Payment terms and installment plans¶

Payment Terms specify all the conditions under which a sale is paid, mostly to ensure customers pay their invoices correctly and on time.

Payment Terms can be applied to sales orders, customer invoices, supplier bills, and contacts. These conditions cover:

The due date

Some discounts

Any other condition on the payment

Defining Payment Terms automatically calculates the payments“ due dates. This is particularly helpful for managing installment plans.

An installment plan allows the customers to pay an invoice in parts, with the amounts and payment dates defined beforehand by the seller.

Examples of Payment Terms:

- Immediate PaymentThe full payment is due on the day of the invoice’s issuance.

- 15 Days (or Net 15)The full payment is due 15 days after the invoice date.

- 21 MFIThe full payment is due by the 21st of the month following the invoice date.

- 2% 10, Net 30 EOM2% cash discount if the payment is received within ten days. Otherwise, the full payment is due at the end of the month following the invoice date.

Примітка

Payment terms are not to be confused with down payment invoices. If, for a specific order, you issue several invoices to your customer, that is neither a payment term nor an installment plan, but an invoicing policy.

Примітка

This document is about the Payment Terms feature, not Terms & Conditions.

Дивись також

Налаштування¶

Go to and click on Create.

The Description on the Invoice is the text displayed on the document (sale order, invoice, etc.).

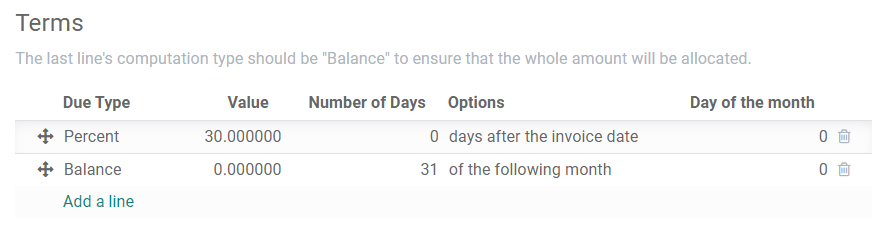

In the Terms section, you can add a set of rules, called terms, to define what needs to be paid and by which due date.

To add a term, click on Add a line, and define its Type, Value, and Due Date Computation.

Важливо

Terms are computed in the order they are set up.

The balance should always be used for the last line.

In the following example, 30% is due on the day of issuance, and the balance is due at the end of the following month.

Використання умов оплати¶

Payment Terms can be defined with the Payment Terms field on:

- ContactsTo set specific payment terms automatically on new sales orders, invoices, and bills of a contact. This can be modified in the contact’s Form View, under the Sales & Purchase tab.

- QuotationsTo set specific payment terms automatically on all invoices generated from a quotation.

- Customer InvoicesTo set specific payment terms on an invoice.

- Vendor BillsTo set specific payment terms on a bill. This is mostly useful when you need to manage vendor terms with several installments. Otherwise, setting the Due Date is enough.

Порада

You can also define a Due Date manually. If Payment Terms are already defined, empty the field so you can select a date.

Записи в журналі¶

Invoices with specific Payment Terms generate different Journal Entries, with one Journal Item for every computed Due Date.

This makes for easier Follow-ups and Reconciliation since Odoo takes each due date into account, rather than just the balance due date. It also helps to get an accurate Aged Receivable report.

In this example, an invoice of $1000 has been issued with the following payment terms: 30% is due on the day of issuance, and the balance is due at the end of the following month.

Рахунок |

Установлений термін |

Дебет |

Кредит |

|---|---|---|---|

Розрахунок з дебіторами |

February 21 |

300 |

|

Розрахунок з дебіторами |

March 31 |

700 |

|

Product Sales |

1000 |

The $1000 debited on the Account Receivable is split into two distinct Journal Items. Both of them have their own Due Date.