Chilean Localization

An all-in-one solution designed for the

modern Chilean business.

Start Now - It's Free

Electronic Invoicing

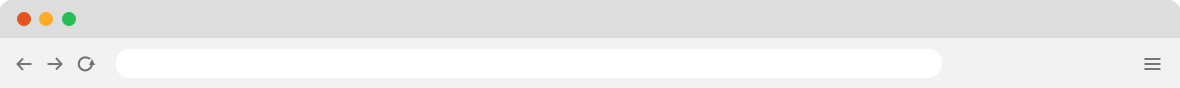

Connection to the SII

Odoo has a direct connection with the SII, so all your accounting records can be synchronized and reported immediately to the Chilean Government.

Odoo also allows you to automatically receive (and process) Vendor Bills, making it easy to track the entire electronic invoice workflow in Odoo every step of the way:

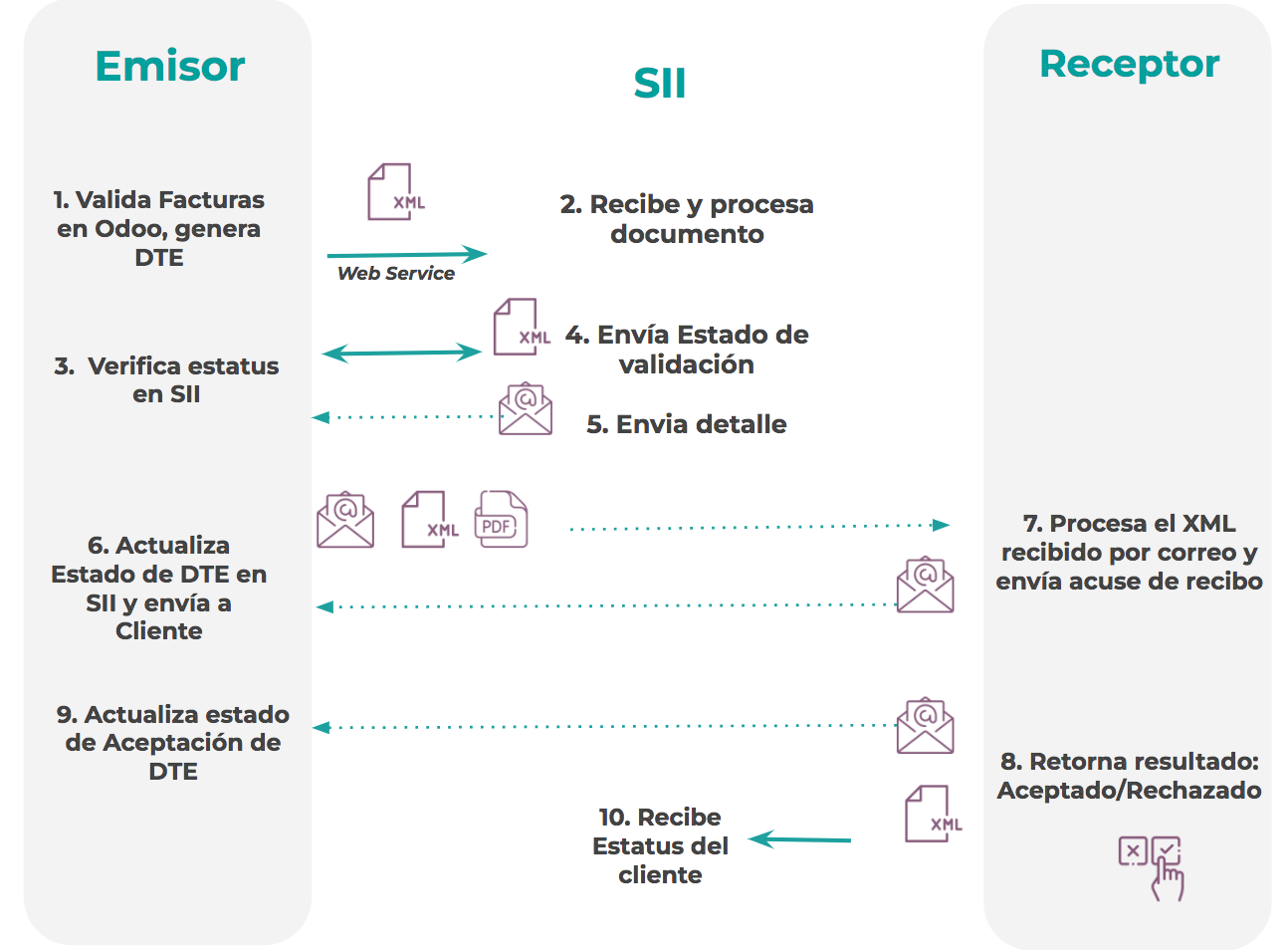

Now, you can select from a wide range of document types, such as:

- Factura Electrónica

- Factura de Crédito Electrónica

- Nota de Débito Electrónica

- Boleta Electrónica

Chart of Accounts

Chart of Accounts Mapping

The Chart of Accounts is installed by default, as part of the data set included in the localization module. The accounts are automatically mapped in:

- Taxes

- Default Account Payable

- Default Account Receivable

- Transfer Accounts

- Conversion Rates

Reporting

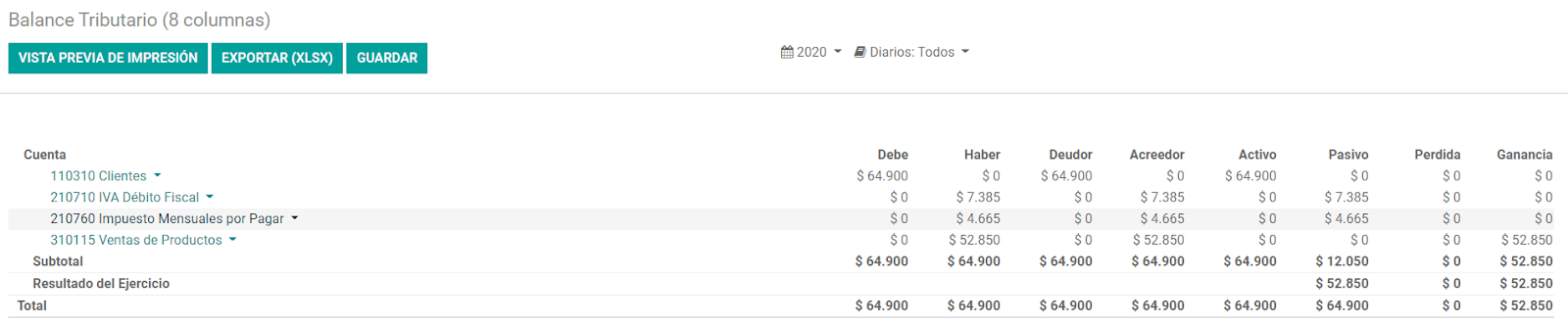

Balance Tributario de 8 Columnas

This in-depth report presents the accounts in detail (with their respective balances), classifying them by origin, and determining the level of profit (or loss) the business had within that evaluated time period.

Propuesta F29

The “F29” form is a new system that the SII introduced to taxpayers. It replaces the Purchase and Sales Books. This report is integrated by Purchase Register (CR) and the Sales Register (RV). Its purpose is to support the transactions related to VAT, improving its control and declaration.

Functional Documentation

Odoo makes it easier for users to configure and implement the localization, by following the steps (and advice) found in our functional documentation.

Read Documentation