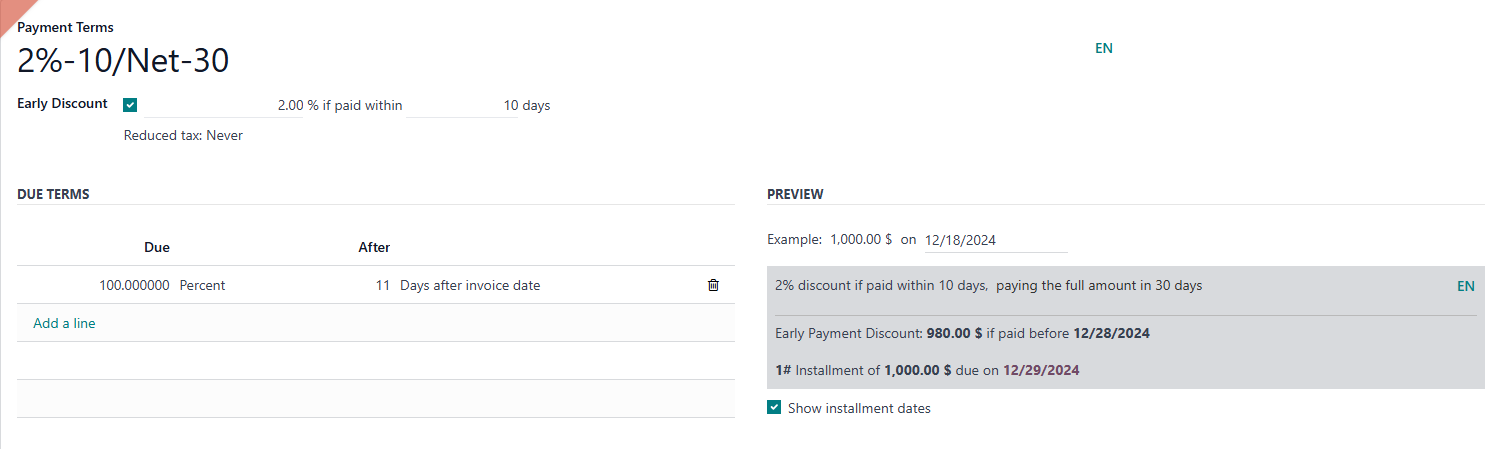

We are trying to set up an early VENDOR payment discount of 2% within 10 days and NET30 on the 11th day

So if paid within 10 days 2% takes off BUT taxes stay the same

so $100 invoice + GST 5% and PST 10% = 115.00

if paid WITHIN 10 days (day 0-10) payment should be $98.00 + the taxes on the original $100.00 do $15.00 for a total of 113.00

When we try this manually from 0-9 days we get ORIGINAL $115.00, if we put payment day on the 10th day then it calculated properly... it's as if it not "within 10 days BUT on the 10th DAY

Is there something that we are missing?