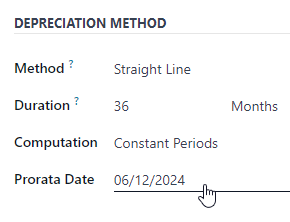

I had an asset in June 2024 that depreciated monthly with a straight line method with no prorata but the Depreciation Board starts with January 2024

How can I solve this to start to compute depreciation at the end of June

I don't want to start depreciating at the start of the year.

I want to start depreciating at the end of the month in which I purchased the asset.