I am testing creation of assets in Odoo v18. When I choose degressive depreciation, it is not calculating the correct values. The monthly depreciation stays identical throughout the whole duration period instead of being adjusted at the end of each fiscal year.

I have searched online about this, but am unable to find anything. I have checked my configurations twice and followed instructions found in documentation to the letter. Is there anything I am missing?

Thank you in advance for your help.

Edited :

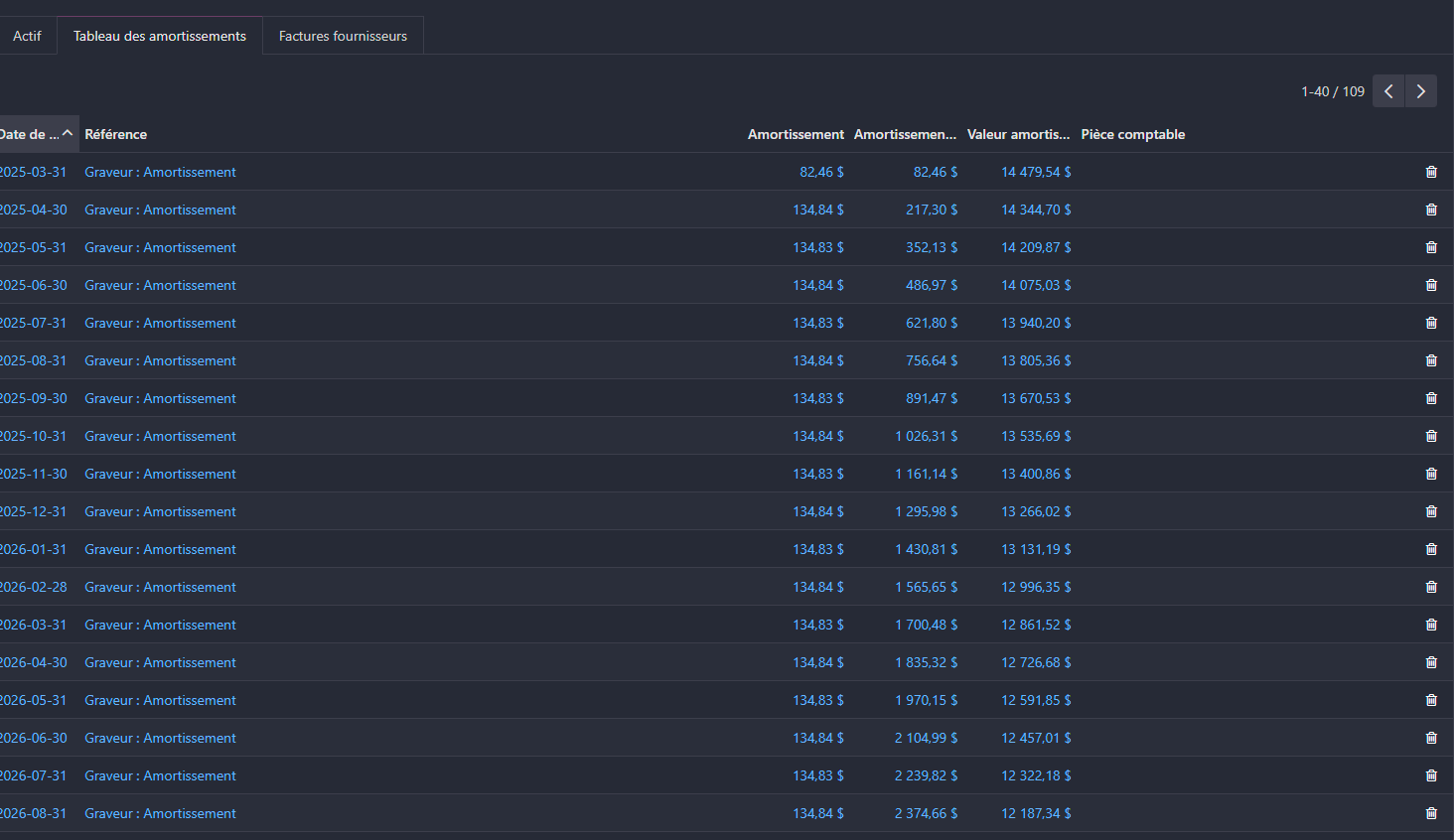

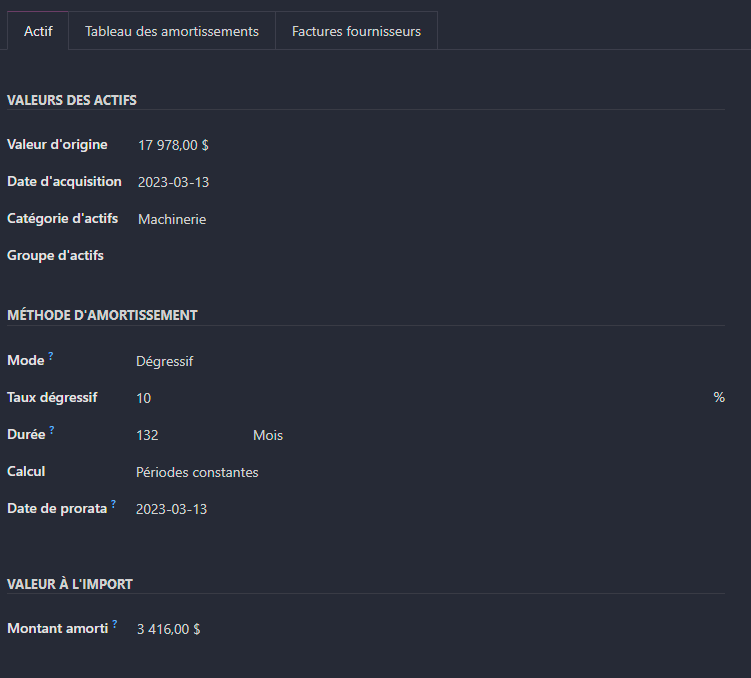

You can see on images that degressive depreciation is calculated as linear. Since I need to register monthly depreciation, I chose 132 months (11 years).

Sharing a screenshot of the way you are defining your asset will probably be needed for readers to discover what you are missing.

Thank you Ray,

I didn't noticed the command prompt in text. I was looking for a button, therefore didn't know how.

I joined the image. As you can see the 134.84$ monthly depreciation is constant accross the entire 5 year period, instead of taking the residual amount at the beginning of each fiscal year.

You're right. Odoo's calculation become linear in the last 5 years.

So I created a LasVegas Sphere: 1 billion, depreciated over 50 years,20%/year, it depreciate beautifully until 35k and 5 years left and then it just linear depreciate 8k/years.

So I create a CarPark with the value of 35k and deprecate 20%/year declinely with 5 years and it is depreciated exactly as the sphere.

I tried to read the code to find where the magic number (5 years) are but can't find anything. Odoo actually convert all the period life time in days.

However, in the documentation, Odoo also specified that the last entries will not use decline method. And maybe by last, it means the magic 5. This is understandable if you want to totally depreciate 100% of the asset value with the % and the number of period.

So good luck with your ticket.

The Declining Depreciation Method multiplies the Depreciable Value by the Declining Factor for each entry. Each depreciation entry has a lower amount than the previous entry. The last depreciation entry doesn’t use the declining factor but instead has an amount corresponding to the balance of the depreciable value so that it reaches $0 by the end of the specified duration.

Lasvegas sphere:

12/31/2059 Lasvegas sphere: Depreciation

$ 101,412.05 $ 999,594,351.81 $ 405,648.19

