Банківські виписки¶

Importing your bank statements in Odoo Accounting allows you to keep track of the financial movements that occur on your bank accounts and reconcile them with the transactions recorded in your accounting.

We recommend you use bank synchronization for more efficiency. Please read the related documentation: Bank synchronization: Automatic import.

However, if you don’t want to use bank synchronization or if your bank is not a supported institution, you still have other options:

Import the bank statement files delivered by your bank

Register the bank statements manually

Import bank statements files¶

Odoo supports multiple file formats to import bank statements:

SEPA recommended Cash Management format (CAMT.053)

Comma-separated values (.CSV)

Відкрити Фінансовий обмін (.OFX)

Швидкий формат обміну (.QIF)

Belgium: Coded Statement of Account (.CODA)

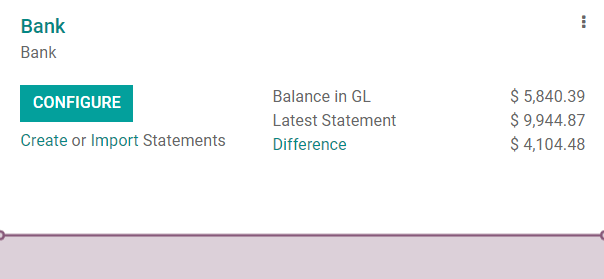

To import them, go to , click on Import Statements, or on the three dots, and then on Import Statement.

Next, select the file you want to import and click on Import.

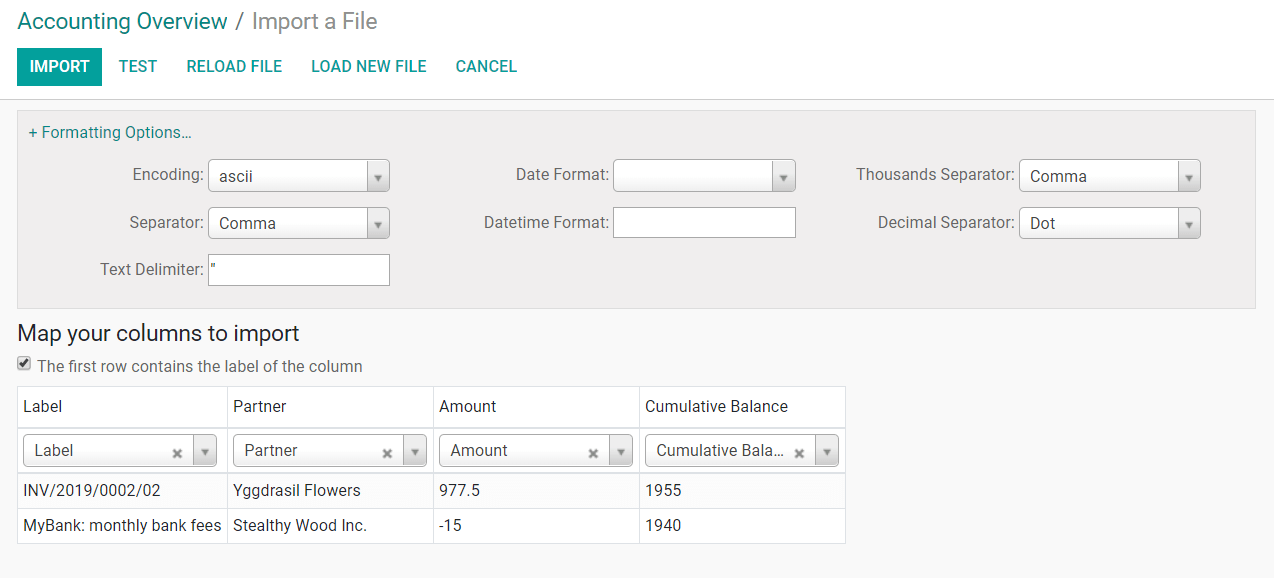

Odoo opens an import widget to help you set the Formatting Options and map the different columns you want to import.

Примітка

Quicken Interchange Format (.QIF) is an older file format that is no longer supported since 2005. If possible, prefer OFX files over QIF.

Реєстрація банківської виписки в Odoo вручну¶

If needed, you can also record your bank statements manually.

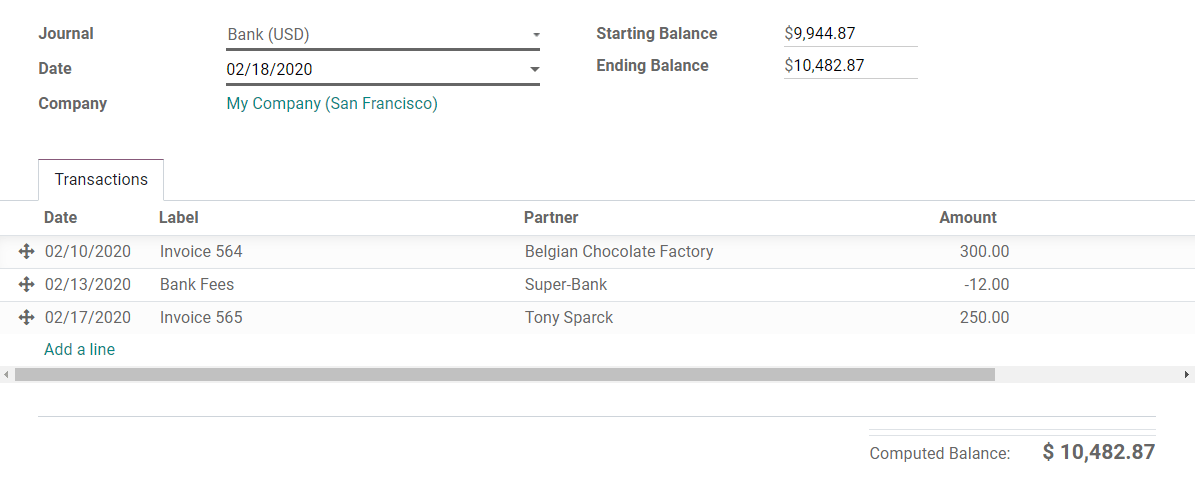

To do so, go to , click on Create Statements, or on the three dots, and then on New Statement.

Add a new line for each transaction written on the original bank statement.

To ease the reconciliation process, make sure to fill out the Partner field. You can also write the payments’ references in the Label field.

Примітка

The Ending Balance and the Computed Balance should have the same amount. If it is not the case, make sure that there is no mistake in the transactions’ amounts.

Дивись також