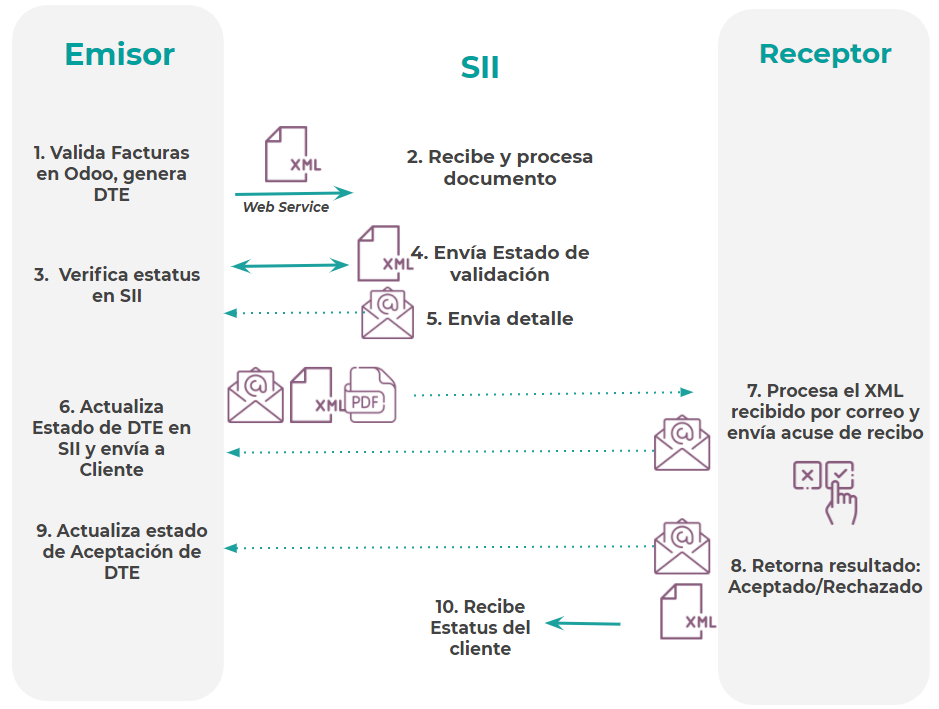

In the Chilean localization the electronic Invoice workflow covers the Emission of Customer Invoices and the reception of Vendor Bills, in the next diagram we explain how the information transmitted to the SII and between the customers and Vendors.

Customer invoice Emission¶

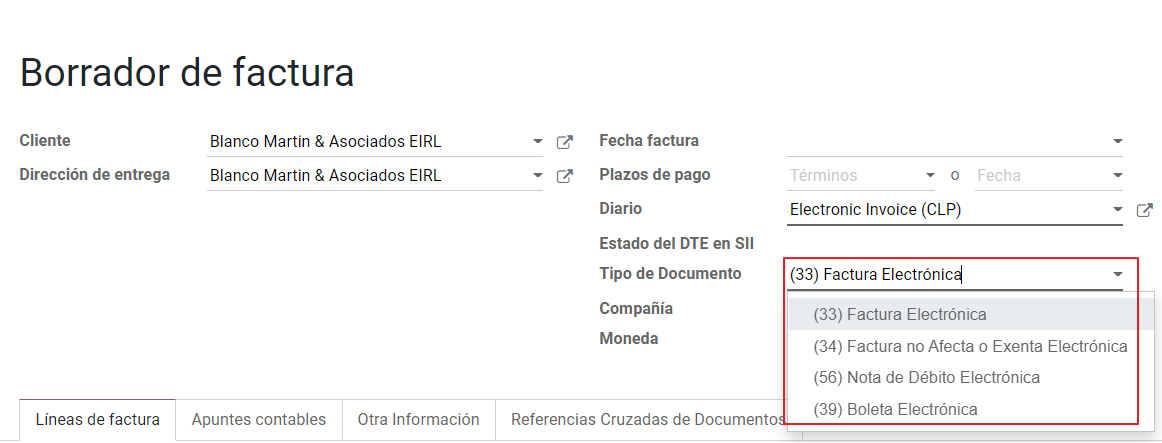

After the partners and journals are created and configured, the invoices are created in the standard way, for Chile one of the differentiators is the document type which is selected automatically based on the Taxpayer.

You can manually change the document type if needed.

