Follow-up on invoices¶

A follow-up message can be sent to customers when a payment is overdue. Odoo helps you identify late payments and allows you to schedule and send the appropriate reminders using follow-up actions that automatically trigger one or more actions according to the number of overdue days. You can send your follow-ups via different means, such as email, post, or SMS.

See also

Configuration¶

To configure a Follow-Up Action, go to . Several follow-up actions are available by default, but you can create new ones if required, and can change the name and the number of days after which the follow-up actions are triggered. The follow-up Actions available are:

Send an email;

Print a letter;

Manual action (creates a task).

It is possible to automatically send a reminder by enabling the Auto Execute option, and attaching the open invoice(s) by enabling Join open invoices, within a specific follow-up action.

Depending on the Actions enabled, the Message tab contains different message options:

The Email Subject and the Description or content of the email automatically used;

If you selected SMS, the content of the SMS text;

If you enabled Manual Action, you can assign someone in the Assign a Responsible field to manage that follow-up and the Manual Action Type (Email, Call, etc.), as well as input a description of the Action To Do.

Note

The text between %(text)s automatically fetches the partner’s info.

%(partner_name)s: Partner name;

%(date)s: Current date;

%(amount_due)s: Amount due by the partner;

%(user_signature)s: User name;

%(company_name)s: User’s company name.

Tip

Set a negative number of days to send a reminder before the actual due date.

Follow-up reports¶

Overdue invoices you need to follow up on are available in . By default, Odoo filters by Customer Invoices that are In need of action.

When selecting an invoice, you see all of the customer’s unpaid invoices (overdue or not), and their payments. The due dates of late invoices appear in red. Select the invoices that are not late by clicking the Excluded column to exclude them from the reminder you send.

It is up to you to decide how to remind your customer. You can select Print Letter, Send By Email, Send By Post, Send By SMS. Then, click on Done to view the next follow-up that needs your attention.

Note

The contact information on the invoice or the contact form is used to send the reminder.

When the reminder is sent, it is documented in the chatter of the invoice.

If it is not the right time for a reminder, you can specify the Next Reminder Date and click on Remind me later. You will get the next report according to the next reminder date set on the statement.

Tip

Reconcile all bank statements right before launching the follow-up process to avoid sending a reminder to a customer that has already paid.

Debtor’s trust level¶

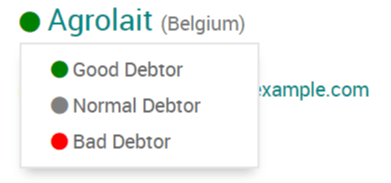

To know whether a customer usually pays late or not, you can set a trust level by marking them as Good Debtor, Normal Debtor, or Bad Debtor on their follow-up report. To do so, click on the bullet next to the customer’s name and select a trust level.

Send reminders in batches¶

You can send reminder emails in batches from the Follow-up Reports page. To do so, select all the reports you would like to process, click on the Action gear icon, and select Process follow-ups.