Brazil¶

See also

Helpful resources for the Brazilian localization, including onboarding materials and videos:

Modules¶

The following modules related to the Brazilian localization are available:

Name |

Technical name |

Description |

|---|---|---|

Brazilian - Accounting |

|

Brazilian fiscal localization package, complete with the Brazilian chart of accounts, taxes, tax report, fiscal positions, and document and identification types. |

Brazil - Accounting Reports |

|

Accounting reports for Brazil. |

AvaTax Brazil, Avatax Brazil Sale & Test SOs for the Brazilian Avatax |

|

Goods and Services tax computation through Avalara. |

Brazilian Accounting EDI |

|

Provides electronic invoicing through Avatax. |

Brazilian Accounting EDI For Sale |

|

Adds some fields to sale orders that are carried over the invoice. |

Brazilian Accounting EDI for POS |

|

Provides electronic invoicing through Avatax in the POS. |

Brazilian Accounting EDI for eCommerce |

|

Allows tax calculation and EDI for eCommerce users. |

Brazilian Accounting EDI for stock |

|

Adds delivery-related information to the NF-e. |

Brazil - Website Sale |

|

Allows tax calculation and EDI for eCommerce users. |

Brazil - Sale |

|

Sale modifications for Brazil |

Brazil - Sale Subscription |

|

Sale subscription modifications for Brazil |

Note

The localization’s core modules are installed automatically with the localization. The rest can be manually installed.

Localization overview¶

The Brazilian localization package ensures compliance with Brazilian fiscal and accounting regulations. It includes tools for managing taxes, fiscal positions, reporting, and a predefined chart of accounts tailored to Brazil’s standards.

The Brazilian localization package provides the following key features to ensure compliance with local fiscal and accounting regulations:

Chart of accounts: a predefined structure tailored to Brazilian accounting standards

Taxes: pre-configured tax rates, including standard VAT, zero-rated, and exempt options.

Chart of accounts¶

In the chart of accounts, the accounts are mapped automatically to their corresponding taxes, and the default account payable and account receivable fields.

Note

The Brazil chart of accounts is based on the SPED CoA, which provides a baseline of the necessary accounts.

Taxes¶

Taxes are automatically created and configured when installing the Brazilian localization. Avalara uses some to compute taxes on sales orders or invoices.

Taxes used for services must be manually added and configured, as the rate may differ depending on the city where the service is offered.

Important

NFS-e can’t be issued for service taxes created manually. To electronically send an NFS-e, compute taxes using Avalara.

Warning

Do not delete taxes, as they are used for the AvaTax tax computation. If deleted, Odoo creates them again when used in an SO or invoice, computing taxes with AvaTax. However, the account used to register the tax must be reconfigured in the tax’s Definition tab, under the Distribution for invoices and Distribution for refunds sections.

Company and contacts¶

To use all the features of this fiscal localization, the following fields are required on the company record:

Name

Address: add City, State, Zip Code, Country

In the Street field, enter the street name, number, and any additional address information.

In the Street 2 field, enter the neighborhood.

Identification Number: CNPJ or CPF

Tax ID: associated with the identification type

IE: State registration

IM: Municipal registration

SUFRAMA code: Superintendence of the Manaus Free Trade Zone - add if applicable

Phone

Email

Configure the Fiscal Information within the Sales and Purchase tab:

Add the Fiscal Position for AvaTax Brazil.

Tax Regime: Federal Tax Regime

ICMS Taxpayer Type: indicates ICMS regime, Exempt status, or Non-Taxpayer

Main Activity Sector

Configure the following extra Fiscal Information to issue NFS-e:

Add the Fiscal Position for AvaTax Brazil.

COFINS Details: Taxable, Not Taxable, Taxable with rate 0%, Exempt, Suspended

PIS Details Taxable, Not Taxable, Taxable with rate 0%, Exempt, Suspended

CSLL Taxable if the company is subject to CSLL or not

Tip

If it is a simplified regime, the ICMS rate must be configured. To do so, go to , scroll down to the Taxes section, and set the Sales Tax and Purchase Tax fields in the Default Taxes section.

The same configuration applies to the relevant contact form when using the AvaTax integration.

Note

Select the Company option for a contact with a tax ID (CNPJ), or check Individual for a contact with a CPF.

AvaTax integration¶

Note

Make sure to install the AvaTax Brazil (

l10n_br_avatax) module.Odoo is a certified partner of Avalara Brazil.

The Avalara AvaTax integration uses In-App-Purchases (IAPs) to compute taxes and handle electronic documents (e.g., NF-e, NFS-e). Each action consumes credits from the IAP credit balance. On creation, new databases receive 500 free credits.

To compute the goods and services tax and process electronic invoices, the following configurations are needed:

Configuration¶

Credentials¶

Activate AvaTax in Odoo and, in the AvaTax Brazil section, add the administrator’s email address for the AvaTax portal in the AvaTax Portal Email field, then click Create account.

Warning

When testing or creating a production AvaTax Portal Email integration in a sandbox or production database, use a real email address, as it is needed to connect to Avalara and set up the certificates, whether to test or use it on production.

There are two different Brazilian Avalara Portals:

One for testing: https://portal.sandbox.avalarabrasil.com.br/

One for production: https://portal.avalarabrasil.com.br/

When the account is created from Odoo, select the right environment. Moreover, the email used to open the account cannot be used to open another account. Save the API ID and API Key when the account is created from Odoo.

After the account is created from Odoo, go to the Avalara Portal to set up the password:

Access the Avalara portal.

Click Meu primeiro acesso.

Add the email address used in Odoo to create the Avalara/AvaTax account, and click Solicitar Senha.

An email will then be received with a token and a link to create a password. Click on this link and copy-paste the token to allocate the desired password.

Tip

If you use AvaTax in Odoo for tax computation only, setting a password or accessing the Avalara portal is unnecessary. However, to use the electronic invoice service, access to AvaTax is needed, and the certificate must be uploaded.

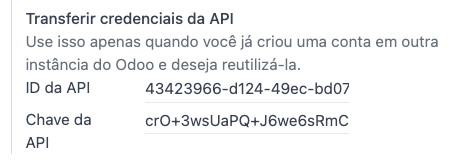

Note

API credentials can be transferred. This option should be used only when an account has already been created in another Odoo instance and must be reused.

A1 certificate upload¶

To issue electronic invoices, a certificate must be uploaded to the AvaTax portal.

The certificate will be synchronized with Odoo as long as the external identifier number in the AvaTax portal matches, without special characters, with the CNPJ number, and the identification number (CNPJ) in Odoo matches the CNPJ in AvaTax.

Important

Some cities require the certificate to be linked within the City Portal system before issuing NFS-e from Odoo.

If an error message from the city that says Your certificate is not linked to the user is received, this process needs to be done in the city portal.

Fiscal positions¶

To set up the Automatic Tax Mapping (Avalara Brazil) fiscal position, enable the Detect Automatically and Use AvaTax Brazil API options.

See also

Products¶

To use the AvaTax integration on sales orders and invoices, enter the following information in the Sales tab of the product form under the Brazil Accounting section, based on how the product will be used.

E-invoices for goods (NF-e)¶

Important

The Avalara integration works on a credit-based system, where each interaction with Avalara consumes one credit. Below are the main credit-consuming operations:

Sales application

Tax calculation on quotations and sales orders.

Accounting application

Tax calculation on invoices.

Electronic invoice submission (NF-e or NFS-e).

Occasional operations: (each step is billed separately)

Note

If taxes are calculated in the Sales app, and the invoice is later issued in the Accounting app, the calculation happens twice, consuming two credits.

Example

CEST Code: tax classification code identifying goods and products subject to tax substitution under ICMS regulations, and helps determine the applicable tax treatment and procedures for specific items. The product’s applicability to this requirement can be verified at https://www.codigocest.com.br/.

Mercosul NCM Code: Mercosur Common Nomenclature Product Code

Source of Origin: origin of the product, which can be foreign or domestic, among other possible options, depending on the specific use case

SPED Fiscal Product Type: fiscal product type according to the SPED list table

Purpose of Use: intended purpose of use for this product

Note

Odoo automatically creates three products to be used for transportation costs associated with sales. These are named Freight, Insurance, and Other Costs and are already configured. If more need to be created, duplicate and use the same configuration:

Product Type Service

Transportation Cost Type: Insurance, Freight, or Other Costs

E-invoices for services (NFS-e)¶

Important

The Avalara integration works on a credit-based system, where each interaction with Avalara consumes one credit. Below are the main credit-consuming operations:

Sales application

Tax calculation on quotations and sales orders.

Accounting application

Tax calculation on invoices.

Electronic invoice submission (NF-e or NFS-e).

Invoice status check (1 credit is consumed each time the invoice status is checked).

Occasional operations: (each step is billed separately)

Note

If taxes are calculated in the Sales app and the invoice is later issued in the Accounting app, the calculation happens twice, consuming two credits.

Example

Mercosul NCM Code: Mercosur Common Nomenclature Product Code

Purpose of Use: intended purpose of use for this product

Service Code Origin: City Service Code where the provider is registered

Labor Assignment: checkbox to select if the service involves labor

Transport Cost Type: type of transport costs to select

Service Codes: City Service Code where the service will be provided; if no code is added, the Service Code Origin will be used.

Tax computation¶

See also

Tax calculations on quotations and sales orders¶

Trigger an API call to calculate taxes on a quotation or sales order automatically with AvaTax in any of the following ways:

- Quotation confirmation

Confirm a quotation into a sales order.

- Manual trigger

Click Compute Taxes Using AvaTax.

- Preview

Click Preview.

- Email a quotation/sales order

Send a quotation or sales order to a customer via email.

- Online quotation access

When a customer accesses the quotation online (via the portal view), the API call is triggered.

Tax calculations on invoices¶

Trigger an API call to calculate taxes on a customer invoice automatically with AvaTax in any of the following ways:

- Manual trigger

Click Compute Taxes Using AvaTax.

- Preview

Click Preview.

- Online invoice access

When a customer accesses the invoice online (via the portal view), the API call is triggered.

Note

The Fiscal Position must be set to Automatic Tax Mapping (Avalara Brazil) for any

of these actions to compute taxes automatically.

Accounting¶

Electronic documents¶

Configuration¶

A series number is linked to a sequence number range for electronic invoices. To configure the series number on a sales journal, go to and set it in the Series field. If more than one series is needed, a new sales journal must be created, and a new series number must be assigned for each series.

Enable the Use Documents? option as the Series field will only be displayed if the Use Documents? option is selected on the journal.

When issuing electronic and non-electronic invoices, the Type field selects the document type used when creating the invoice.

Note

When creating the journal, ensure the Dedicated Credit Note Sequence field in the Accounting Information section is unchecked, as in Brazil, sequences between invoices, credit notes, and debit notes are shared per series number, which means per journal.

Customer invoices¶

To process an electronic invoice for goods (NF-e) or services (NFS-e), the invoice must be confirmed and taxes must be computed by Avalara. The following fields must be filled out:

Customer, with all customer information

Payment Method: Brazil: Specify the expected payment method.

Document Type: Select (55) Electronic Invoice (NF-e) or (SE) Electronic Service Invoice (NFS-e).

Other Info tab:

Fiscal Position set as Automatic Tax Mapping (Avalara Brazil).

Some optional fields depend on the nature of the transaction. These fields in the Other Info tab are not required, so in most cases, leaving them blank will not result in errors from the government when the invoice is submitted:

Freight Model determines how the goods are planned to be transported - domestic.

Transporter Brazil determines who is doing the transportation.

Then, click Send. In the Print & Send window, click Process e-invoice and any other options, such as Download or Email. Finally, click Send to process the invoice with the government.