重要

单据类型 33:电子发票必须至少有一个含税物料,否则 SII 拒绝单据验证。

Validation and DTE Status¶

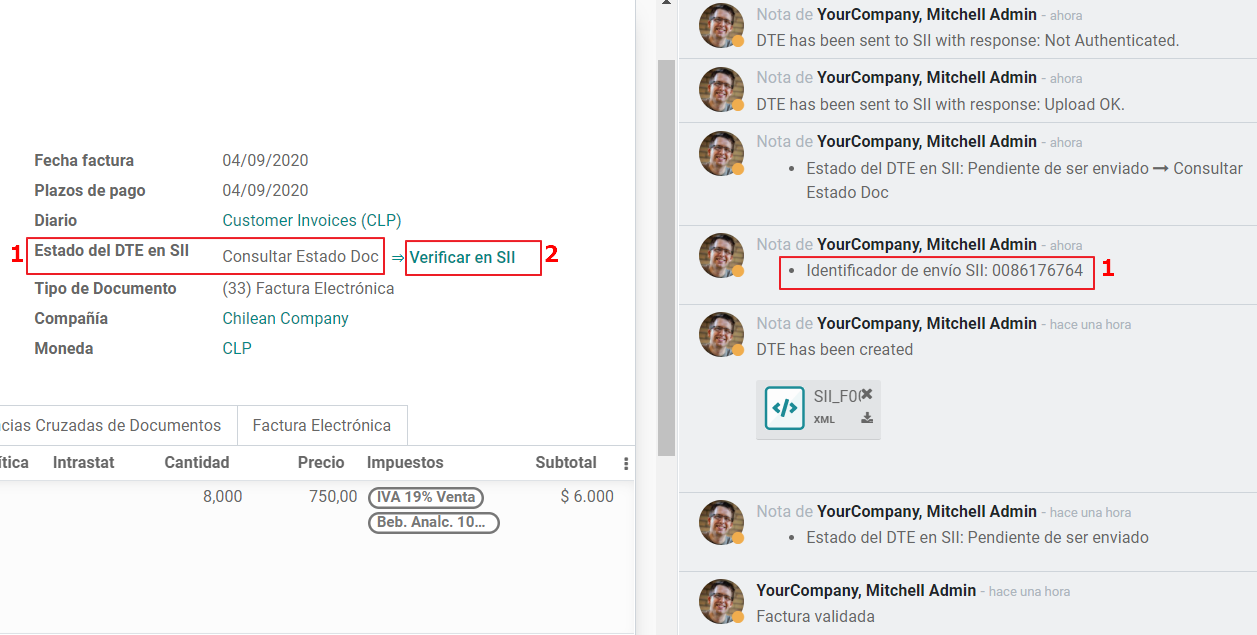

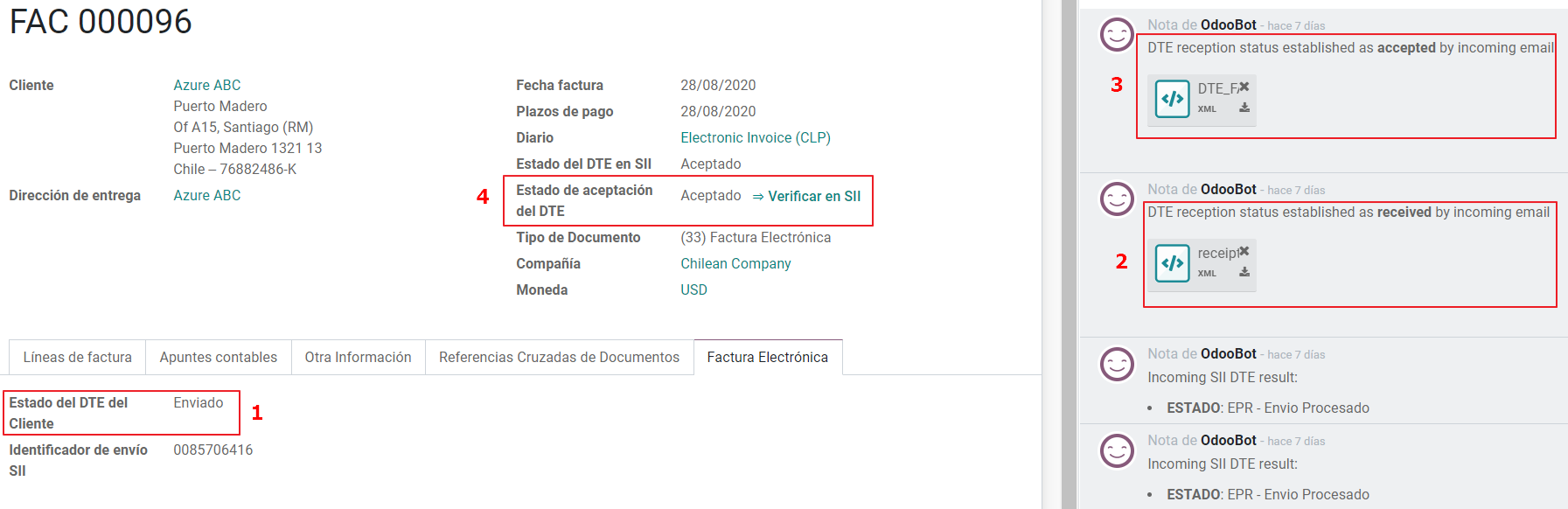

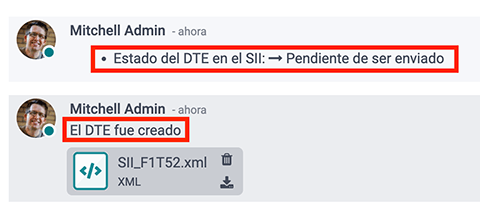

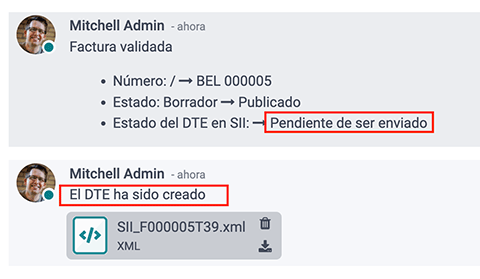

发票信息填写完成后,无论从销售订单手动或自动创建发票,都需要继续验证发票。发票过帐后:

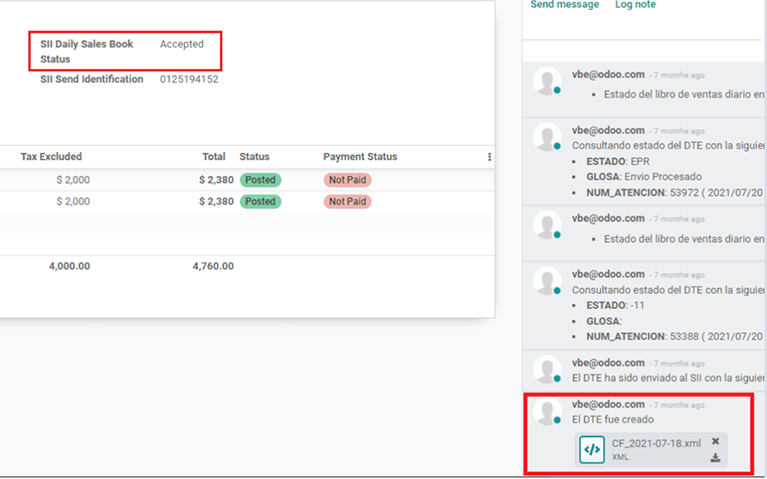

The DTE File (Electronic Tax Document) is created automatically and added in the chatter.

The DTE SII status is set as: Pending to be sent.

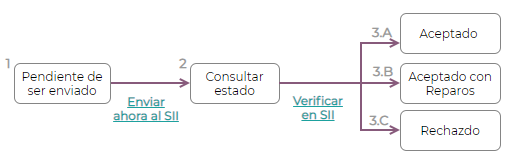

The DTE Status is updated automatically by Odoo with a scheduled action that runs every day at night, if you need to get the response from the SII immediately you can do it manually as well. The DTE status workflow is as follows:

In the first step the DTE is sent to the SII, you can manually send it using the button: Enviar Ahora, a SII Tack number is generated and assigned to the invoice, you can use this number to check the details the SII sent back by email. The DTE status is updated to Ask for Status.

Once the SII response is received Odoo updates the DTE Status, in case you want to do it manually just click on the button: Verify on SII. The result can either be Accepted, Accepted With Objection or Rejected.

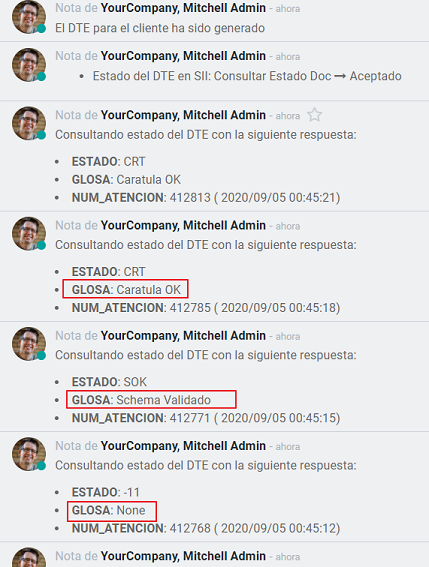

在接受或拒绝之前,SII中有数个内部状态,如果连续单击SII中的“验证”按钮,您将在聊天中收到中间状态详细信息:

The final response from the SII, can take on of these values:

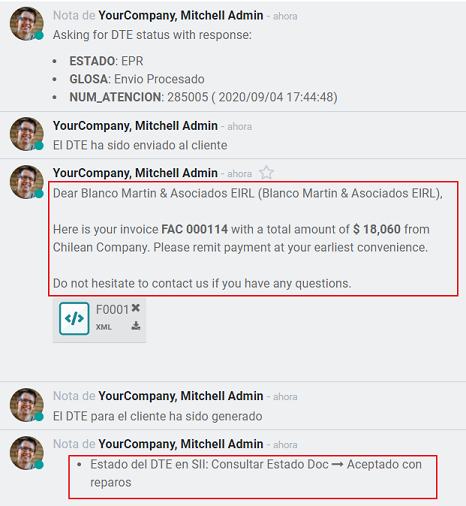

**接受:**表示发票信息正确,文件在财务方面有效,并将自动发送给客户。

**接受但有异议:**表示发票信息正确,但发现了小问题,尽管如此,文件在财务方面仍为有效,并会自动发送给客户。

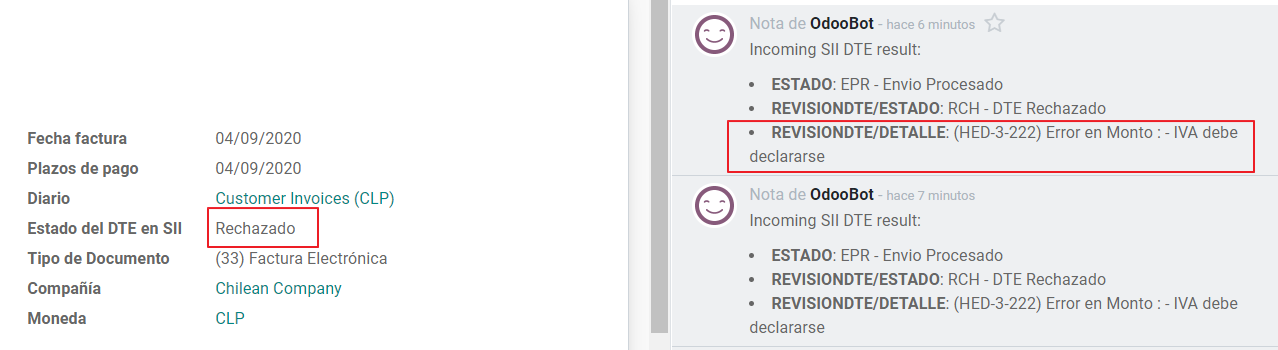

Rejected: Indicates the information in the invoice is incorrect and needs to be corrected, the detail of the issue is received in the emails you registered in the SII, if it is properly configured in Odoo, the details are also retrieved in the chatter once the email server is processed.

If the invoice is Rejected please follow this steps:

Change the document to draft.

Make the required corrections based on the message received from the SII.

Post the invoice again.

