Customer invoices

You make some customer invoices during the month of October

Vendor bills

You make some vendor bills during the month of October

Balance sheet

Then, we will have a look at the balance sheet

Therefore we should pay to the Administration: 203.7€ - 63€ = 140.7€

Let’s have a look at the Tax Report (“Déclaration périodique à la TVA”)

Create the XML file

You can export the file in XML since you can send it at the Administration (standard format)

What does it look like a VAT Statement in XML?

You can open it with your code editor as Sublime → STANDARDIZED file that Administration can read directly in its system.

Note:

When you have sent your VAT STATEMENT the best practice is to use the lock-date

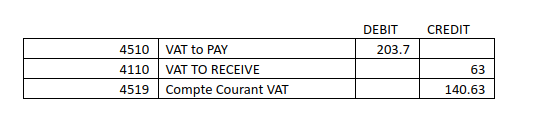

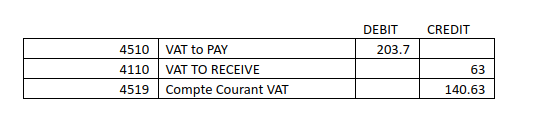

Create the Journal Entry

Now you need to make the manual accounting entry.

Accounting → Accounting → Journal Entry

In the example, I need to pay to the Authorities 140.63€. So you book a current liabilities.

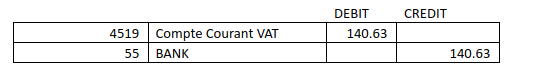

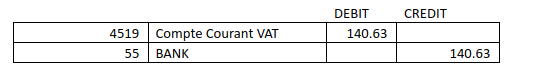

Then, when you will pay the VAT, the accounting entry created by the bank statement will be: