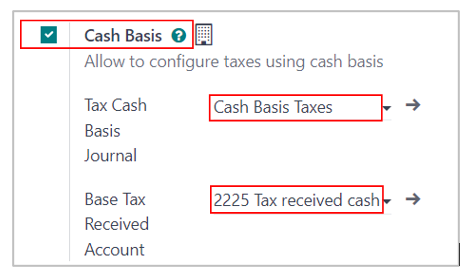

Prerequisite:

This article includes intricate tax configuration and cash basis tax features. The screenshot provided pertains to version 17 and the USA localization; nevertheless, the process should apply to the majority of versions.

Purpose:

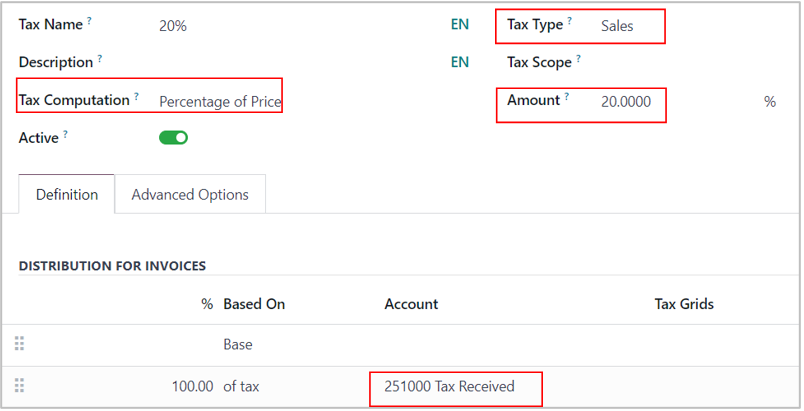

