Mise en place d’arrondis d’espèces¶

In some currencies, the smallest coins do not exist. For example, in Switzerland, there is no coin for 0.01 CHF. For this reason, if invoices are paid in cash, you have to round their total amount to the smallest coin that exist in the currency. For the CHF, the smallest coin is 0.05 CHF.

There are two strategies for the rounding:

Add a line on the invoice for the rounding

Add the rounding in the tax amount

Both strategies are applicable in Odoo.

Configuration¶

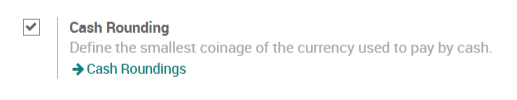

First, you have to activate the feature. For this, go in and activate the Cash Rounding.

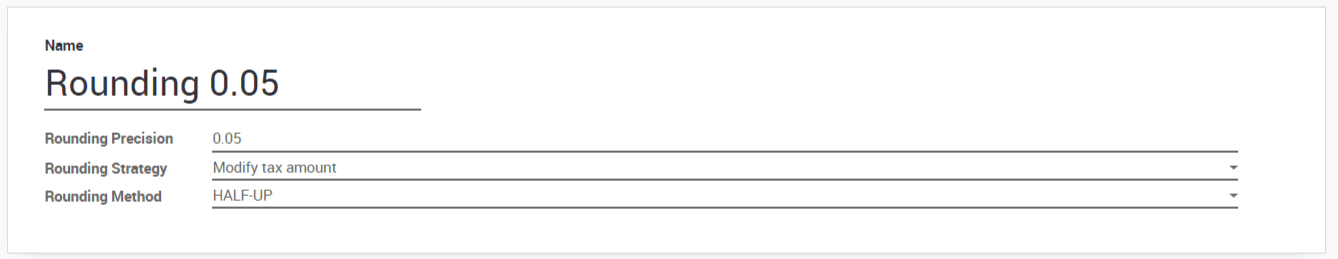

Il existe un nouveau menu pour gérer les arrondis d’espèces dans :menuselection: Comptabilité -> Configuration -> Gestion -> Arrondi d'espèces.

Now, you can create cash roundings. You can choose between two rounding strategies:

Add a rounding line: if a rounding is necessary, Odoo will add a line on your customer invoice to take this rounding into account. You also have to define the account in which the rounding will go.

Modifier le montant de la taxe: Odoo ajoutera l’arrondi au montant de la taxe la plus élevée.

Apply roundings¶

Once your roundings are created, you can apply them on customer invoices. On the customer invoices, there is a new field called Cash Rounding Method where you can simply choose one of the rounding methods created previously. If needed, a rounding will be applied to the invoice.