12/31/2060 Lasvegas sphere: Depreciation

$ 81,129.64 $ 999,675,481.45 $ 324,518.55

12/31/2061 Lasvegas sphere: Depreciation

$ 64,903.71 $ 999,740,385.16 $ 259,614.84

12/31/2062 Lasvegas sphere: Depreciation

$ 51,922.97 $ 999,792,308.13 $ 207,691.87

12/31/2063 Lasvegas sphere: Depreciation

$ 41,538.37 $ 999,833,846.50 $ 166,153.50

12/31/2064 Lasvegas sphere: Depreciation

$ 33,230.70 $ 999,867,077.20 $ 132,922.80

Carpark:

12/31/2025 Car park: Depreciation

$ 8,711.23 $ 8,711.23 $ 34,844.91

12/31/2026 Car park: Depreciation

$ 8,711.23 $ 17,422.46 $ 26,133.68

12/31/2027 Car park: Depreciation

$ 8,711.23 $ 26,133.69 $ 17,422.45

12/31/2028 Car park: Depreciation

$ 8,711.23 $ 34,844.92 $ 8,711.22

12/31/2029 Car park: Depreciation

$ 8,711.22 $ 43,556.14 $ 0.00

@Econ Odoo,

I think I have found a partial answer to my question. I did several tests and what I noticed is that the lifespan of 10 years is not nearly enough for degressive rate to apply (which I still don't understand). I extended the lifespan of equipment to 25 years and I can see degressive rate appear but, just like in your case, the last 5 years are linear. So I will do 2 things :

1. I will f/u on my ticket with Odoo and see if they can explain it to me better.

2. I will reach out to the external accountant to see if there are any fiscal consequences with gvt that could occur.

I do want to thank you for taking time to try and help me.

Once I have Odoo's answer, I will share it here.

An update on this post :

No matter which method we choose (Declining or Declining then straigth line), both will end up being Declining then straight line. This is beacuse it is mandatory to pick out a lifespan of the asset. The only difference is the moment at which the straight line method kicks in.

This makes sense because, if Declining method were to remain, the equipment would never be fully depreciated.

The problem I had in my example is that 10% depreciation rate on a 11 year lifespan is already below the straight-line method. This is why the system, was applying the straight-line method since year 1.

Here are some other examples where one could expect straight-line method to kick in :

20% rate = 5 years before end of lifespan

25% rate = 4 years before end of lifespan

33% rate = 3 years before end of lifespan

This confirms also what you observed at your end @Econ. I hope this info can help others on this forum.

Once again, thank you @Ray and @Econ for the help provided.