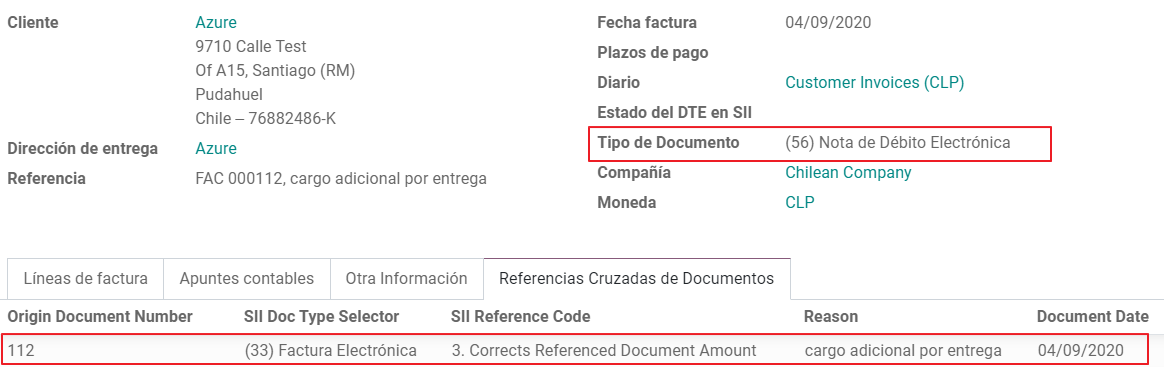

Crossed references¶

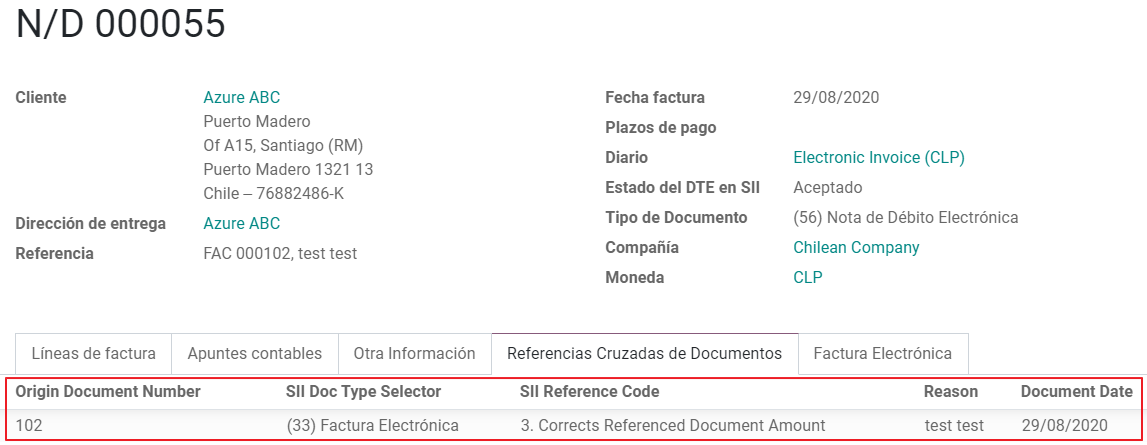

When the Invoice is created as a result of another fiscal document, the information related to the originator document must be registered in the Tab Cross Reference, which is commonly used for credit or debit notes, but in some cases can be used on Customer Invoices as well. In the case of the credit and debit notes, they are set automatically by Odoo:

Invoice PDF Report¶

Once the invoice is accepted and validated by the SII and the PDF is printed, it includes the fiscal elements that indicate that the document is fiscally valid.

重要

如果您托管在Odoo SH或本地,则应手动安装“pdf417gen”库。使用以下命令安装它:“pip install pdf417gen”。

Commercial Validation¶

Once the invoice has been sent to the customer:

DTE partner status changes to “Sent”.

The customer must send a reception confirmation email.

Subsequently, if all the commercial terms and invoice data are correct, they will send the Acceptance confirmation, otherwise they send a Claim.

The field DTE acceptation status is updated automatically.

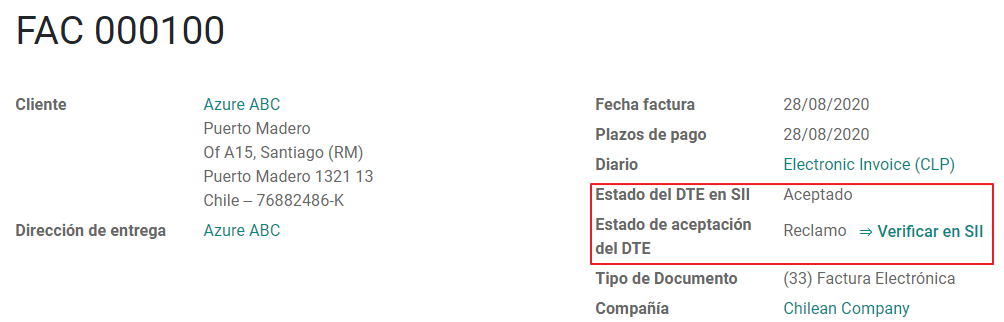

Processed for Claimed invoices¶

发票被SII接受后,无法在Odoo中取消。如果您收到客户的索赔要求,正确的处理方法是使用贷项通知单取消或更正发票。有关详细信息,请参见:ref:`智利/贷方票据`部分。

Common Errors¶

There are multiple reasons behind a rejection from the SII, but these are some of the common errors you might have and which is the related solution.

错误:

RECHAZO- DTE Sin Comuna Origen.Hint: Make sure the Company Address is properly filled including the State and City.

Error en Monto:

- IVA debe declararse.Hint: The invoice lines should include one VAT tax, make sure you add one on each invoice line.

错误:

Rut No Autorizado a Firmar.Hint: The invoice lines should include one VAT tax, make sure you add one on each invoice line.

错误:

Fecha/Número Resolucion Invalido RECHAZO- CAF Vencido : (Firma_DTE[AAAA-MM-DD] - CAF[AAAA-MM-DD]) > 6 个 meses。错误:“元素”{http://www.sii.cl/SiiDte%7DRutReceptor“:此元素不是预期的。预期是 ( {http://www.sii.cl/SiiDte%7DRutEnvia )。’’

提示: 确保在客户和主公司中设置了“文档类型”和“增值税”字段。

GLOSA:

Usuario sin permiso de envio.提示: 此错误表明,您的公司很可能尚未通过 SII - Sistema de Facturación de Mercado 中的“认证流程<https://www.sii.cl/factura_electronica/factura_mercado/proceso_certificacion.htm>”。如果是这种情况,请联系您的客户经理或客户支持,因为此认证不是Odoo服务的一部分,但我们可以为您提供一些替代方案。

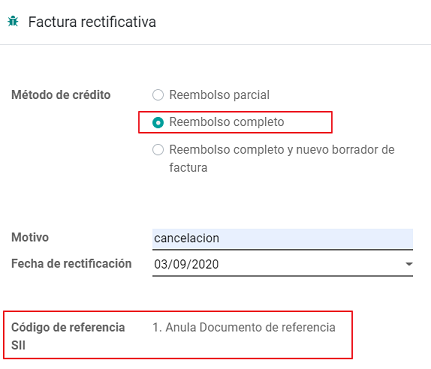

退款¶

当需要对已验证的发票进行取消或更正时,必须生成贷方通知单。重要的是要考虑到信用票据需要CAF文件,该信用票据在SII中被标识为文档64。

小技巧

请参见:ref:CAF部分<智利/CAF文件>,其中介绍了在各文件类型上加载CAF的过程。

案例¶

Cancel Referenced document¶

如果您需要取消或作废发票,请点击“添加贷记票据”按钮,选择“全额退款”,在这种情况下,SII参考代码将自动设置为:Anula Documento de referencia。

