We are currently doing a migration to Odoo from a legacy system.

We have migrated one year of SOs, POs and Opening Balance and inventory for the client.

Our system have Accounting, Sales, Purchase, Inventory and CRM modules.

The issue is that in order to cater for Open SOs and also to cater for Open and closed invoices, we have entered some journal entries for invoice and payments.

This resulted in some values automatically calculated in Undistributed profit/loss account (999999).

We are having trouble clearing this account so that it is zero for the financial year which started in last April.

Another reason we need to clear this account is it is reflected in the balance sheet for current year which we do not want.

Odoo is the world's easiest all-in-one management software.

It includes hundreds of business apps:

- CRM

- e-Commerce

- Accounting

- Inventory

- PoS

- Project management

- MRP

This question has been flagged

The balance in this account represents a prior year profits/losses balance that has not been cleared.

- A credit balance represents un-cleared profits

- A debit balance represents un-cleared losses

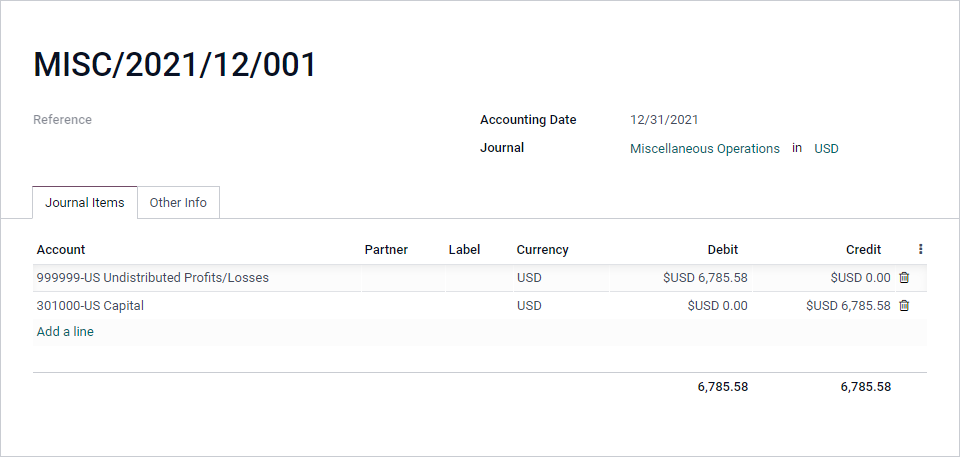

Create a Manual Journal Entry on the last date of your Fiscal Year.

The account to credit would normally be your retained earnings account, this example clears a credit (profit) from the 999999 account.

Our full Year End Close process is at https://www.odoo.com/documentation/master/applications/finance/accounting/taxation/fiscal_year/close_fiscal_year.html

If you are now starting a new financial year, you will need to do a year end for the previous year.

The following link may be of use:

https://www.odoo.com/documentation/user/12.0/accounting/others/adviser/fiscalyear.html

Hope this helps.

Enjoying the discussion? Don't just read, join in!

Create an account today to enjoy exclusive features and engage with our awesome community!

Sign up| Related Posts | Replies | Views | Activity | |

|---|---|---|---|---|

|

|

1

Mar 23

|

2019 | ||

|

|

1

Feb 22

|

1464 | ||

|

|

1

Jun 24

|

1711 | ||

|

|

0

Apr 24

|

709 | ||

|

|

0

Feb 24

|

284 |