Can someone better explain the Stock Interim Accounts and how to use these?

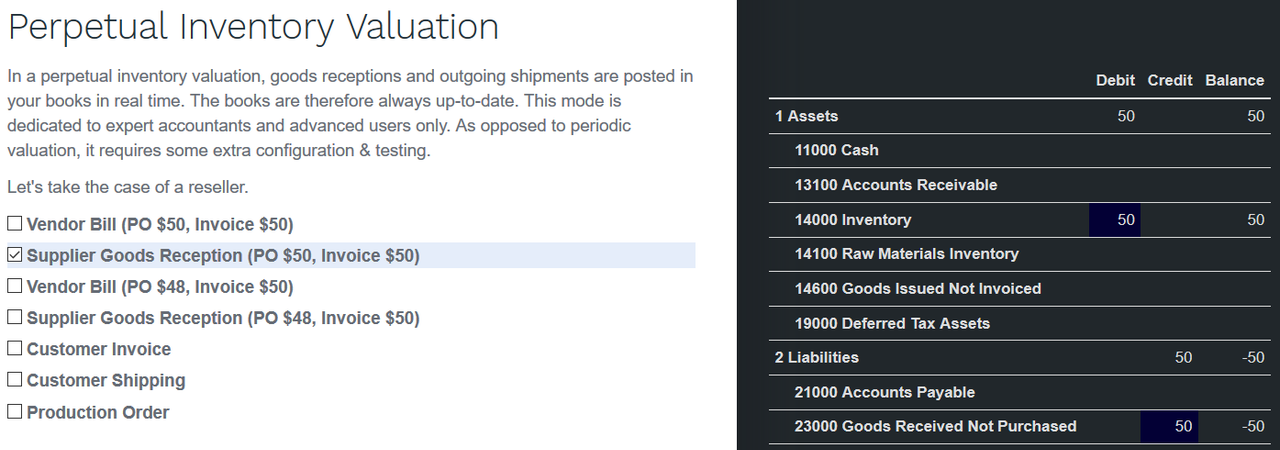

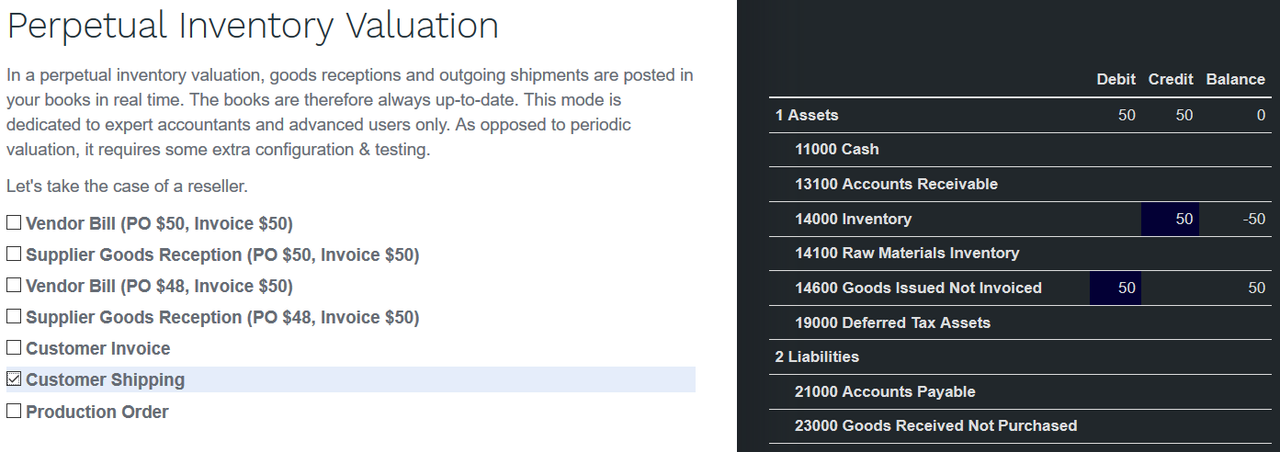

When we create invoices from Purchase Orders for stockable products (standard/automated valuation), should the account used be a Stock Interim Account instead of a Cost of Goods account? The system seems to default this way.