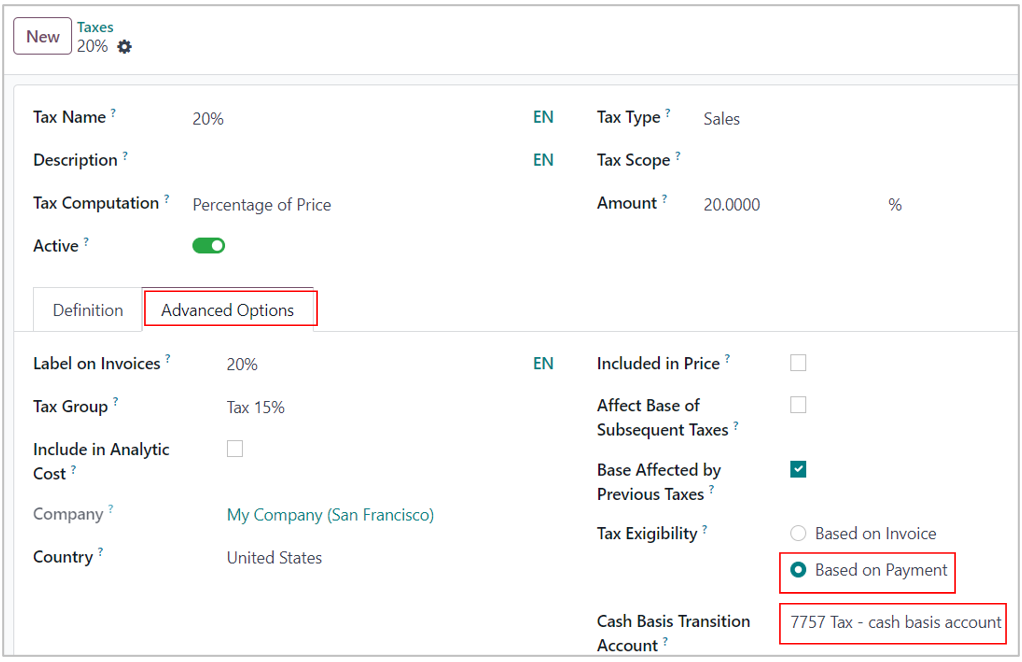

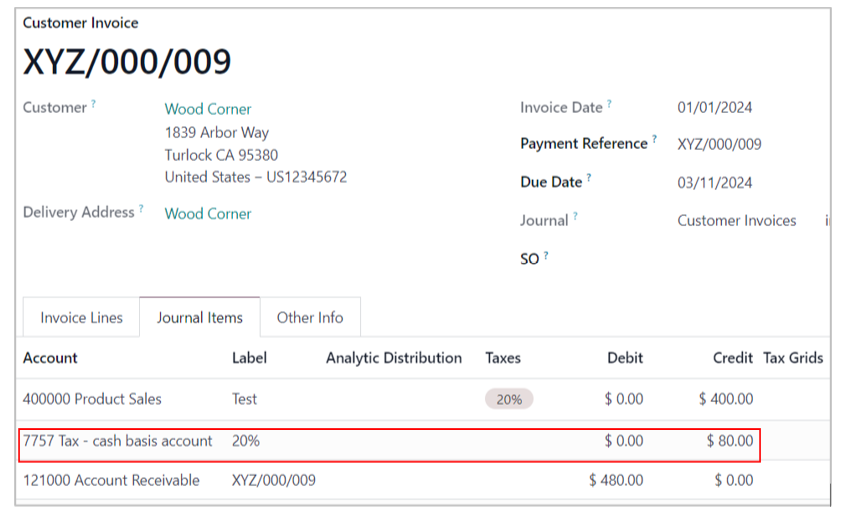

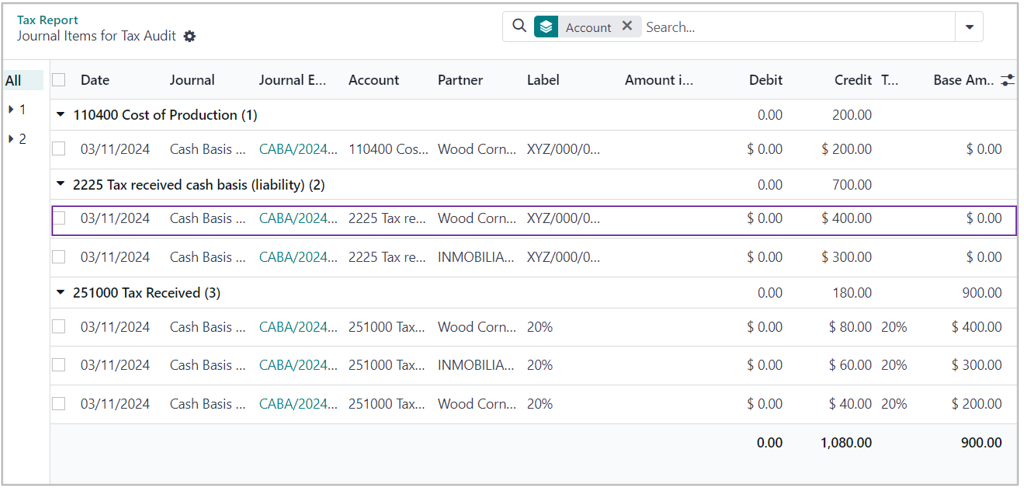

The regular tax is recorded on the invoice date.

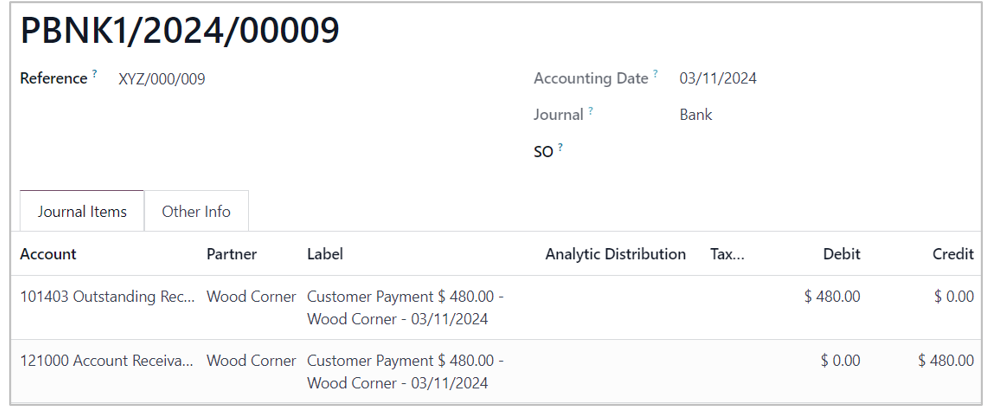

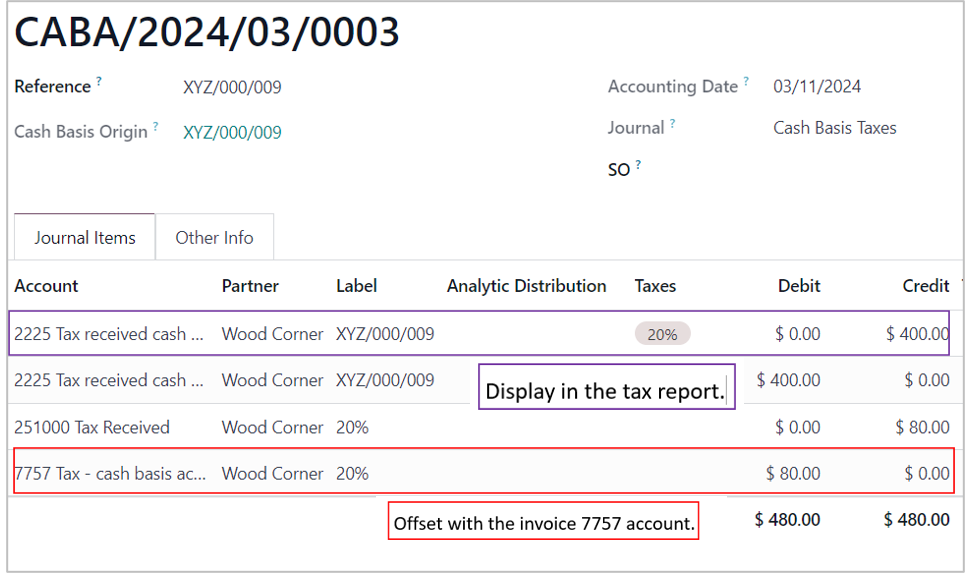

Conversely, Odoo offers a customized cash basis tax that is recorded according to the payment date.