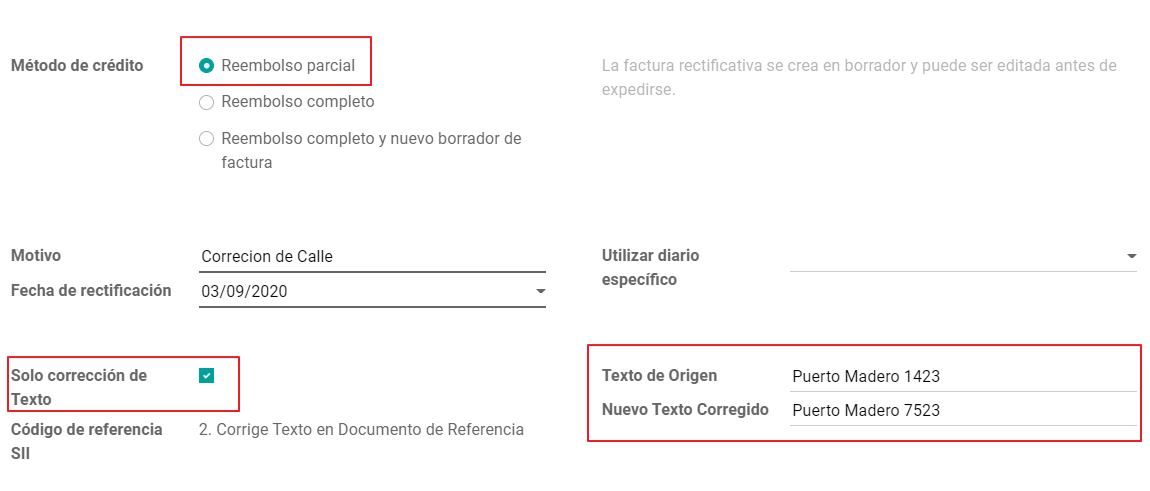

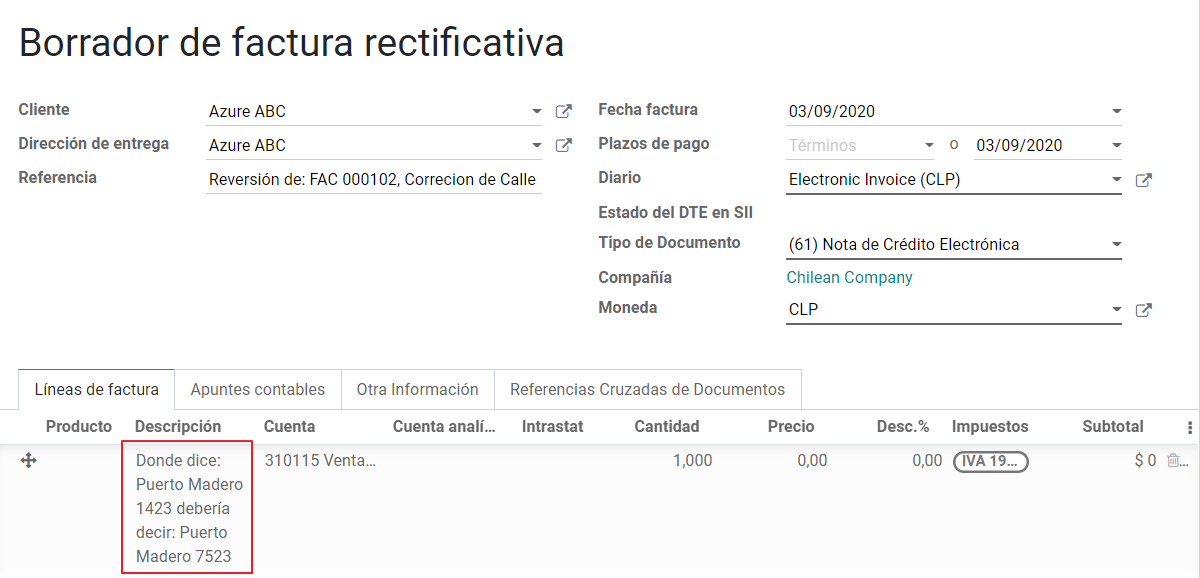

Corrects Referenced Document Text¶

If a correction in the invoice information is required, for example the Street Name, use the button Add Credit note,select Partial Refund and select the option “Solo corregir Texto”. In this case the SII reference Code is automatically set to: Corrige el monto del Documento de Referencia.

Odoo creates a Credit Note with the corrected text in an invoice and price 0.

重要

在销售日记帐中规定默认信用账户非常重要,因为它是针对特定情况使用的。

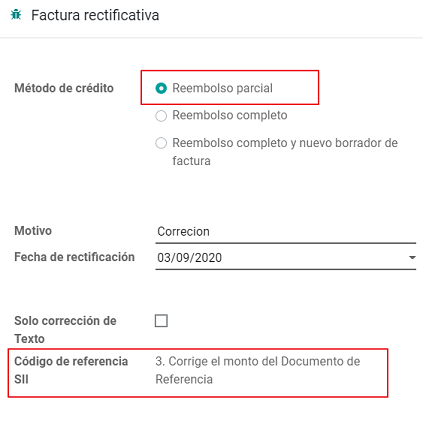

Corrects Referenced Document Amount¶

When a correction on the amounts is required, use the button Add Credit note and select Partial Refund. In this case the SII reference Code is automatically set to: Corrige el monto del Documento de Referencia.

借方备注¶

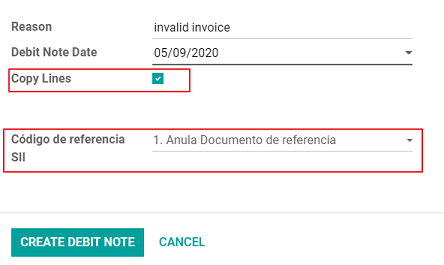

作为智利本地化的一部分,除了从现有文件创建贷项凭单外,您还可以创建借项凭单,只需点击“添加借项凭单”按钮。以下详细介绍了借项凭单的两个主要用例。

案例¶

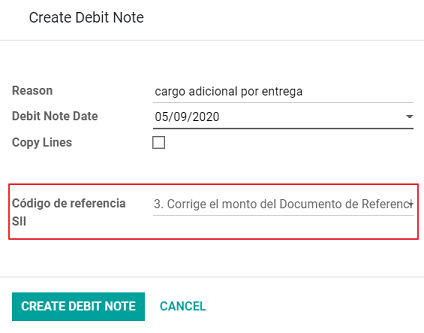

Add debt on Invoices¶

The most common use case for debit notes is to increase the value of an existing invoice, you need to select option 3 in the field Reference code SII:

In this case Odoo automatically includes the source invoice in the cross reference section:

Cancel Credit Notes¶

In Chile the debits notes are used to cancel a validated Credit Note, in this case just select the button Add debit note and select the first option in the wizard: 1: Anula Documentos de referencia.

