Chart of accounts¶

The chart of accounts (COA) is the list of all the accounts used to record financial transactions in the general ledger of an organization. The chart of accounts can be found under .

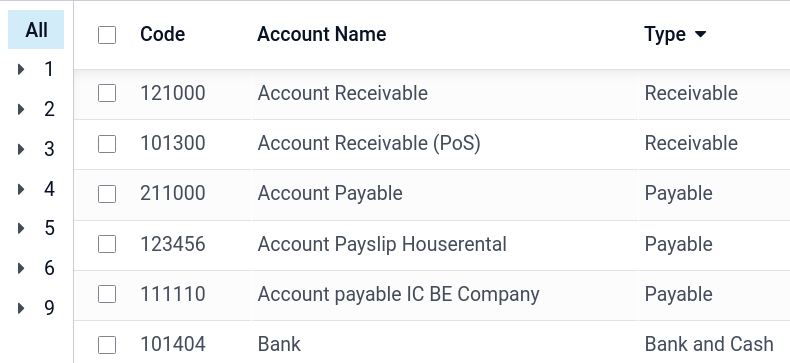

When browsing your chart of accounts, you can sort the accounts by Code, Account Name, or Type, but other options are available in the drop-down menu

Configuration of an account¶

The country you select during the creation of your database (or additional company in your database) determines which fiscal localization package is installed by default. This package includes a standard chart of accounts already configured according to the country’s regulations. You can use it directly or set it according to your company’s needs.

To create a new account, go to , click Create, and fill in (at the minimum) the required fields (Code, Account Name, Type).

Warning

It is not possible to modify the fiscal localization of a company once a journal entry has been posted.

Code and name¶

Each account is identified by its Code and Name, which also indicate the account’s purpose.

Type¶

Correctly configuring the account type is critical as it serves multiple purposes:

Information on the account’s purpose and behavior

Generate country-specific legal and financial reports

Set the rules to close a fiscal year

Generate opening entries

To configure an account type, open the Type field’s drop-down selector and select the corresponding type from the following list:

Report |

Category |

Account Types |

Description |

|---|---|---|---|

Balance Sheet |

Assets |

Receivable |

Money owed to the company by customers for goods or services delivered |

Bank and Cash |

Funds held in company bank accounts or on hand as cash |

||

Current Assets |

Short-term assets expected to be converted into cash within a year |

||

Non-current Assets |

Long-term assets not expected to be converted to cash within a year |

||

Prepayments |

Payments made in advance for goods or services to be received in the future |

||

Fixed Assets |

Tangible long-term assets like buildings, machinery, and vehicles used in operation and subject to depreciation |

||

Liabilities |

Payable |

Money the company owes to suppliers or vendors |

|

Credit Card |

Balances and transactions associated with company credit card usage |

||

Current Liabilities |

Obligations due within one year, such as short-term loans or accrued expenses |

||

Non-current Liabilities |

Long-term debts and financial obligations due beyond one year |

||

Equity |

Equity |

The owner’s residual interest in the company after liabilities are deducted from assets |

|

Current Year Earnings |

The company’s net profit or loss accumulated in the current fiscal year |

||

Profit & Loss |

Income |

Income |

Revenue generated from the company’s primary business activities |

Other Income |

Revenue from secondary or non-operational sources, like interest or asset sales |

||

Expense |

Expense |

Costs incurred during operations to generate revenue |

|

Depreciation |

The allocation of the cost of tangible assets over their useful life |

||

Cost of Revenue |

Direct costs attributable to the production or delivery of goods and services |

||

Other |

Other |

Off-Balance Sheet |

Transactions not displayed on the balance sheet or profit and loss report |

Assets¶

Some account types can automate the creation of asset entries. To automate entries, click View on an account line and go to the Automation tab.

You have three choices for the Automation tab:

No: this is the default value. Nothing happens.

Create in draft: whenever a transaction is posted on the account, a draft entry is created but not validated. You must first fill out the corresponding form.

Create and validate: you must also select a Deferred Expense Model. Whenever a transaction is posted on the account, an entry is created and immediately validated.

Default taxes¶

In the View menu of an account, select a default tax to be applied when this account is chosen for a product sale or purchase.

Account groups¶

Account groups are useful to list multiple accounts as sub-accounts of a bigger account and

thus consolidate reports such as the Trial Balance. By default, groups are handled automatically

based on the code of the group. For example, a new account 131200 is going to be part of the group

131000. You can attribute a specific group to an account in the Group field under

View.

Create account groups manually¶

Note

Regular users should not need to create account groups manually. The following section is only intended for rare and advanced use cases.

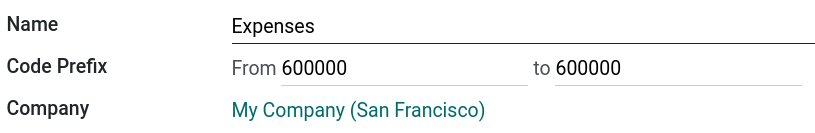

To create a new account group, activate developer mode and head to . Here, create a new group and enter the name, code prefix, and company to which that group account should be available. Note that you must enter the same code prefix in both From and to fields.

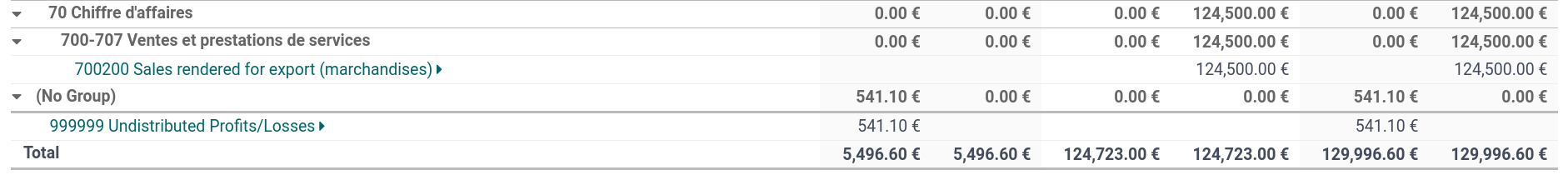

To display your Trial Balance report with your account groups, go to , then open the Options menu and select Hierarchy and Subtotals.

Allow reconciliation¶

To keep the reconciliation process simple, when reconciling a bank, cash, or credit card transaction with an existing journal item, only journal items that debit or credit accounts with the Allow reconciliation option enabled are displayed as possible matches.

To enable this option on an account, tick the Allow Reconciliation checkbox in the account’s settings, and Save; or enable the button from the chart of accounts view.

Deprecated¶

It is not possible to delete an account once a transaction has been recorded on it. You can make them unusable by using the Deprecated feature: check the Deprecated box in the account’s settings, and Save.