Prerequisite

1. The parent company's currency, tax ID, and chart of accounts are consistent across all branches.

2. The parent company serves as the sole legal entity, eliminating the need for branch-specific tax filings.

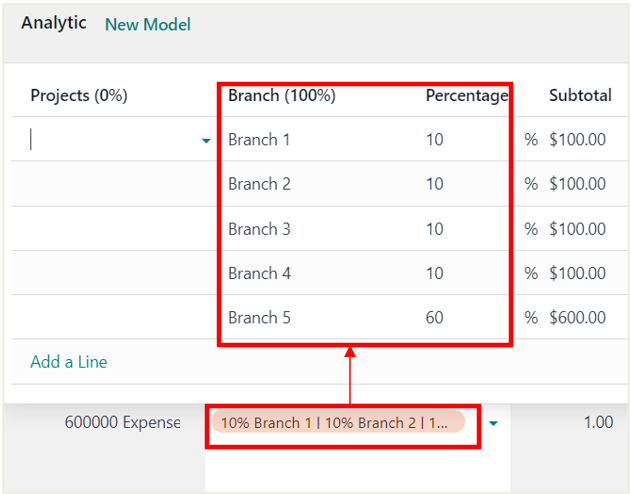

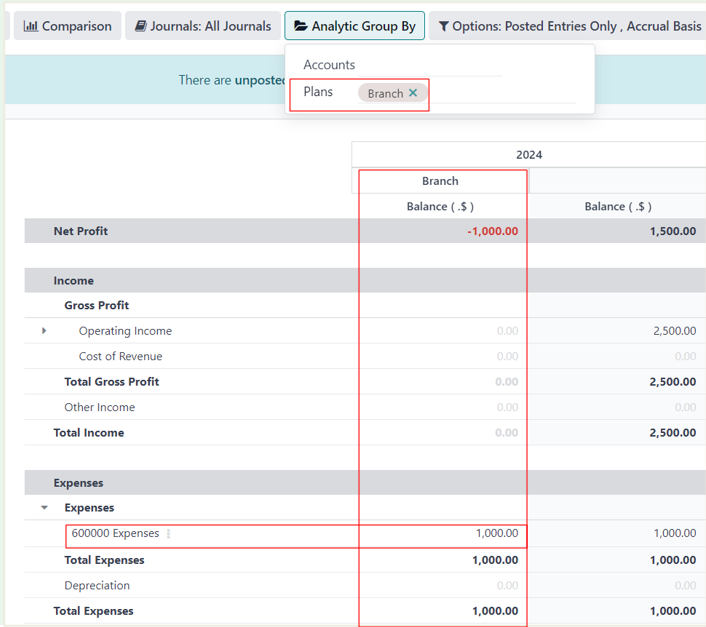

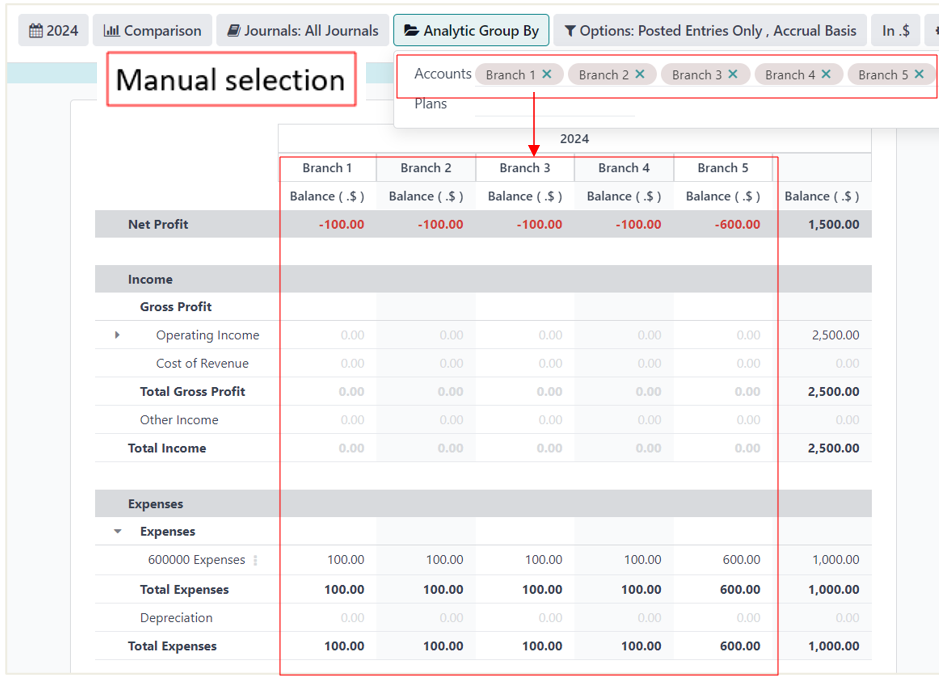

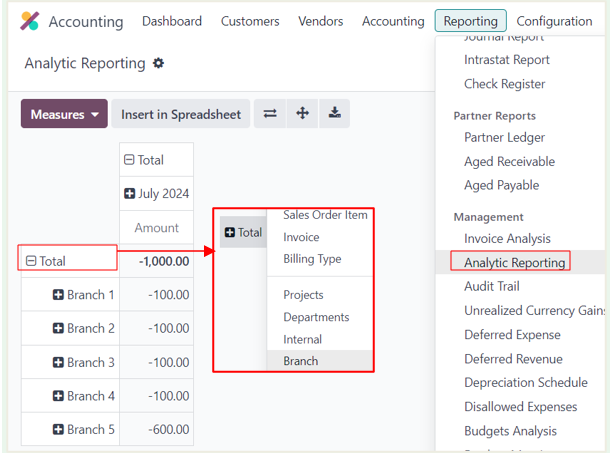

3. Analytic accounts provide access to profit and loss statements for individual branches.