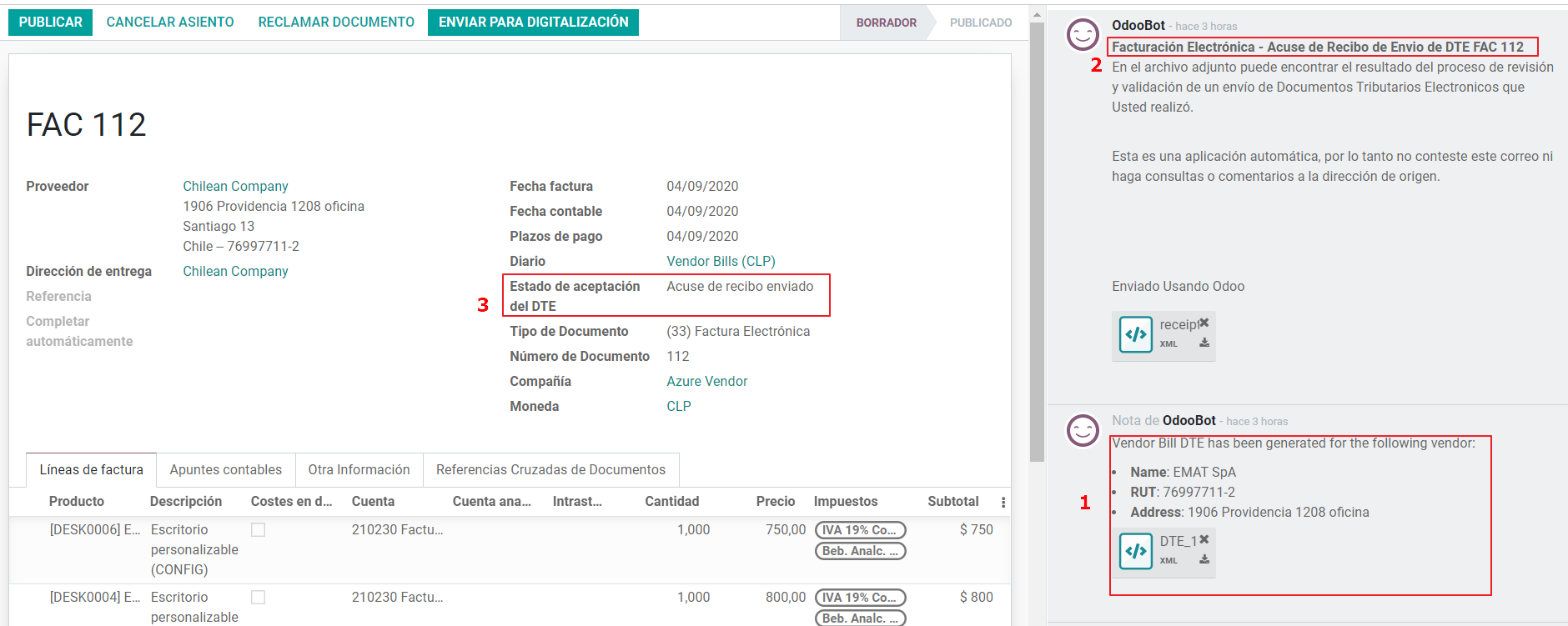

供应商账单¶

As part of the Chilean localization, you can configure your Incoming email server as the same you have register in the SII in order to:

Automatically receive the vendor bills DTE and create the vendor bill based on this information.

Automatically Send the reception acknowledgement to your vendor.

Accept or Claim the document and send this status to your vendor.

接收¶

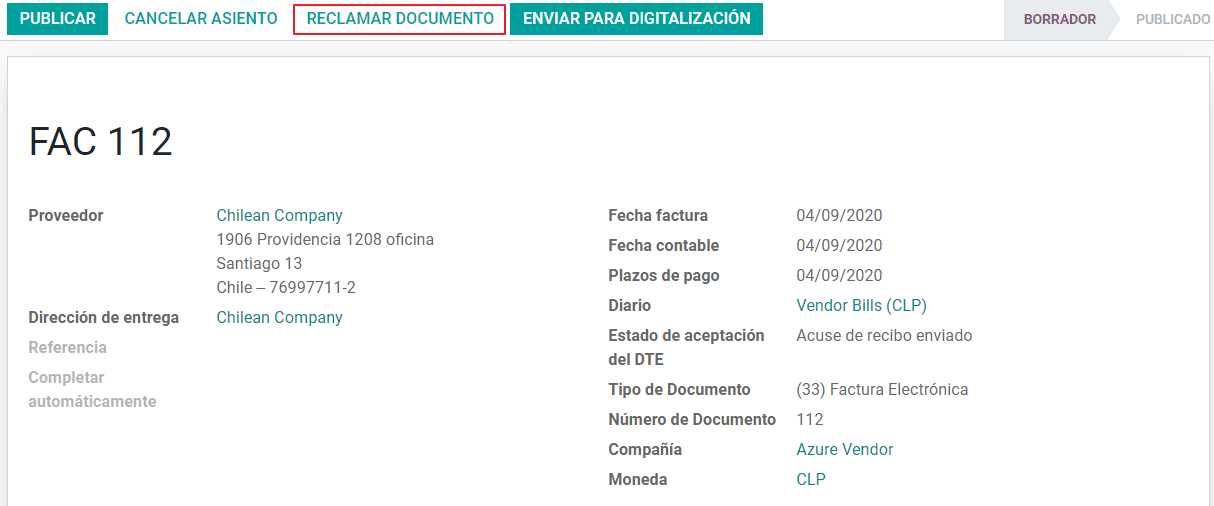

收到附有DTE的供应商电子邮件后:1. 供应商账单映射xml文件中包含的所有信息。2. 向供应商发送电子邮件,并附上接收确认。3. DTE状态设置为:Acuse de Recibido Enviado

