Reconciliation models¶

Once the bank statements are correctly imported, it is essential to reconcile the records properly and ensure all journal entries are balanced and in agreement. To ease and speed up the reconciliation process, you can configure reconciliation models, which are particularly useful with recurrent entries such as bank fees.

Note

Reconciliation models are also useful when handling Cash Discounts. Please refer to the cash discounts for more information.

Types of reconciliation models¶

There are three types of reconciliation models:

Suggest counterpart values¶

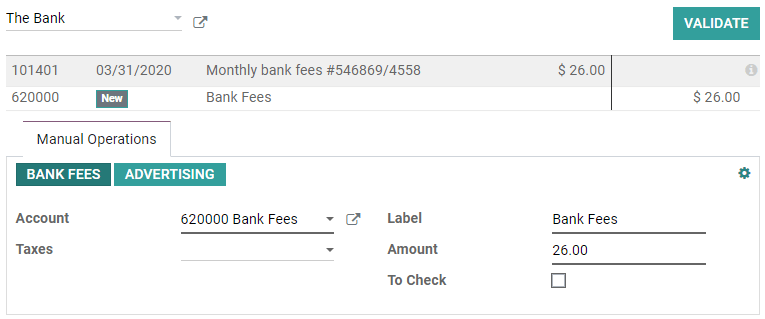

This type of reconciliation model immediately suggests counterpart values when selecting an entry, which then only needs to be validated. This automation is based on a set of rules defined in the reconciliation model.

Match existing invoices/bills¶

This type of reconciliation model automatically selects the right customer invoice or vendor bill that matches the payment. All that is left to do is to validate the entry. This automation is based on a set of rules defined in the reconciliation model.

Configuration¶

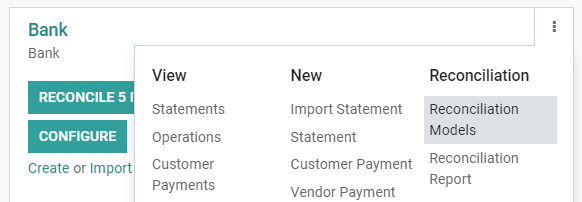

To manage or create new reconciliation models, go to . Alternatively, you can also open this menu from .

Important

The first entry, Invoices Matching Rule, is responsible for the current matching of invoices and bills. Therefore, it is advised to leave it at the top of the list and not delete it.

Open the model you want to modify or click on Create to create a new one, and fill out the form.

Type¶

See types of reconciliation models for an explanation about the different types of reconciliation models.

Note

If the Documents application is installed on your database, an additional Activity type field appears when To Check is ticked. Selecting the value Reconciliation request implies that whenever you use this model, a Request Document window pops up to request a document from the user.

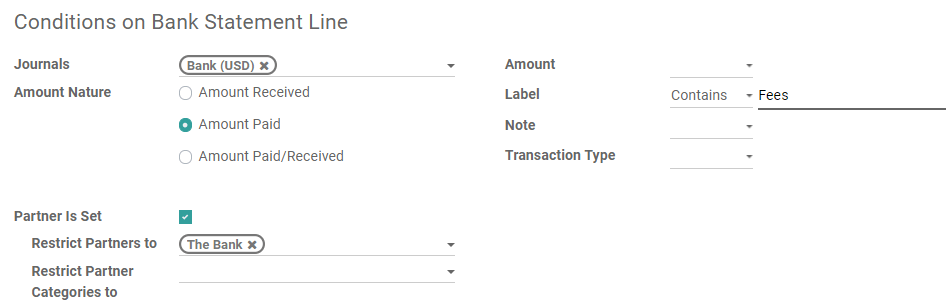

Conditions on bank statement line¶

Define here all the conditions that should be fulfilled for the reconciliation model to be applied. Depending on the Type of model you choose, different options are available.

Important

If a record matches with several reconciliation models, the first one in the list is applied. Models can be rearranged by dragging and dropping the handle next to their name.

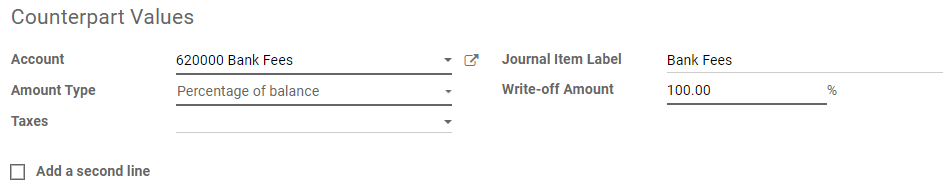

Counterpart values¶

This section comprises the values that are applied by the reconciliation model. If the value to reconcile needs to be written-off in two separate accounts, click on Add a second line a second time.