Payment terms and installment plans¶

Payment Terms specify all the conditions under which a sale is paid, mostly to ensure customers pay their invoices correctly and on time.

Payment Terms can be applied to sales orders, customer invoices, supplier bills, and contacts. These conditions cover:

截止日期

某些折扣

关于付款的所有其他条件

Defining Payment Terms automatically calculates the payments’ due dates. This is particularly helpful for managing installment plans.

**分期付款计划**允许客户支付发票的部分金额,由卖方事先确定付款金额和日期。

付款条件举例:

- 立即付款需在开具发票当日支付全款。

- 15天**(或**Net 15)开具发票日期后15天支付全款。

- 21 MFI在开具发票日期当月的21日支付全款。

- 2% 10, Net 30 EOM2% 现金折扣,如在10天内收到付款。否则,在开具发票日期当月月底前支付全款。

注解

Payment terms are not to be confused with down payment invoices. If, for a specific order, you issue several invoices to your customer, that is neither a payment term nor an installment plan, but an invoicing policy.

注解

This document is about the Payment Terms feature, not Terms & Conditions.

配置¶

前往 :menuselection:`会计 –> 配置 –> 付款条件`并点击*创建*。

The Description on the Invoice is the text displayed on the document (sale order, invoice, etc.).

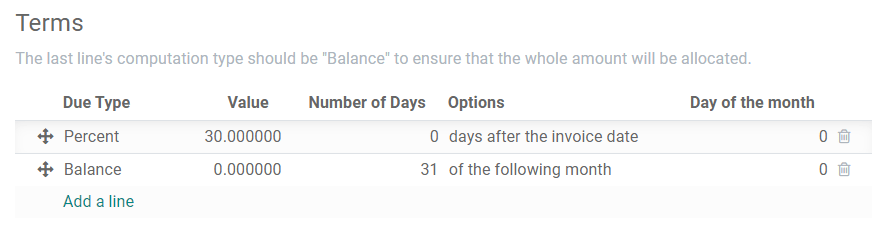

In the Terms section, you can add a set of rules, called terms, to define what needs to be paid and by which due date.

如要添加条件,点击*添加行*,并定义*类型*、值*和*截止日期计算。

重要

条件将按设置的顺序进行计算。

**余额**应始终用于最后一行。

In the following example, 30% is due on the day of issuance, and the balance is due at the end of the following month.

使用付款条款¶

Payment Terms can be defined in the Due Date field, with the Terms drop-down list, on:

- 报价对于从报价生成的所有发票自动设置特定付款条件。

- 客户发票对发票设置特定付款条件。

- 供应商账单对账单设置特定付款条件。这项功能对于管理多次分期付款的供应商条件非常有用。否则,只需设置*截止日期*。

小技巧

You can also define a Due Date manually. If Payment Terms are already defined, empty the field so you can select a date.

付款条件可在以下各项的**付款条件**字段中定义:

- 联系人在联系人的新销售订单、发票、账单上自动设置特定付款条件。它可在*销售和采购*选项卡下联系人*表单视图*中修改。

会计凭证¶

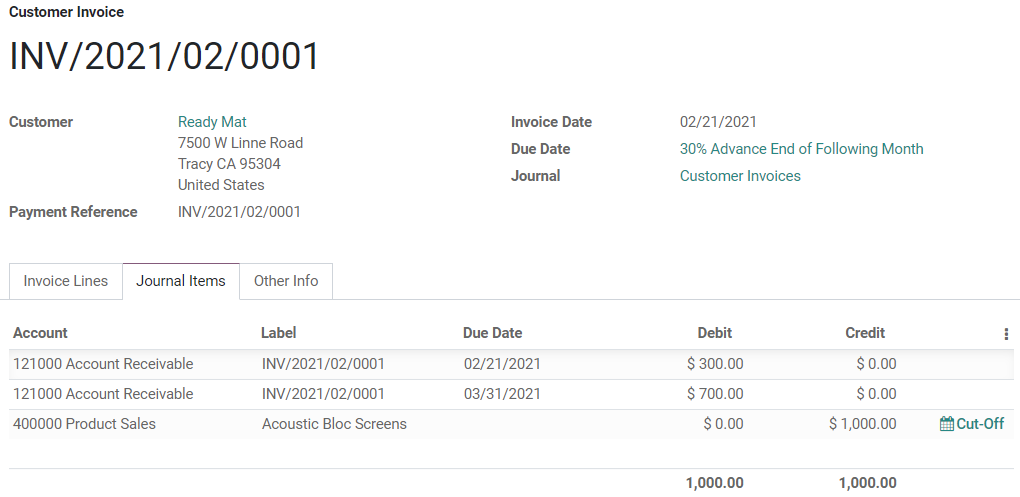

Invoices with specific Payment Terms generate different Journal Entries, with one Journal Item for every computed Due Date.

This makes for easier Follow-ups and Reconciliation since Odoo takes each due date into account, rather than just the balance due date. It also helps to get an accurate Aged Receivable report.

In this example, an invoice of $1000 has been issued with the following payment terms: 30% is due on the day of issuance, and the balance is due at the end of the following month.

科目 |

到期日期 |

借方 |

贷方 |

|---|---|---|---|

应收账款 |

2月21日 |

300 |

|

应收账款 |

3月31日 |

700 |

|

产品销售 |

1000 |

应收账款科目上的$1000被分成两个不同的*日记账项目*。它们都有自己的**截至日期**。