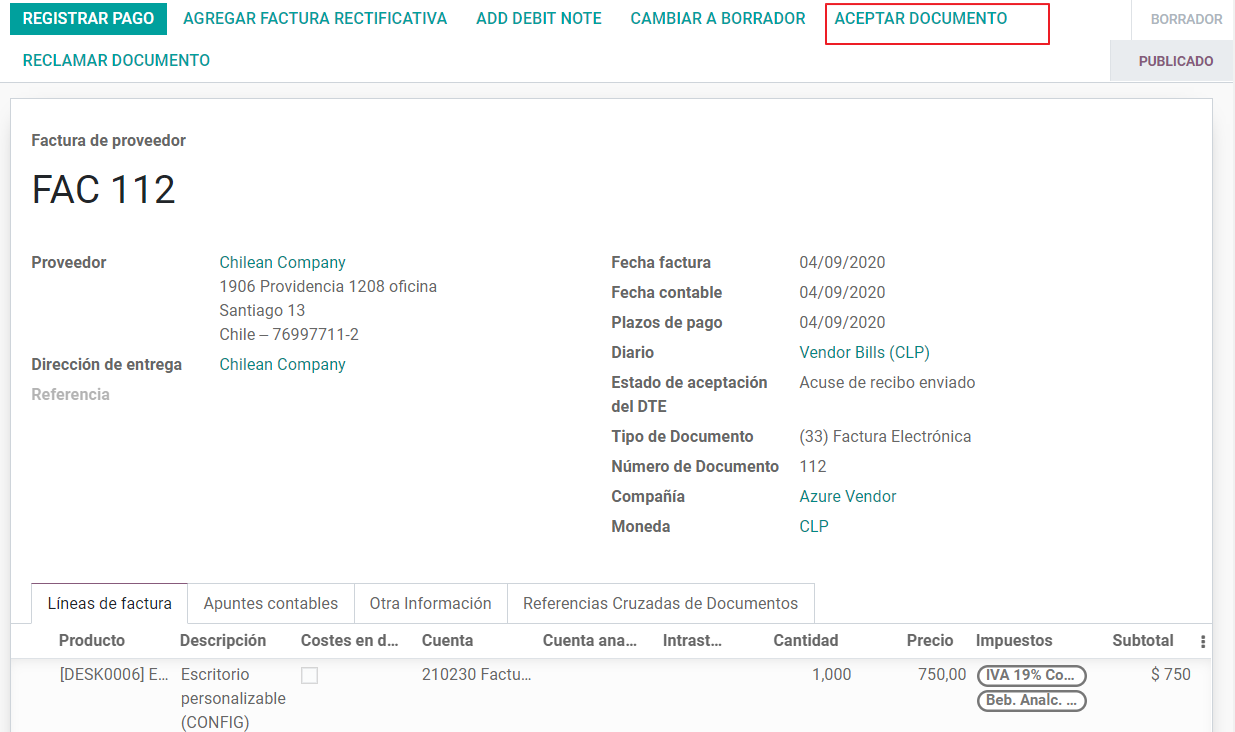

Acceptation¶

如果供应商账单中的所有商业信息全部正确,可以点击:guilabel:`Aceptar Documento`按钮,以接受文件。接受文件后,DTE接受状态变为:guilabel:“已接受”,并向供应商发送有关接受的电子邮件。

Claim¶

如果存在商业问题,或供应商账单中存在错误信息,您可以在验证前点击“索赔”按钮,对文件进行索赔,完成后,DTE接受状态变为“索赔”,并向供应商发送有关接受的电子邮件。

如果您对供应商账单提出索赔,状态会从“草稿”变为“自动取消”。鉴于这是最佳做法,所有索赔文件应取消,因为它们对您的会计记录无效。

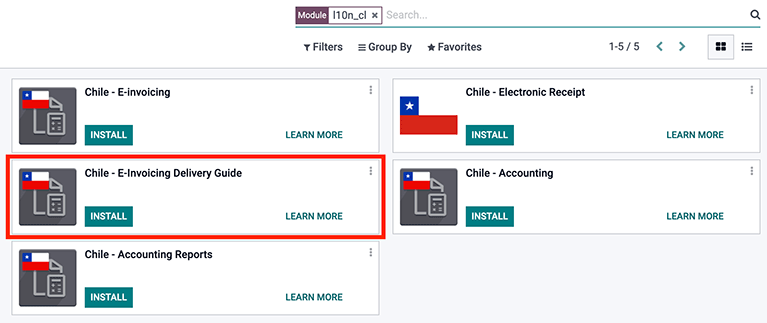

发货指南¶

要安装发货指南模块,跳转至:菜单选择:应用程序,搜索:guilable:智利(l10n_cl)。在:guilabel:智利电子开票发货指南`模块中单击:guilable:`安装。

注解

智利电子开票交付指南*依赖于*智利-Facturación Electrónica。安装交付指南模块后,Odoo自动安装依赖项。

交付指南模块包含向SII发送DTE、PDF报告中的交付章。

完成电子发票配置(例如,上传有效公司证书、设置主数据等)后,交付指南需要CAF。请参阅:ref:CAF文件<chile/CAF documentation>,查看如何获取电子交付指南CAF的详细信息。

确定*交付指南价格*配置中的以下重要信息:

:guilabel:

来自销售订单:交付指南从销售订单获取产品价格,并显示在文件中。:guilable:

来自产品模板:Odoo获取产品模板中配置的价格,并显示在文件中。:guilabel:

无显示价格:交付指南中无显示价格。

电子交付指南用于将库存从一个地点转移至另一地点,可以代表销售、抽样、寄售、内部转移,基本上所有产品动态。

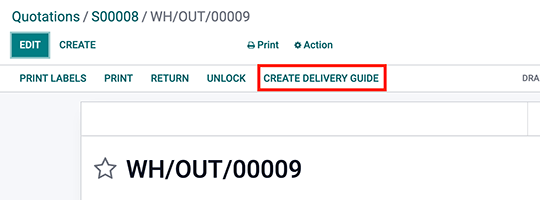

来自销售流程的交付指南¶

警告

一份交付指南**不应**长于一页,或包含超过 60 个产品系列。

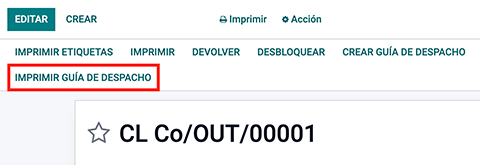

创建并确认销售订单后,将生成交货订单。验证交货单后,将激活创建交货指南的选项。

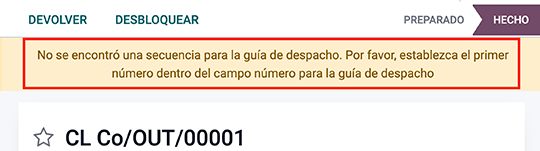

首次单击:guilable:`创建交货指南`按钮时,弹出提醒消息,显示以下内容:

该提示信息意味着,用户需要指示Odoo生成交货指南所需的下一个序列号,在Odoo中首次创建交货指南时发生这种情况。正确生成首个文件后,Odoo使用CAF的下一个可用编号生成之后的交货指南。

交货指南创建后:

将自动创建DTE文件(电子税务文件),并添加至聊天窗口。

The DTE SII status is set as: Pending to be sent.

