Use case:

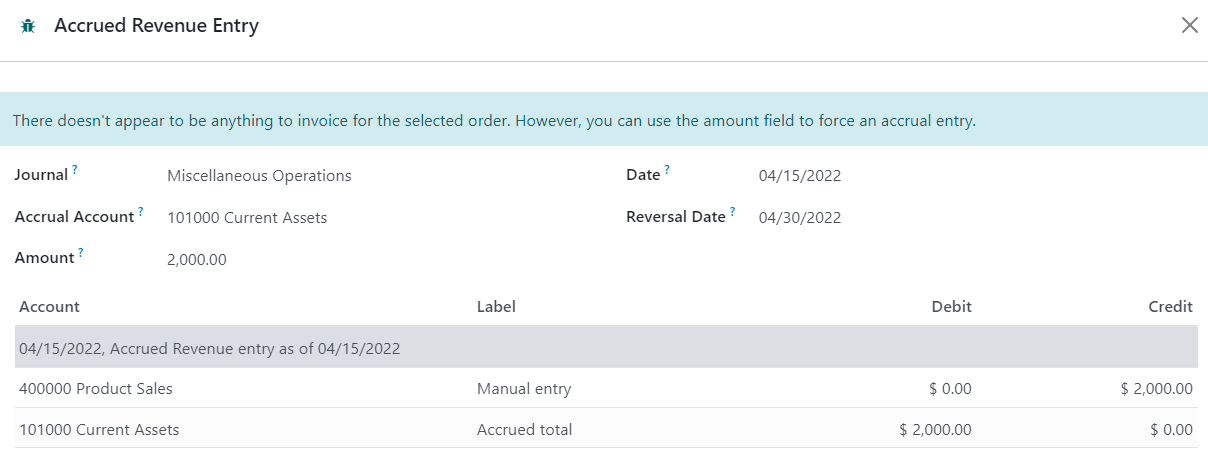

We as VisionTech need to process the accrued revenue journal entry. VisionTech provided a consulting service to Company ABC from 4/1/2022 to 4/30/2022 . The agreement delineates two milestones.

After each of which company ABC owes VisionTech $2,000. Also, the agreement only allows one billing at the end of the project (4/30/2022). ($4,000 total)

- Today is 4/15/2022. VisionTech provided half of the service.

- VisionTech needs to create accrued entry to keep track of the milestone invoicing track without bill company ABC.

- VisionTech will create a final invoice on 4/30/2022 for $4000