India¶

Installatie¶

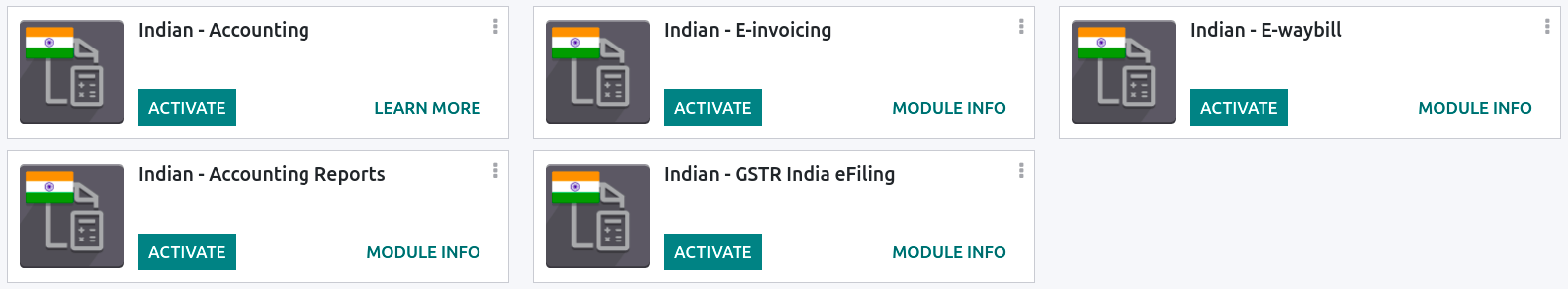

Install the following modules to get all the features of the Indian localization:

Naam |

Technische naam |

Omschrijving |

|---|---|---|

Indian - Accounting |

|

Default fiscal localization package |

Indian E-invoicing |

|

|

Indian E-waybill |

|

|

Indian - Accounting Reports |

|

Indian tax reports |

Indian - Purchase Report(GST) |

|

Indian GST Purchase report |

Indian - Sale Report(GST) |

|

Indian GST Sale report |

Indian - Stock Report(GST) |

|

Indian GST Stock report |

e-Invoice system¶

Odoo is compliant with the Indian Goods and Services Tax (GST) e-Invoice system requirements.

Belangrijk

Indian e-invoicing is available from Odoo 15.0. If needed, upgrade your database.

Instellingen¶

NIC e-Invoice registration¶

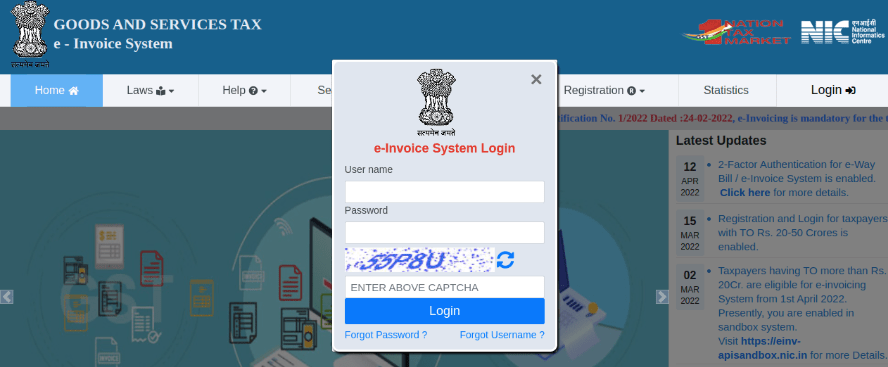

You must register on the NIC e-Invoice portal to get your API credentials. You need these credentials to configure your Odoo Accounting app.

Log in to the NIC e-Invoice portal by clicking Login and entering your Username and Password;

Notitie

If you are already registered on the NIC portal, you can use the same login credentials.

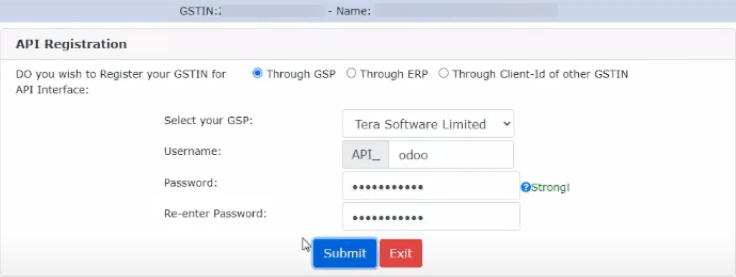

From the dashboard, go to ;

After that, you should receive an OTP code on your registered mobile number. Enter the OTP code and click Verify OTP;

Select Through GSP for the API interface, set Tera Software Limited as GSP, and type in a Username and Password for your API. Once it is done, click Submit.

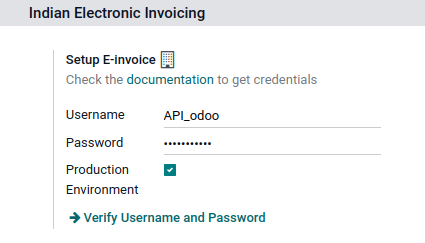

Configuration in Odoo¶

To enable the e-Invoice service in Odoo, go to , and enter the Username and Password previously set for the API.

Dagboeken¶

To automatically send e-Invoices to the NIC e-Invoice portal, you must first configure your sales journal by going to , opening your sales journal, and in the Advanced Settings tab, under Electronic Data Interchange, enable E-Invoice (IN) and save.

Workflow¶

Invoice validation¶

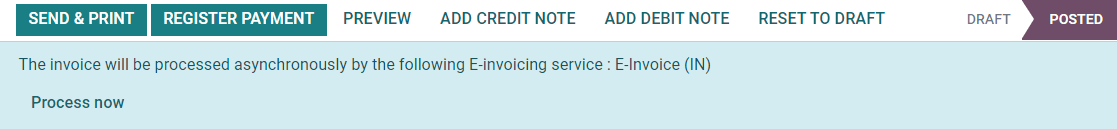

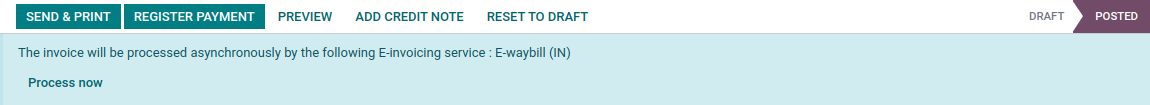

Once an invoice is validated, a confirmation message is displayed at the top. Odoo automatically uploads the JSON-signed file of validated invoices to the NIC e-Invoice portal after some time. If you want to process the invoice immediately, click Process now.

Notitie

You can find the JSON-signed file in the attached files in the chatter.

You can check the document’s EDI status under the EDI Document tab or the Electronic invoicing field of the invoice.

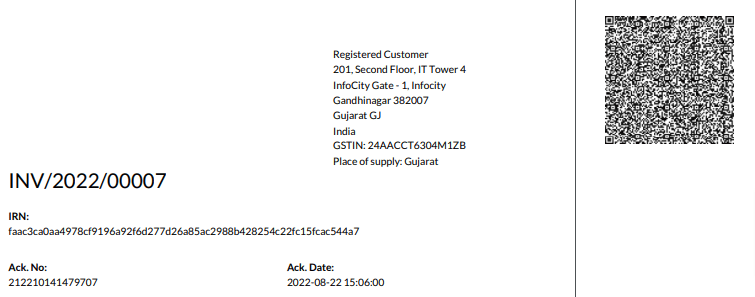

Invoice PDF report¶

Once an invoice is validated and submitted, the invoice PDF report can be printed. The report includes the IRN, Ack. No (acknowledgment number) and Ack. Date (acknowledgment date), and QR code. These certify that the invoice is a valid fiscal document.

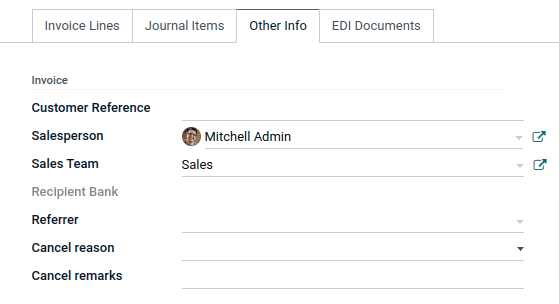

e-Invoice cancellation¶

If you want to cancel an e-Invoice, go to the Other info tab of the invoice and fill out the Cancel reason and Cancel remarks fields. Then, click Request EDI cancellation. The status of the Electronic invoicing field changes to To Cancel.

Belangrijk

Doing so cancels both the e-Invoice and the E-Way bill.

Notitie

If you want to abort the cancellation before processing the invoice, then click Call Off EDI Cancellation.

Once you request to cancel the e-Invoice, Odoo automatically submits the JSON-signed file to the NIC e-Invoice portal. You can click Process now if you want to process the invoice immediately.

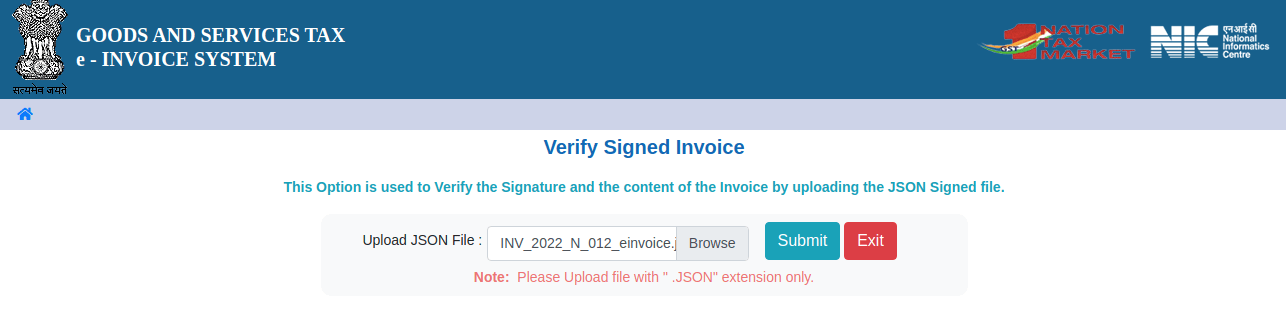

GST e-Invoice verification¶

After submitting an e-Invoice, you can verify if the invoice is signed from the GST e-Invoice system website itself.

Download the JSON file from the attached files. It can be found in the chatter of the related invoice;

Open the NIC e-Invoice portal and go to ;

Select the JSON file and submit it;

If the file is signed, a confirmation message is displayed.

E-Way bill¶

Instellingen¶

Odoo is compliant with the Indian Goods and Services Tax (GST) E-waybill system requirements.

Belangrijk

Indian E-waybill is available from Odoo 15.0. If needed, upgrade your database.

API registration on NIC E-Way bill¶

You must register on the NIC E-Way bill portal to create your API credentials. You need these credentials to configure your Odoo Accounting app.

Log in to the NIC E-Way bill portal by clicking Login and entering your Username and Password;

From your dashboard, go to ;

Click Send OTP. Once you have received the code on your registered mobile number, enter it and click Verify OTP;

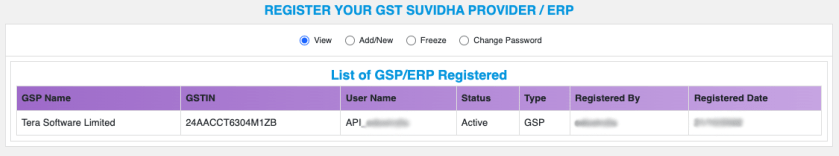

Check if Tera Software Limited is already on the registered GSP/ERP list. If so, use the username and password used to log in to the NIC portal. Otherwise, follow the next steps;

Select Add/New, select Tera Software Limited as your GSP Name, create a Username and a Password for your API, and click Add.