Note

All fields available on the invoice used to issue an electronic invoice are also available on the sales order, if needed. When creating the first invoice, the Document Number field is displayed and allocated as the first number to be used sequentially for subsequent invoices.

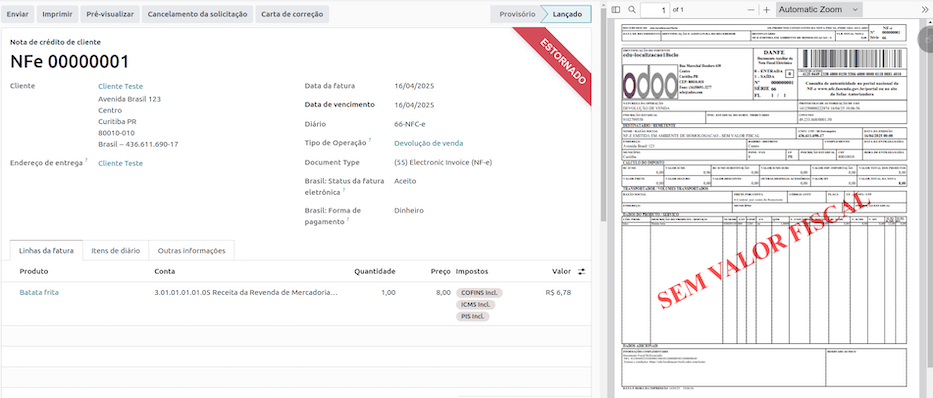

Credit notes¶

If a sales return needs to be registered, a credit note can be created in Odoo and sent to the government for validation.

Note

Credit notes are only available for electronic invoices for goods (NF-e).

Debit notes¶

If additional information needs to be included or values that were not accurately provided in the original invoice need to be corrected, a debit note can be issued.

Note

Debit notes are only available for electronic invoices for goods (NF-e).

Only the products included in the original invoice can be included in the debit note. While changes can be made to the product’s unit price or quantity, products cannot be added to the debit note. The purpose of this document is only to declare the amount to be added to the original invoice for the same or fewer products.

Invoice cancellation¶

It is possible to cancel an electronic invoice that the government validated.

Note

Check whether the electronic invoice is still within the cancellation deadline, which may vary according to each state’s legislation.

E-invoices for goods (NF-e)¶

To cancel an e-invoice for goods (NF-e) in Odoo, click Request Cancel and add a cancellation Reason on the pop-up that appears. To send this cancellation reason to the customer via email, enable the E-mail checkbox.

Note

This is an electronic cancellation, which means that Odoo will send a request to the government to cancel the NF-e. It will then consume one IAP credit, as an API call occurs.

E-invoices for services (NFS-e)¶

To cancel an e-invoice for services (NFS-e) in Odoo, click Request Cancel. There is no electronic cancellation process in this case, as not every city has this service available. The user needs to cancel this NFS-e on the city portal manually. Once that step is completed, they can request the cancellation in Odoo, which will cancel the invoice.

Correction letter¶

A correction letter can be created and linked to an electronic invoice for goods (NF-e) that the government validated.

To do so in Odoo, click Correction Letter and add a correction Reason to the pop-up. To send the correction reason to a customer via email, enable the E-mail checkbox.

Note

Correction letters are only available for electronic invoices for goods (NF-e).

Invoice number range invalidation¶

A range of sequences that are assigned to sales journals can be invalidated by the government if they are not currently used and will not be used in the future. To do so, go to , open the journal, click the (gear) icon, and select Invalidate Number Range (BR). On the Invalidate Number Range (BR) wizard, add the Initial Number and End Number of the range that should be cancelled, and enter an invalidation Reason.

Note

Invoice number range invalidation is only available for electronic invoices for goods (NF-e).

The journal’s chatter records the log of the cancelled numbers, along with the XML file.

Vendor bills¶

When receiving an invoice from a supplier, encode the bill in Odoo by adding all the commercial information and the same Brazilian-specific information recorded on the customer invoices.

