Belgium¶

Fiscal certification: POS restaurant¶

In Belgium, the owner of a cooking business such as a restaurant or food truck is required by law to use a government-certified Cash Register System for their receipts. This applies if their yearly earnings (excluding VAT, drinks, and take-away food) exceed 25,000 euros.

This government-certified system entails the use of a certified POS system, along with a device called a Fiscal Data Module (or black box) and a VAT Signing Card.

Important

Do not forget to register as foodservice industry manager on the Federal Public Service Finance registration form.

Certified POS system¶

The Odoo POS system is certified for the major versions of databases hosted on Odoo Online and Odoo.sh. Please refer to the following table to ensure that your POS system is certified.

Odoo Online |

Odoo.sh |

On-Premise |

|

|---|---|---|---|

Odoo 16.0 |

Certified |

Certified |

Not certified |

Odoo 15.2 |

Not certified |

Not certified |

Not certified |

Odoo 15.0 |

Certified |

Certified |

Not certified |

Odoo 14.0 |

Certified |

Certified |

Not certified |

See also

A certified POS system must adhere to rigorous government regulations, which means it operates differently from a non-certified POS.

On a certified POS, you cannot:

Make a refund.

Set up and use the global discounts feature (the

pos_discountmodule is blacklisted and cannot be activated).Set up and use the loyalty programs feature (the

pos_loyaltymodule is blacklisted and cannot be activated).Reprint receipts (the

pos_reprintmodule is blacklisted and cannot be activated).Modify prices in order lines.

Modify or delete order lines in POS orders.

Sell products without a valid VAT number.

Use a POS that is not connected to an IoT box.

The cash rounding feature must be activated and set to a Rounding Precision of

0,05and a Rounding Method set as Half-Up.Taxes must be set as included in the price. To set it up, go to , and from the Taxes section, open the Default Sales Tax form by clicking the arrow next to the default sales tax field. There, click Advanced Options and enable Included in Price.

At the start of a POS session, users must click Work in to clock in. Doing so allows the registration of POS orders. If users are not clocked in, they cannot make POS orders. Likewise, they must click Work Out to clock out at the end of the session.

Warning

If you configure a POS to work with a black box, you cannot use it again without it.

The Fiscal Data Module¶

The FDM, or black box, is a government-certified device that works together with the Point of Sale application and saves your POS orders information. Concretely, a hash (unique code) is generated for each POS order and added to its receipt. This allows the government to verify that all revenue is declared.

Note

Ensure your black box is approved by the Belgian government. You can check the compliance of your black box by visiting the Federal Public Service Finance website.

Configuration¶

Before setting up your database to work with an FDM, ensure you have the following hardware:

a registered black box (go to www.boîtenoire.be to order yours);

an RS-232 serial null modem cable per FDM;

an RS-232 serial-to-USB adapter per FDM;

an IoT Box (one IoT box per black box); and

a receipt printer.

Black box module¶

As a pre-requisite, activate the Belgian Registered Cash Register module

(technical name: pos_blackbox_be).

Once the module is activated, add your VAT number to your company information. To set it up, go to , and fill in the VAT field. Then, enter a national registration number for every staff member who operates the POS system. To do so, go to the Employees app and open an employee form. There, go to , and fill in the INSZ or BIS number field.

Tip

To input your information, click on your avatar, go to , and enter your INSZ or BIS number in the designated field.

Warning

You must configure the black box directly in the production database. Utilizing it in a testing environment may result in incorrect data being stored within the black box.

IoT Box¶

In order to use a Fiscal Data Module, you need a registered IoT Box. To register your IoT box, you must contact us through our support contact form and provide the following information:

your VAT number;

your company’s name, address, and legal structure; and

the Mac address of your IoT Box.

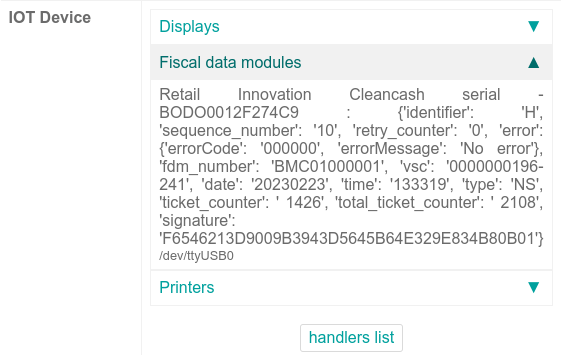

Once your IoT box is certified, connect it to your database. To verify that the IoT Box recognizes the FDM, go to the IoT homepage and scroll down the IOT Device section, which should display the FDM.

Then, add the IoT to your POS. To do so, go to , select your POS, scroll down to the Connected Device section, and enable IoT Box. Lastly, add the FMD in the Fiscal Data Module field.

Note

To be able to use an FDM, you must at least connect one Receipt Printer.

VAT signing card¶

When you open a POS session and make your initial transaction, you are prompted to enter the PIN provided with your VSC. The card is delivered by the FPS upon registration.