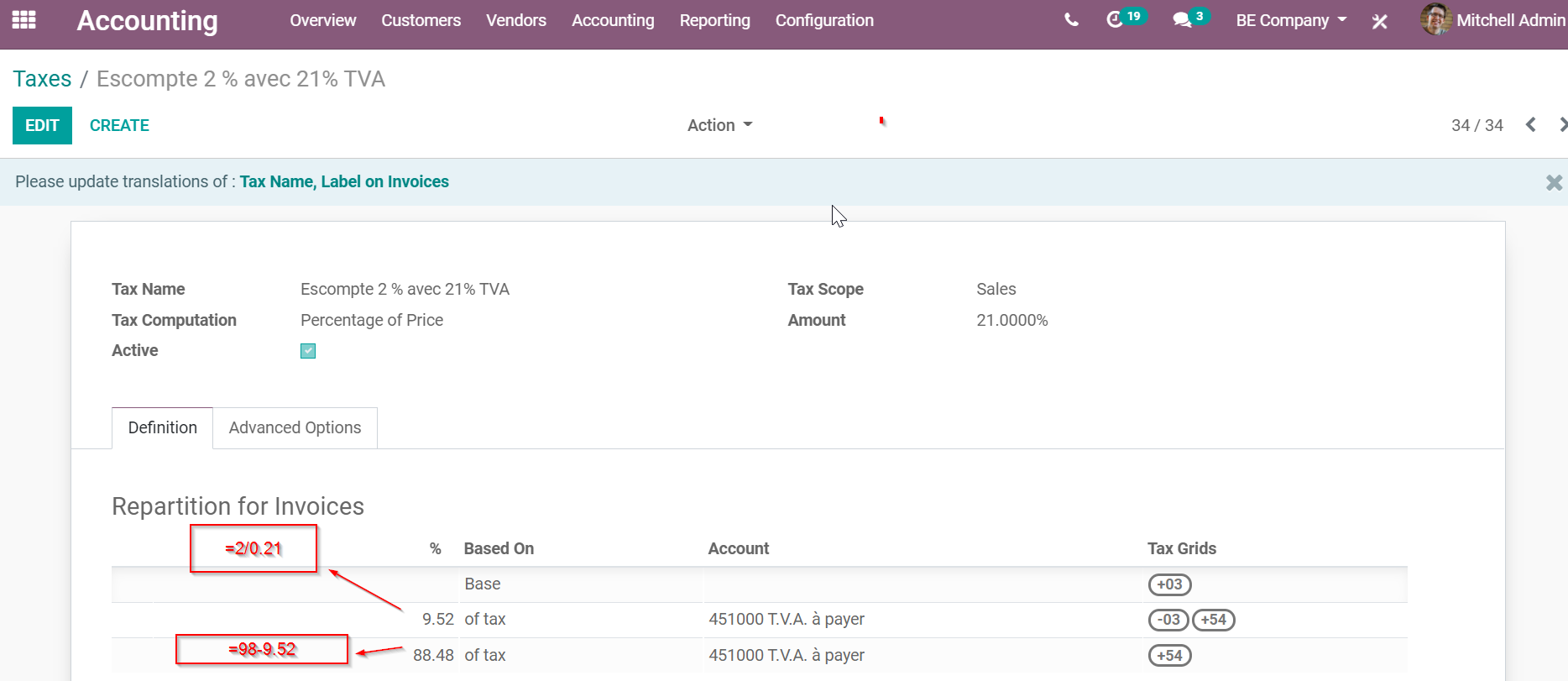

In Belgium the cash discount (= escompte/korting) is quite specific.

The cash discount impacts the basis to calculate the VAT amount and the basis itself.

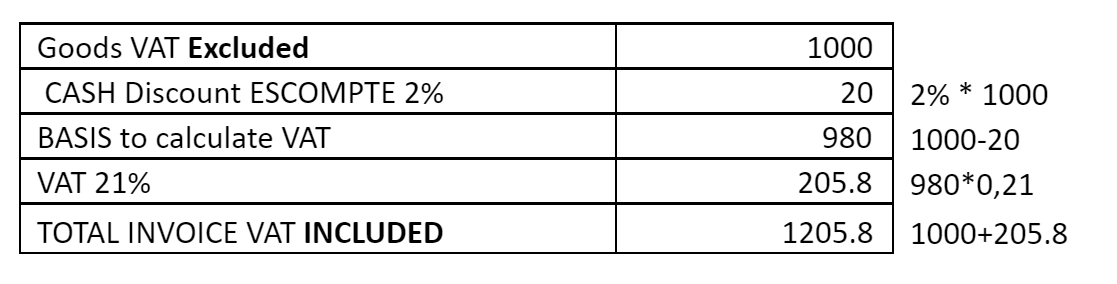

If we take the following example:

You sell goods for 1.000€ VAT Excluded

You give 2% cash discount to your client if he pays you during 7 days after the invoice date.