Configuration in Odoo¶

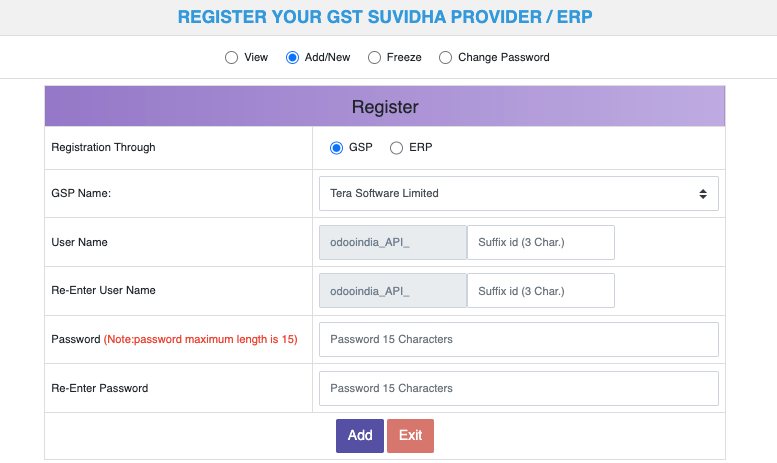

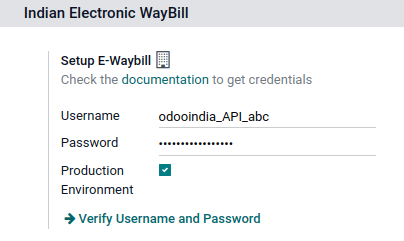

To set up the E-Way bill service, go to , and enter your Username and Password.

Workflow¶

Send an E-Way bill¶

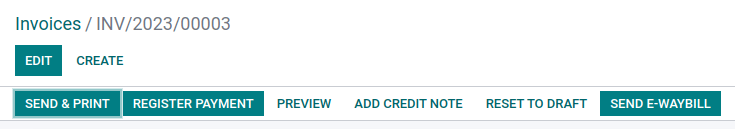

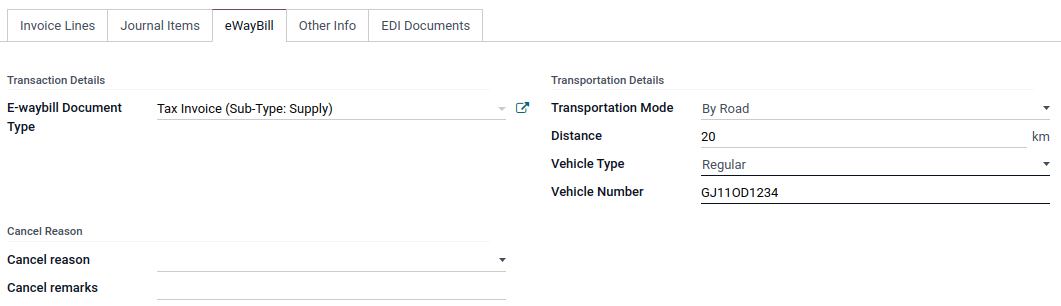

You can manually send an E-Way bill by clicking Send E-Way bill. To send the E-Way bill automatically when an invoice or a bill is confirmed, enable E-Way bill (IN) in your Sales or Purchase journal.

Invoice validation¶

Once an invoice has been issued and sent via Send E-Way bill, a confirmation message is displayed.

Notitie

You can find the JSON-signed file in the attached files in the chatter.

Odoo automatically uploads the JSON-signed file to the government portal after some time. Click Process now if you want to process the invoice immediately.

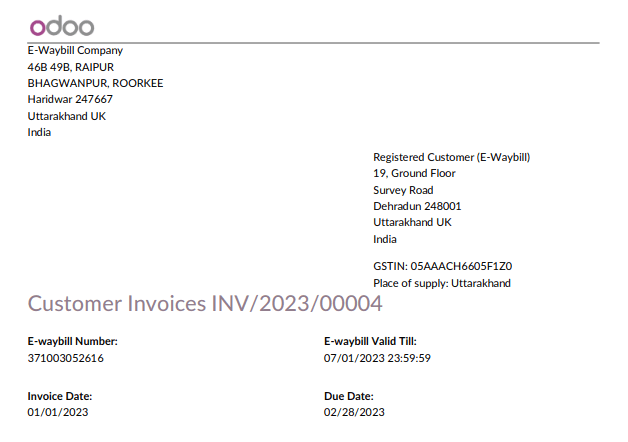

Invoice PDF report¶

You can print the invoice PDF report once you have submitted the E-Way bill. The report includes the E-Way bill number and the E-Way bill validity date.

E-Way bill cancellation¶

If you want to cancel an E-Way bill, go to the E-Way bill tab of the related invoice and fill out the Cancel reason and Cancel remarks fields. Then, click Request EDI Cancellation.

Belangrijk

Doing so cancels both the e-Invoice (if applicable) and the E-Way bill.

Notitie

If you want to abort the cancellation before processing the invoice, click Call Off EDI Cancellation.

Once you request to cancel the E-Way bill, Odoo automatically submits the JSON-signed file to the government portal. You can click Process Now if you want to process the invoice immediately.