V14

Explanation of the flow:

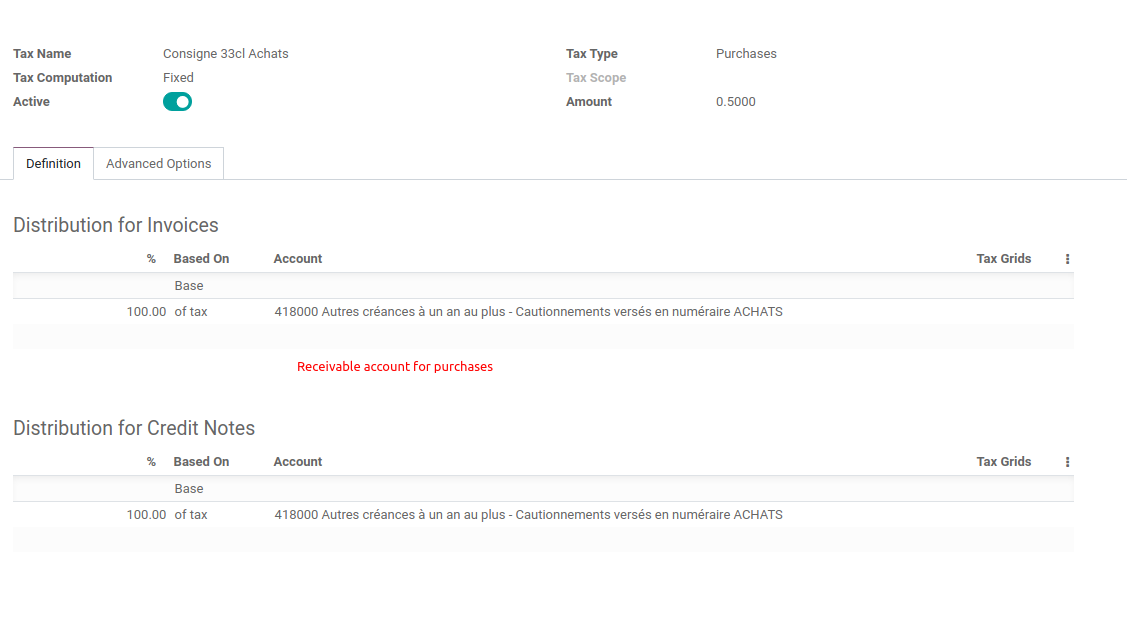

Example of returnable beer bottles (33cl) :

- The supplier sells beers with an extra price of 50 cents on each bottle, refundable if the empty bottle is returned to him.

- The end customer pays the same 50 cents extra price on each beer sold for the bottle.

- The customer get the 50 cents back for each bottle he brings back to the points of sale accepting the empty bottles.

- There is a stock of empty bottles to hold, to be returned to the supplier and get refunded the same amount per bottle.

- The amount is fixed per bottle type (33cl, 75cl,...).

- Not tax to apply on this amount.

How to create this flow and use it in Odoo ?