The following calculation has to be done:

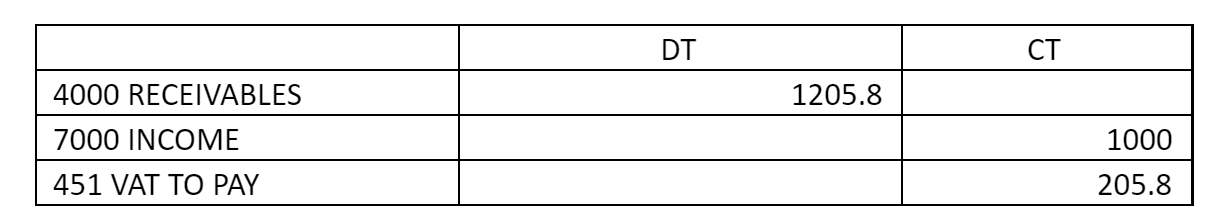

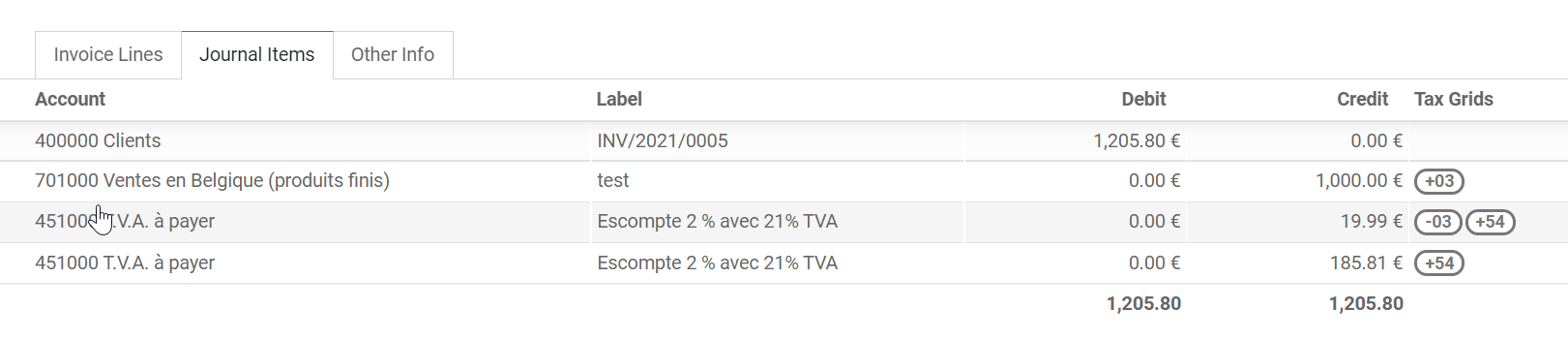

When you create the invoice the following entry is generated:

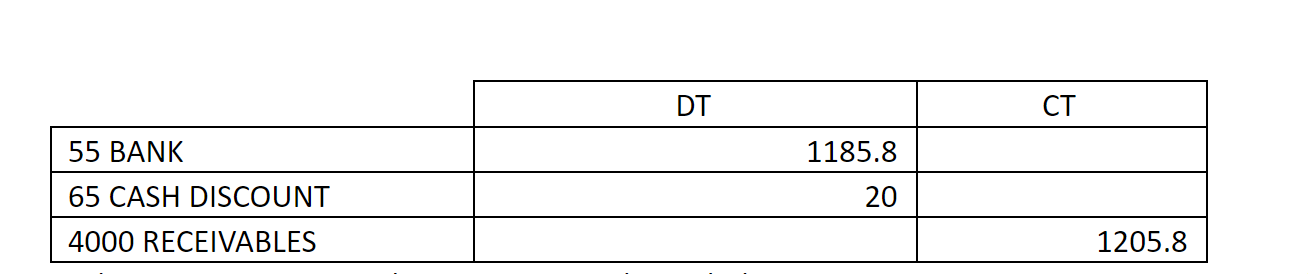

CASE 1) The client pays you during the week after the invoice date ( = so the client can benefit from the cash discount)

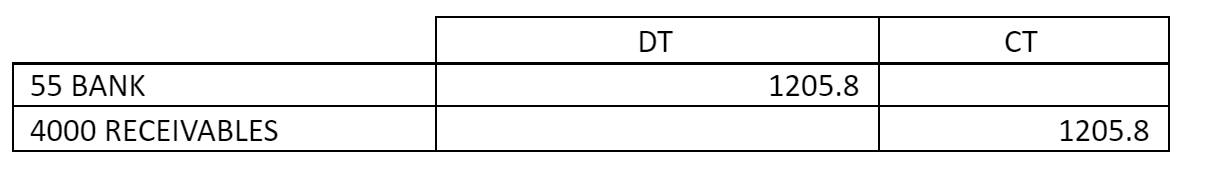

CASE 2) The client pays you after the 7 days

Thanks BEK , quite recurring question!