These Brazilian-specific fields are:

Payment Method: Brazil: Specify the expected payment method.

Document Type: used by the vendor

Document Number: the invoice number from the supplier

Freight Model: NF-e specific how goods are planned to be transported - domestic

Transporter Brazil: NF-e specific who is doing the transportation.

Point of sale NFC-e¶

The NFC-e is a legal document that supports selling goods or merchandise to the final customer. Like the NF-e, the electronic customer invoice is also issued in XML file format and has an auxiliary document (DANFC-e) known as the NFC-e Summary. This electronic document can be issued through Odoo Point of Sale.

Its legal validity is guaranteed by the digital signature and by each Brazilian state’s SEFAZ (Secretaria da Fazenda).

Important

The Avalara integration operates on a credit-based system. Each operation that involves communication with Avalara consumes one credit. The following operations within the Point of Sale (POS) application are subject to credit consumption:

Tax calculation at the time of sale

Electronic invoice issuance (NFC-e)

Note

Each step is billed separately. For example, calculating taxes and issuing an invoice for the same POS transaction consumes two credits.

See also

Configuration¶

Install the Brazilian Accounting EDI for POS (l10nbr_edi_pos)

module and make sure to activate AvaTax.

CSC details¶

Go to and scroll to the Taxes section. In the NFC-e configuration section, complete the following CSC (Taxpayer Security Code) fields:

CSC ID: The CSC ID or CSC Token is an identification of the taxpayer security code, which can have 1 to 6 digits and is available on the official website of your state’s Department of Finance (SEFAZ).

CSC Number: The CSC Number is a code of up to 36 characters that only you and the Department of Finance know. It is used to generate the QR Code of the NFC-e and ensure the authenticity of the DANFE.

Note

The information required for these fields can be generated through the SEFAZ website of each Brazilian State by the company’s accountant.

Product configuration¶

Access the relevant product form in POS, then configure the product’s Brazil Accounting fields.

Point of sale¶

Go to and make sure that the relevant Point of Sale is selected at the top of the screen. Then, scroll to the Accounting section and configure the Brazilian EDI fields:

Series

Next number: the next NFC-e number in the sequence to be issued, for instance, if the last number issued in SEFAZ is

100, the Next number will be101.

Workflow¶

Generating an NFC-e¶

To generate an NFC-e, follow these steps:

Validate the payment to calculate taxes and issue an NFC-e. The valid NFC-e appears on the right side of the screen.

Note

It is also possible to issue an NFC-e that identifies the customer by their CPF/CNPJ. To do so, click Customer, search for the customer, or create a new one.

The following are mandatory fields to issue a CPF/CNPJ identified NFC-e:

Name

City and State where the invoice is being issued

CPF/CNPJ

Click Validate. The NFC-e appears, highlighting the customer’s CPF on the print.

Click Print or Send via e-mail to deliver the invoice to the customer.

NFC-e ticket print¶

After generating and validating the NFC-e, click Print to deliver the invoice.

Note

The Odoo NFC-e feature is compatible with any thermal printer and does not require an Odoo IoT Box.

Re-issuing a PoS order with an NFC-e error¶

If the NFC-e returns an error, follow these steps:

Correct the error.

Re-issue the NFC-e by clicking the (menu) icon and selecting Orders.

Filter the list to show only Paid orders and click Details. The error is displayed.

Click Send NFC-e.

Note

If the error has been corrected and the PoS session is closed, Odoo logs the tax adjustment in the chatter of the related journal entry. The journal entry for the order indicates that the taxes were incorrectly calculated. In this case, reprocessing the NFC-e is required.

NFC-e refunds & cancellations¶

Refunds can be processed directly in Odoo, but cancellations must be performed through the official government portal.

When the process is finalized, the approved return NF-e is created, meaning the previous NFC-e is canceled.

Important

SEFAZ only allows cancellation of an NFC-e within 30 minutes of its issuance on the SEFAZ website. After this period, a manual refund must be processed, along with the issuance of a Return of Goods NF-e.