Prerequisite:

1. All the branches share the same company currency, tax ID, and chart of accounts with the parent company.

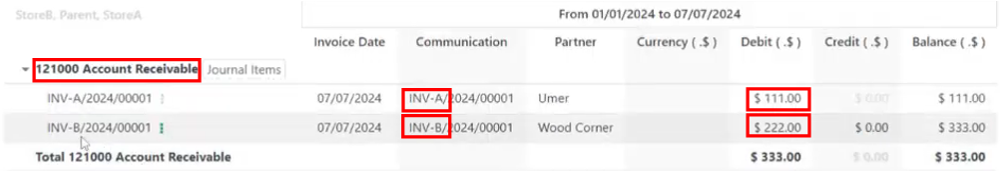

We can create additional branch-specific accounts and it will become part of the parent company account.

2. There is one parent company as a legal entity. We do not file tax reports for branches.

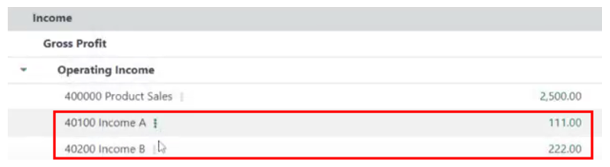

3. We can get each branch's profit and loss statement.