通过Odoo每晚运行的计划操作,自动更新DTE状态。要立即从SII获得响应,单击:guilable:`立即发送到SII`按钮。

发送交货指南后,单击:guilable:`打印交货指南`按钮,即可打印交货指南。

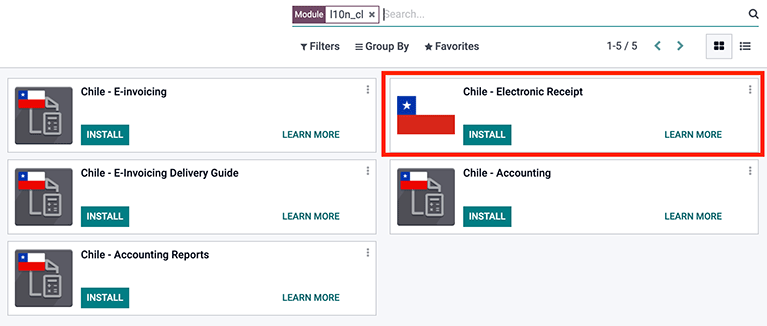

电子收据¶

要安装电子收据模块,跳转至:菜单选择:应用程序,搜索:guilable:智利(l10n_cl)。然后,在模块:guilabel:智利电子收据`中单击:guilable:`安装。

注解

智利电子收据*依赖于*智利-Facturación Electrónica。安装电子开票交货指南模块后,Odoo自动安装依赖项。

该模块包含自动向SII发送的电子收据和每日销售报告。

完成电子发票配置(例如,上传有效公司证书、设置主数据等)后,电子收据需要CAF。请参阅:ref:CAF文件<chile/CAF documentation>,查看如何获取电子收据CAF的详细信息。

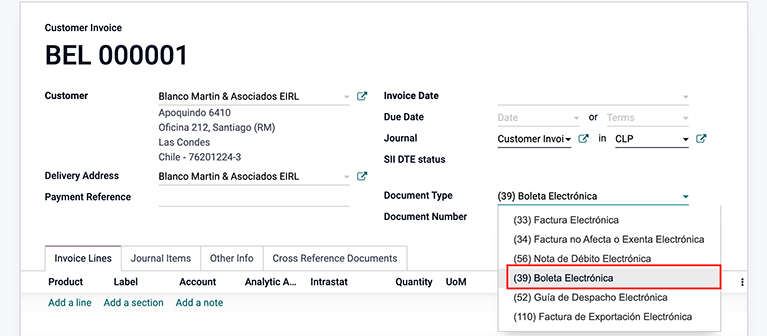

如果客户不需要电子发票,可以使用电子收据。在默认情况下,数据库中有名为“匿名最终消费者”的合作伙伴,通用RUT 66666666-6,纳税人类型为“最终消费者”。该合作伙伴可以用于电子收据,也可以为此目的创建记录。

虽然电子收据应用于具有通用RUT的最终消费者,但也可用于特定合作伙伴。创建和配置合作伙伴和日记账后,将以电子发票的标准方式创建电子收据,但应选择文档类型:guilable:(39)电子收据,如下所示:

Validation and DTE Status¶

在销售订单中手动或自动填写电子收据信息后,继续验证收据。在默认情况下,文件类型为“电子发票”,为了正确验证收据,请将文件类型改为“电子收据”。

收据过账后:

将自动创建DTE文件(电子税务文件),并添加至聊天窗口。

The DTE SII status is set as: Pending to be sent.

通过Odoo每晚运行的计划操作,自动更新DTE状态。要立即从SII获得响应,单击:guilable:`立即发送到SII`按钮。

请参阅:ref:`DTE工作流<智利/电子发票验证>,因为电子发票与电子收据的工作流相同。

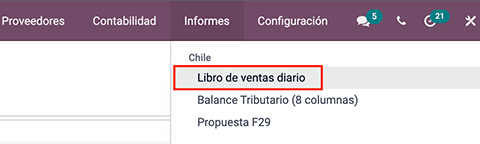

每日销售报告¶

电子收据创建后,系统将创建每日销售报告,包含当日所有电子收据,加盖电子章,以XML格式隔夜向SII发送。每日销售报告可在:菜单选择:`报告–>每日销售报告`中找到。

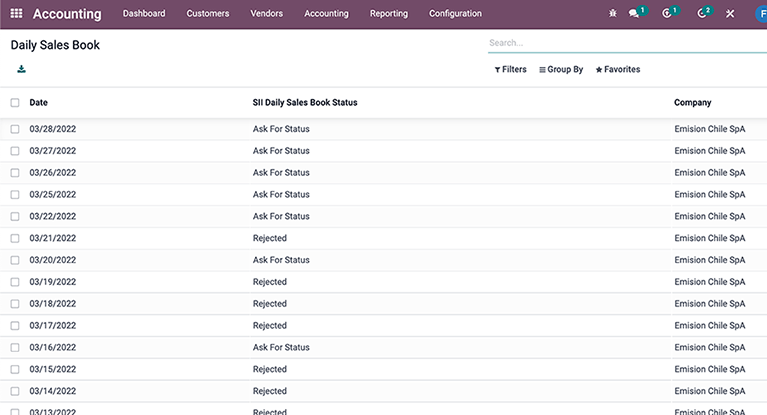

显示每日销售报告列表,每日向SII发送DTE。

如果某天未收到电子收据,仍会发送报告,但报告中无收据。如果报告被接受或拒绝(取决于公司证书和有效收据),SII会给出回复。

重要

对于智利本地化,请注意,电子收据*不*支持价格中包含的功能税。

如果在另一个系统中为某一天创建了每日销售报告,则因为使用的序列号,Odoo中的每日报告将被拒绝。在这种情况下,单击:guilable:重试,Odoo自动生成新序列号。之后,用户可以手动使用SII,验证报告状态,或等待Odoo在夜间更新状态。

财务报告¶

Balance Tributario de 8 Columnas¶

This report presents the accounts in detail (with their respective balances), classifying them according to their origin and determining the level of profit or loss that the business had within the evaluated period of time, so that a real and complete knowledge of the status of a company.

You can find this report in

Propuesta F29¶

The form F29 is a new system that the SII enabled to taxpayers, and that replaces the Purchase and Sales Books. This report is integrated by Purchase Register (CR) and the Sales Register (RV). Its purpose is to support the transactions related to VAT, improving its control and declaration.

记录由SII收到的电子税务文件(DTE)提供。

You can find this report in